How much for the dog?What if it doesn't pass and TSLA drops to -$500 and I have to sell my house and my dog and suffer the lifelong regret that I had made it, lost it, then sold out as others made it.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Zero, judging by the SP...Estimates/projections and release date for P&D Q4?

A lot of people here are very concerned about their investment.

Although that's quite understandable, let me try to put the current situation a bit in perspective.

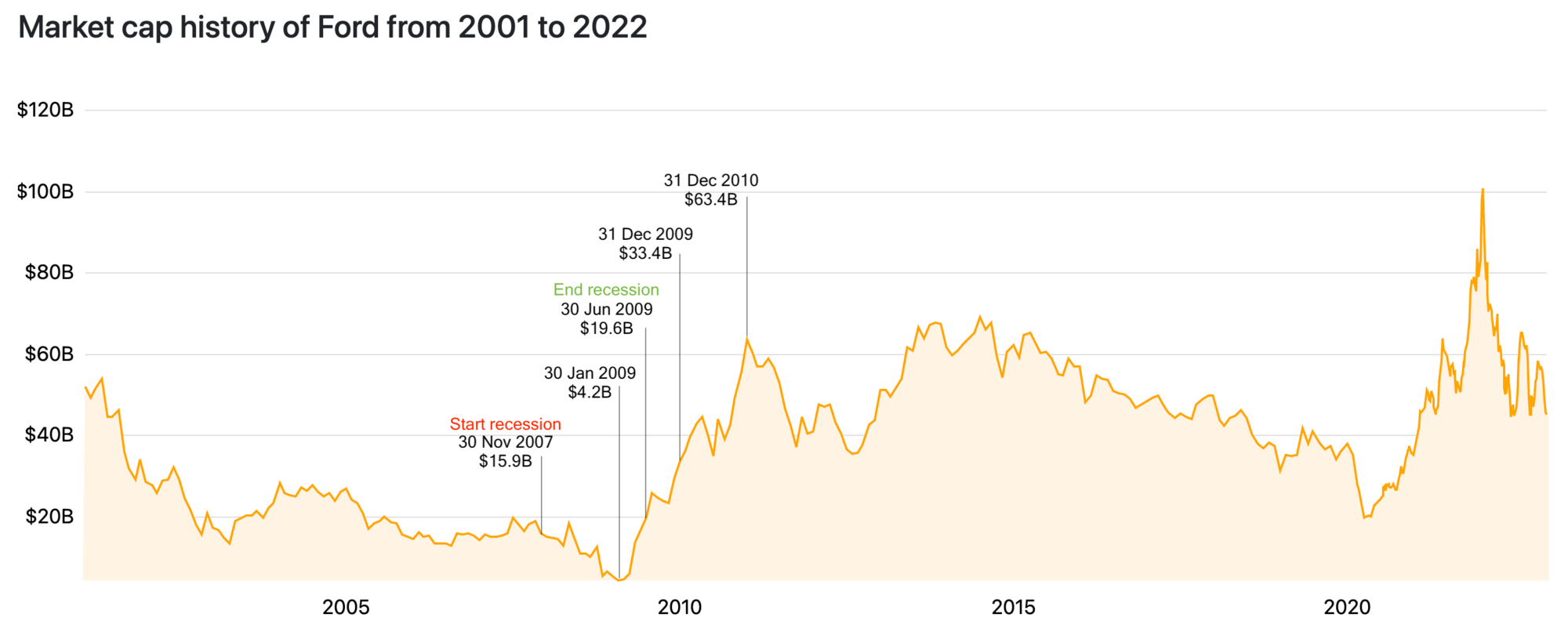

I constructed a picture of what happened with the stock price (market cap) of Ford during the last recession.

As pointed out in this post, the last official recession was between Dec 2007 and June 2009.

From the start in Dec 2007 the market cap of Ford went down over 70% (sounds familiar?), from $15.9B to $4.2B at the end of Jan 2009, so in a little over one year.

However, at the end of the recession in June 2009, just 5 months later, the market cap had rebounded to $19.6B.

1.5 Year later, at the end of 2010, Ford's market cap was a whopping $63.4B.

Now, a lot can be argued about this being just one example, other times, different circumstances, different brand, etc., etc.

But to me Ford at that time was nowhere in the 'ramping up position' that Tesla is now. With fantastic products and more at the horizon.

And a recession now is still not sure.

I am wondering when the stock price of Tesla will explode, because that's what I think is going to happen.

Just don't know when, so sit tight and watch in amazement.

At least that is what I am doing.

Although that's quite understandable, let me try to put the current situation a bit in perspective.

I constructed a picture of what happened with the stock price (market cap) of Ford during the last recession.

As pointed out in this post, the last official recession was between Dec 2007 and June 2009.

From the start in Dec 2007 the market cap of Ford went down over 70% (sounds familiar?), from $15.9B to $4.2B at the end of Jan 2009, so in a little over one year.

However, at the end of the recession in June 2009, just 5 months later, the market cap had rebounded to $19.6B.

1.5 Year later, at the end of 2010, Ford's market cap was a whopping $63.4B.

Now, a lot can be argued about this being just one example, other times, different circumstances, different brand, etc., etc.

But to me Ford at that time was nowhere in the 'ramping up position' that Tesla is now. With fantastic products and more at the horizon.

And a recession now is still not sure.

I am wondering when the stock price of Tesla will explode, because that's what I think is going to happen.

Just don't know when, so sit tight and watch in amazement.

At least that is what I am doing.

Agreed. Tesla efficiency in a VW Polo sized package would surely be a winner. A nippy city car that’s genuinely usable for longer journeys because of Superchargers would sell in droves throughout Europe.There could be 10x BYD out there, doesn't matter - there's no "EV market", just the car market, and it's huge... sure, you would expect ICE to survive a while in less developed countries, but many countries now have legislation banning new sales, just a matter of time

The TAM for EV's is huge, Tesla can growth 50% until 2030 and still not be the biggest player, I really don't worry about competition, in fact it's necessary, Tesla cannot enable the transition away from ICE all by themselves

And I do think the compact hatch-back needs to arrive sooner rather than later, can make 2x the amount of the M3 with half the batteries, same margins, would accelerate EV adoption massively for urban areas. M3 is nice and all that, but still too big to cities and impractical being a sedan

verystandard

Member

Good news is that the amount of money I lost per day is getting less and less despite of those -10% plus days.

Now I really have to think of a good entry point for my additional shares just so I won't be regret for life

My prediction for today is -5%, then -3% follow by -8%. Sooner later we will see a crazy day that is going up 25%.....

Yee Haw

Now I really have to think of a good entry point for my additional shares just so I won't be regret for life

My prediction for today is -5%, then -3% follow by -8%. Sooner later we will see a crazy day that is going up 25%.....

Yee Haw

Todesbuckler

Member

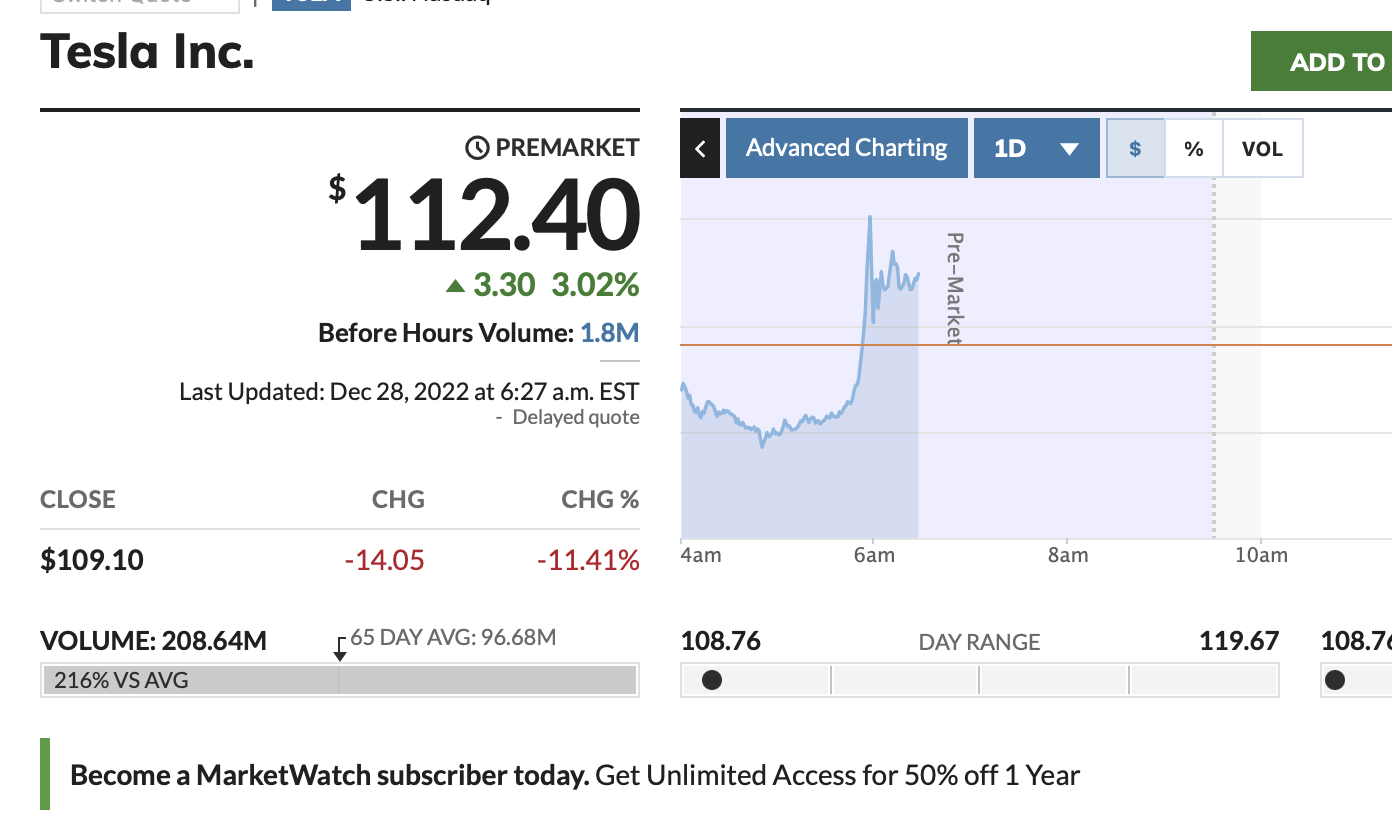

Any news? Stock is climbing 7 $ within 10 minutes

Artful Dodger

"Neko no me"

So Reuters was incorrect. Again.

The upside here is that Tesla China likely fed that false info to the REUTERS leaker (ie: New Year break skewed by 1 day; different info sent in different memo's then see which version makes it to REUTERS).

That former-employee is likely being handed their hat as we speak. And lucky for them too, because in old Shanghai they'd be sent out for 're-education' (2-yrs less a day, at an all-expenses paid Federal resort).

Cheers!

Artful Dodger

"Neko no me"

Any news? Stock is climbing 7 $ within 10 minutes

TSLA Pre-Market Quotes Live

This page refreshes every 30 seconds.Data last updated Dec 28, 2022 06:00 AM ET.

| Consolidated Last Sale | $106.15 -2.95 (-2.70%) |

|---|---|

| Pre-Market Volume | 2,759,485 |

| Pre-Market High | $115.55 (05:58:16 AM) |

| Pre-Market Low | $104.22 (04:51:12 AM) |

GF3's progress has been amazing, they seem to run a very tight ship, quality of the cars is superb, not sure about the comms aspect, but Tesla CN seem a bit better at it than Tesla USThe lack of a PR dept is destroying tens if not hundreds in investor wealth.

I am not sure right now if a coo is enough, nor if the head of Tesla China is the right guy.

COO or mini-CEO, I don't know, but I think it would be beneficial

I would like to ask that certain people please stop posting the same idea over and over that EM be either removed as CEO.....or that he has caused great harm to Tesla the company.

First IMHO you are wrong....but more importantly most of you have posted your opinion many, many times.

First IMHO you are wrong....but more importantly most of you have posted your opinion many, many times.

googlepeakoil

Member

I think Tesla has good long term value for anyone picking it up below $100 now it's in the 20ish PE level. I'm surprised to see it come down in a ski-slope rather than bump up and down. The $400 (1 trillion price) was ludicrous, 120x PE at the time was nuts! Maybe it'll bounce off $99.99? Seems a good psychological level for it to bounce from?I think it will crash quick once it breaks thru 100 but I still have feeling it will settle down around mid 70’s. We’ll pick up a few before then and then settle in for the long haul again.

Elon seems to be making less headlines the last week or so. Possibly a good sign and maybe a sign he has recognized the damage that the brand has been taking lately.

All jmho. Safe travels on those roads folks.

Featsbeyond50

Active Member

I thought 220 was a steal.I think Tesla has good long term value for anyone picking it up below $100 now it's in the 20ish PE level. I'm surprised to see it come down in a ski-slope rather than bump up and down. The $400 (1 trillion price) was ludicrous, 120x PE at the time was nuts! Maybe it'll bounce off $99.99? Seems a good psychological level for it to bounce from?

Ark Invest bought Tesla last week 4 days and yesterday, Tuesday as well. I used them in the past as a good indicator when a bottom is near. After the brutal sell-off and panic yesterday Tesla is heavily oversold and we may see finally some upward pressure appearing. Shorts became too confident in the last weeks and may be in for a hard awakening. Many bulls have been waiting at the sidelines and if we get 1-3- days of flat or even slightly green trading they may jump in.

Because it's hard to imagine that Tesla will remain at such a low level in all of 2023 it's also possible that first larger funds consider opening long positions. That's all speculation of course and I don't know more than you do but what I know is that fundamentals always and without exception dictate the stock price in the long run.

It is a lot of suffering for all investors regardless of long-term like me (2014) or others who jumped in a year ago but long-term investors have seen these brutal sell-offs before.

Patience is required and a lot can happen in the days to come but let's all remember that fundamentals are simply awesome and Tesla will do very well.

Ignore the noise and listen to the signal

Because it's hard to imagine that Tesla will remain at such a low level in all of 2023 it's also possible that first larger funds consider opening long positions. That's all speculation of course and I don't know more than you do but what I know is that fundamentals always and without exception dictate the stock price in the long run.

It is a lot of suffering for all investors regardless of long-term like me (2014) or others who jumped in a year ago but long-term investors have seen these brutal sell-offs before.

Patience is required and a lot can happen in the days to come but let's all remember that fundamentals are simply awesome and Tesla will do very well.

Ignore the noise and listen to the signal

Attachments

Not surprising that he did this, I would have too if the party that should be supportive turned against him.Some time back he posted about taking the red pill. I laughed at people who said he had become politicized. I thought he was just being a nerd and referencing the matrix.

googlepeakoil

Member

Opinion amongst my friends in the UK is that Elon has gone off the deep end / is f*ing stupid! Many like me weren't impressed that he went after that British caver in Thailand 3 years ago! That was one of the first signs for me he was a bit unhinged. Paying a private dick $30k to shadow the guy and find out if he was a nonce! That received a lot of bad press in the UK! Even the Daily Fail in the UK doesn't think he's wonderful anymore - and that rag hate electric cars anyway! Most in Europe are democratic leaning, aren't overly religious and are 99% anti-gun. So Elon courting the Republicans doesn't look good in Europe! They see the Dems as for environmental controls - and if they have bought a Tesla a lot will have bought for clean air / environmental reasons. People who have money to buy a Tesla are often making a conscious decision for the less polluting vehicle. Remember the Green party is in power in Germany (all be-it part of a coalition).Just my opinion based on everyone I talk to and correspond with. They like the car but would no longer consider buying one or the stock because of the CEO.

So none.

Was there any news on the way down this month?Any news? Stock is climbing 7 $ within 10 minutes

Not surprising that CAPEX is so low. They have one factory and not much product development since at core Polestar are badge-engineered Volvos. They do have some differences in packaging but not much. Polestar are built on Geely/Volvo platforms and built in Gelly/Volvo factories, except for a single showcase in Chengdu:Cash flows are a good metric to track because they are harder to massage. In the case of Polestar, it has 9-month free cash flow of -$1.0 billion. Default dead?

This year, it has only spent $7 million on property, plant, and equipment. That number is a bit of a head-scratcher to me. Could be that they just aren't spending any money on innovating or growing manufacturing.

Edit: Further context. BYD's 6-month free cash flow to June was roughly +$1 billion. See report. Tesla's 9-month free cash flow to September was +$6.1 billion. See report.

Polestar Production Facility

The new Chengdu headquarter for the electric performance car producer Polestar combines world-class production facilities with touchpoints for both customers and visitors. The bright and spacious production facility is open to everyone, and the building provides great outdoor spaces, while allowi...

Think of them as analogues of Toyota/Lexus, Nissan/Infiniti, Chevrolet/GMC. Even Hyundai/Kia is more differentiated. VW/Skoda/Seat are nearly identical but have different national histories and factories.

That really explains why Capex is so low. Geely loves multiple versions of everything with multiple brands.

googlepeakoil

Member

Is the tide turning? Was as low as $105 or $106 pre-market, now $113.

TSLA Pilot

Active Member

Obviously time to post this SMR link again on the folly of diversification--it's just so especially silly to do when people on this board have so much knowledge/information asymmetry about Tesla--for long-term investing results, of course . . . .I applaud what you are doing, but putting 100% into TSLA is what affected the sustainability of future scholarships. Please diversify. The TSLA gravy train of the last few years was never going to last forever.

(That said, yes, we are down by more than 70% from ATH so should be the time to back up the truck, yet I pulled the trigger and sold 7-figures worth to prevent a forced margin call sale back at $151-ish. Now THAT was the most expensive "Tuition of Life" payments I've made thus far: DON'T USE TOO MUCH MARGIN DUMMY! Didn't tell my spouse.)

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K