If you don't have time to read this post in its entirety, skip to the Auditing the Warranty Reserve Section

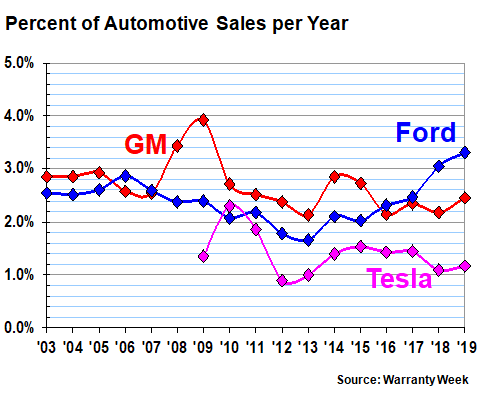

I write this post to address allegations by Tesla bears that there is fraud with Tesla's Warranty Accounting.

The allegations are nonsense and I am confident that the Tesla's Warranty Reserve is fairly stated as audited by PwC

Warranty reserves are required for Tesla Autos and Energy products but in this post, I will use Tesla Auto in examples.

Background

Tesla provides a limited warranty on new vehicles of 4 years/50,000 miles and for the battery and drive unit - 8 years/100k-150k miles (depending on model), whichever comes first. When a vehicle is sold, Tesla needs to expense expected warranty costs upfront.

Computing the Warranty Reserve

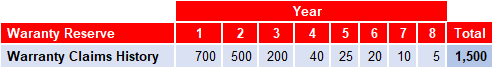

To determine what amount to record as warranty expense at the time of sale, Tesla uses warranty claims history. These numbers are estimated and used for illustrative purposed only. Past Claims per Car may look as follows:

Although the repairs and cash outlay will occur over 8 years, Tesla records $1,500 per car at the time of the sale. They do this by setting up a reserve of $1,500. Since $1,500 has all been recorded in Year 1, future charges (e.g. $500 in year 2) does not impact the income statement in Year 2 as it is charged against the reserve that was set up in Year 1. So Tesla has a charge of $1,500 in year one and nothing thereafter (assuming the $1,500 estimate is good).

The Goodwill Allegation

If a repair does not fall under the warranty policy, a Service Center may do the work free of charge to keep a customer happy. This is a Goodwill repair. Although Goodwill repairs hit expense, they do so in the year incurred and not reserved for at the time of sale. This is proper accounting. The allegation from some claiming fraud is that Tesla is coding warranty work as goodwill to lower the reserve required at the date of sale.

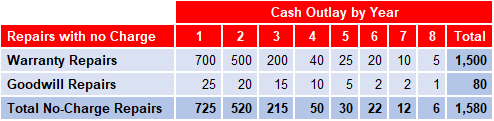

Here is an example with amounts that are for illustrative purposes (not actual).

If the cash outlays in years 1-8 are as follows......

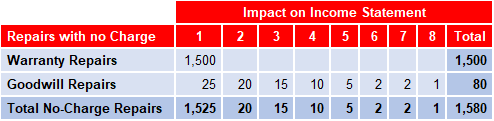

....then the impact to the income statement is as follows:

As you can see, Warranty expenses are all recorded in year 1 but the Goodwill expenses get recorded as incurred.

The people shouting fraud are stating that many of the Goodwill charges are really Warranty expenses (mis-coded) and should be charged in year 1 (thereby understating expenses in year 1).

Auditing the Warranty Reserve

There are a number of steps performed in auditing the Warranty Reserve but one audit step addresses the Goodwill claim. Auditors will review data to ensure all and only warranty claims data have been accounted for. Since there are thousands of transactions, it is not unlikely for there to be a few miscoding errors. If PwC found some repairs coded as goodwill rather than warranty, it is likely that it was addressed in one of the following ways:

- the miscoding was not material enough to change the reserve and allowed for a clean Audit Opinion to be issued.

- the miscoding was quantified and Tesla adjusted its warranty reserve in the published financial statements.

- the miscoding is already accounted for in Tesla's warranty reserve calculation (adding additional expense to account for miscoding).

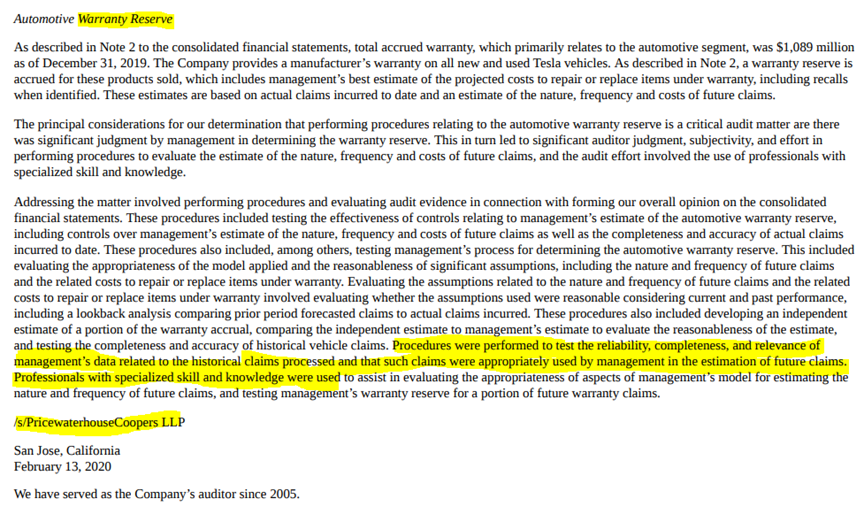

The reason we can feel comfortable that PwC has done a thorough job at auditing the warranty reserve is because they told us. It is written right in their Audit Opinion Letter in the 2019 10K (see page 64 of 10K). They actually bring in professionals with specialized skills in this area to audit the Warranty Reserve.

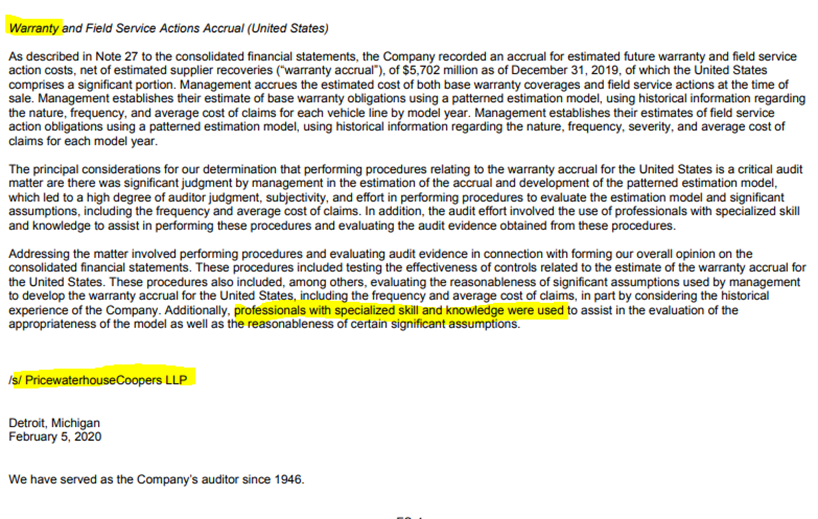

They wrote something similar for Ford (who they also audit):

I write this post to address allegations by Tesla bears that there is fraud with Tesla's Warranty Accounting.

The allegations are nonsense and I am confident that the Tesla's Warranty Reserve is fairly stated as audited by PwC

Warranty reserves are required for Tesla Autos and Energy products but in this post, I will use Tesla Auto in examples.

Background

Tesla provides a limited warranty on new vehicles of 4 years/50,000 miles and for the battery and drive unit - 8 years/100k-150k miles (depending on model), whichever comes first. When a vehicle is sold, Tesla needs to expense expected warranty costs upfront.

Computing the Warranty Reserve

To determine what amount to record as warranty expense at the time of sale, Tesla uses warranty claims history. These numbers are estimated and used for illustrative purposed only. Past Claims per Car may look as follows:

Although the repairs and cash outlay will occur over 8 years, Tesla records $1,500 per car at the time of the sale. They do this by setting up a reserve of $1,500. Since $1,500 has all been recorded in Year 1, future charges (e.g. $500 in year 2) does not impact the income statement in Year 2 as it is charged against the reserve that was set up in Year 1. So Tesla has a charge of $1,500 in year one and nothing thereafter (assuming the $1,500 estimate is good).

The Goodwill Allegation

If a repair does not fall under the warranty policy, a Service Center may do the work free of charge to keep a customer happy. This is a Goodwill repair. Although Goodwill repairs hit expense, they do so in the year incurred and not reserved for at the time of sale. This is proper accounting. The allegation from some claiming fraud is that Tesla is coding warranty work as goodwill to lower the reserve required at the date of sale.

Here is an example with amounts that are for illustrative purposes (not actual).

If the cash outlays in years 1-8 are as follows......

....then the impact to the income statement is as follows:

As you can see, Warranty expenses are all recorded in year 1 but the Goodwill expenses get recorded as incurred.

The people shouting fraud are stating that many of the Goodwill charges are really Warranty expenses (mis-coded) and should be charged in year 1 (thereby understating expenses in year 1).

Auditing the Warranty Reserve

There are a number of steps performed in auditing the Warranty Reserve but one audit step addresses the Goodwill claim. Auditors will review data to ensure all and only warranty claims data have been accounted for. Since there are thousands of transactions, it is not unlikely for there to be a few miscoding errors. If PwC found some repairs coded as goodwill rather than warranty, it is likely that it was addressed in one of the following ways:

- the miscoding was not material enough to change the reserve and allowed for a clean Audit Opinion to be issued.

- the miscoding was quantified and Tesla adjusted its warranty reserve in the published financial statements.

- the miscoding is already accounted for in Tesla's warranty reserve calculation (adding additional expense to account for miscoding).

The reason we can feel comfortable that PwC has done a thorough job at auditing the warranty reserve is because they told us. It is written right in their Audit Opinion Letter in the 2019 10K (see page 64 of 10K). They actually bring in professionals with specialized skills in this area to audit the Warranty Reserve.

They wrote something similar for Ford (who they also audit):