Especially when it only goes up to 240, not nearly far OTM enough…My support group encourages me to ignore messages like this.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Lolyeah it Is a meme stock for sure and not what I would invest in, but where i come from a 46% move in $10,000 worth of peanuts is the same thing as a 46% move in $10,000 worth of anything else.

in others words, a 46% move is a 46% move regardless.

And the 61% fall from its high - not sure that Is worthy of crapping on a stock for, especially on a TSLA forum currently (given Tesla -70% off its ATH).

A lot of people on this forum seem to forget this. I'm not sure if it's blind faith in being part of a great company, or some kind of renewable energy thing they got going but in my mind I'll take a 46% Move in a weapons company as long as my portfolio moves up 46% too. Money is money, and what Elon musk has discovered is that you can do whatever you want when you have money. It doesn't matter who you piss off, because money talks.

Also we are officially in meme territory. I think we were down 75% off ATH at one stage? We are worse than Facebook. So there really isn't any pointing and laughing at anyone at this stage.

Any who my point is I wish TSLA had a 46% move in a single day because that's where all my money is.

thesmokingman

Active Member

It's a honey trap. Yea sure 46% is 46%, but that is meaningless now, they're dangling it so the dopes will go yea, jump in and tomorrow, it craters.yeah it Is a meme stock for sure and not what I would invest in, but where i come from a 46% move in $10,000 worth of peanuts is the same thing as a 46% move in $10,000 worth of anything else.

in others words, a 46% move is a 46% move regardless.

And the 61% fall from its high - not sure that Is worthy of crapping on a stock for, especially on a TSLA forum currently (given Tesla -70% off its ATH).

It would have been useful if trend showed a dip..That chart is completely useless. It only goes back to October 20th, not even a full quarter. You would need several years worth of data in the same data gathering series AND adjusted for sales volume. Charts like that serve only one purpose, to feed anti-Tesla headlines.

Thekiwi

Active Member

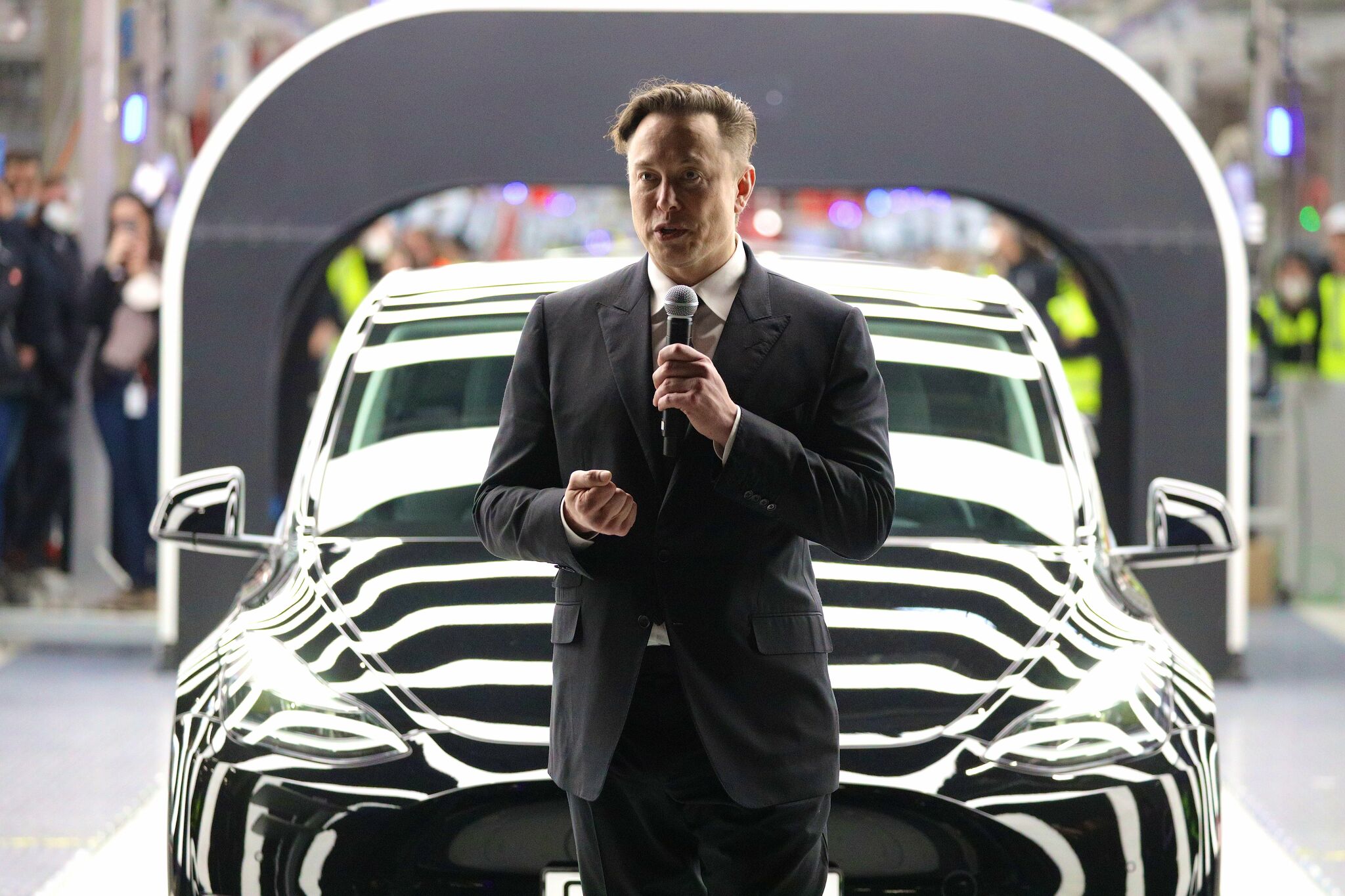

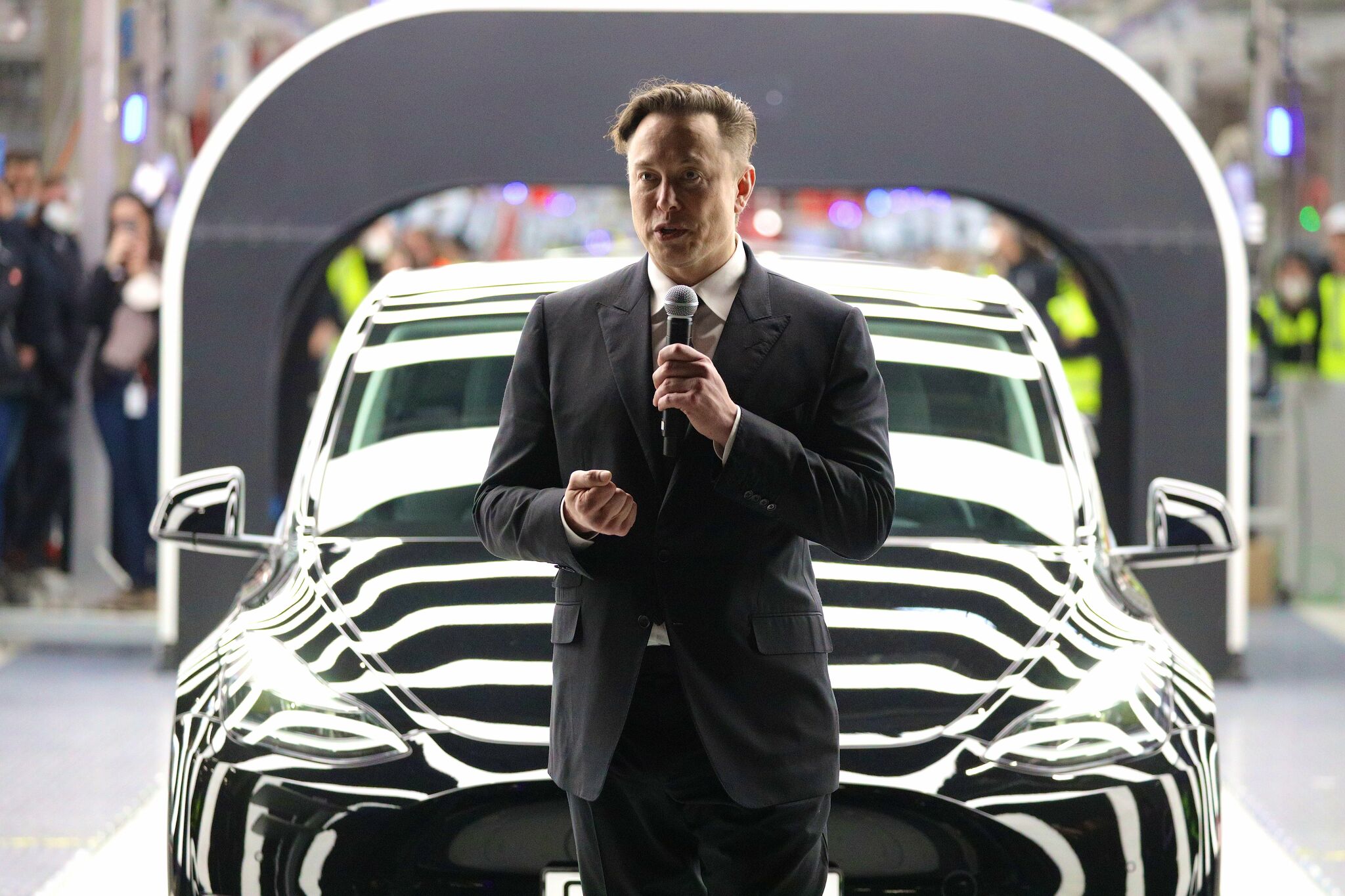

Had bloo berg TV on in background. My ears perked up when they had a segment on last hour talking about Tesla. First they ragged on how puny Fords EV numbers were vs Tesla, and then they had a short conversation where they were pondering if Elon Musk had toned down his public political statement since he doesn't seem to have posted anything that controversial for the last week (since his poll asking whether he should stop shooting himself in the foot ).

Just mentioning as possible slight narrative change here by Bloomberg. They did still have a bearish fund manager on though to talk, but even he said something to the effect that tesla is a great comapny, but stock not so much right now, which is more neutral than the normal “Telsa is doomed“ bear narrative.

Just mentioning as possible slight narrative change here by Bloomberg. They did still have a bearish fund manager on though to talk, but even he said something to the effect that tesla is a great comapny, but stock not so much right now, which is more neutral than the normal “Telsa is doomed“ bear narrative.

StealthP3D

Well-Known Member

yeah it Is a meme stock for sure and not what I would invest in, but where i come from a 46% move in $10,000 worth of peanuts is the same thing as a 46% move in $10,000 worth of anything else.

in others words, a 46% move is a 46% move regardless.

So, you're saying you wish you had timed the peanut market? And used a high percentage of your savings to do so?

Yeah, me too. Of course, anyone would be happy to capture a 46% move without any of the downside. But I don't have a time machine which is why I'm not a market timer. There is a reason why market timers have lower (or negative) returns compared to buy/hold investors.

Knightshade

Well-Known Member

So, you're saying you wish you had timed the peanut market?

That's nuts!

Hadn’t really thought about this, but where does this put companies like Lambo, Ferrari, and Rimac?

Tesla’s already trouncing BMW, Mercedes, and Audi. How soon before the high end gets tossed too?

Who would pay $1m for a Lambo only to get smoked by a $250k Roadster?

People buy super cars and hyper cars because nobody else can. Status symbol. Even if the Roadster 2.0 smokes then with a 0-60 in under 1 sec with cold thruster, I can guarantee you these guys will still be driving their cars powered on dinosaur juice.

All the people paying 1M for a Lambo are here. The Fast&Furious generation. They don’t want Teslas

Last edited:

There are apparently many people posting here who simply do not understand what marketing is, thinking it is a synonym for hype All the names you mention, plus nearly all products of LVMH (the new richest person in the world), and many more achieve stellar margins year after year through superior product position, placement, production and pricing. They also all provide unusually good customer service. All of them share those, all components of marketing. In short, quoting from a thesis I wrote decades ago, “marketing is what you do if you’re too large to personally know all your customers”.Apple gets most of its revenue from traditionally bad low margin markets (various consumer electronics categories) that usually attract single digit margins. That must be why they are worth “only” $2 Trillion. /s

People (like that Shorty McShortyFace) need to learn to separate a company from the industries it operates in and look at individual fundamentals of each company. The list of companies that make high margins in low margin industries is lengthy, usually due to strong brands, superior product & business models.

Coke sells sugar water.

Nike sells shoes.

Starbucks sells coffee.

Dyson sells vacuum cleaners.

Ikea sells furniture.

McDonalds sells burgers.

Etc etc.

Porsche has proven for decades it is possible to be a volume manufacturer of cars and maintain high margins In the traditionally low margin auto industry. Tesla is doing the same, but at an order of magnitude larger scale and with much broader ambitions into many other areas.

@petit_bateau , for example, provides excellent information, but forgets or does not know that price simply never if the prime driver in decision making, despite quite consistently being described as such by purchasers. That is to say people do change purchase timing based on price and they will often nit make purchases they cannot afford. Neither of those precludes very high margins.

Many of us and most analysts assume that low market share reflects poor performance. That may be true, but in the Tesla case for cars and TE, the entire market is nascent, but growing very quickly. Thus market share is titillating, but not terribly relevant.

About three or four years from now we will know whether Tesla can deliver high market share with consistent high profit and high quality. Before that we have only clues. Right now we cannot know whether Tesla will be similar to LVMH, Apple or Amazon. It even could turn out more like Kodak or Xerox.

in the meantime we need intelligent critical analysis, including understand Impediments to success. Examining carefully helps us to be more nearly rational in our decidions.

One good result probably is that most sane investors now know how ridiculous it is to use much margin, less so any derivative. Strangely some seeming wise investors are viewing Tesla as a generic car company so is overpriced. Such a decision is only possible if one does ignore product, design, placement and positioning.

There are definitely lots of possibilities both good and bad. We don’t actually know what the listed inventory numbers represent in terms of physical vehicles as it’s suspected Tesla doesn’t list repeats of a single configuration at one location. So you could see one Model Y of one configuration listed in a location, but there could be more than one of that configuration at that location. What it looks like overall, some speculate but only Tesla knows.Although I do agree the previous end of quarter discounting and lack of IRA for the 5 seater Y is likely a drag on current sales, to put things in perspective Tesla produces well over 10k a week from its US factories, so inventory building into the low single digit thousands is not exactly a “panic stations” situation.

We have no idea what’s happening internally - Tesla may have already converted most of the Y production to the IRA eligible 7 seaters for all we know, and they are flying out the door at a higher ASP (to tesla) than the 5 seater Ys. Not saying that Is happening, but it is just one possibility.

I’m not sure if a chart going back years would add more value considering the pace at which production is increasing, I would assume inventory numbers several years ago would be far lower because production several years ago was a tiny fraction of today’s. Inventory as a % of production at that same time might be interesting.That chart is completely useless. It only goes back to October 20th, not even a full quarter. You would need several years worth of data in the same data gathering series AND adjusted for sales volume. Charts like that serve only one purpose, to feed anti-Tesla headlines.

Even today’s inventory numbers can’t be looked at in isolation because we know production continues ramping to a target of 50% compounding annual growth and deliveries somewhere in the 40-50% range. If demand at a certain price point doesn’t accelerate at a pace matching production, the pace of inventory growth can continue accelerating.

Last edited:

CVNA is like 98% off from its high. It became a major target by traders to short into oblivion. The 46% gain is just a short covering rally.yeah it Is a meme stock for sure and not what I would invest in, but where i come from a 46% move in $10,000 worth of peanuts is the same thing as a 46% move in $10,000 worth of anything else.

in others words, a 46% move is a 46% move regardless.

And the 61% fall from its high - not sure that Is worthy of crapping on a stock for, especially on a TSLA forum currently (given Tesla -70% off its ATH).

Damn, the OP Said 61%. 98% is a lot worse lol. That would require a 50 times to break even.CVNA is like 98% off from its high. It became a major target by traders to short into oblivion. The 46% gain is just a short covering rally.

MC3OZ

Active Member

So I assume the critics think the conversation at a delivery centre goes like this......That chart is completely useless. It only goes back to October 20th, not even a full quarter. You would need several years worth of data in the same data gathering series AND adjusted for sales volume. Charts like that serve only one purpose, to feed anti-Tesla headlines.

Tesla worker 1 - Hey a lot of cars seem to be piling up in the lot, should we tell someone?

Tesla worker 2- Hmmm - all of the computers at HQ are broken, they will have no idea what inventory levels are.

Tesla worker 1 - I guess we don't want to the ones to bring bad news?

Tesla worker 2 - Perhaps we can get rid of them somehow?

/s

Artful Dodger

"Neko no me"

PSA: Reminder that the NASDAQ market will be closed on Monday, Jan 16, 2023 for MLK Day.

NASDAQ Trading Hours & Market Holidays [2022-2023]

NASDAQ Trading Hours & Market Holidays [2022-2023]

Accident

Member

Tesla planning big new industrial site west of Houston, advertising jobs in Brookshire

Tesla appears to be preparing a large new industrial facility just west of Houston in a...

23 acres facility outside of Houston. 120 miles from Austin.

Hmmm. Brookshire. Way west of the city on I-10. There’s an executive airport nearby, and its a pretty straight shot to Austin. Have to go through/around the city to get to the port.

Tesla planning big new industrial site west of Houston, advertising jobs in Brookshire

Tesla appears to be preparing a large new industrial facility just west of Houston in a...www.houstonchronicle.com

23 acres facility outside of Houston. 120 miles from Austin.

Wonder what’s up?

Last edited:

I think that’s true to some extent, but being the fastest around has always bee part of that caché.People buy super cars and hyper cars because nobody else can. Status symbol. Even if the Roadster 2.0 smokes then with a 0-60 in under 1 sec with cold thruster, I can guarantee you these guys will still be driving their cars powered on dinosaur juice.

All the people paying 1M for a Lambo are here. The Fast&Furious generation. They don’t want Teslas

Teslabot mass production? Just a potentially silly guess, I have no idea. Does the article say what the jobs are (paywalled for me).Hmmm. Brookshire. Way west of the city on I-10. There’s an executive airport nearby, and its a pretty straight shot to Austin. Have to go through/around the city to get to the port.

Wonder what’s up?

Edit: honestly, I am waiting for the day when we see a fully automated factory of Teslabots making more Teslabots….

Accident

Member

Battery cell manufacturing? Here’s one of the job listings:Teslabot mass production? Just a potentially silly guess, I have no idea. Does the article say what the jobs are (paywalled for me).

Edit: honestly, I am waiting for the day when we see a fully automated factory of Teslabots making more Teslabots….

“As a Manager of Production Control Warehouse, you will have the responsibility to design and oversee material handing functions in the Cell Materials production area”

Artful Dodger

"Neko no me"

Brookshire. Way west of the city on I-10. There’s an executive airport nearby, and its a pretty straight shot to Austin. Have to go through/around the city to get to the port.

Wonder what’s up?

23 acres is only a square 1,000' on a side. That's a large warehouse, or a small factory (per above, possibly for battery materials)

Got a handy Google Street View at that address? I wonder what's there right now?

Cheers!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K