2daMoon

Mostly Harmless

Looking at that compact portable briefcase phone reminded me just how revolutionary Agent 86's Shoe Phone was...

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Do we really believe that additional financial incentive thrown at battery materials will increase output, or will it just cause more market dislocations? From my understanding Lithium Americas has been working on permits for Thacker Pass for like 5 years and have largely been met with red tape delays. It seems to me that there's already enough financial incentives for these projects and we've seen what happens when too much money gets injected into the system.

I made this prediction 2 months ago. The upcoming TSLAQ talking point: decreasing wait times indicates demand is falling.The Coming TSLAQ Talking Point

The Tesla backlog wait time obviously needs to drop. With Giga-Texas coming on board, it will not only provide more Model Y supply but it will take the pressure off Fremont where they can increase the supply of Model 3s.

At some point it would be great to see wait times at 4-6 weeks in North America basically meaning that supply matches demand. When demand increases each quarter by 10%, supply will increase as well by 10% keeping wait times at 4-6 weeks.

As the backlog wait times drop from 11 mths to 9 mths to 6 months, and so on, TSLAQ will along the way point to this as proof demand is disappearing.

We will see TSLAQ twitter graphs, Seeking Alpha articles with elaborate analyses and deceptive prose.

Once again they will be disappointed.

How many times have we heard demand is falling?

View attachment 818760

rameznaam.com

rameznaam.com

exactly.I made this prediction 2 months ago. The upcoming TSLAQ talking point: decreasing wait times indicates demand is falling.

View attachment 846155

Written in 2019...

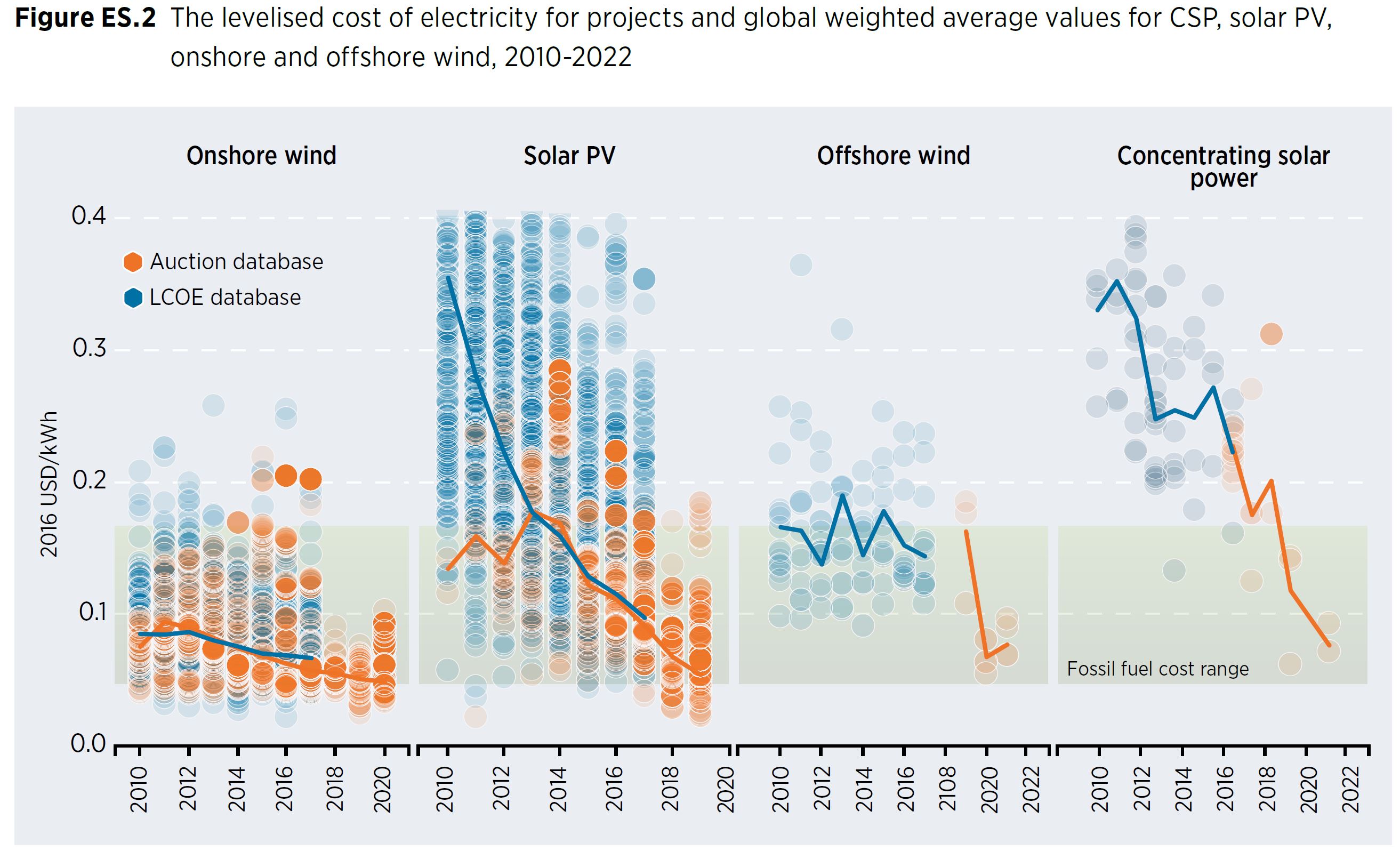

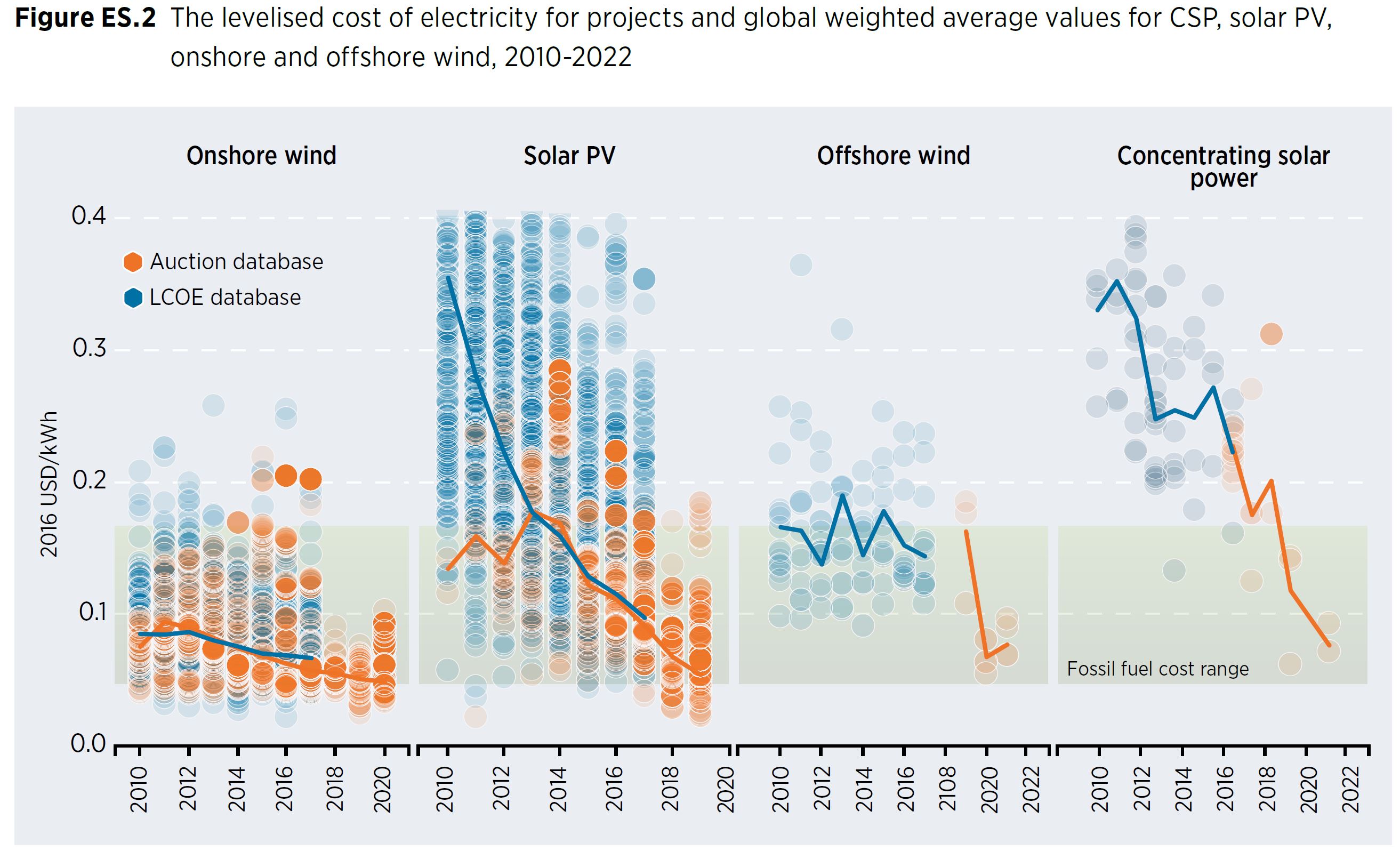

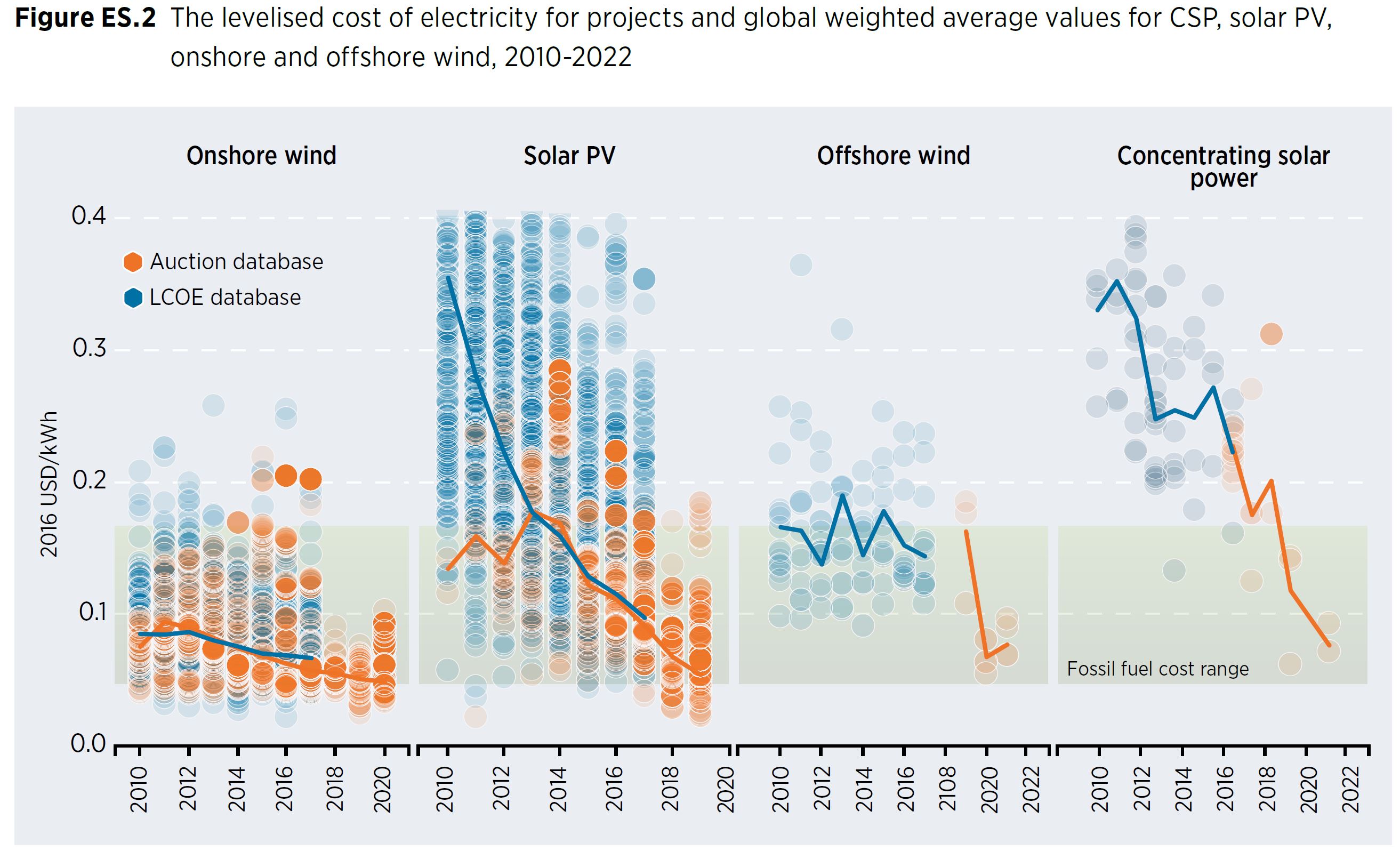

"The whole point of growing renewables has been to drive down their cost. The actual amount of solar and wind that policies have deployed up until now is almost immaterially small. It just isn’t enough to matter. What matters is that policies up until now have driven down the cost of solar, wind, and energy storage by more than an order of magnitude.

If those policies – and the fact that renewables are now competitive for new power even without subsidies in the sunny and windy parts of the world – continue for long enough for renewables to drop another factor of 2 or 3 in price – on top of the factor of 10 or more that they’ve fallen already, then we’ll enter a new domain where renewable growth rates aren’t determined by fickle policy. Instead, they’ll be limited only by the pace at which renewables can be deployed – the pace at which factories for solar panels, wind turbines, and batteries can be built; the pace at which labor forces can be trained to deploy them; the pace at which capital can be deployed to pay for their installation.

How fast is that? I have no idea. But there’s good reason to believe that in this second and third phase of renewables, the growth rate will accelerate rather than slowing. We will look back and see that the growth of renewables is an S-curve to be sure."

The Third Phase of Clean Energy Will Be the Most Disruptive Yet

Building new solar, wind, and storage is about to be cheaper than operating existing coal and gas power plants. That will change everything. When the history of how humanity turned the corner on climate change isrameznaam.com

In the US, it costs 3x capitol expense for financing + installation of home solar. Certainly not the solar farm ratio possible, but that seems like opportunity knocking for non-commercial.To put 1 euro/kWh in perspective, (I’m using very rough numbers here): 10000 euro buys you a 10000Wp solar panel installation. Which delivers almost 10000kWh per year. In regions where the excess solar production can be used 1 on 1 to compensate for your utility produced electricity, the payback time is 1 year. Which leaves you with 10000kWh free electricity every year. In other words, Putins war is the biggest incentive ever in Europe to install solar panels.

My head already hurts...I've been thinking this as well.

Lets say you need 40% of value to be approved. Does it say anywhere that EVERY single car you sell has to achieve that? Or only the ones sold to someone that uses the tax break? If only half the cars sells to buyers using the tax break then you could potentially only need 20% value. Yes, I know that more than half probably will but trying to keep the math easy.

When you shut in an oil & ges well, it is shut tight. Nothing comes out. (unless you've four or five valves that have all failed - SSSV, LMGV, UMGV, FWV, CHK). The same is true irrespective of whether it is a pure gas well, or whether it is an oil well with associated gas. Most of these Russian fields are high GOR oil wells with lots of associated gas that 'fizzes' out of solution as the oil goes from reservoir pressure to atmospheric pressure during the production process.Gas is a byproduct of oil extraction and even if you shut the well it still gases out.

Flaring gas also brings in zero revenue...

Indeed, and we should be thankful they are flaring rather than venting, as the CO2 from the flare is somewhat better than the CH4 from venting, in greenhouse gas terms.Saw them flaring it. This is from portovaya. Picture is about 30km from the ng compressor station, picture taken from finnish side of the border. It's s big flame.

@betstarshipWritten in 2019...

"The whole point of growing renewables has been to drive down their cost. The actual amount of solar and wind that policies have deployed up until now is almost immaterially small. It just isn’t enough to matter. What matters is that policies up until now have driven down the cost of solar, wind, and energy storage by more than an order of magnitude.

If those policies – and the fact that renewables are now competitive for new power even without subsidies in the sunny and windy parts of the world – continue for long enough for renewables to drop another factor of 2 or 3 in price – on top of the factor of 10 or more that they’ve fallen already, then we’ll enter a new domain where renewable growth rates aren’t determined by fickle policy. Instead, they’ll be limited only by the pace at which renewables can be deployed – the pace at which factories for solar panels, wind turbines, and batteries can be built; the pace at which labor forces can be trained to deploy them; the pace at which capital can be deployed to pay for their installation.

How fast is that? I have no idea. But there’s good reason to believe that in this second and third phase of renewables, the growth rate will accelerate rather than slowing. We will look back and see that the growth of renewables is an S-curve to be sure."

The Third Phase of Clean Energy Will Be the Most Disruptive Yet

Building new solar, wind, and storage is about to be cheaper than operating existing coal and gas power plants. That will change everything. When the history of how humanity turned the corner on climate change isrameznaam.com

@betstarship

I keep posting these graphs, using 10 year growth rates of wind and solar renewables, since you asked "who knows", well anyone can make reasonable extrapolations based on historical data and growth rates

the graphs get "silly" exponential sometime in mid 2040's or so as growth rate _should_ slow

also, PV was about $100/watt in 1974 so its more a factor of >100+x, not 10x

(I recommend "The Peace War" by Vernor Vinge for light reading)

data file included in excel format

View attachment 846210

View attachment 846211

well, those graphs are a cursory glance at the data, not in depth analysis, lots of stumbling points.,I've thought that instead of an exponential, its just a long s-curve as we go off planet and space becomes a market.

The EU already has the concept of "balcony PV":In the US, it costs 3x capitol expense for financing + installation of home solar. Certainly not the solar farm ratio possible, but that seems like opportunity knocking for non-commercial.

In an emergency, I could see a solar kit offering, ground based (lean against your wall crazy simple, wire into some heater coils) - EU heat this winter anyone? No inverter, no roof install, just a kit and a regulator for power delivery. I know I’d be ordering panels now in a similar situation.

It won't help in Dec/Jan/Feb which is the pinch months. Of the new renewables only wind helps in those months, plus the old renewables (hydro) and of course nuclear and fossils.The EU already has the concept of "balcony PV":

1-2 panels with a 600/800 Watt inverter can be installed and simply plugged into any adequate home-outlet with minimal administration.

Costs ~800-1500€

Delivery Times 2+ months

Any unused Power will be fed back to the grid for free.

Now a completly crazy idea:

Some government invests €2B to order these packages in bulk. Then resells them for 50% off.

~1.5GW perfectly distributed power generation for €1B

Any takers?

It won't help in Dec/Jan/Feb which is the pinch months. Of the new renewables only wind helps in those months, plus the old renewables (hydro) and of course nuclear and fossils.

This is the issue that the pro-solar lobby never want to face up to. Wind of course also means big grid transmission links, and big battery storage schemes, in order to provide the requisite despatchibility in those critical winter months.

This is the same issue worldwide in all temeperate locations where humans live.

So .... over-investing in solar is the ultimate wasted investment.

Emotionally good, technically less so.

(and historically the Baviarian NIMBYs have vetoed Germam attempts to do the necessary, and the corresponding voters in other countries)

Of course it's not the solution for the complete grid, but:It won't help in Dec/Jan/Feb which is the pinch months. Of the new renewables only wind helps in those months, plus the old renewables (hydro) and of course nuclear and fossils.

This is the issue that the pro-solar lobby never want to face up to. Wind of course also means big grid transmission links, and big battery storage schemes, in order to provide the requisite despatchibility in those critical winter months.

This is the same issue worldwide in all temeperate locations where humans live.

So .... over-investing in solar is the ultimate wasted investment.

Emotionally good, technically less so.

(and historically the Baviarian NIMBYs have vetoed Germam attempts to do the necessary, and the corresponding voters in other countries)

...Now he's claiming Tesla can't figure out the size of objects with their camera positions.

Yep, only one obvious resource is how most "successful" companies acquire money. /SYou’re on! You know the Northern part, which I do not. I know parts of the Central and South America routes. The trick is to avoid both winters and survive the really hard areas near the Darien on both ends. There are a handful of spots where Spanish doesn’t work.

Prehaps Tesla might help

Methinks you're overanalyzing a simple fact:

-Rating agencies are paid by the entities that offer securities.

Consequence: no securities offered, no rating agency income.

Tesla offers zero corporate debt. Thus: zero income.

Tesla offers only a handful of securitized loans/leases. mot much income there.

Consequence: minimal incentive to raise the rating to investment grade.

Question: How many corporations will make a decision knowing that the action will result in, at best, zero financial benefit?

People persist in manufacturing conspiracies. That is not needed at all. Simple financial interests explain it. A corporation (e.g. rating agency) does not give benefits without compensation.