Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chickenlittle

Banned

Could not agree moreI did invest in a startup earlier this year. Not public. Yet. For me, it comes down to knowing enough about the investment that my initial response is an unqualified YES!!!, rather than a 'well, need to investigate further'. If I don't feel that passion about it, that excitement, then it's not going to work for me. (And I can see some of you backing away from your screen, thinking 'she's not one of us!'.) I'm okay with totally unbalanced. (No snarky remarks, please.)

Here's the deal - If I'm not excited by the company / technology / team / market potential , then I'm not going to pay attention like I should. And if I'm not excited about it, why should anyone else be excited about it? So that's my first rule. No passion-less investing. I've probably missed out on more than one great deal. But you know what? My annual returns are, ummm, well hey! I'm getting an X! And keeping my Roadster.Tesla won out on the YES!!!! and continues to do so. Gigafactory? OMG YES!!! I pay attention to just about everything that comes across on the company. I've been on the factory floor 5 times now. LinkedIn is sure I must have worked for Tesla at some point because of all my internal connections. I can regurgitate their reports on request.

Wasn't it Buffett who recommended growing your portfolio by finding a winning company and really understanding it well? Diversification is for those who don't completely trust their own judgment. I know the market can do things that I can't control. So I have my own safeguards in place to protect myself. But I invest in companies and technology and management teams that I believe in. Unqualified YES.

That's the truth. The thousands of times that people tell you to SELL and you tell them you know what you're doing and you don't sell, because you know what you're doing. And the best part? Those people now ask, 'So ... what else are you investing in these days?'

THIS is better than all the money. My family is full of aunts/uncles/nephews/nieces/brothers who said 'you are crazy to invest in that company and buy that car'......

How does that go:

Buying TSLA in April 2013 $40-50/share

Adding some options before the Detroit Auto Show Jan 2014 $.75/contract

Having your family asking: "You are retiring...now??" PRICELESS

I really don't understand people's reluctance to use debt, especially when they could write a check to pay back the debt. Every large corporation uses debt (bonds) to leverage its equity. Why should you rely solely on equity financing? US tax law makes taking on mortgage debt very advantageous to responsible borrowers.

There is an irrational myth that "consumer debt" is the path to financial ruin. Poppycock. Sure, taking on debt to live beyond your means is folly, but when the after-tax cost of interest is lower than the dividends on your equity or the expected capital gains on your TSLA holdings, it's hard to make a rational case for not taking on the mortgage debt.

Exactly! I could have paid cash for my P85+. Instead I took a 90K loan at 1.5%, and bought $90K worth of stock. (I have since bought much more). That 90K worth of stock has more than doubled and paid the interest on my loan many times over....

581 Actual decisions. It seems I make $1783 every time I trade, so I should start doing it more...

1,035,923... congrats

Johann Koeber

Happy Owner

Now ... about 6 years after the last post

many more members of the club have been made.

But no one posted.

When will we need a Tbillionaire thread?

many more members of the club have been made.

But no one posted.

When will we need a Tbillionaire thread?

pz1975

Active Member

So if "Teslanaire" is the term for $1,000,000 total profit, what is the term for gaining $1,000,000 (paper) profit in 1 DAY? That was me yesterday as I am sure many others on here also experienced.

So if "Teslanaire" is the term for $1,000,000 total profit, what is the term for gaining $1,000,000 (paper) profit in 1 DAY? That was me yesterday as I am sure many others on here also experienced.

Not that I'm breathing this rarefied air, but I always thought to be a Teslanaire was to earn $1,000,000 profit in one day. In any case, quite the accomplishment, well done!

Back in the day (2013), this was called a "Tezillionaire".So if "Teslanaire" is the term for $1,000,000 total profit, what is the term for gaining $1,000,000 (paper) profit in 1 DAY? That was me yesterday as I am sure many others on here also experienced.

LN1_Casey

Draco dormiens nunquam titillandus

I'm just happy my shares are in the $100k range.  Would need to be much higher than current for me to breach $1mil.

Would need to be much higher than current for me to breach $1mil.

TSLA Pilot

Active Member

I got in the club when the stock hit 120 something. The only stock I ever bought in my life against a professionals advice. Pure emotion. Right now I just use the money to buy Omaha steaks for the crew at the Columbus service center whenever they work on my car. :smile:

Glad this thread is re-awakened with the SP at over $2k yesterday! As an aside, the ARK Invest report from Jan 2020 suggests that's just a point on the road to a much, much higher SP:

Tesla Price Target: Tesla's Potential Trajectory During the Next Five Years

Of greater import is this part: while I'm sure this poster was just trying to be nice, PLEASE don't buy Omaha steaks, or any steaks, for anyone. It's in direct conflict with having a usable planet, and the reason Tesla exists in the first place:

COWSPIRACY: The Sustainability Secret

Key point (one of many, BTW):

Animal agriculture is responsible for 18 percent of greenhouse gas emissions, more than the combined exhaust from all transportation.

Thx.

Last edited:

TSLA Pilot

Active Member

If the last-price on my Jun 22 $1250's would update then this would be very close to starting with a "2", maybe today...

View attachment 578917

Next step: getting to 8-figures, then 9 . . . just think of the possibilities as Tesla builds out a fleet of Gigafactories, each a bit more efficient than the last. As Elon said, it's the machine building the machine that matters most [paraphrased].

I think you mean that those options haven't traded recently. For options, what I (and some brokers) do is to assume that if the last trade was below the current bid, use the bid, if it was above the current ask, use the ask, otherwise use the last trade.If the last-price on my Jun 22 $1250's would update then this would be very close to starting with a "2", maybe today...

View attachment 578917

I keep track on a weekly basis in my own spreadsheet; it forces me to look in detail at each holding, not too often (that can lead to frenzy and stupid trades), but often enough to spot important trends.

Tslynk67

Well-Known Member

I think you mean that those options haven't traded recently. For options, what I (and some brokers) do is to assume that if the last trade was below the current bid, use the bid, if it was above the current ask, use the ask, otherwise use the last trade.

I keep track on a weekly basis in my own spreadsheet; it forces me to look in detail at each holding, not too often (that can lead to frenzy and stupid trades), but often enough to spot important trends.

In this case, the last trade was 17th August, the bid/ask is 300 higher, I have 4 so there's $120k under the surface.

Now I wonder what to do with these as they're clearly a bit illiquid. TBH I'm thinking to just hold them until expiry and exercise - I don't foresee needing the money before then, plus I have $3500's on the same date, which I expect to be ITM by them, so I could probably sell one of those to buy the $1250's as shares, which would be excellent gains.

"Teslanaire" - yep I am there too

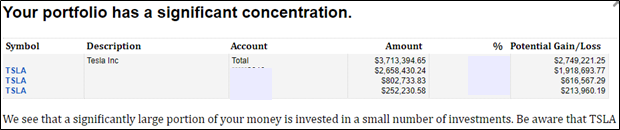

And Fidelity is not happy with my lack of diversification

(Account numbers and portfolio weight blocked out)

"Tezillionaire" - not yet there, most I have made in a day is 0.5M.

"Tezbillionaire" probably not in this lifetime, but hey a girl can dream!

And Fidelity is not happy with my lack of diversification

(Account numbers and portfolio weight blocked out)

"Tezillionaire" - not yet there, most I have made in a day is 0.5M.

"Tezbillionaire" probably not in this lifetime, but hey a girl can dream!

You have to work as an engineer for 10-15 years and quit and get a new job. Roll over the 401k into an IRA then you have a self-directed IRA. Otherwise yeah its real tough.

Don’t know if you’re distinguishing between an IRA where you can make investment decisions vs. a Self-Directed IRA which is a specific type of IRA with specific types of restrictions on holdings. My Traditional, Roth and Beneficiary IRAs are at a brokerage/advisory, and I can tell the guy to buy certain things, including TSLA and types of options in any of them. I would assume that applies to Fidelity, etc.

Similar threads

- Replies

- 1

- Views

- 676

- Replies

- 12

- Views

- 3K

- Replies

- 69

- Views

- 10K

- Replies

- 7

- Views

- 1K