You know what you have to do here. Take one for the team...Man, every time I buy Tesla stonks drop even more and every time I sell it grows like hellI am terrible

But at least I don’t sell much

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

My Plaid gets gushing comments and stares everywhere I go. Wife's lady friends drool over her MYP. Neighbors ask me why my lights stay on during blackouts (PowerWalls).....all good stuff. And then....

At work today, a colleague asked if Tesla was going to stop making cars. Shocked, I asked where on earth he got that idea. He stated he read/heard that Tesla was letting go a large number of employees, and that would affect the 'start-up' so badly, they would not be able to make cars out of their one factory.

Hmmm. 15 minutes later, he understood how many employees Tesla has, what the growth projections have been and what has been met, their market share, their margins, how many factories this 'start-up' has, and the adjacent markets that Tesla is in besides cars.

He left to go buy some stock.

I had a 2013 P85 for 7 years and now have a Y. I must say that the Plaid looks pretty amazing and I'm tempted to make another change.

I have a Perf. Y and a Plaid.... anytime I drive the Y it feels like a dinosaur compared to my Plaid... I don't think I can go back even if I wanted toI had a 2013 P85 for 7 years and now have a Y. I must say that the Plaid looks pretty amazing and I'm tempted to make another change.

Gigapress

Trying to be less wrong

I have reached a very different conclusion for many reasons that I'll leave for the full thesis.The West has been offshoring manufacturing for quite a while, that solar is mostly made from coal in China (directly and indirectly). Start putting CBAMs into place* and reshoring to a carbon-neutral manufacturing environment and I think solar costs start rising across the board. I think the current costs of solar are pretty much as good as it will get, which is imho not unreasonable.

Wind I think has reasonable runway left, and battery storage lots of runway. Carbon capture and storage, not a cat in hells chance (and I've done carbon capture for real).

YMMV.

(* which is why I pay attention to CBAM progress on the energy news clippings thread)

Solar PV panels are already quite carbon negative on a cradle-to-grave lifecycle basis, so in the first place I don't see any point in zooming in on certain components of the overall emissions and insisting on making them carbon neutral. China will also eventually be making solar panels with solar power, so making them with coal is a transient phenomenon. Coal can't compete long term. They will close those coal plants.

Berkeley National Laboratory (USA) estimates that these days solar PV has an average energy payback period of 0.5 to 2 years, meaning that about 6-24 months worth of its energy collection is used across the lifecycle for fabrication + transportation + construction + maintenance + deconstruction + recycling. If a panel nominally rated for 100W produces a daily average of 0.5kWh, then across a year that’s 0.5 * 365 = ~180kWh, and across an estimated 25-year panel life it's 180 kWh * 25 = 4.5 MWh. With current retail electricity costs in China of approximately $0.084/kWh on average (source), the embedded energy cost is at most around $0.084/kWh * 180 kWh/year * 1 year typical energy payback / 100W nominal = ~$0.15/W embedded energy cost, approximately 15% of the entire current $1/W cost of solar. Even if going carbon neutral doubles this energy cost to 30%, that's still only a 15% increase, equivalent to a single year of overall solar PV cost decline.

Let's look at it another way. I see various estimates that solar has embedded CO2 equivalent of roughly 1 ton CO2e/MWh. Carbon offset credits cost on the order of $10/ton. With unsubsidized all-in solar costs today of about $30/MWh in Western nations with favorable insolation (like USA, Australia & NZ), carbon offsets would drive up cost by 25% to $40/MWh. Again, only for now because eventually solar energy will be used to make more solar energy and all the logistics and construction and all that will be going renewable too, dropping the CO2e/MWh to vastly less than it is today.

I am willing to bet that whatever carbon capture and storage you have worked on was not a plant designed to exploit the low low solar costs I'm expecting, so that analogy would not apply because the technology and industrial engineering would be very different. No such plants currently exist and few are even proposing them today, because few expect solar costs to keep falling 10%+ annually or have done the math on the ramifications of that trend for CO2 capture, H20 electrolysis, and Sabatier methane production.

Last edited:

ZeApelido

Active Member

My Plaid gets gushing comments and stares everywhere I go. Wife's lady friends drool over her MYP. Neighbors ask me why my lights stay on during blackouts (PowerWalls).....all good stuff. And then....

At work today, a colleague asked if Tesla was going to stop making cars. Shocked, I asked where on earth he got that idea. He stated he read/heard that Tesla was letting go a large number of employees, and that would affect the 'start-up' so badly, they would not be able to make cars out of their one factory.

Hmmm. 15 minutes later, he understood how many employees Tesla has, what the growth projections have been and what has been met, their market share, their margins, how many factories this 'start-up' has, and the adjacent markets that Tesla is in besides cars.

He left to go buy some stock.

Wait... you work?

Serious FOMO for the Plaid, and you're not helping.I have a Perf. Y and a Plaid.... anytime I drive the Y it feels like a dinosaur compared to my Plaid... I don't think I can go back even if I wanted to

My guess is this nutty inflation has brought many workers back that were previously "out of the job market"...don't know how long it takes for that to officially show up in the stats...

Since we're talking about this, my take is that it goes hand in hand, people refusing to work under conditions/pay they don't like are also more open to changing jobs, or at least inquiring if they can find a better deal for themselves.When I was in Elementary school kids always talked about wishing for a million dollars so they could just live off the interest for eternity.

Now a million dollars eating at the principle won't last me 15 years, far short of eternity.

I could see someone misjudging their retirement funds, retiring too early and having to go back to work even if they had invested wisely in terms of the actual investments.

B

betstarship

Guest

I have reached a very different conclusion for many reasons that I'll leave for the full thesis.

Solar PV panels are already quite carbon negative on a cradle-to-grave lifecycle basis, so in the first place I don't see any point in zooming in on certain components of the overall emissions and insisting on making them carbon neutral. China will also eventually be making solar panels with solar power, so making them with coal is a transient phenomenon. Coal can't compete long term. They will close those coal plants.

Berkeley National Laboratory (USA) estimates that these days solar PV has an average energy payback period of 0.5 to 2 years, meaning that about 6-24 months worth of its energy collection is used across the lifecycle for fabrication + transportation + construction + maintenance + deconstruction + recycling. If a panel nominally rated for 100W produces a daily average of 0.5kWh, then across a year that’s 180kWh and across an estimated 25-year panel life it's 4.5 MWh. With current retail electricity costs in China of approximately $0.084/kWh on average (source), the embedded energy cost is at most around $0.084/kWh * 180 kWh/year * 1 year typical energy payback / 100W nominal = ~$0.15/W embedded energy cost, approximately 15% of the entire current $1/W cost of solar. Even if going carbon neutral doubles this energy cost to 30%, that's still only a 15% increase, equivalent to a single year of overall solar PV cost decline.

I am willing to bet that whatever carbon capture and storage you have worked on was not a plant designed to exploit the low low solar costs I'm expecting, so that analogy would not apply because the technology and industrial engineering would be very different. No such plants currently exist and few are even proposing them today, because few expect solar costs to keep falling 10%+ annually or have done the math on the ramifications of that trend for CO2 capture, H20 electrolysis, and Sabatier methane production.

My translation: dividends passive income dividends passive income dividends passive income y'all

thesmokingman

Active Member

Interesting... NIO is gonna push their AI training to compete with the big T. I think AMD now has 3-4 of the top 10 supercomputer record holders.

www.benzinga.com

www.benzinga.com

What Happened: Shanghai-based Nio will reportedly use AMD’s EPYC family of processors in its high-performance computing (HPC) platform.

The move is expected to lift the electric vehicle maker’s AI deep learning training and shorten product development cycles.

Nio Agrees To Chip Supply Partnership With AMD: What You Should Know - NIO (NYSE:NIO), Advanced Micro Devices (NASDAQ:AMD)

Nio Inc (NYSE: NIO) and Advanced Micro Devices Inc (NASDAQ: AMD) have entered a chip supply partnership, CnEVpost

Knightshade

Well-Known Member

Tick . . . . Tick . . . Tick . . . until June 25th

Annual Meeting is on August 4th.

Proxy Materials providing information on matters that Shareholders will vote on are due no later than 40 calendar days before meeting.

40 days prior to Aug 4th meeting is June 25.

Anytime between now and June 25 we will find out the number of shares Tesla will ask Shareholders to authorize.

I think my info is correct but paging @Knightshade (who is knowledgeable on such matters) to weigh in.

I believe the 40 days thing comes from

240.14a-16 Internet availability of proxy materials.

(a)

(1) A registrant shall furnish a proxy statement pursuant to § 240.14a-3(a), or an annual report to security holders pursuant to § 240.14a-3(b), to a security holder by sending the security holder a Notice of Internet Availability of Proxy Materials, as described in this section, 40 calendar days or more prior to the security holder meeting date, or if no meeting is to be held, 40 calendar days or more prior to the date the votes, consents or authorizations may be used to effect the corporate action, and complying with all other requirements of this section.

(2) Unless the registrant chooses to follow the full set delivery option set forth in paragraph (n) of this section, it must provide the record holder or respondent bank with all information listed in paragraph (d) of this section in sufficient time for the record holder or respondent bank to prepare, print and send a Notice of Internet Availability of Proxy Materials to beneficial owners at least 40 calendar days before the meeting date.

insaneoctane

Well-Known Member

How long can this continue? (I hope a long time...) Tesla's are FAST, GREEN, HIGH TECH and PRETTY. Competition will keep trying to offer some or most of that, but not to the degree Tesla's do. I think we'll have FSD to add before the competition is able to offer almost just as fast, just as green, and just as high tech. The kids also know nothing about the Supercharger network....I was stopped at lights earlier and a little boy, 7 max, was crossing the road with his Dad. He shouted "Dad is that a Tesla?". And the Dad smiled and said to me He loves Teslas.

Literally 5 minutes later I was passing a group of secondary school boys and one of them shouted "There's a Tesla"

Advertising anyone? Admittedly I had just had it washed

My frustration is that this is all going to play out over a period of decades. In the mean time the climate is going to get worse and worse. Until much of this comes online. More abundant/ affordable power will be one of the first pieces we need and that is ~10 years out. Carbon capture a few years behind that. Becoming carbon negative is likely a decade or more after aggressive capture begins. Seeing the results of that carbon capture likely another 50+ years after we become carbon negative.I am willing to bet that whatever carbon capture and storage you have worked on was not a plant designed to exploit the low low solar costs I'm expecting, so that analogy would not apply because the technology and industrial engineering would be very different. No such plants currently exist and few are even proposing them today, because few expect solar costs to keep falling 10%+ annually or have done the math on the ramifications of that trend for CO2 capture, H20 electrolysis, and Sabatier methane production.

The good news is cheap energy and synthetics will likely create a new era of manufacturing in the mean time. The bad news is by the time we come out the world will be vastly different and the transformation will be painful.

Happy that Tesla is at the center of the solution. Hopefully other players will step up.

I hear Bill Gates has invested more money than anyone else on fighting climate change. That's gotta mean something right? /s

The Accountant

Active Member

I used to be "normal people" before I joined up with you degenerates.

2daMoon

Mostly Harmless

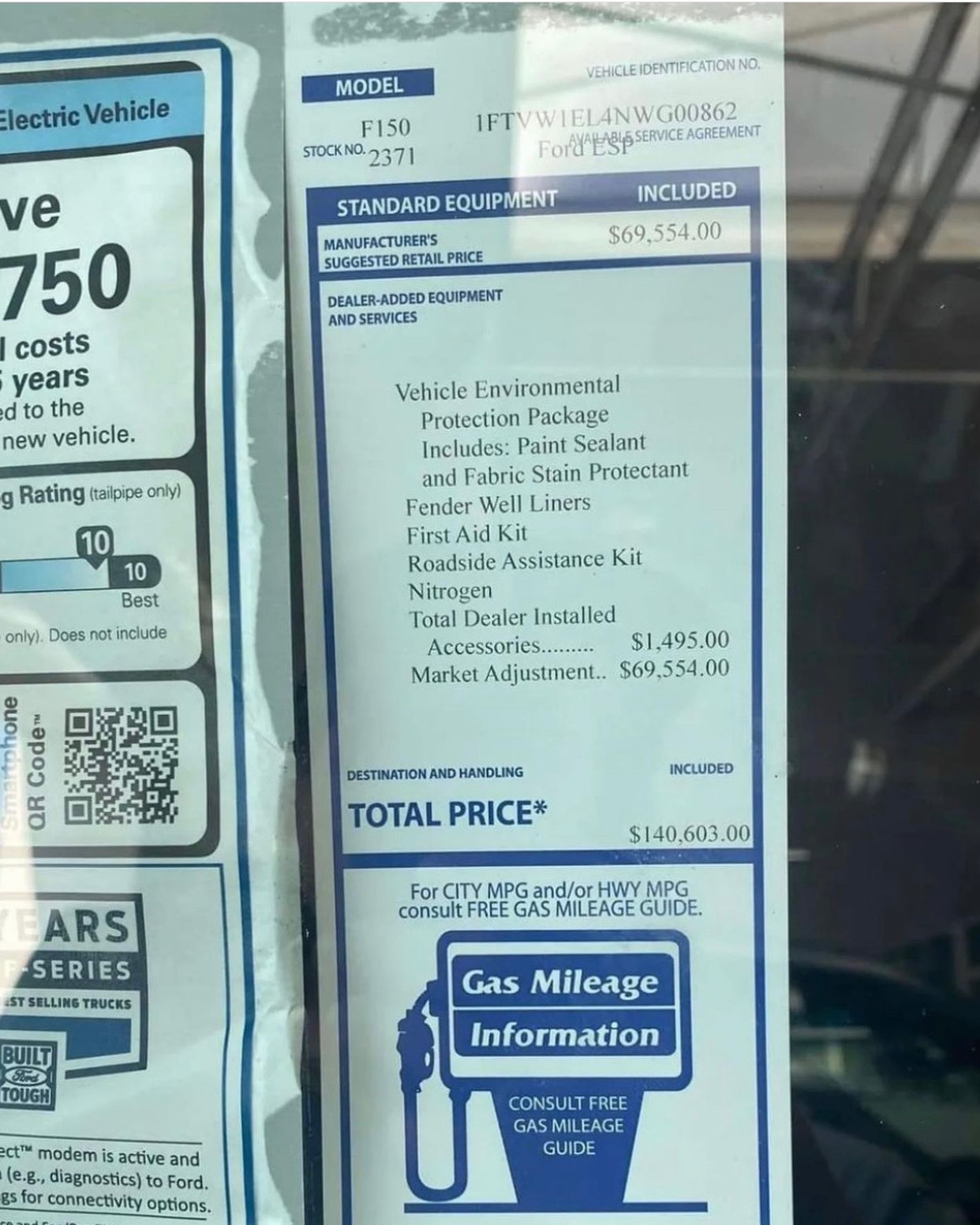

UPDATE: Ford dealership applies $69,554 markup on F-150 Lightning despite corporate orders

UPDATE 6/8/2022, 2:58 pm: Ford’s North American Product Communications Director, Mike Levine, said Gary Smith Ford confirmed the sticker was an error as the MSRP was input twice online, which is why the MSRP and market adjustment are the same price. This sticker was mistakenly placed on a demo...

I can't believe the unmitigated nerve of this dealership overcharging by $134.00 for their "Market Adjustment" on the F-150 Lightning.

69,554

- 134

= ?

Last edited:

Until everyone's expectations of what a car should like have been reset.How long can this continue? (I hope a long time...) Tesla's are FAST, GREEN, HIGH TECH and PRETTY. Competition will keep trying to offer some or most of that, but not to the degree Tesla's do. I think we'll have FSD to add before the competition is able to offer almost just as fast, just as green, and just as high tech. The kids also know nothing about the Supercharger network....

I suspect it won't take too long.

B

betstarship

Guest

Starlink IPO still 3-4 years away, though that slide deck from the SpaceX company all-hands...

www.cnbc.com

www.cnbc.com

Elon Musk says an IPO of SpaceX's Starlink satellite internet business is still 3 or 4 years away

Elon Musk has told SpaceX employees the company isn't likely to take its Starlink satellite internet business public until 2025 or later, CNBC has learned.

insaneoctane

Well-Known Member

J

jbcarioca

Guest

I am thrilled that you're so impressed. Would you like to buy my 2022 Volvo XC40 Recharge Pure Electric? IT's freshly updated with the latest update. You can then directly enjoy all those magnificent Android Auto innovations yourself. I then can move back to the primitive Tesla OS. Sounds like a win-win to me. I'm really not capable of appreciating all that excellence. I'd settle for the same display format in front of the driver and the central screen. Moving back to the old-fashioned Tesla would also allow my co-pilot (and spouse) to stop complaining about trying to read the permanent north-up display.Thanks @cab, I've been ignorant of the developments in Apple Carplay and Android Auto, and I wouldn't be surprised if others are too. It's worth getting the facts and avoiding an Apple-to-oranges comparison (pun intended).

I'm impressed by the current state of Android Automotive OS (vs. infotainment-only Android Auto - see screen shot below). Unlike the proposed Apple Carplay (which requires an iPhone), Android Automotive OS is not a skin @Discoducky, but the default software in the vehicle:

"Android Automotive is an operating system and platform running directly on the in-vehicle hardware. It is a full-stack, open source, highly customizable platform powering the infotainment experience. Android Automotive supports apps built for Android as well as those built for Android Auto."

According to ArsTechnica:

"It controls not just maps and media, but the air conditioning, lights, ride settings, seat location, camera views, and most other car settings. You don't need a smartphone, since Android Automotive OS is installed on the car computer storage. An onboard version of the Play Store even lets you download apps directly to your car. The car is like the world's biggest Android device."

If you look at videos of, for example, Polestar's OS, (wow! that's a... Tesla-like experience!) there is no "default OEM software", it's only Android Automotive OS. So the problems others have noted about not having an iPhone at all times don't exist with Android Automotive OS.

And unlike Tesla, Android Automotive OS offers apps - like Lyft. It would be better for Lyft to be built-in to the car rather than the driver using their tiny phone to run their ride-share.

And one other advantage Google has over Apple: Google has a long-established record of collaborating with 3rd-party manufacturers - like Samsung - to develop Android on independent hardware devices. Apple? Not so much.

View attachment 813735

K Mods, I guess this should move to another thread now.

So, I'm prepared to make an attractive deal. I'm sure it is irrelevant to you that the Volvo uses 370 wh/mi vs my Model S Plaid at 294. Surely that is a small price to pay for all that superior Android Auto experience.

Feel free to PM me your offer. I will accept any Tesla in trade.

Note: Of course this is not sarcastic. I'll sell quickly and throw in that impeccable deal experience without extra cost.

Note 2: Full disclosure: the wonderful foot-actuated back trunk opener does not work. However, there have only been four dealer attempts to fix it aided by two factory visits so I'm sure those mvens at Android Auto can solve the problem by eliminating the feature. I'll include the phone numbers, email addresses too. They don't answer for me, but they'll probably do so for you.

Note 3: on second thought this is all sarcastic. Nobody sane would buy one of these things. I did, so you probably should accept I'm not sane either and then buy my Volvo anyway.

Note 4: It's convenient that a phone isn't necessary because the link disappears every week or too, so remote functions disappear also. MY home charger maintains it's link so I can easilocontrol changing from that. Charging anywhere else needs setting charging instructions on the screen, that only can be done after charging has been commenced. Maybe I don't understand and that's security feature from Android Auto, just like the inability to use a phone as a key.

As you know this is a magnificent accomplishment that elderly Tesla and Apple guys like me just don't understand.

During this demented post the price has gone down. Remember that PM!

Last edited by a moderator:

I'm not saying the markets are rigged, but...Been enjoying finally having nice weather where I'm at and finally golfing.... so probably have missed things and if this has been discussed ignore.

But on a macro level... this Target business is a very good sign. Retailers have been having growing inventories that they can't sell at elevated prices... Target finally being the one to breakdown and finally admit they can't prop prices up is very good for the whole macro market. It will likely force others to follow suit... which will become a strong deflationary factor in the months ahead. Likely won't offset all of the inflation, but should help bend the curve. At this moment we are just waiting for official news that inflation has peaked. It might be this Friday or in a month or two, but it is coming soon with this pressure.

On the market reaction, this didn't wipe out the 30 day MA support for the Nasdaq and Vix is looking to get under 24. There just needs to be some positive catalyst to get things going. CPI would be a great start and the Fed showing some trepidation of going too high next week would set it off. Two large ifs right there.

For Tesla, the jobs drama just allowed the gamma pressure to die. There is basically no positive pressure on the chain and it would take a 100 pt run to start to run into major issues there. Tesla needs a catalyst to jump start something. Elon finding a way to walk away from Twitter would do it. Strong May production in Shanghai. Disclosure on the stock split. Something to that extent to gain back some momentum.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K