SellI’m surprised by the ease with which many on this thread are willing to assume Elon’s comments mean nothing or simply indicate business as usual. I’ll be the first to admit we are lacking clarity and real specific details, but as investors it seems prudent to consider all the possibilities and avoid an echo chamber of rainbow, butterflies and unicorns.

It seems to be factual that the 4680 ramp isn’t going as optimal as hoped. It seems when building the Austin and Berlin gigas, Tesla had to plan for a certain 4680 ramp/maturity. I believe they bet fairly big or optimistically on where the 4680 ramp would be...maybe too much so? We've seen Tesla acknowledge that Berlin had a 2170 backup plan pretty early on. I think he said they are putting in a similar plan in Austin. I believe these adjustments to the original plan and the compatibility with structural pack is the real curve ball at the new gigas. Of course all the supply chain issues exasperate the problem and offer additional issues with chips and more. I know Tesla is agile and doing amazing things to overcome....but we are operating without a lot of positive data here on this topic, so it seems like we shouldn't assume everything is rosey...I am hoping to learn more about the 4680 ramp and mitigation plans at our next conference call to give us more facts and clarity.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Confused again, I looked at our original 2018 agreement and made things worse.Right, but that was EAP from no AP at all. There was a point in time that upgrading from AP to EAP was 3k. I would bite right now at that price for the few extra features that EAP gives you over AP. It would be nice on road trips. 6k, however, I'll just dump that into more TSLA shares, not the product.

What happened to FSD? We bought it, paid 8K for all I'm sure, and it's doing left turns in the city now. Where did they put the 3K?

April 2018 Purchase Agreement:

one moreAustin is not a Shanghai "Cut and Paste". Lots of new tech coming on board (and not only with batteries).

Bumps are to be expected by reasonable investors.

A slower ramp at Austin would be a big problem if the technology was the same as Shanghai's; it's not.

A slower ramp at Austin would be a big problem if Tesla's competition was nipping at its heels; they're not.

A slower ramp at Austin would be a big problem if Tesla had negative cash flow with high debt; they don't

A slower ramp at Austin would be a big problem if Tesla would need the volume to achieve 50% growth; they won't.

Patience my fellow investors . . . patience.

"Production Hell" it's not

no tents required

Last edited:

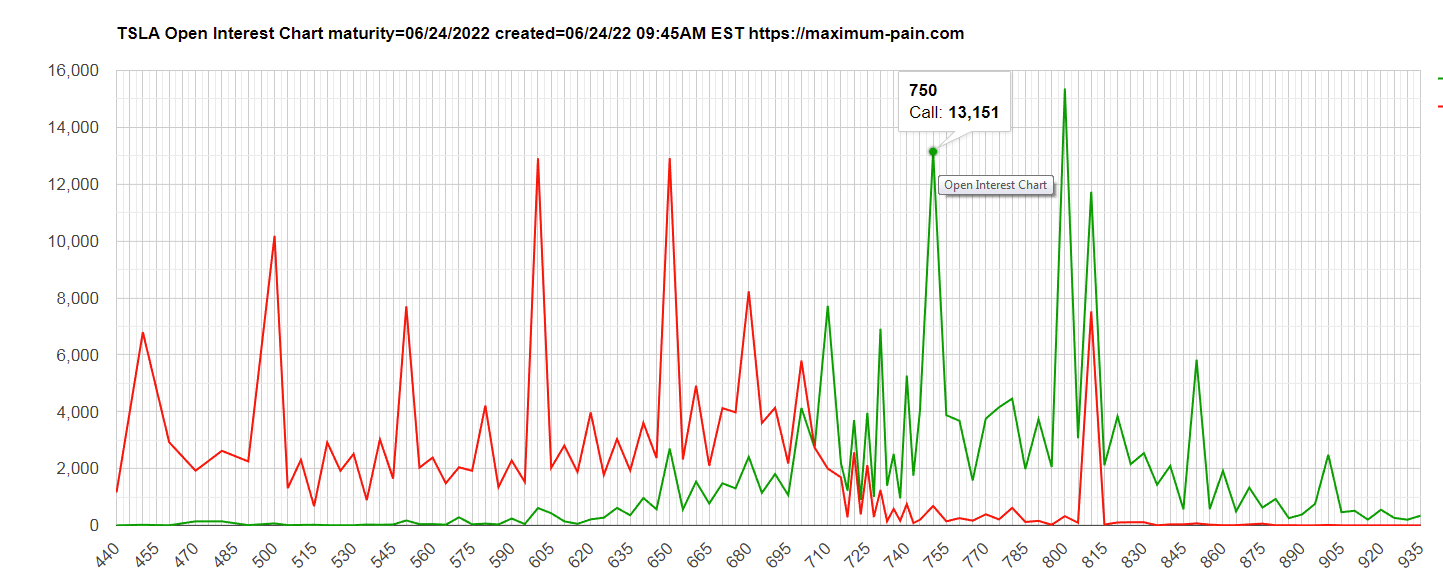

Calling 749.90 for the close (10% confidence, it's TSLA).

Todd Burch

14-Year Member

Why? Getting added into that index will force funds to purchase TSLA--so wouldn't you expect people would want to get in ahead of that?I was anticipating a dip today ahead of the Russell 1000 index rebalancing in after hours.

I don't understand all this hand wringing over AP vs EAP vs FSD ... if you want it you pay the asking price .... simple

IIRC I could have bought FSD on my first MS in 2017 for $5K ... i did not do it.. shame on me...I have since sold that car but is would have been $10K to get FSD .... you snooze you lose ...

if FSD is "solved " these numbers will be small .. just saying

IIRC I could have bought FSD on my first MS in 2017 for $5K ... i did not do it.. shame on me...I have since sold that car but is would have been $10K to get FSD .... you snooze you lose ...

if FSD is "solved " these numbers will be small .. just saying

2018 was before "The EAP Change"Confused again, I looked at our original 2018 agreement and made things worse.

What happened to FSD? We bought it, paid 8K for all I'm sure, and it's doing left turns in the city now. Where did they put the 3K?

April 2018 Purchase Agreement:

View attachment 820441

Tesla Full Self-Driving Upgrade Costs Drop To $3k For Enhanced Autopilot Users

$3k to upgrade to FSD was offered June 2020

From reddit via TMC:

In a normal world yes. But who actually needs to purchase them (or am I mistaken and there is no buying)?Why? Getting added into that index will force funds to purchase TSLA--so wouldn't you expect people would want to get in ahead of that?

And do they have friends that will lower the mark to get the better price?

Agreed, but I'm not a hand-wringer, not sure I've ever done that. I'm reminded of...I don't understand all this hand wringing over AP vs EAP vs FSD ... if you want it you pay the asking price .... simple

IIRC I could have bought FSD on my first MS in 2017 for $5K ... i did not do it.. shame on me...I have since sold that car but is would have been $10K to get FSD .... you snooze you lose ...

if FSD is "solved " these numbers will be small .. just saying

Krugerrand

Meow

Umm…no.The point you silly cat is that the next 3 product launches require the 4680. That panosonic says 2024. That tesla, despite a 2 year head start, can not get the 4680 lines to really scale much faster than panosonic. That like bitcoin sometimes Tesla screws up. That any wise investor would be looking at the risks associated with their investment and be monitoring the performance of the company.

Because Tesla is operating in a period of high demand this won't impact things too much other than some blown capital. In 2 years it appears we'll be awash in alternative vehicles. In 4 years some of them may be quite decent and not early kludges. Ford may have some 250,000 trucks on the road before Tesla and at that point may be really scaling- they will have battery capacity to do a million a year at that point.

I'm still trying to see the panic, other than Elon's usual over-the-top words at being upset his new factories are not yet up to the speed he'd like to see.

Yes. Some significant amount of Wall St. chronically underestimating what Tesla will accomplish in next quarters and years ties to them not comprehending Elon often issues over-the-top words on the latest situation serious enough to warrant a major slice of his attention.

How much is from his immediate alarm (which he never hesitates to make public) and how much is calculated to set employees to full scramble mode I can't say. Take the example of last years "SpaceX could go bankrupt if Raptor 2 can't yet be manufactured as fast and cheap as it needs!"

I may have missed some recent updates from Elon on that existential crisis, but my impression following the SpaceX sub thread is it is fixed or partly fixed and is moving to fully fixed and he's now moved on to other high priority SpaceX issues.

My only disagreement with the original post is that most of us who have followed Tesla and SpaceX closely for years know that serious problems don't fester until they blow up with massive damage (like Ford's 2M + recall). Ramp estimates of super challenging technical problems like 4680 may prove to be too optimistic, but they WILL get sorted out and eventually fill their intended role in the years long master plan and execution.

UkNorthampton

TSLA - 12+ startups in 1

Tesla related: until Tesla came along, Toyota Prius still held green credentials for many people - a petrol-driven hybrid (obv. other electric cars such as Leaf, Zoe etc existed, but not that well known in popular culture). Toyota was (is?) a huge producer of cars. So, in some ways Toyota is a competitor for Tesla, both in products, but more in people's heads as a green brand. Toyota really are out of step with the worldI think Toyoda loves the respect, even adoration he gets from suppliers, Japanese government & in general. Moving to EVs is an earthquake to suppliers & he'll lose what he enjoys most. I suspect he surrounds himself with Yes-Men and he's had too much power for too long.

It will be a rude awakening for Toyoda, Toyota, suppliers, Japanese Government & people.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ITC5SX2UT5PVFJP7AR6WYKQPAE.jpg)

Exclusive: After pressure from Toyota chief, Japan emphasized support for hybrids

Toyota Motor Corp's chief lobbied the Japanese government to make clear it supported hybrid vehicles as much as battery electrics or face losing the auto industry's support, a senior lawmaker told a ruling party meeting.

Toyoda/Toyota pressure may work in Japan, elsewhere it will damage Toyota & Japanese sales. It seems like the wheels might fall off the whole Japanese car industry...

Akira Amari, a former industry minister and a veteran member of the Liberal Democratic Party (LDP), requested changes to the government's annual economic policy roadmap at a June 3 meeting, saying he had spoken with Toyoda a day earlier, according to notes and audio of the meeting reviewed by Reuters.

The final version of the document included a reference to "so-called electric-powered vehicles" and appeared to put fossil-fuel burning hybrids on equal footing with zero-emission battery vehicles, even though environmentalists say there is a vast difference.

"I spoke with Chairman Toyoda yesterday and he said that JAMA cannot endorse a government that rejects hybrids," Amari told the policy meeting of LDP lawmakers, according to the notes and audio.

Use of synthetic fuel, such as from hydrogen, would make hybrids "100% clean energy" cars and the policy document should make that explicit, Amari said.

"If we don't make that clear, JAMA will push back with all its might," Amari said, according to the notes and audio.

insaneoctane

Well-Known Member

My point is that there is increasing information indicating that the 4680 ramp and Giga outputs are behind. I have seen too many responses saying this is all expected and everything is fine. Maybe long-term, but if Q2 numbers are lower than expectations beyond what's already associated with Shanghai shutdown, then it matters in the short-term. We get so used to dismissing FUD around here, I don't want to miss potentially legitimate insight. I'm just wanting a bit more objectivity here with admitting what we know as facts vs what we don't know. I'm not selling (actually I added some more yesterday), but I am not sure what Q2 will bring...Okay let’s go with that for argument’s sake. So, what’s your point then? Exactly.

Does it mean TSLA is worth the current SP? Or less?

Does it mean Tesla is going bankrupt?

In relation to Tesla/TSLA as an investment what exactly does the above POV mean to you? Because to me it doesn’t change a single itty bitty thing. To me, it’s literally just noise like the day to day SP gyrations.

insaneoctane

Well-Known Member

EXCELLENT reminder of what we were recently told. Maybe the FUD has ME second guessing what I know....which is really MY problem. Thank you!No.

This is totally incorrect save for the Bitcoin and Solar Roof part, and it directly contradicts what Tesla leaders have stated on both of the last two earnings calls. Does it not get tiresome being so grumpy and pessimistic all the time?

Q4 ‘21

Elon Musk:

“The fundamental focus of Tesla this year is scaling output. So both last year and this year, if we were to introduce new vehicles [such as Cybertruck], our total vehicle output would decrease. This is a very important point that I think people do not -- a lot of people do not understand. So last year [2021], we spent a lot of engineering and management resources solving supply chain issues, rewriting code, changing our chips, reducing the number of chips we need, with chip drama central.

And there were not -- that was not the only supply chain issue, so -- just hundreds of things. And as a result, we were able to grow almost 90% while at least almost every other manufacturer contracted last year. So that's a good result. But if we had introduced, say, a new car last year, we would -- our total vehicle output would have been the same because of the constraints -- the chips constraints, particularly.

So if we'd actually introduced an additional product, that would then require a bunch of attention and resources on that increased complexity of the additional product, resulting in fewer vehicles actually being delivered. And the same is true of this year. So we will not be introducing new vehicle models this year. It would not make any sense because we'll still be parts constrained.

We will, however, do a lot of engineering and tooling, whatnot to create those vehicles: Cybertruck, Semi, Roadster, Optimus, and be ready to bring those to production hopefully next year. That is most likely. But like I said, it is dependent on are we able to produce more cars or fewer cars?”

…

Drew Baglino:

“So throughout 2021, we focused on growing cell supply alongside our in-house 4680 effort to provide us flexibility and insurance as we attempt to grow as fast as possible. As we sit today, sales from suppliers is actually -- it sort of exceeds our other factory-limiting constraints that you mentioned, Elon, in 2022, or to say differently, 4680 cells are not a constraint to our 2022 volume plans based on the information we have.

But we are making meaningful progress of the ramp curve in Kato. We're building 4680 structural packs every day, which are being assembled into vehicles in Texas. I was driving one yesterday and the day before. And we believe our first 4680 vehicles will be delivered this quarter.

Our focus on the cell, the pack, and the vehicles here is driving yield quality and cost to ensure we're ready for larger volumes this year as we ramp and next year. And the 4680 and pack tool installations here at Giga Austin are progressing well with some areas producing first parts. And the internet has also noticed that.”

Elon Musk:

”Yeah.”

Drew Baglino:

“Yeah, I was touring the factory -- the cell factory here. I'm super pumped. It's like a really exciting accomplishment for us to bring everything into one Austin factory here in Texas.”

Elon Musk:

“Absolutely. And just to repeat Drew's point, we are still -- we still expect to be part or primarily chip-limited this year [2022]. So that's the thing -- that's actually the driver.”

Drew Baglino:

“Yeah.”

Elon Musk:

“And that chip limitation should alleviate next year [2023]. And then probably, we transition into a cell limitation battery, you know, total gigawatt-hours of cell limitation, which is when the 4680 will become very important.”

Drew Baglino:

“Agreed.”

…

Elon Musk:

“… and I should say, like, we did short-change the energy business last year, and that vehicle took priority over the energy side. So --“

Drew Baglino:

“Not on cells, but on chip side.”

Elon Musk:

“Yeah, on chip side, exactly.”

Drew Baglino:

“Yeah.”

…

Jed Dorsheimer:

“That's helpful. Thank you. So you what -- do you see that '22 is kind of the opening of that -- the energy business reaccelerating?”

Elon Musk:

“It's hard to predict 2022 because we still have lingering supply chain -- there are still lingering supply chain issues globally. But I think the chip stuff -- at least the chip side of things appears to -- looks like it will alleviate end of this year or '23. I mean, there are a crazy number of chip fabs being built, which is great. The sheer number of chip fabs being built right now is exciting to see, yeah.

So there could be other issues. We're trying to anticipate those as much as possible but, you know, predicting the future is difficult.”

Drew Baglino:

“And the goal is definitely to grow it this year.”

Elon Musk:

“Yeah. We'll grow it this year, for sure. It's just, you know, we -- if we're simply -- we're able to respond to demand, it might grow by like 200% or 300% or something, you know, as opposed to sort of 50% or something.”

Zach Kirkhorn:

“Yeah. I mean, I think it's exactly that. I mean, it's a question of does it double, triple, quadruple? I mean, either way, I think, you know, our plans are pretty ambitious for Megapack this year and storage in general.”

Elon Musk

“Yeah.”

Zach Kirkhorn:

“The exact amount of growth is hard to know. But ultimately -- I mean, to Elon's point about the growth of this business, I mean, we need to be growing it faster than the vehicle business.”

Elon Musk:

“And it will naturally grow faster than the vehicle business once we can less shipthe --“

Zach Kirkhorn:

“Yeah.”

Elon Musk:

“The damn chip constraint, frankly. So it will grow like kelp on steroids, basically, on their own.”

Q1 ‘22

Drew Baglino:

“…[For 4680s] It’s really about rate and yield, which will come in time, as Elon said, over the course of this year and next.”

…

Martin Viecha:

“All right. And maybe the last question from investors is what is the current run rate of 4680 cell production at Fremont and at Giga Texas? What do you expect run rates of 4680 to be in Fremont and Giga Texas or Berlin at the end of the year?”

Elon Musk:

“Well, Berlin is using the 2170 nonstructural pack, so they’re not concerned about 4680. They will transition to 4680 hopefully later this year, but current Berlin production doesn’t require that. We also have, just as a risk mitigation, 2170 nonstructural pack capability here at Giga Texas as well, but if things go according to plan, we will be in volume production with 4680 sometime perhaps towards the end of the third quarter and certainly in the fourth quarter. That’s accurate, Drew?”

Drew Baglino:

“Yeah, and the other thing I would add is with the China COVID shutdown and the semiconductor bottlenecks we had through Q4 and a little bit in Q1, we have sizable cell inventory at the moment and excess cells to support the 2022 volume targets you described. So that gives us the ability to be pretty deliberate in the 4680 ramp where we can maximize learning step by step, take engineering downtime to upgrade key pieces of equipment and modify the structural pack designs to improve reliability all while achieving what you just said.”

Elon Musk:

“Yeah, 4680 output is not a risk to achieving one and a half million vehicles produced this year, but it would become a risk next year if we do not solve volume production by early 2023, but we’re highly confident of doing so.”

StealthP3D

Well-Known Member

No.

This is totally incorrect save for the Bitcoin and Solar Roof part, and it directly contradicts what Tesla leaders have stated on both of the last two earnings calls. Does it not get tiresome being so grumpy and pessimistic all the time?

You can rest easy knowing those who are always grumpy and pessimistic probably have a long history of watching the rest of us get the lion's share of the gains. It's no wonder they are so grumpy, it can't be easy having to watch us rake in millions and increase our share counts while their pessimism has prevented them from buying into the idea that TSLA really is superior.

It seems they might think they have done well if they have only 20% of their portfolio in TSLA part-time, for only 30% of the gains. Deep down inside they know better, so it makes perfect sense why they are so grumpy. But this raises the chicken and the egg dilemma. Did they miss out on most of TSLA's rise because they are grumpy, or are they grumpy because they missed out on most of TSLA's rise?

I'm pragmatic, so it's good enough for me to simply know they are grumpy, pessimistic and missed out on most of TSLA's gains (and will continue to miss out on mot of the future gains). I don't need to know why.

Last edited:

2daMoon

Mostly Harmless

FTFYOkay so base your investment on Tesla failing to scale 4680s like how Tesla had trouble scaling model 3s in 2018. Pretty sure care bears are all washing up on a beach somewhere after falling overboard from the TSLA cruise ship from their short or lack of investment into Tesla from 4 years ago

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K