petit_bateau

Active Member

Graceful progressively decline and transfer over to BEV seems unlikely. These legacy dino-juice companies aren't good at down-scaling, and their BEV offerings are almost certainly not making any significant profit (GM%). If their BEV offerings were significantly profitable they'd be bragging about it.You conveniently left out the other elephant in the room. Parts suppliers and their economics. There is a reason Ford supported bailout of GM & Chrysler. If any big OEM goes under, a lot of suppliers will shutdown and we should expect major disruption.

A more likely scenario is where legacy manufacturers slowly shrink and EV manufacturers grow. Finally when legacy manufacturers go under, no one even notices. Like how Sears or K-Mart went bankrupt.

I expect a few types of failure as their dino-juice volumes turn down and their NM goes negative:

- split the BEV division off into a new floated entity via IPO/SPAC; then flush the legacy debts and union agreements and pension liabilities via bankruptcy;

- straightforward collapse with the 'surprise' finding that the debt load was all taxpayer (state) backed in a lot of jurisdictions;

My guess is faulure of JLR's UK-based operations first, unless Tata can screw more money out of the UK taxpayer (pay up, or your auto industry is Brexit toast). Other weak ones might be Mitsubishi and Mazda, though Covid has thrown a wobbler into the stats. One way or another nation-states will be left holding the bill, if only in the unemployment statistics and the political consequences.

Average net profit margin: car companies 2020 | Statista

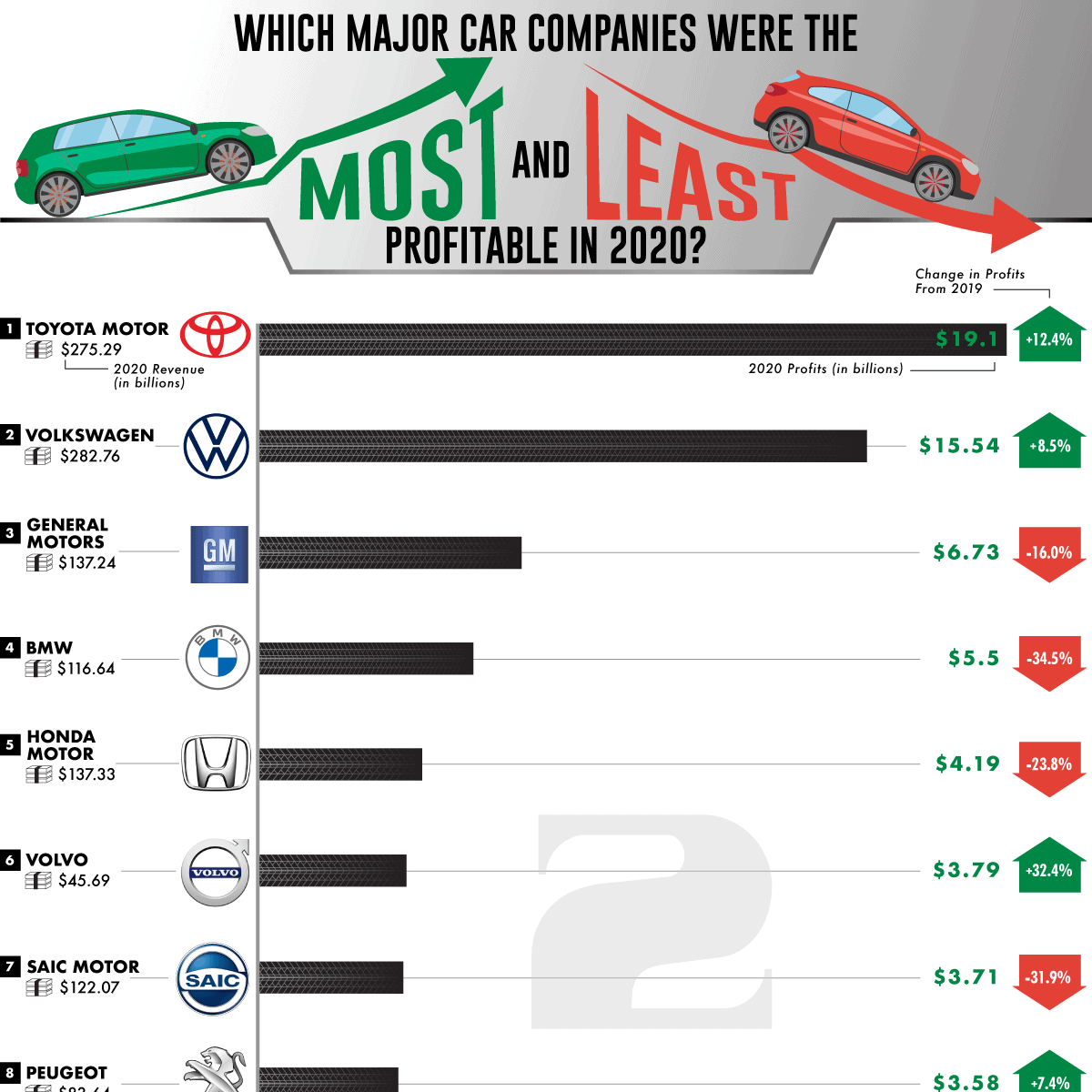

With average net profit margins of around 7.5 percent, Great Wall and Subaru had the highest average net profit margin in the five years leading up to 2020.

Which Major Car Companies Were the Most and Least Profitable in 2020

Find how much the largest car companies earned in profits during 2020 as well as the ones that ended up not being profitable at all.

- That is the most obvious size to pick for the 2/Z. It needs to be much shorter than the 3/Y, or it simply cannot be parked in a lot of streets around the world.That might be just large enough to cast a complete subframe for a car midway in size between a VW Golf and Polo. The die width seems sufficient, although the max length would be tight.

BTW, Tesla is now building a "Die shop" on the West side of the new Cathode plant at Giga Texas, according to speculation from Joe Tegtmeyer. I don't think these new dies will be for Gigapresses, since they already have their own milling machines in the casting workshop to make new casting dies.

Instead, I think the new "Die shop" will manufacture DBE platen rollers. You know, the kind that Tesla said they kept bending while rolling the DBE cathodes at the pilot plant on Kato Rd. in Fremont. Might as well "roll your own" (and keep it in-house) if you're gonna need moar for the forseeable future.

- Calender rollers tend to be a long lead item, which is problematic if you are tring to tune profiles and surface types, quite apart from the operational issues. Having a manufacturing shop of this nature on site would be handy. But at a guess - if they are doing this - they'll still be ordering in the foundry items from the relevant steel foundries and holding them as unmachined stock.