Yowser. Bears - please excuse the pun - repeating from my post in the investor roundtable.

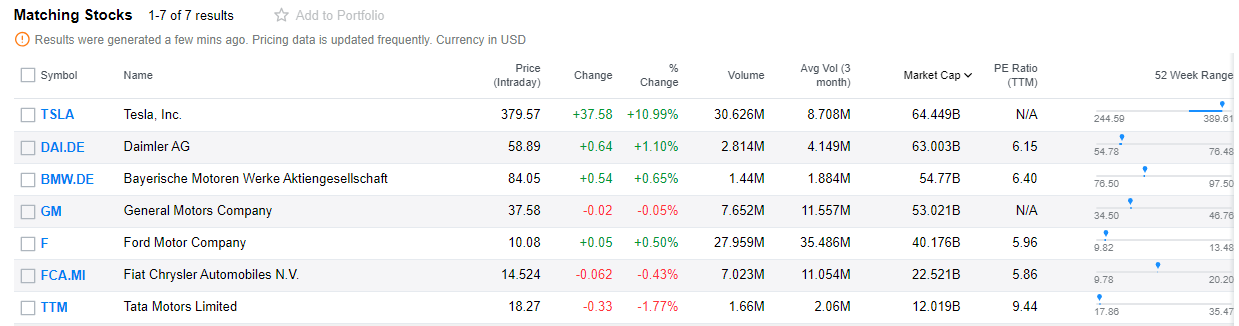

Excluding a couple of Chinese and Indian conglomerates, today Tesla became the most valuable automotive company in (most of) the world - more valuable than GM, Ford, Fiat/Chrysler, even more than BMW and Daimler:

Excluding a couple of Chinese and Indian conglomerates, today Tesla became the most valuable automotive company in (most of) the world - more valuable than GM, Ford, Fiat/Chrysler, even more than BMW and Daimler: