Looks like CNBS can also write snide articles about other EVs and EV makers.Their explanation makes no sense. If the battery cell technology is obsolete why not just use new battery cells? Anyway, looks like they're going to need to buy a lot more Tesla ZEV credits.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

-

- Tags

- elon is an ass

Down 10% in real terms?How Expensive is it to Buy a Tesla Now vs Pre-Covid?

January 2020

Tesla AWD Model Y List Price: $52000

Interest Rates: ~ 3.5%

Monthly Payment ($10k down): $764

April 2023

Tesla AWD Model Y List Price: $50000

Interest Rates: ~ 6.5%

Monthly Payment ($10k down): $782

Ignoring other factors for now, Tesla's most sold car is still more expensive than it was over 3 years ago.

Other factors:

Supply / Demand Curves: All else equal, as volume increases, prices needed to sustain demand should decrease. Tesla has increased production rate by a factor of 4 in 3 years, yet the affordability of the car has not gone down.

Wage Inflation: Average wages were up ~4%,4%, and 6% the last 3 years. Assuming white collar jobs matched these, raw purchasing power should have went up ~ 15% and so higher monthly payments should be tolerated.

Total Inflation: However total inflation has been even higher the past 2 years, while lower in 2020. Inflation obviously increases costs of other expenses reducing purchasing power for cars. I'd say this washes out wage inflation for now.

View attachment 931774

Summary

The economic factors presented to Tesla in 2023 should mean that prices should even be lower than they currently are. Monthly payments are actually higher than 3 years ago while supporting a much larger base of potential customers.

Costs also inflated but should see some alleviation later this year, unfortunately those lag price cuts.

Price cuts effect on demand are not instantaneous, we may not see most effects until later this year.

Thus, this is the worst period of time for financials. Prices may need to be cut again. Q1 or Q2 should be the worst of it. Peak FUD is now through rest of Q2 and probably Q3.

Conclusion

Tesla does not have a demand problem, in fact, I would argue it is up. (I am surprised by this finding)

Tesla does not have an advertising problem.

Tesla has a "the economy sucks and there's nothing we can do about it but be patient" problem.

Investors need to suck it up and be patient too.

bkp_duke

Well-Known Member

Can you provide a link to some discussions regarding the 3/Y having worse degradation curves than the S/X please? Thanks. Cheers.

This is the mother of all 3 battery health threads:

Range Loss Over Time, What Can Be Expected, Efficiency, How to Maintain Battery Health

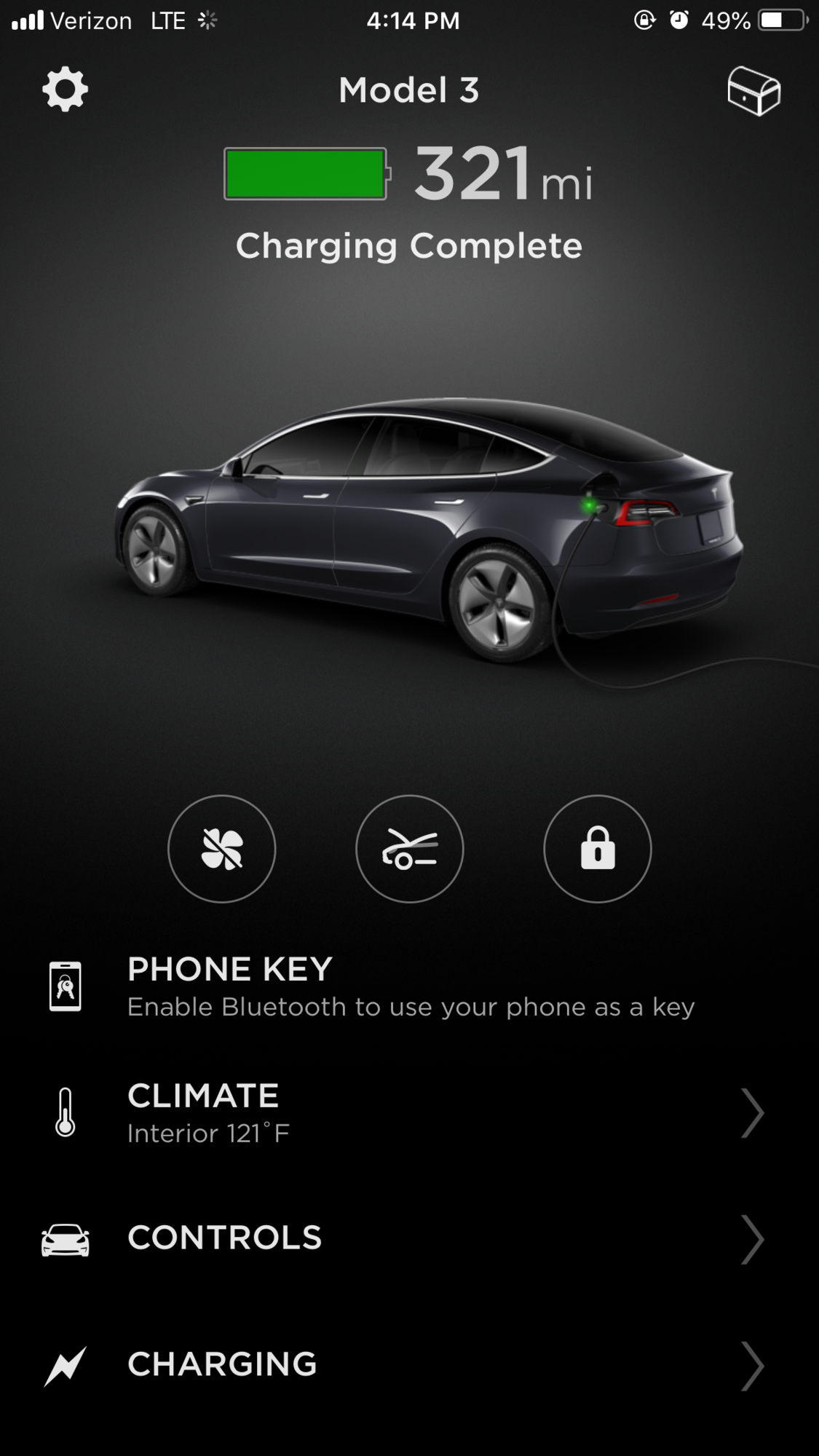

i bought my model 3 in aug 2018. After the software upgrade I only got 316 miles when charged to 100%. Last night I got only 312 miles from 5% SOC to 100%. A 4% degradation within 10 months? Have others degraded similarly?

I've been in and out of that thread for both our 3 and Y, both of which have 10+% degradation with between 10,000 and 25,000 miles on them at the time (and not a lot of supercharging), and the consensus was "this is normal for the 2170 packs".

Krugerrand

Meow

I have less than 8% degradation at over 90,000 miles.This is the mother of all 3 battery health threads:

Range Loss Over Time, What Can Be Expected, Efficiency, How to Maintain Battery Health

i bought my model 3 in aug 2018. After the software upgrade I only got 316 miles when charged to 100%. Last night I got only 312 miles from 5% SOC to 100%. A 4% degradation within 10 months? Have others degraded similarly?teslamotorsclub.com

I've been in and out of that thread for both our 3 and Y, both of which have 10+% degradation with between 10,000 and 25,000 miles on them at the time (and not a lot of supercharging), and the consensus was "this is normal for the 2170 packs".

Woop-D-Woop

Member

Electroman

Well-Known Member

A lesson for those short sighted share holders who have been making noises on share buy backs, or dividends.

How Expensive is it to Buy a Tesla Now vs Pre-Covid?

January 2020

Tesla AWD Model Y List Price: $52000

Interest Rates: ~ 3.5%

Monthly Payment ($10k down): $764

April 2023

Tesla AWD Model Y List Price: $50000

Interest Rates: ~ 6.5%

Monthly Payment ($10k down): $782

Ignoring other factors for now, Tesla's most sold car is still more expensive than it was over 3 years ago.

Other factors:

Supply / Demand Curves: All else equal, as volume increases, prices needed to sustain demand should decrease. Tesla has increased production rate by a factor of 4 in 3 years, yet the affordability of the car has not gone down.

Wage Inflation: Average wages were up ~4%,4%, and 6% the last 3 years. Assuming white collar jobs matched these, raw purchasing power should have went up ~ 15% and so higher monthly payments should be tolerated.

Total Inflation: However total inflation has been even higher the past 2 years, while lower in 2020. Inflation obviously increases costs of other expenses reducing purchasing power for cars. I'd say this washes out wage inflation for now.

View attachment 931774

Summary

The economic factors presented to Tesla in 2023 should mean that prices should even be lower than they currently are. Monthly payments are actually higher than 3 years ago while supporting a much larger base of potential customers.

Costs also inflated but should see some alleviation later this year, unfortunately those lag price cuts.

Price cuts effect on demand are not instantaneous, we may not see most effects until later this year.

Thus, this is the worst period of time for financials. Prices may need to be cut again. Q1 or Q2 should be the worst of it. Peak FUD is now through rest of Q2 and probably Q3.

Conclusion

Tesla does not have a demand problem, in fact, I would argue it is up. (I am surprised by this finding)

Tesla does not have an advertising problem.

Tesla has a "the economy sucks and there's nothing we can do about it but be patient" problem.

Investors need to suck it up and be patient too.

So your argument is that the monthly cost of a Model Y increased 2.4% absolute over the last 39 months and that people are so on edge financially that this is the limit?

So we should be expecting the 1.8m cars this year to come it an 18% margin? Or even lower?

Excellent post!!

One interesting side-effect of the way IRA was structured is until Jan 2024, payments are unaffected by the tax rebate. Unless people have $7,500 they can lend themselves until tax time, they will need to qualify for the full amount and eventually get the credit on their taxes next year. Some people will think to change their withholdings, but most will just get a big gift at next years tax season.

Seems like a trivial amount, but increasing the payment by $150/ month has interesting knock on effects. If your car loan is considered high risk because it's too big a chunk of your income, your interest rate goes way up.

Even though that bonus is dangling out there, many people who might be able to stretch and get a $43k car may be put off or not qualify for $50k with a $7,500 tax incentive which they have to wait a year to get. Seems like this will be a bit of a tailwind into 2024 as the full impact of the rebate comes into play.

Where did you get $150/month? He said $764 --> $782.

Also average US gasoline prices are up a lot more than electricity. From about $2.50 a gallon in Jan 2020 to around $3.60 now (+44%) vs. an increase of $0.134 Kwh to $0.166 Kwh (+24%)

Last edited:

Any graph that shows inventory as absolute numbers and not as a % of production rate is at least slightly disingeniousSome Fear being spread, but it seems the real story is that Model Y and S sales are doing just fine, which makes sense.

MC3OZ

Active Member

Best to take a stab at that after Q2 earnings.So we should be expecting the 1.8m cars this year to come it an 18% margin? Or even lower?

We know many raw materials price reductions are still working their way through the system and that will play out over the next 12 months or so.

We don't know how interest rates will track, and how the economy more generally will track this year,

IMO at least some of the causes of concern after Q1 earnings, might turn out to be temporary in nature.

Tesla makes about 3k cars per day. So this inventory graph is pretty meaningless. It used to say something when production was no where near this high.Any graph that shows inventory as absolute numbers and not as a % of production rate is at least slightly disingenious

Was talking about the delta between actual purchase price ($50k) and subsidized cost ($43k). The difference in payments would be roughly $150. People have to finance the full $50k so all of the talk about how much lower the cost is doesn’t really play out for many consumers.Where did you get $150/month? He said $764 --> $782.

Also average US gasoline prices are up a lot more than electricity. From about $2.50 a gallon in Jan 2020 to around $3.60 now (+44%) vs. an increase of $0.134 Kwh to $0.166 Kwh (+24%)

The problem with any computation about savings due to tax credits (until 2024) or fuel savings down the road is banks don’t take that into account when they make car loans. If the ration of you payments to income is too high, you either don’t qualify or you are classified as high credit risk. The fact that you are getting $7,500 back and that it costs $100/ month less to operate doesn’t mean bumpkis to the bank.

Artful Dodger

"Neko no me"

MSFT beat:

12,990.50 +181.00 (+1.41%)

As of 01:48AM EDT. Market open.

Nasdaq 100 Jun 23 (NQ=F)

CME - CME Delayed Price. Currency in USD12,990.50 +181.00 (+1.41%)

As of 01:48AM EDT. Market open.

Buckminster

Well-Known Member

Last edited:

One of the replies had an interesting idea:

This would also give an opportunity to encourage upgrade to FSD.

Can you provide a link to some discussions regarding the 3/Y having worse degradation curves than the S/X please? Thanks. Cheers.

Battery cell degradation is a function of how often it is recharged. For a given total mileage, a car with a bigger battery has to be recharged less often, so degradation is less. S/X have bigger batteries than 3/Y on average (assuming same chemistry obviously, 3/Y with LFP will have different curve).

Huskyf

Member

Excuse me is that billions revenues is not add on the actual revenues ? It's correctI'm reading up on FSD deferred revenue recognition and, in particular, its history here:

Thinking about the ramifications here on the financials...

If I were to recognize ~$1.75B in pure 100% profit in a quarter (due to the official release of FSD to the public), I'd want to phase that out over time while picking up the take-rate of that feature across the entire vehicle base of current owners as well as new purchasers. It just seems wild to create a 7% increase (using $25B in quarterly revenue as the line in the sand number) in quarterly profits and have nothing to show for it in future quarters without a plan to increase the take-rate across the entire vehicle base of current and new vehicle purchasers.

Also, are they really going to offer just a button on the UI to enable this massively expensive feature? Like enable FSD, take thousand's of dollars from my checking account and wire it over in a single business day?

Edit: Excuse me, $3B in deferred revenue. That'd make it 12% increase in quarterly revenue.

Stretch2727

Engineer and Car Nut

I hope they offer a subscription for EAP as well. I think there are many that would take this for $99 or less and would upgrade to FSD once it is fully baked.One of the replies had an interesting idea:

This would also give an opportunity to encourage upgrade to FSD.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K