Most eyebrow-raising element in the SpC map being discussed here this morning:

There are two locations planned in Ukraine.

There are two locations planned in Ukraine.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Ukraine Ev adoption before the war was quite high, including Teslas. Solar made sense for many people, so free charging. Also EV incentives (tax?)Most eyebrow-raising element in the SpC map being discussed here this morning:

There are two locations planned in Ukraine.

Below is a Barrons article by Al Root that questions if Tesla will have a free cash flow issue in Q2.

Does Tesla Have a ‘Free Cash Flow’ Problem? What It Would Mean for the Stock.

The article references a report put out by Pierre Ferragu that includes the following:

“Will Tesla burn cash in the second quarter,” is a question New Street Research analyst Pierre Ferragu asked in a Monday report.

“Cash out for payables relating to [costs] of the previous quarter” is an indirect impact that Ferragu sees.

Ferragu also believes Tesla is likely to only break even in terms of free cash flow, a far more downbeat view than the $1.3 billion consensus figure.

Pierre is one of the better analysts out there but I'm still surprised by his downbeat expectations for FCF. Does @The Accountant or any of the other financial modellers have any comment on expectations for FCF for Q2? We can expect deliveries to be down on expectations (particularly if analysts don't update) but it would be a shock to see FCF down that much.

I have been thinking that more of the Shanghai shipments to Europe (and elsewhere) since left late may not get delivered in Q2 and slip to July. How would that hurt FCF if at all?Right now I have FCF slightly under $1B (at $900m). Besides payables payments another hard number to estimate is spend on Capital Expenditures.

Here are actual numbers and my estimate for Q2 2022:

$1.4b - Q1 2021

$1.5b - Q2 2021

$1.8b - Q3 2021

$1.9b - Q4 2021

$1.8b - Q1 2022

$1.5b - Q2 2022 (est)

I expect Tesla, rather than attempting to ship to Europe, would just send more cars to the China market this quarter to try to make up for lost time. You save time so can ship more cars locally, but you also probably save some on the shipping expenses. (Not sure of details of shipping contract).I have been thinking that more of the Shanghai shipments to Europe (and elsewhere) since left late may not get delivered in Q2 and slip to July. How would that hurt FCF if at all?

I expect Tesla, rather than attempting to ship to Europe, would just send more cars to the China market this quarter to try to make up for lost time. You save time so can ship more cars locally, but you also probably save some on the shipping expenses. (Not sure of details of shipping contract).

Famous last words.TSLA up 4x the Q's at 1:00 est. Looking good!

One item I am aware of is Tesla's payables vs receivables time shift. If the shut down left then with a bunch of parts/ work in progress/ inventory that they are not able to clear out by EoQ, that could cause a hit due to paying for it before selling the cars(reverse of usual flywheel). However, it seems the month of high build rate they have combined with the suppliers also being impacted should render this minimal.Below is a Barrons article by Al Root that questions if Tesla will have a free cash flow issue in Q2.

Does Tesla Have a ‘Free Cash Flow’ Problem? What It Would Mean for the Stock.

The article references a report put out by Pierre Ferragu that includes the following:

“Will Tesla burn cash in the second quarter,” is a question New Street Research analyst Pierre Ferragu asked in a Monday report.

“Cash out for payables relating to [costs] of the previous quarter” is an indirect impact that Ferragu sees.

Ferragu also believes Tesla is likely to only break even in terms of free cash flow, a far more downbeat view than the $1.3 billion consensus figure.

Pierre is one of the better analysts out there but I'm still surprised by his downbeat expectations for FCF. Does @The Accountant or any of the other financial modellers have any comment on expectations for FCF for Q2? We can expect deliveries to be down on expectations (particularly if analysts don't update) but it would be a shock to see FCF down that much.

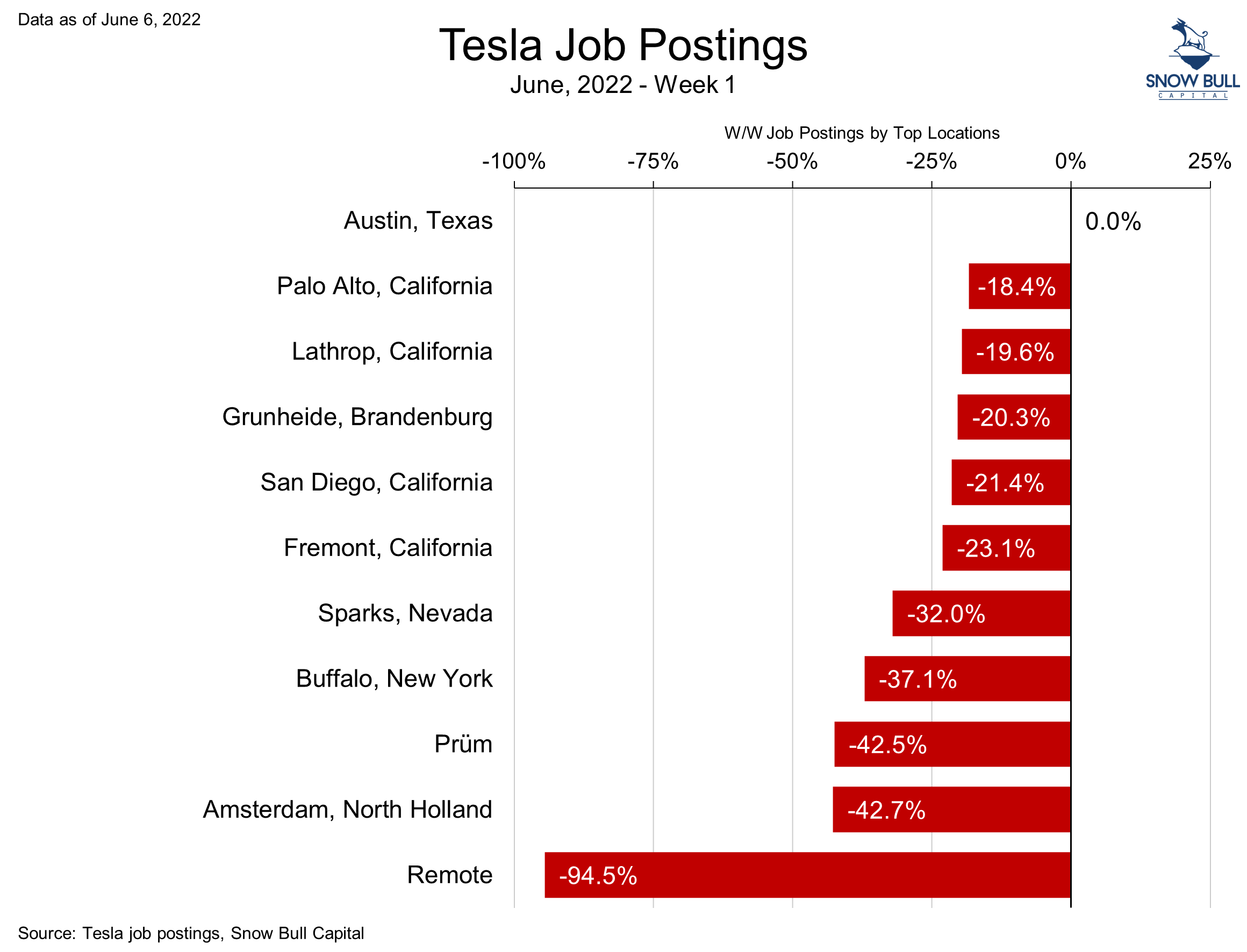

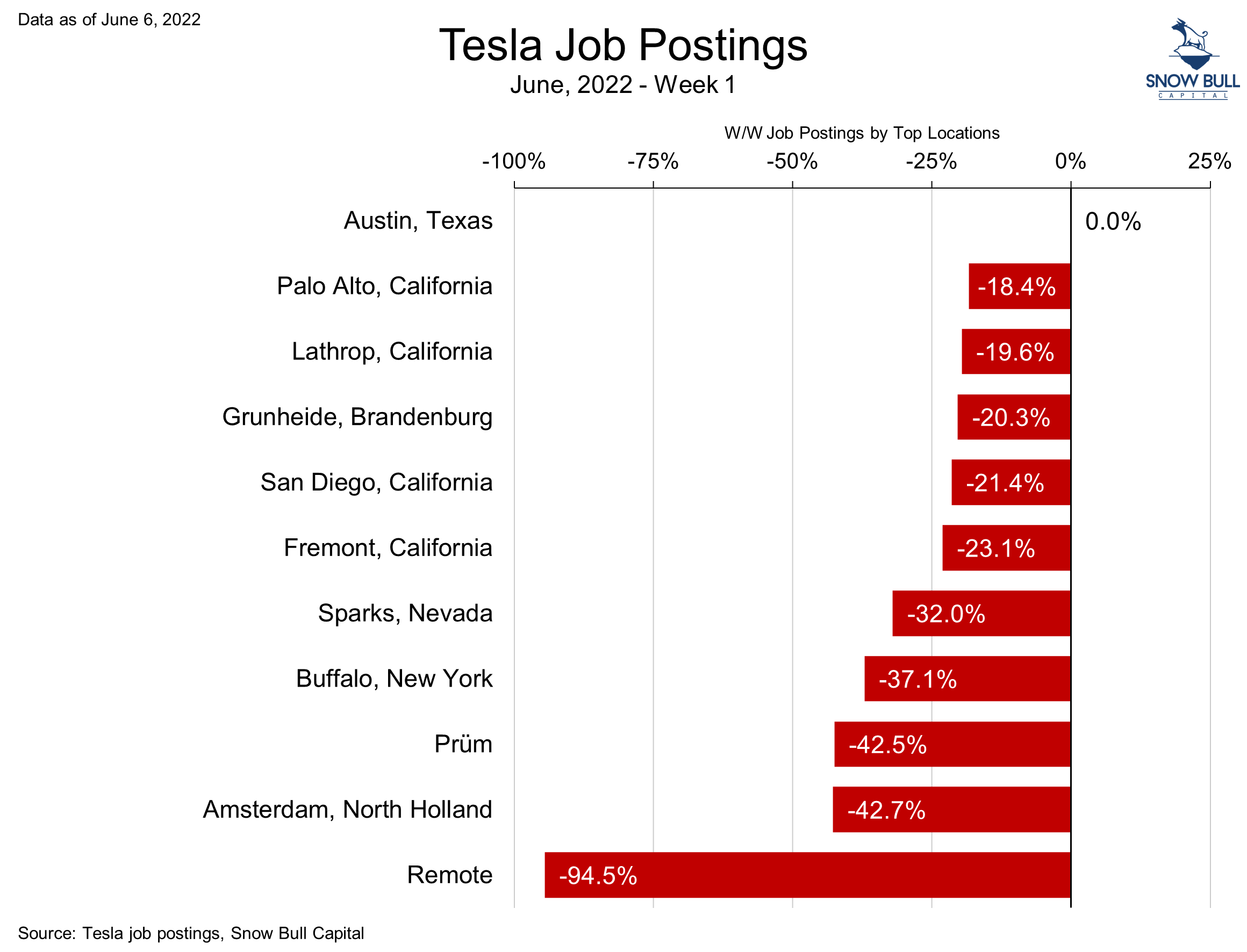

It pains me to know you bought into anything Taylor Ogan puts out. That twitter account posts slanted Tesla related information non-stop.......all while acting like he's a Tesla investor. He's been exposed multiple times, yet he keeps up the charade.Pains me to say it but Taylor Ogan has a good thread showing where Tesla has cut back on job postings:

Famous last words.

This is what happens when you outsource components. Ford buys their chargers from a third party. Since the Tesla is the most common EV the third party throws in a Tesla adaptor because most people will need it... LOLThis is pretty funny that Ford would be wasting their money on this when every Tesla already has one.

Ford F-150 Lightning Reportedly Includes Free Tesla Charging Adapter

The F-150 Lightning can provide energy to outside sources, such as other EVs and your home when properly equipped. With an adapter, it can also charge a Tesla.insideevs.com

Actually, possibly the first refugees I saw here in Switzerland where here in a TM3Ukraine Ev adoption before the war was quite high, including Teslas. Solar made sense for many people, so free charging. Also EV incentives (tax?)

LOVE ITA few minutes ago I was leaving the grocery store and it had started pouring down rain. Everyone was waiting outside under the shelter, hoping it would let up.

I just whipped out my phone, summoned my Tesla, hopped in, and drove off.

Everyone there saw what I did. Why would Tesla ever need to advertise?

Tesla has no presence in Ukraine, all Teslas there are privately imported. But I gather there's a good amount.Ukraine Ev adoption before the war was quite high, including Teslas. Solar made sense for many people, so free charging. Also EV incentives (tax?)