Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

-

- Tags

- elon is an ass

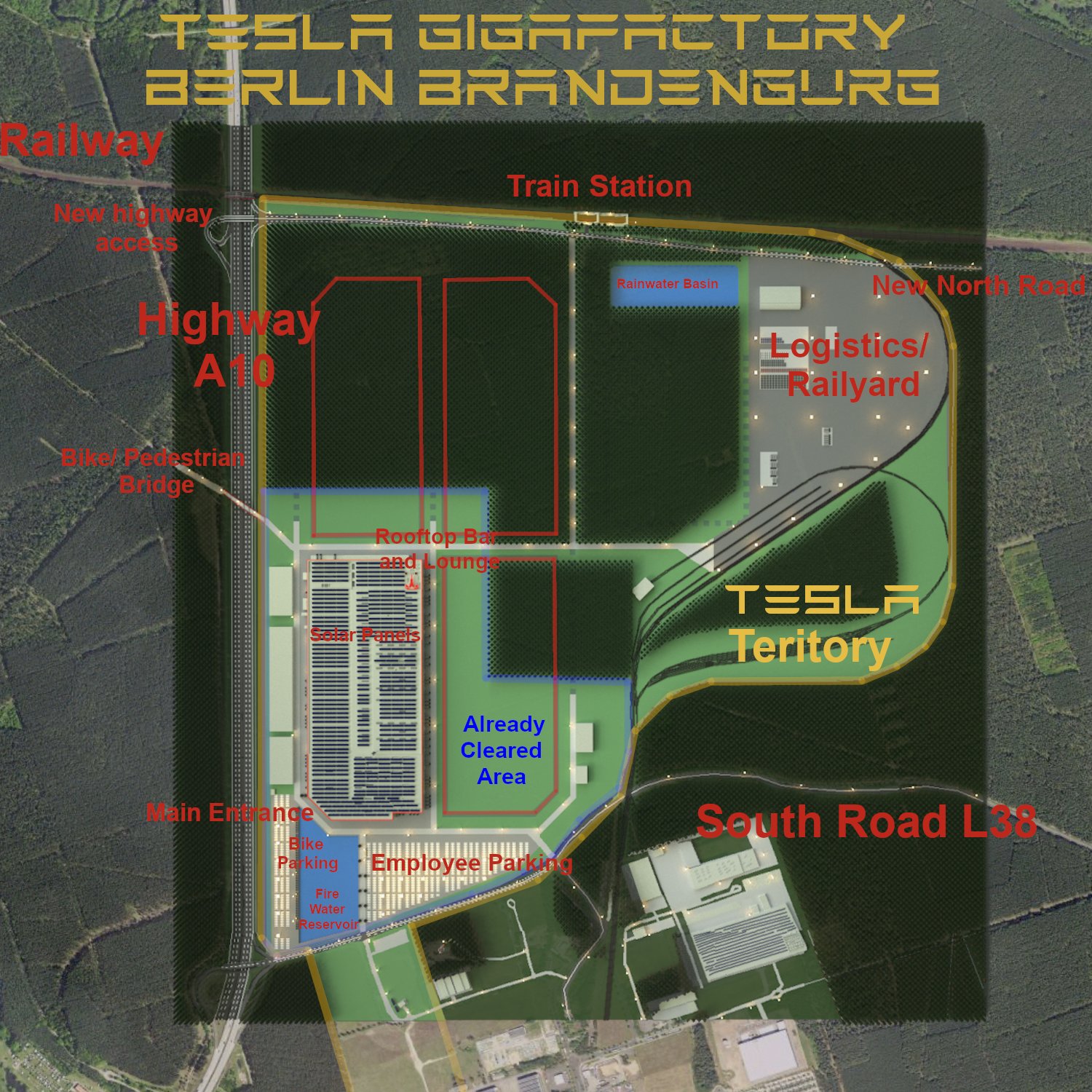

The other day we saw news that forest clearing has begun at gigaberlin for expansion.

Question: can anyone shed light on what the expansion is? Is it for support buildings for the existing model y factory & cell factory, or is this for an entire new vehicle assembly building?

For a new vehicle assembly building. This map is not quite up to date, but the area cleared now (see my previous post) corresponds to the top left quadrant of the main building. Support buildings are all in place. Also, teslamag reported:

"The northern part of the areas to be cleared will be cleared for the planned next expansion stage of the Gigafactory," Tesla is said to have explained in a message to the municipality of Grünheide.

The plans for additional production buildings in Grünheide should not be confused with another expansion that Tesla announced this September : A logistics center measuring a good 100 hectares is to be built on an area east of the previous property that has not yet been developed. The municipality has not yet officially started to deal with this request for a development plan, which is likely to delay the project.

Easy to lose track with things moving at Tesla speed

Last edited:

StarFoxisDown!

Well-Known Member

Unless production is 15k higher, which is a stretch, this is a rather disappointing number. Maybe there’s 10k sitting on the lot and at the docks

More realistic to expect 230k or so out of Shanghai instead of 270k.

I think people expecting a huge ramp from Shanghai in Q4 need to curb their expectations. A huge increase in production does not appear to be occurring?

What exactly does this number miss? Cars not loaded onto ships at the docks and cars sold locally not yet delivered? If Tesla is not killing themselves to deliver a la wave (they never did in first month of Q anyway), then it makes sense for a week of production to not be in that number which should translate to 15 to 20k.Unless production is 15k higher, which is a stretch, this is a rather disappointing number. Maybe there’s 10k sitting on the lot and at the docks.

More realistic to expect 230k or so out of Shanghai instead of 270k.

It is a record first month of the quarter and Tesla does ramp towards the end of the Q, but 230 to 250 is probably the number for Shanghai in 4Q.

But Shanghai is doing great in the end. What we really need is for Austin and Berlin to ramp. Don’t know why we will not get 50K between the two of them this Q.

Todd Burch

14-Year Member

Yes, for China numbers any cars at the docks or in transit from the factory intended for export, as well as any local cars sold but not registered or in transit to customers are not included in the count. So this number gives us a lower bound.

The question is, how much of the delivery overhang from Q3 was counted as exported, vs still sitting in the docks at the end of Sep? That determines how much of that Q3 overhang was actually counted in September’s number vs October. Not sure we have that information.

Obviously it’s the best first month we’ve ever seen, but it’s hard to gauge exactly where production numbers sit from this as again, logistics matters.

The question is, how much of the delivery overhang from Q3 was counted as exported, vs still sitting in the docks at the end of Sep? That determines how much of that Q3 overhang was actually counted in September’s number vs October. Not sure we have that information.

Obviously it’s the best first month we’ve ever seen, but it’s hard to gauge exactly where production numbers sit from this as again, logistics matters.

Just because Tesla kept the factory open and paid triple time doesn't mean 100% of the work force decided to stay. Production should still be affected during the holidays.Unless production is 15k higher, which is a stretch, this is a rather disappointing number. Maybe there’s 10k sitting on the lot and at the docks.

More realistic to expect 230k or so out of Shanghai instead of 270k.

Todd Burch

14-Year Member

Market shoots way up today. Mark my words.

Why? Cramer’s Phillies lost in a no-hitter.

Why? Cramer’s Phillies lost in a no-hitter.

New report showing EU BEV increased from 9.8% of new car sale in Q3 2021 to 11.9% for Q3 2022.

www.acea.auto

www.acea.auto

Fuel types of new cars: battery electric 11.9%, hybrid 22.6% and petrol 37.8% market share in Q3 2022

Brussels, 3 November 2022 - In the third quarter of 2022, the market share of battery electric vehicles (BEVs) increased further, accounting for 11.9% of total EU passenger car registrations.

Depends on whether Powell speaks todayMarket shoots way up today. Mark my words.

Why? Cramer’s Phillies lost in a no-hitter.

From the fourth Tweet in the threadUnless production is 15k higher, which is a stretch, this is a rather disappointing number. Maybe there’s 10k sitting on the lot and at the docks.

More realistic to expect 230k or so out of Shanghai instead of 270k.

October had the China National Holiday from Oct 1-7 — Tesla worked through that period (3x pay for workers) but was not at full staff. December is usually the strongest month for wholesale, as a portion of November production gets delivered locally -

@CPAinNYC

ZachF

Active Member

Market shoots way up today. Mark my words.

Why? Cramer’s Phillies lost in a no-hitter.

I’m literally in tears…

His endorsement really *is* the kiss of death.

ZachF

Active Member

No, Europe doesn't want another sedan, Europe likes hatch-backs, we need a mini-Y

Model smöl

(I think jrp3 coined this)

Depends on whether Powell speaks today

I have come to realize Powell speaking has now more effect on the stock price than Elon tweeting anything he thinks. Elon speaking about how he sees TSLA being a 10T valued company has less effect on the stock price than Powell hawkishness.

Congo Line

(not the dance)

Meet Kevin makes a good point here. Jpowell is purposely tanking the market as its part of the inflation fighting strategy. The minute he heard from the reporter that markets were green, Powell became relentless and just caused the the s&p to have a straight line down.

JPow is a holdover appointee from a Republican administration.

Controversial opinion: small but real possibility that he is intentionally tanking the markets and economy as an act of sabotage against the current administration.

Whether one likes Biden or not, personally I think he made a political mistake in keeping Powell on for another term. Would have been easy to blame and fire him for failing to realize inflation was not 'transitory' when it first appeared.

Regardless, Powell clearly wants to deflate the stock market, which means we may need to be bravely HODLing through unfavorable macro for longer than previously anticipated.

ZachF

Active Member

Elon’s superpower? Avoiding this:

Andrej talks about it too.

Andrej talks about it too.

Gray Man

∇x E = -∂B(t)/∂t

Down 5% yesterday? Looks like I'm going to buy some more shares this morning!

I'm very torn on the FED right now. I've been assuming they would finally wake up and chill out a bit. The actual notes were dovish, so I don't know if Powell is talking a tough talk to keep the markets more or less flat to lightly down, or if he really does care more about the FED's tough reputation vs results. The notion that they can just increase liquidity if they go to far was not comforting and reeks of being out of touch. Reversing course after going to far means you have destroyed some lives in the process. Going back to QE doesn't fix that.JPow is a holdover appointee from a Republican administration.

Controversial opinion: small but real possibility that he is intentionally tanking the markets and economy as an act of sabotage against the current administration.

Whether one likes Biden or not, personally I think he made a political mistake in keeping Powell on for another term. Would have been easy to blame and fire him for failing to realize inflation was not 'transitory' when it first appeared.

Regardless, Powell clearly wants to deflate the stock market, which means we may need to be bravely HODLing through unfavorable macro for longer than previously anticipated.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K