Thank you and please call me out, my working knowledge of Tesla is old as I left in 2015, but then worked on other systems during my time at Google AI (full stack) until I retired last year. And just to be clear, I've seen various people talk about what they think they know and what they perceive is happening in the autonomous space. Basically James is the best I've seen on our own @DaveT 's channel.Discoducky had experience with autonomous vehicles, but I do know that other members of the community would call him out on his bullshit if he made random claims like that.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Buckminster

Well-Known Member

First Tesla. MYLR Shanghai build with FSD. Staines, UK pickup. Lots of cars. Tesla in control.

StarFoxisDown!

Well-Known Member

So please don't take this as me saying you're spouting FUD but this "If tesla growth has fallen from 110%, to 48,5% to 29,3%, it wouldn't surprise me if the marked is pricing in growth following the same trajectory going forward." to me, at least, starts to fall in the realm of FUD. Or at least very much a bearish take on Tesla. For these following reasons:(Just so we're clear though. I'm a huge believer in FSD, and i think this will be somewhat priced into the share price. Tesla will probably always have a + 10-15 bonus in it's PE solely on the hope of the robotaxi network coming to fruition.)

Well, marked prices are based on expectations of future earnings. If tesla growth has fallen from 110%, to 48,5% to 29,3%, it wouldn't surprise me if the marked is pricing in growth following the same trajectory going forward. Given this trajectory 20% growth rate is only a few years away, which would make tesla hit 1,5x of future net income growth. Maybe the PE could be a few points higher, but either way the PE would only be a few years away from 30. It's fine to disagree on the PE though, as long as we're discussing the numbers for 2025. I also think the PE's in general will stay lower for the following years compared to what we've seen the last 5+ years.

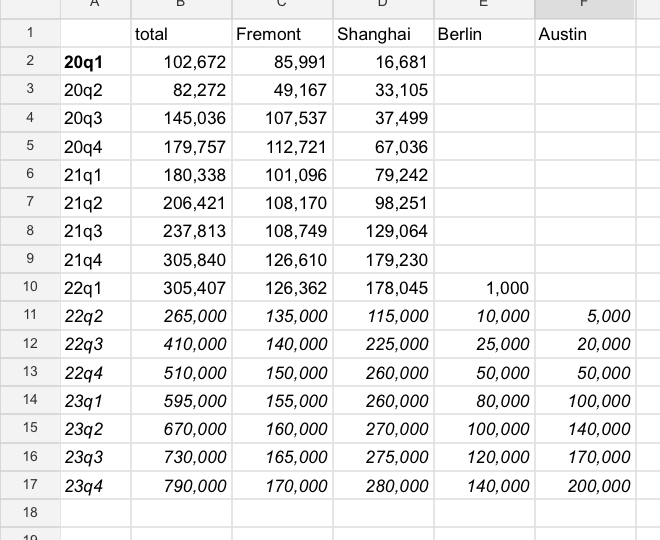

I guess i could raise 2025 PE to 35 while still being slightly on the conservative side. Here's an updates version then. I've also dialed down the dilution.

View attachment 822656

- Tesla has openly stated both that they expect to grow revenues at 50% for the next few years. Not just this year or next year or the year after that.

- Tesla has stated their goal for 2030 in terms of production.......which walked back on a annual growth %, means Tesla is planning on growing close to 50% until 2030.

- Your numbers are based on earnings growth. Tesla's earnings growth will be 1.5-2X their revenue growth for as long as they continue building and expanding Gigafactories. This isn't just based on unrealistic expectations. We can look at the past year and a half to see how operational leverage has affected earnings.

- You have revenue growth of 76% in 2023, 44% in 2024, and 35%. Yet you have Net income growth of 111%, 45%, and 27% for those corresponding years. Those numbers don't add up. In fact, I'd argue many of your numbers in 2024 and 2025 are illogical and this is where your numbers really fall apart for me. There's a ton of very bearish assumptions in those numbers for 2024/2025. Those numbers assume Tesla's operating leverage and execution has fallen dramatically and I simply don't agree with that.

I have a quick question. What were your peer's thoughts on Tesla AI at Google?Thank you and please call me out, my working knowledge of Tesla is old as I left in 2015, but then worked on other systems during my time at Google AI (full stack) until I retired last year. And just to be clear, I've seen various people talk about what they think they know and what they perceive is happening in the autonomous space. Basically James is the best I've seen on our own @DaveT 's channel.

ZeApelido

Active Member

Might want to up that rate........significantly.

I don't trust Electrek's sources so I'm not about to get all giddy about it. But 2k/week from Austin + 1200/week from Berlin (now that it's 6 days a week) is in the ballpark of 40k per quarter and we're not even in Q3 yet.

Given further increases to production rate throughout Q3, I think at least 50k from Austin/Berlin with a upside to 75K is definitely possible.

So still on track for a Q3 P/D print of 420k.

5000 in a week?!

Drumheller

Active Member

Cabin overheat protection will automatically disable if the state of charge is below 20%. It can also be disabled at any time in the controls.Just a wild guess that I made up and very probably wrong. The hatches are open on cars with a lower state of charge to keep them cool so the overheat protection (A/C) doesnt turn on or can't turn on. Easier to identify and close at the end of the day if the customer doesnt pick up their car or the weather looks like it is going to rain than windows being down.

ZachF

Active Member

Some rough guesstimates for future production rates:

After this (2024) I expect new factories to be coming online… east coast, 2nd European, Indonesia, and maybe Brazil.

After this (2024) I expect new factories to be coming online… east coast, 2nd European, Indonesia, and maybe Brazil.

Last edited:

That's about right.5000 in a week?!

Electrek seems to have zero fact checking going on. Are they hiding all of these cars in the factory because they aren't shipping out 5k/ week.

2k? sure.

PKEllefsen

Member

So please don't take this as me saying you're spouting FUD but this "If tesla growth has fallen from 110%, to 48,5% to 29,3%, it wouldn't surprise me if the marked is pricing in growth following the same trajectory going forward." to me, at least, starts to fall in the realm of FUD. Or at least very much a bearish take on Tesla. For these following reasons:

- Tesla has openly stated both that they expect to grow revenues at 50% for the next few years. Not just this year or next year or the year after that.

- Tesla has stated their goal for 2030 in terms of production.......which walked back on a annual growth %, means Tesla is planning on growing close to 50% until 2030.

- Your numbers are based on earnings growth. Tesla's earnings growth will be 1.5-2X their revenue growth for as long as they continue building and expanding Gigafactories. This isn't just based on unrealistic expectations. We can look at the past year and a half to see how operational leverage has affected earnings.

- You have revenue growth of 76% in 2023, 44% in 2024, and 35%. Yet you have Net income growth of 111%, 45%, and 27% for those corresponding years. Those numbers don't add up. In fact, I'd argue many of your numbers in 2024 and 2025 are illogical and this is where your numbers really fall apart for me. There's a ton of very bearish assumptions in those numbers for 2024/2025. Those numbers assume Tesla's operating leverage and execution has fallen dramatically and I simply don't agree with that.

Well, how the numbers are adding up are all in the table. I'd be happy to change some of them to make the numbers different if you can point out which ones looks off to you (not the sum of the numbers, but factors actually making the results like deliveries, margins, ASP, operating expenses and so on). Net income growth and revenue growth doesn't have to correspond. If tesla is barely making a cent one year, it's easy for them to 10x their net income while their revenue is growing at the same pace as earlier.

I'm not sure if tesla has stated that the revenue will grow at 50% every year? I think they have just said 50%, which i assume would be vehicle deliveries. Might be mistaken on that though. Might also be an average from 2020 or 2021 or something.

Anyways, as stated, this projection is without fsd, tesla themselves are probably including it if they are planning to increase revenue by 50% for both 2024 and 2025 and so on. If you can increase my projected revenue for 2025 by 50% compared to 2024 without including fsd i would be mighty impressed (of course, while making the numbers still looking somewhat realistic).

damonbrodie

Member

Aren't Revenue and vehicle deliveries roughly locked ratio-wise?I'm not sure if tesla has stated that the revenue will grow at 50% every year? I think they have just said 50%, which i assume would be vehicle deliveries.

insaneoctane

Well-Known Member

Unless Tesla slows down their innovating.... I just don't see that happening. Wouldn't both FSD/robotaxis and Optimus all have to be failures for 2025+ not to be more exciting?... but if I was a betting man (and I am), I would bet that the 2026-2030 period will be more exciting and lucrative than 2021-2025.

Hell, I'm really anxious to hear the Master Plan III, and that likely applies more to <2026 than after!

Last edited:

PKEllefsen

Member

Aren't Revenue and vehicle deliveries roughly locked ratio-wise?

No, because of two things: 1. They deliver other products which affects the delivery/revenue relationship. 2. In the future they will most likely sell cheaper vehicles, so despite them increasing deliveries by 50%, revenue could still only grow by 30%. This would of course be the opposite if they started selling a lot more expensive vehicles.

example: If someone is selling 100K cars at 50K each that would amount to 5 Billion in revenue. Now they increase production by 50K cars which costs 25K each, so their new revenue becomes 6,25 Billion. Now their deliveres have increased by 50%, but revenue only by 25%.

edit: too much pressure

Last edited:

StealthP3D

Well-Known Member

The future becoming clearer to all in a year or two bodes well for the price of TSLA in the next year or so because it's very difficult to make a killing in the stock market buying something that everyone already knows is a no-brainer. Those who buy big during the darkest looking times, profit the most.In 2026, Tesla will have $Billions of Cash to invest, be the leader in Battery Technology and perhaps be a big player in AI technology.

There won't be a lack of innovation and there won't be a lack of money. I think things will become clearer to all in a year or two.

I know I'm stating the obvious, but I do it because people often get lost in the gloom of the moment, with an inability to see the forest for the trees. Fear, uncertainty and doubt is the biggest enemy of an investor who wants success. That is why FUD is such a valuable tool to the market players. If an investor waits until everything looks good to every Tom, Dick and Sally, they can be confident their returns will look very average!

Interesting data point, but take with a grain of salt until confirmed.

Looking at demand, and the products coming on line in the next couple of years, it seems unlikely ASPs will come down.No, because of two things: 1. They deliver other products which affects the delivery/revenue relationship. 2. In the future they will most likely sell cheaper vehicles, so despite them increasing deliveries by 50%, revenue could still only grow by 30%. This would of course be the opposite if they started selling a lot more expensive vehicles.

example: If someone is selling 100K cars at 50K each that would amount to 5 Billion in revenue. Now they increase production by 50K cars which costs 25K each, so their new revenue becomes 6,25 Billion. Now their deliveres have increased by 50%, but revenue only by 25%.

edit: too much pressure

It's looking less and less likely Tesla will ever release a $25k car at all. Looks a lot more like FSD/ Robotaxi comes online first which will better address the need for low income buyers. Before Tesla looks at launching a $25k vehicle, demand for their current lineup plus the Cybertruck needs to start slacking off.

StarFoxisDown!

Well-Known Member

I guess we'll find out in the a few days. If Tesla posts a print of say 275k-280k, then we know Austin P/D was much higher than we all expected.5000 in a week?!

The 5,000 number still seems pretty high.

StarFoxisDown!

Well-Known Member

I believe this guys numbers are including the 30th/31st of May which skews the numbers somewhat. Granted the number of deliveries on those two days wouldn't have nearly the same that they've been delivering throughout June. So maybe take off like 2,000 of that number.Interesting data point, but take with a grain of salt until confirmed.

To counter that though, production in the past 10 days will likely have been much higher than the first half of June so Tesla could up that delivery rate to something like 3,000/day for the last 4 days of the month.

henchman24

Active Member

You're right on there being a disconnect and it not being a direct relationship. With Tesla still heavily skewed to being an auto maker, it is still pretty close to direct.No, because of two things: 1. They deliver other products which affects the delivery/revenue relationship. 2. In the future they will most likely sell cheaper vehicles, so despite them increasing deliveries by 50%, revenue could still only grow by 30%. This would of course be the opposite if they started selling a lot more expensive vehicles.

example: If someone is selling 100K cars at 50K each that would amount to 5 Billion in revenue. Now they increase production by 50K cars which costs 25K each, so their new revenue becomes 6,25 Billion. Now their deliveres have increased by 50%, but revenue only by 25%.

Here's my counter point on the cheaper price point... as of now and any vehicle we know of, there is little reason to think the average sale price will drop in the near term (meaning 2-3 years). We've seen the price increases on the current model range that still has a significant backlog. The roadster and semi are much higher priced, but unlikely to materially impact ASP with their low volumes. The next volume vehicle is the Cybertruck, and we don't fully know the pricing yet. We do know the single motor and tri motor were 'canceled.' Leaving only dual and quad motor versions. Reasonable to expect the dual motor to at least start at 50k that it was originally announced and 55k is probably more realistic. The quad motor is likely 75-80k. This is before EAP or FSD. The ASP should actually increase for the next ~2-3 years. If there is a new model that is cheaper, we are likely ~4 years from volume production.

Now we may see the backlog dry up and prices have to be cut to keep up demand. That could hurt ASP and is a risk, but I don't think we'd see more than a 5% cut and certainly not more than 10%. This would also likely come at the time we have a quad motor Cybertruck pumping up ASPs too.

StarFoxisDown!

Well-Known Member

To summarize quickly, while I do think ASP will decline in 2024/2025 (though not quite to the extent that you have), I believe gross profit margin will be at a all-time high due to cheaper cost of goods (Tesla riding the 4680 Cell cost of good decline curve) and amortization/depreciation being spread across much higher production out of each factory.Well, how the numbers are adding up are all in the table. I'd be happy to change some of them to make the numbers different if you can point out which ones looks off to you (not the sum of the numbers, but factors actually making the results like deliveries, margins, ASP, operating expenses and so on). Net income growth and revenue growth doesn't have to correspond. If tesla is barely making a cent one year, it's easy for them to 10x their net income while their revenue is growing at the same pace as earlier.

I'm not sure if tesla has stated that the revenue will grow at 50% every year? I think they have just said 50%, which i assume would be vehicle deliveries. Might be mistaken on that though. Might also be an average from 2020 or 2021 or something.

Anyways, as stated, this projection is without fsd, tesla themselves are probably including it if they are planning to increase revenue by 50% for both 2024 and 2025 and so on. If you can increase my projected revenue for 2025 by 50% compared to 2024 without including fsd i would be mighty impressed (of course, while making the numbers still looking somewhat realistic).

Further your operating expenses are too high. Tesla already guided to operating expenses remaining relatively flat from last year and Tesla has shown that due to operating leverage, they are very very good at increasing production without increasing the same % of operating costs. They already have all the factories in place and ready to go to reach 3 million production. To go from 3 million to 5.4 million will only require 2 additional factories. But that will only increase operating expenses for Tesla in total about 25-30% from 2023 to 2025. You have operating expenses increasing 40% this year, 40% in 2023, and then 30% in 2024 and 2025. I think those numbers are grossly inaccurate.

PKEllefsen

Member

Looking at demand, and the products coming on line in the next couple of years, it seems unlikely ASPs will come down.

It's looking less and less likely Tesla will ever release a $25k car at all. Looks a lot more like FSD/ Robotaxi comes online first which will better address the need for low income buyers. Before Tesla looks at launching a $25k vehicle, demand for their current lineup plus the Cybertruck needs to start slacking off.

Well, i would be very worried right now if they had any sort of problem selling a bit more than 1 million model y's and 3's a year when they should be selling around 4 million in 2025. The biggest marked in the world is by far the sub 30K cars, so in my mind there is no doubt they will go into this marked at some point. Right now ASP's are also extremely high because there are almost no other car manufacturers managing to have any ev production at all.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K