Why? Planning on selling today? I've always [well past 3 months anyway] assumed we break $100 which hits stop losses and margin calls sending us to the $80s. As a long term investor I'll be thrilled if/when this happens.Sheesh, ugly out there premarket. I guess that's to be expected with the price cuts in China. Hoping we don't test 100 and find a bunch of stop losses.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Bounce then slow death.Bounce from $99 ? Or slow death? Takes too long to sell house to take advantage of this gift.

Remember everyone. Elon said something to the effect of "Our prices are embarrassing" a couple months back.

mach-edriver

Member

Nothing special about Tesla being “able” to reduce prices. They are “able” to reduce them still further. The issue is the necessity that drives them to do it.The fact that Tesla is able to reduce China prices so much suggests that the Shanghai upgrades dramatically reduced costs and Q4 could be a huge beat.

It's better to do one big price cut than a bunch of little ones that keep consumers waiting for more price cuts. They should do a tiny price increase in about a month to make sure everyone knows the cuts are over.

This is the first piece of genuinely bad news I can remember for a long time. I mean for Tesla the company rather than all the surrounding noise. There's no escaping the fact that price cuts are bad news. I accept that. And there will be downward pressure on earnings in 2023, certainly in the short term.

However Tesla enters this period in a very strong position. It has industry leading margins and wads of cash sitting on the balance sheet. If you had to pick one car company to weather the storm, Tesla would be it. And probably BYD.

You fear for the other electric start ups and indeed the legacy auto companies trying to transition to electric. Tesla is already smashing records across the globe, and with prices even lower, which company can possibly compete? That's not a rhetorical question. How do they compete? Tesla cars have become competitive not just with other electric cars, but now their ICE equivalents. And that's before Cybertruck starts prowling the streets. The logic for buying a Tesla just got even more compelling. The demand for Teslas will go through the roof and everyone else will be left in its wake.

2022 was very painful as a Tesla shareholder and I'm expecting more of the same in 2023 and its not pleasant. But there's a big prize for those who back the strongest player in the field. It just so happens that the prize will pushed out a year or two into the future.

The share price will go as low as it goes. That's a fact. There is nothing I can do about that. Just sit it out and wait.

However Tesla enters this period in a very strong position. It has industry leading margins and wads of cash sitting on the balance sheet. If you had to pick one car company to weather the storm, Tesla would be it. And probably BYD.

You fear for the other electric start ups and indeed the legacy auto companies trying to transition to electric. Tesla is already smashing records across the globe, and with prices even lower, which company can possibly compete? That's not a rhetorical question. How do they compete? Tesla cars have become competitive not just with other electric cars, but now their ICE equivalents. And that's before Cybertruck starts prowling the streets. The logic for buying a Tesla just got even more compelling. The demand for Teslas will go through the roof and everyone else will be left in its wake.

2022 was very painful as a Tesla shareholder and I'm expecting more of the same in 2023 and its not pleasant. But there's a big prize for those who back the strongest player in the field. It just so happens that the prize will pushed out a year or two into the future.

The share price will go as low as it goes. That's a fact. There is nothing I can do about that. Just sit it out and wait.

Mike Smith

Active Member

Yes there is something special about Tesla being able to reduce prices. They're massively increasing production at existing factories which reduces costs. I don't see anyone else making over 1M EVs per year in a single factory.Nothing special about Tesla being “able” to reduce prices. They are “able” to reduce them still further. The issue is the necessity that drives them to do it.

Nope, I'll probably be buying today. But I still hate to see the stock getting decimated.Why? Planning on selling today? I've always [well past 3 months anyway] assumed we break $100 which hits stop losses and margin calls sending us to the $80s. As a long term investor I'll be thrilled if/when this happens.

larmor

Active Member

Regarding price cuts: I still do not understand how they are planning to bring a 500 mile range cybertruck with the proposed 70k price. Are current price cuts reflecting this pending improved efficiency in output and production?

I'm quite excited that Tesla has sold 17k cars in Germany in December alone, and almost the same in UK. Huge numbers compared to before, and they just started. If Norway is to be taken as an example, they'll grow for years and years.German market looking good for Tesla in 2022, too:

-Tesla sales up 76.2% compared to 2021

-BEVs had 17.7% market share

For December:

-Tesla market share 2.6%

-Model Y most sold SUV

-Model 3 most sold EV

Pressemitteilungen - Fahrzeugzulassungen im Dezember 2022 - Jahresbilanz

Flensburg, 4. Januar 2023. Der letzte Zulassungsmonat des Jahres schließt das Jahr positiv ab. 314.318 Personenkraftwagen (Pkw) wurden im Dezember 2022 neu zugelassen, +38,1 Prozent mehr als im Dezember 2021.www.kba.de

Pressemitteilungen - Die Nummer 1 der Segmente und die Nummer 1 der alternativen Antriebsarten im Dezember 2022

Flensburg, 6. Januar 2023. Im Berichtsmonat Dezember 2022 zeigten sich in vier Segmenten ein Wechsel des zulassungsstärksten Modells. Im Segment der Kompaktklasse war der VW ID.3 das meist zugelassene Modell, in der Oberen Mittelklasse war es der BMW 5er. Bei den SUVs dominierte der Tesla Model...www.kba.de

European market is far from mature, so not worried about demand - in EU, at least.

Agree, these were bold price cuts, a non nonsense approach to being highly price competitiveThe fact that Tesla is able to reduce China prices so much suggests that the Shanghai upgrades dramatically reduced costs and Q4 could be a huge beat.

It's better to do one big price cut than a bunch of little ones that keep consumers waiting for more price cuts. They should do a tiny price increase in about a month to make sure everyone knows the cuts are over.

and regain sales momentum.

At this point I expect most of the bearish news to have been discounted.

I expect sales everywhere to accelerate.

The price reduction of 10% will be offset to a degree by the quantity sold (maybe 40% plus) and the lower

cost of goods sold (maybe 10 % plus ).

.

Today might sting, but I like the band aid approach. Spreading it out slowly in tiny drips across different countries would have given more time to spread FUD and push the SP down more and more importantly encouraged buyers to wait for yet more discounts.

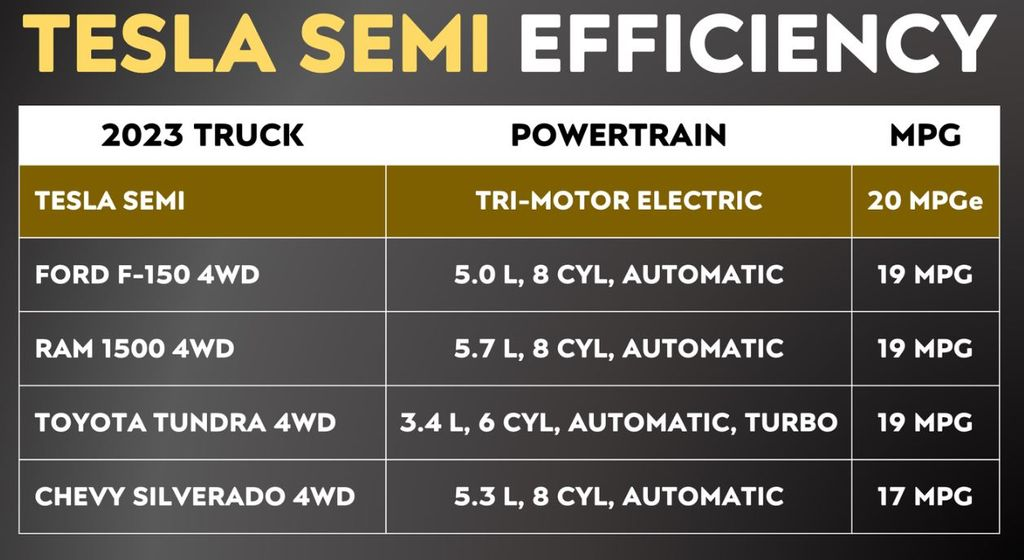

A nice reminder below.

insideevs.com

insideevs.com

A nice reminder below.

Tesla Semi Efficiency Is Unreal, Twice As Thrifty As Ford F-150

Tesla is known for making some of the most efficient vehicles ever, and the Tesla Semi is no exception. Being highly efficient is key for commercial EVs.

Artful Dodger

"Neko no me"

This is the first piece of genuinely bad news I can remember for a long time. I mean for Tesla the company rather than all the surrounding noise. There's no escaping the fact that price cuts are bad news. I accept that.

Wot, back to the same price level we were at in China while Giga Shanghai was still ramping? Now we have 200% more production, but the same pricing power? (and much lower COGS with >90% localized production)

I'd call that a win. The Market is gonna try to twist the results, and often succeeds in the short term. But perception doesn't trump performance, and when the recession clouds clear Tesla will emerge as a major manufacturor with no debt, a strong balance sheet, and an amazing TAM for it's upcoming product, the $25K car (which will sell 8M / yr).

Planning. Perspective. Focus. We are Winning (and soon shortzes will be whining).

Cheers to the Longs!

Last edited:

This is the first piece of genuinely bad news I can remember for a long time. I mean for Tesla the company rather than all the surrounding noise. There's no escaping the fact that price cuts are bad news.

Were the price raises good new then?

Sure, selling more at a higher price is better than selling more at a lower price, but was that ever an option?

In the Q2 2022 earnings call they stated the plan was to increase production and adjust pricing to control the backlog.

FastEddieB

Member

Dead cats are known to bounce as well!Bounce from $99 ?

B

betstarship

Guest

Americans Largely Pessimistic About U.S. Prospects in 2023

Majorities of Americans predict negative outcomes in 2023 for a host of economic, political, societal and international issues.

news.gallup.com

news.gallup.com

Mike Smith

Active Member

I'm glad Tesla management took our advice to not be hasty with the share buybacks.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K