E-minis are dropping a bit tonight after the BOJ made a surprise change in bond purchases/interest rates - the change is said to be in the opposite direction of the rest of the world. Rut roh.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

What are your next buy orders set at everyone? Betting the house mortgage at $140?

You don’t want to miss out if $142.69 is the low. Just buy X amount of shares with each $2 drop, for example.

When it will be at $300, $400, $500 what exact price you paid will be a blur.

I’m adding shares most days. So exciting!

dhanson865

Well-Known Member

No dude, don't you remember Solar Freakin Roadways!!!!!Solar Walls?

Those have to be Solar Freakin Walls!!!!

Artful Dodger

"Neko no me"

Thoughts?

Yeah, it's mostly a demand lever for the EOY delivery numbers. An easy way to encourage people to get it done before Jan 1st, which also ties in with the (assumed) IRA rebates.

But Europe and China also have EOY incentives to take delivery, so I think that's mostly it.

Cheers!

dhanson865

Well-Known Member

Hybrids won't be blocking superchargers because they only support AC charging. No Fast charger Tesla or otherwise work with the plug in hybrids.That's why I'm afraid of Tesla opening up their SCs to other mfgs. It seems other mfgs purposely kneecap the EV experience because they have ulterior motives.

Just imagine all of these slow-charging / non-user-friendly non-Tesla EVs blocking our SCs. God forbid people bring their plug-in hybrids to SCs ("my dealership told me I could charge at Tesla Superchargers!")

Well I would not consider 0.9% in ES and 1.1% in NQ is just a bit.E-minis are dropping a bit tonight after the BOJ made a surprise change in bond purchases/interest rates - the change is said to be in the opposite direction of the rest of the world. Rut roh.

dhanson865

Well-Known Member

Have we covered the class action guys chasing Tesla yet?

www.reddit /r/TeslaModel3/comments/zq6s5v/got_this_from_a_random_law_office_about_my_tesla/

www.reddit /r/TeslaModel3/comments/zq6s5v/got_this_from_a_random_law_office_about_my_tesla/

Skryll

Active Member

'there was a news article cnet' ROFL

chronopublish

2008 Roadster #VP27

I can confirm that I have lost no sleep over the current value of my IPO shares.Don’t we all? I bet 2/3 of the belly aching on the forum would be non existent if we all had a nice chunk DCA’d at $35 pre splits.

Gigapress

Trying to be less wrong

Wow, ok.THIS is why I have a problem with Troy. Fear-mongering and passing off opinion as fact.

It’s no wonder that fly4dat is his favorite follower.

I guess since next year's sales growth in the USA being good or not so good all depends on the amount of Twitter political controversy, then that means none of the following factors will matter:

- The rate of production growth at Giga Texas

- Possibility of lowering prices by several thousands of dollars if needed, especially on Model Y from which almost all the growth will come, due to:

- Model Y demand being so high right now that the minimum price in the US is still $66k, which means that if we assume conservatively a $42k average cost of goods then gross profit per Y ordered today is $24k+ (depending on the variant)

- Subsidies of about $3k per vehicle for batteries

- Breathtakingly low manufacturing cost at Giga Texas once in high-volume production

- Lower finished-vehicle shipping costs due to using Tesla Semi and also not shipping every Y from the West Coast

- Inflationary cost pressures expected to recede substantially in 2023, according to guidance from Elon and Zach on the Q3 call

- Perpetual pace of improvement, especially on manufacturing cost reduction and simplification, that is unmatched by anyone in the industry as conclusively shown by Munro teardown demos

- Incoming $7500 tax credits for most Model Y buyers, and Model 3 too if cells for the RWD begin to be sourced from N America or if prices for the 3P or 3LR are reduced to $55k or less

- The possibility of adding Model 3 Long Range and Model Y Rear-Wheel Drive back onto the menu, or S/X with a single motor, less than 100 kWh of battery, and less propulsive power than a Lamborghini Huracan

- The possibility of charging less than 105 THOUSAND FREAKING DOLLARS MINIMUM for S&X

- Exponentially growing general demand for EVs

- Las Vegas Loop, including expansion out from Resorts World to some other locations on the Strip, giving hundreds of thousands of people positive first impressions of riding in Teslas, with drivers who are very well-practiced at answering FAQs about the cars and correcting common misconceptions

- The massive Cybertruck backlog implying almost guaranteed demand for anything Giga Texas could reasonably manage to produce between now and 2024

- The massive free marketing that the mere presence of Cybertrucks in the hands of customers will generate as the most unique, flamboyant, instantly recognizable, and badass vehicle on the roads

- Another ~300 Supercharger stations and ~3,000 Supercharger stalls being constructed in America

- The possibility of switching which paint colors are standard and which cost extra in order to appeal to customers who would prefer something other than white or silver without a $1k+ upcharge

- FSD becoming increasingly practical and comfortable to use for most American customers who do most of their driving outside of complicated urban areas

@Troy can you confirm if this is what you are saying or am I misunderstanding? Twitter controversy will be more influential in 2023 than all of this combined? Can you provide evidence for this claim that's more scientific than a few anecdotes that you and a CNET author found about people cancelling orders?

Last edited:

Sorry if I’m repeating, but i might have missed this amongst all the noise over the last number of pages.

Take a look at this thread. Pretty eye opening numbers. To be honest, I haven’t paid enough attention to the mega pack business and the Lathrop factory. I’m going to start paying much closer attention going forward.

Drumheller

Active Member

Correction, I was thinking of Pelosi. I don't have info regarding Warren's stock trades.She and her husband have held TSLA positions for quite some time. There is an account on another app that tracks all of her stock moves so that retail investors can copy her moves, and indirectly benefit from the Congress's insider trading

Carsonight agrees, cites CATL 90 GWh battery supply supporting TE

Sorry if I’m repeating, but i might have missed this amongst all the noise over the last number of pages.

Take a look at this thread. Pretty eye opening numbers. To be honest, I haven’t paid enough attention to the mega pack business and the Lathrop factory. I’m going to start paying much closer attention going forward.

Has Reuters already found a dement Mexican grandmother that is willing to act as a "source more than familiar with the matter", that she is operating a huge drugs and anti-EV gang in each and every town that Tesla is possibly looking at for their next Gigafactory?

ToTheStars

Member

How many couches do you have?You don’t want to miss out if $142.69 is the low. Just buy X amount of shares with each $2 drop, for example.

When it will be at $300, $400, $500 what exact price you paid will be a blur.

I’m adding shares most days. So exciting!

Artful Dodger

"Neko no me"

Wow, ok.

I guess since next year's sales growth in the USA being good or not so good all depends on the amount of Twitter political controversy, then that means none of the following factors will matter:

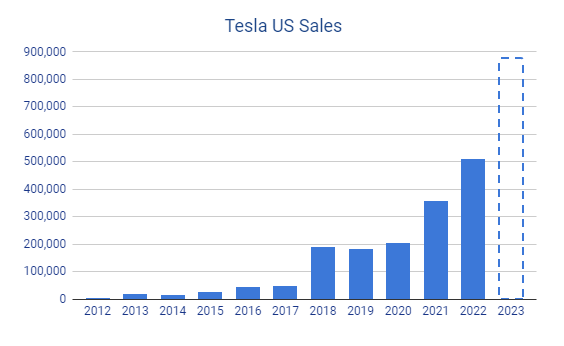

Indeed, he just tweeted a Tesla US Sales estimate chart for 2023. Going from ~500K in 2022 to ~880K in 2023 is a 75% increase in sales YoY:

Trying to set up Tesla for a miss in 2023, or raising expectations to 'skip a beat' on sales? It's difficult to reconcile, but today's chart is a reversal of his estimate for 2023 sales posted on TMC back on Jan 28, 2022:

Troy on TMC: "2023 is going to be clearly below 50%" (excerpted from #322,194)

So which will it be, over 75% increase in sales, or clearly below 50% in 2023? Tesla hasn't changed guidance for 2023+, but Troy's estimates bounce around like a pea in a whistle.

That's not a rigorous methodology. Nobody should expect these estimates to beat company guidance over the long term.

Personally, I think there is a little way to go before the bear market is over. Fed signals need to change their tone first.Soooo...for those who still have money left in the couch and have been "holding off" on buying more, what is your trigger to purchase more? Are you looking for a certain price on the fall (i.e. $140? $99, etc) to pull the trigger OR perhaps you are OK with missing out on the elusive "bottom" and are looking for a more solid move to the upside (i.e. $175? $200?, etc.)? I know we've seen a number of recent reports of players moving back in to TSLA here at $150ish....what about you guys?

Maybe it's not a "price" at all, but something else like interest rates, inflation, overall macro environment, etc.

If, as I suspect, the SP largely moves sideways for a month or two I don't see much point using spare cash which could be deployed in the event of another Black Swan event pushing it down. If Q4 P&D is regarded as a 'miss' yet income exceeds expectations there could be a buying opportunity, for e.g.

Thekiwi

Active Member

Carsonight agrees, cites CATL 90 GWh battery supply supporting TE

The 90 GWH CATL shanghai factory delivering cells to both GigaShanghai & Tesla Energy USA is interesting.

For instance any temporary situation leading to excess production in a particular region, there is a place to redirect cells in the interim to another place that will gobble them up as fast as possible (Tesla Energy USA).

Redicrecting cell supply to Tesla Energy is perhaps a better option than temporarily having to drop prices substantially (by which I mean a lot lower than the small discounts currenlty on offer) to utilize the local shanghai battery supply for continued high rate auto production.

I’m not a fan of rapidly changing pricing to fulfill short term oversupply periods - do it to often and in too big an amount and consumers get wise and more will hold off waiting for the seemingly inevitable end of quarter discounting to happen.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K