Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

cliff harris

Member

A UK politician once said on TV that the GFC was strange because although many people lost jobs, for people who did NOT lose their job, everything was fine, especially if they happened to have some stocks.Yeah that's a hard disagree from me.

You think consumers are more worried over paying more for items than a collapse of the banks + credit being frozen + huge spikes in unemployment + mass defaults on mortages??

Sure ok

All the UoM consumer sentiment index is showing here is how irrelevant it really is. My post isn't saying that inflation doesn't affect consumer confidence, it obviously does. What I'm pointing out is that if the UoM consumer sentiment index is saying people are more down on the economy than the GFC.....then it's very much not working like it should and I would say it's quite broken.

Anyone here that tries to argue consumer sentiment is currently on par in the general population as it was with the GFC, since I lived through it, well I'll just say I'm going to very much disagree with you. I live in Seattle, was just in NYC and then Florida, have family and friends across California, Arizona, South Carolina, Texas, Colorado, and Maine.....across every income bracket (mostly in middle income, 2nd most in upper middle income, some just below middle income) and not single person I know would say the economy or the outlook of the economy is even remotely close to the GFC.

This is very true. If I had not had access to any news, I would not know 2008 even happened. My business and income was totally unaffected.

But I sure do notice the price of everything has gone up in the last few months.

adiggs

Well-Known Member

My takeaway is that this is the board's way of telling investors that we'll all be involved anytime in the future there is a split, at least the next time around.Thankfully all my LEAPs are at a $750 strike and will end up beautifully at $250. Otherwise my OCD would be kicking into high gear right about now.

What I don't understand is why Tesla wouldn't request authorization for many more shares than they need for this 3:1 split. That way they'd avoid needing to go through a shareholder vote each time they want to split.

I was expecting / hoping for more like an increase to 100B authorized shares so the board could split several times in desired multiples, without needing a shareholder vote each time.

Yeah that's a hard disagree from me.

You think consumers are more worried over paying more for items than a collapse of the banks + credit being frozen + huge spikes in unemployment + mass defaults on mortages??

Sure ok

All the UoM consumer sentiment index is showing here is how irrelevant it really is. My post isn't saying that inflation doesn't affect consumer confidence, it obviously does. What I'm pointing out is that if the UoM consumer sentiment index is saying people are more down on the economy than the GFC.....then it's very much not working like it should and I would say it's quite broken.

Anyone here that tries to argue consumer sentiment is currently on par in the general population as it was with the GFC, since I lived through it, well I'll just say I'm going to very much disagree with you. I live in Seattle, was just in NYC and then Florida, have family and friends across California, Arizona, South Carolina, Texas, Colorado, and Maine.....across every income bracket (mostly in middle income, 2nd most in upper middle income, some just below middle income) and not single person I know would say the economy or the outlook of the economy is even remotely close to the GFC.

Who the heck is Bob?

Good, because I'm LEAP shopping come MondayThe rally from this won't really be until it is official. There is a small bump when they are announced (happened in April in this case), but the rally based on the split really waits until the execution (see Google and Amazon). Which will be August. Especially as a share dividend it will wait. What this will likely do though it the start of the naked shorting unwinding starting soon since the shorts won't want this to gamma.

Can anyone here honestly come up with anything of value that the Tesla board contributes? Only time I ever see their names is when they're cashing-in their shares.Ellison stepping away from the board is interesting news. It'll be used as FUD for sure, but likely a nothing burger.

Seem like a bunch of freeloaders to me, but I'm open to being corrected on that

Depends on your broker's pricing. Right now if I sell 5x $GOOGL calls then I pay $19.95 transaction fees, when $GOOGL splits 20:1 I'll be paying $250 on 100x contracts weeklyNow we know why Ken Griffin's crew at Citadel didn't need to bother pushing TSLA to $700 at the close. They already knew this split announcement was coming and it'd clear $700 easily in the after hours trading. Must be nice. No more $700 put payouts for you!

I'm OK with 3:1, but we'll be at $500 again in no time. I was hoping for 20:1 to make weekly options more interesting. I guess I'll take it. Anything to force a clearing of all naked shorts.

Funny how the whole world seems to have planned for a rally to begin today........except the CPI people!

Owners elect the board...Can anyone here honestly come up with anything of value that the Tesla board contributes? Only time I ever see their names is when they're cashing-in their shares.

Seem like a bunch of freeloaders to me, but I'm open to being corrected on that

Healthcare and tuition have been rising substantially for the last 20 yearshealthcare and tuition have always been at absurd levels at least for the last 20 years

while the cpi barely rose. Which may imply the cpi is under reporting

inflation.

The Accountant

Active Member

I was expecting / hoping for more like an increase to 100B authorized shares so the board could split several times in desired multiples, without needing a shareholder vote each time.

By only authorizing enough for this Split, it removes the FUD that excess authorized shares were meant for a future capital raise.

There is still considerable FUD that Tesla is tight on cash. TSLAQ claims Tesla runs dangerously low on cash during the month only reaching a cash balance of $16b-$18B at month end by use of accounting tricks (e.g. delaying payments to suppliers). They point to Tesla's low interest income as evidence (which is flawed).

Last edited:

I thought we agreed not to use initials, odd acronyms, etc in posts.That fits the bill too. I just asked Google and it said Global. You say Potato and I say Banana, let's call the whole thing off.

Stretch2727

Engineer and Car Nut

By only authorizing enough for this Split, it removes the FUD that excess authorized shares were meant for a future capital raise.

There is still considerable FUD that Tesla is tight on cash. TSLAQ claims Tesla runs dangerously low on cash during the month only reaching a cash balance of $16b-$18B at month end by use of accounting tricks (e.g. delaying payments to suppliers). They point to Tesla's low interest income as evidence (which is flawed)

Not sure it is this. $5B raise is only 20M shares assuming $250 a share post split. 20M shares is a drop in the bucket with approx 3B shares available to issue after the split.

I really think it comes down to some realistic expectations for the market value of the company and a reasonable share price range.

If the shares hit $1000 post split this is more than $3T market value. More than Saudi Aramaco!

Krugerrand

Meow

Be more impressive if they don’t go bankrupt or get bought and absorbed/dismantled. How impressive was the Model S when it came out, and yet -

Rivian's R1T AWD System Gets Praised by a Well-Known Engineer, He Calls It the Holy Grail

There’s no denying that Rivian is turning into a very likable manufacturer. Its vehicles are highly desirable. But besides being a cool, practical, innovative, and forward-thinking company, the R1T is stealing the whole show with its amazing characteristics. That’s why this famous engineer says...www.autoevolution.com

Pretty impressive!

henchman24

Active Member

Along with that, I think we see a desire to have the shares priced in the 300-400 range (which at the more realistic and in early year prices 900-1200 fits perfectly). Each split looks to be designed to fit around there with some growth overhead. This gives room for the company to still double from here and split again.Not sure it is this. $5B raise is only 20M shares assuming $250 a share post split. 20M shares is a drop in the bucket with approx 3B shares available to issue after the split.

I really think it comes down to some realistic expectations for the market value of the company and a reasonable share price range.

If the shares hit $1000 post split this is more than $3T market value. More than Saudi Aramaco!

J

jbcarioca

Guest

There is another aspect of this that has been largely ignored. Well designed BEV wheel control systems are easily capable of very precise traction control. Off-roading makes those advantages glaringly obvious, as in the Rivian example.Be more impressive if they don’t go bankrupt or get bought and absorbed/dismantled. How impressive was the Model S when it came out, and yet -

Back in early 2016 I was driving an S70 to Crater Lake, Oregon. Overnight there was un forecast heavy snow. My rented S70 had summer tires RWD. It looked dire, more so since a Range Rover parked next to me was stuck. The Tesla had minimal slippage and extracted itself with relatively little drama. A week later a Tesla tech told me about the software that made that possible. Obviously that does not really make driving in very slippery conditions safe, it does reduce the risks substantially.

my lesson: a well designed purpose built pure BEV can have vastly better directional control and stability than can any ICE vehicle. That enhanced stability reduces wind risks, especially for, say, large articulated trucks. It reduces risk of losing directional control. And more, plus this is far cheaper than is ICE drivetrains.

We rarely discuss that set of issues. Those should be BEV standards, but cannot typically be with the BEV conversions of ICE vehicles.

Is that control advantage contributing to lower Tesla accident rates? Will it do so for Rivian too? It seems so to me.

That should be a focus for NTSB. ICE is dangerous! They catch fire easily, and have dangerously poor traction control! Ban ICE!

Artful Dodger

"Neko no me"

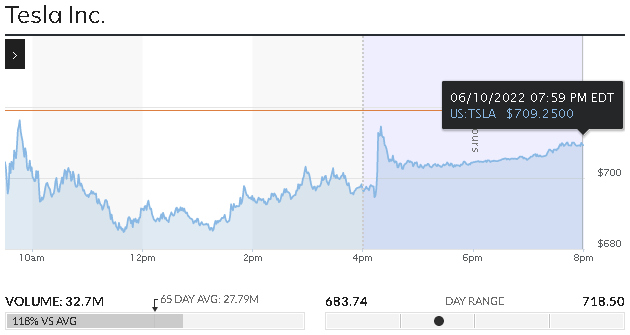

Heavy After-hrs trading in TSLA on Fri, Jun 10, 2022 with 1,582,571 shares changing hands during the session.

Additionally, the SP traded up significantly over the final 2 hrs (6-8 PM), when most Retail participants have finished trading, with only MMs and Hedge funds remain at the table. This indicates short covering by the largest players working against TSLA, due to fears of the looming 3:1 Share Dividend (which they can not counterfeit, nor spoof away with a hand wave):

Tesla is perfectly positioned to weather any coming economic storm, and will continue to grow at an accelerated pace throughout the next 2-3 years. As such, TSLA will draw investors to it like moths to a street light. When this is all done, Tesla may emerge as the largest company on the Planet.*

Cheers to the Longs!

*Pressurized Cybertruck (SpaceX Ed.) will be roving Mars by 2029, so this implies a timeline for the above claim.

Additionally, the SP traded up significantly over the final 2 hrs (6-8 PM), when most Retail participants have finished trading, with only MMs and Hedge funds remain at the table. This indicates short covering by the largest players working against TSLA, due to fears of the looming 3:1 Share Dividend (which they can not counterfeit, nor spoof away with a hand wave):

Tesla is perfectly positioned to weather any coming economic storm, and will continue to grow at an accelerated pace throughout the next 2-3 years. As such, TSLA will draw investors to it like moths to a street light. When this is all done, Tesla may emerge as the largest company on the Planet.*

Cheers to the Longs!

*Pressurized Cybertruck (SpaceX Ed.) will be roving Mars by 2029, so this implies a timeline for the above claim.

Last edited:

UkNorthampton

TSLA - 12+ startups in 1

Tesla-related - people will really be looking at EVs in the Highlands. Longer-range vans/HGVs with access to a great charging network would be great. High fuel costs mean that higher EV prices would be offset within a short time.

Article about high fuel prices in remote areas of UK. 208.7p / litre for petrol & 221.7p/litre for diesel.

Edit: Adding spoiler & this note: it won't take much for fuel infrastructure economics to collapse. Once it hits a certain point, ICE are stranded.

Article about high fuel prices in remote areas of UK. 208.7p / litre for petrol & 221.7p/litre for diesel.

Edit: Adding spoiler & this note: it won't take much for fuel infrastructure economics to collapse. Once it hits a certain point, ICE are stranded.

I've lived in some rural areas and many locals are older, do very few miles, often local shops and doctors. Visits to the local town 10-20 miles away for hospital appointments. Most garages (fuel and service) are run by older people and many will close soon. Rural retired drivers are people who would benefit from EVs - running costs, charging at home, lower maintenance but anecdotally seem to be represented as being least likely to get EVs. UK is fairly densely populated, how much more relevant for people in sparsely populated, high-aged areas of USA & other places? Refuelling at a supermarket might mean a 40 mile round trip.

Also effects on transport costs, even willingness for deliveries at all. In UK, some parts are NOT included in home-delivery offers, or there may be a surcharge, Amazon UK have a policy that sellers can't refuse anywhere in UK (maybe just GB now), but can surcharge delivery. I found some Amazon listings that explicitly said they wouldn't deliver though.

In many parts of the world, getting fuel to a pump involves dangerous roads, banditry, bribes to cross internal as well as international borders/arbitrary checkpoints*, crossing swollen rivers on ferries or even wading. Fuel infrastructure seems easy, but compared to electricity generated locally or via transmission lines, it's awful. Most places already have electricity (which is needed for fuel pumps, possibly could use diesel generators, but problems running those for years).

EVs are better with local generation via solar/wind/storage projects. As more become available, awareness will grow until ICE has no relevancy, good riddance. Plus mountain roads, regen, less brake wear.

*I was travelling with an Indian Army officer when someone tried to get him to pay a "toll" at a checkpoint some local gang had set up. That was entertaining...

Also effects on transport costs, even willingness for deliveries at all. In UK, some parts are NOT included in home-delivery offers, or there may be a surcharge, Amazon UK have a policy that sellers can't refuse anywhere in UK (maybe just GB now), but can surcharge delivery. I found some Amazon listings that explicitly said they wouldn't deliver though.

In many parts of the world, getting fuel to a pump involves dangerous roads, banditry, bribes to cross internal as well as international borders/arbitrary checkpoints*, crossing swollen rivers on ferries or even wading. Fuel infrastructure seems easy, but compared to electricity generated locally or via transmission lines, it's awful. Most places already have electricity (which is needed for fuel pumps, possibly could use diesel generators, but problems running those for years).

EVs are better with local generation via solar/wind/storage projects. As more become available, awareness will grow until ICE has no relevancy, good riddance. Plus mountain roads, regen, less brake wear.

*I was travelling with an Indian Army officer when someone tried to get him to pay a "toll" at a checkpoint some local gang had set up. That was entertaining...

Fuel costs: The drivers living with the UK's highest prices

People living in parts of the Highlands are used to paying more for petrol and diesel.

www.bbc.co.uk

Last edited:

Who the heck is Bob?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K