willow_hiller

Well-Known Member

Yeah, a form 4-- Form 4 must be filed within two business days following the transaction date

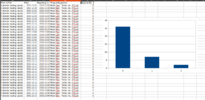

Thought I'd take a look back at the last year of Elon's Form 4 filings to put something useful together:

Elon filed a Form 4 a total of 35 times in the last 12 months. Of those 35, 26 of them (74%) were filed the same day as the trade. 7 (20%) were filed the day after the trade. 2 (6%) were filed two days after the trade.