Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Causalien

Prime 8 ball Oracle

So, what happens to the other side of the trade. The one who "buys" the shares that this particular guy naked shorted? Wouldn't that person be able to then turn around and lend it out at 80% interest for nothing?

An Alternate Explanation

i had made a few calls about this trade, and today one of my buddies called me back with a plausible explanation.

several other observations are important at this point:

1. the trades are always happening in deep in the money options that have some open interest.

2. i was wrong about how settlement works with the options exercise. if i am long a call and i exercise today, it's just like i bought the stock today. the shares will settle t+3. meaning with trades done on tuesday the shares will settle on friday: tues= t+0, weds = t+1, thur = t+2, fri = t+3.

3. my brokers are telling me a lot of these prints are getting posted as spread trades.

ok, so here's the alternate theory.

there's a guy larry. he's short a lot of tesla. the short charges are killing him, but he knows this is a good trade and wants to hang on.

larry's buddy moe is short too. and he's feeling the pinch of the short charges as well.

and oh this third guy curly. curly luvs tesla and he's playing long by owning the may 35 and june 25 calls, which he bought from a market maker named shemp. for the sake of argument, we'll say curly is long the entire open interest of 500 contracts in both the may 35 and june 25 calls and the market maker is short the entire open interest of 500 calls of may 35's and june 25's.

larry and moe are tired of curly yukking it up, so they hatch a plan. they're going to trade with each other in the may 35 and june 25 calls. they agree to exercise the contracts immediately, and to price the contracts at parity with each other on the trades. since the options trade at zero intrinsic value, it's going to be easy. on tuesday with tesla trading at $41, larry sells the may 35 / june 25 spread to moe, 3000 contracts a side, and at a $10 credit. after the trade, their positions look like this:

larry's positions:

long 3000 june 25s

short 3000 may 35s

short 500,000 tesla (for example)

moe's positions:

short 3000 june 25s

long 3000 may 35s

short 600,000 tesla (for example)

now larry and moe both exercise the long side of their calls. since the total open interest for the options counting all the 3 stooges is 3500 contracts, they each will get assigned on (3000/3500) x 3000 = 2,571 of their short call options. that will leave each short 429 calls, larry short the may 35s and moe short the june 25s. each will also end up having bought net 42,900 tesla, but since the shares come from an options exercise they will never hit the tape.

the next day, their positions look like this:

larry:

short 429 may 35s

short 457,100 tesla

moe:

short 429 june 25s

short 557,100 tesla

so shemp is the one who gets screwed. he gets assigned on 429 may 35s and jun 25s that he was short. fortunately he was long 80,000 shares as a delta hedge against the short calls. but he'll have to deliver 85,800 shares on friday. and since he won't know about the trade until at least wednesday, there's nothing he can do. he's going to have to pay 3 days interest being short 5,800 shares over the weekend. and he won't be earning interest on the 80,000 shares of tesla he owned that he had loaned out. since he suddenly finds himself short 5,800 shares, he will go into the market weds morning and quickly clean up his position, covering 5,800 shares at the open.

meanwhile, larry and moe are thrilled because the shares they are getting delivered will offset their short position and save them the 50% borrowing cost over the weekend: 85,800 x $41 x 50% x 3/365 = $14,450 split between the two of them. and they will still be short tesla by being short the calls. it's not as good as being short the stock, but it's a hell of a lot cheaper and the delta of the options is nearly 100, so it's pretty much the same thing. as long as curly doesn't exercise either his may 25s or may 35s, larry & moe can stay short the calls and use those to save a lot on borrowing shares.

at $41 for tesla and a 50% borrowing rate, the 429 short calls (which represent 42,900 shares) save them 42,900 x $41 x 50% x (1/365) = $2,409 per day.

now that was my example with 3000 contracts. multiply that by 7. 21,000 contracts across multiple strikes. probably they end up saving over $15,000 a day in carrying charges. that's $450,000 a month. now figure these guys are hedgies who are probably paid 1 & 20. that means 20% of that $450,000 = $90,000 extra goes directly into their paychecks.

how can these guys get screwed? well the only real way is if curly suddenly decides on tuesday to exercise all his options. in that case those guys will get stuck paying short charges on all their shares over the weekend. and of course if tesla keeps climbing.

there's a few other details i need to ponder a bit longer.

i had made a few calls about this trade, and today one of my buddies called me back with a plausible explanation.

several other observations are important at this point:

1. the trades are always happening in deep in the money options that have some open interest.

2. i was wrong about how settlement works with the options exercise. if i am long a call and i exercise today, it's just like i bought the stock today. the shares will settle t+3. meaning with trades done on tuesday the shares will settle on friday: tues= t+0, weds = t+1, thur = t+2, fri = t+3.

3. my brokers are telling me a lot of these prints are getting posted as spread trades.

ok, so here's the alternate theory.

there's a guy larry. he's short a lot of tesla. the short charges are killing him, but he knows this is a good trade and wants to hang on.

larry's buddy moe is short too. and he's feeling the pinch of the short charges as well.

and oh this third guy curly. curly luvs tesla and he's playing long by owning the may 35 and june 25 calls, which he bought from a market maker named shemp. for the sake of argument, we'll say curly is long the entire open interest of 500 contracts in both the may 35 and june 25 calls and the market maker is short the entire open interest of 500 calls of may 35's and june 25's.

larry and moe are tired of curly yukking it up, so they hatch a plan. they're going to trade with each other in the may 35 and june 25 calls. they agree to exercise the contracts immediately, and to price the contracts at parity with each other on the trades. since the options trade at zero intrinsic value, it's going to be easy. on tuesday with tesla trading at $41, larry sells the may 35 / june 25 spread to moe, 3000 contracts a side, and at a $10 credit. after the trade, their positions look like this:

larry's positions:

long 3000 june 25s

short 3000 may 35s

short 500,000 tesla (for example)

moe's positions:

short 3000 june 25s

long 3000 may 35s

short 600,000 tesla (for example)

now larry and moe both exercise the long side of their calls. since the total open interest for the options counting all the 3 stooges is 3500 contracts, they each will get assigned on (3000/3500) x 3000 = 2,571 of their short call options. that will leave each short 429 calls, larry short the may 35s and moe short the june 25s. each will also end up having bought net 42,900 tesla, but since the shares come from an options exercise they will never hit the tape.

the next day, their positions look like this:

larry:

short 429 may 35s

short 457,100 tesla

moe:

short 429 june 25s

short 557,100 tesla

so shemp is the one who gets screwed. he gets assigned on 429 may 35s and jun 25s that he was short. fortunately he was long 80,000 shares as a delta hedge against the short calls. but he'll have to deliver 85,800 shares on friday. and since he won't know about the trade until at least wednesday, there's nothing he can do. he's going to have to pay 3 days interest being short 5,800 shares over the weekend. and he won't be earning interest on the 80,000 shares of tesla he owned that he had loaned out. since he suddenly finds himself short 5,800 shares, he will go into the market weds morning and quickly clean up his position, covering 5,800 shares at the open.

meanwhile, larry and moe are thrilled because the shares they are getting delivered will offset their short position and save them the 50% borrowing cost over the weekend: 85,800 x $41 x 50% x 3/365 = $14,450 split between the two of them. and they will still be short tesla by being short the calls. it's not as good as being short the stock, but it's a hell of a lot cheaper and the delta of the options is nearly 100, so it's pretty much the same thing. as long as curly doesn't exercise either his may 25s or may 35s, larry & moe can stay short the calls and use those to save a lot on borrowing shares.

at $41 for tesla and a 50% borrowing rate, the 429 short calls (which represent 42,900 shares) save them 42,900 x $41 x 50% x (1/365) = $2,409 per day.

now that was my example with 3000 contracts. multiply that by 7. 21,000 contracts across multiple strikes. probably they end up saving over $15,000 a day in carrying charges. that's $450,000 a month. now figure these guys are hedgies who are probably paid 1 & 20. that means 20% of that $450,000 = $90,000 extra goes directly into their paychecks.

how can these guys get screwed? well the only real way is if curly suddenly decides on tuesday to exercise all his options. in that case those guys will get stuck paying short charges on all their shares over the weekend. and of course if tesla keeps climbing.

there's a few other details i need to ponder a bit longer.

blakegallagher

Member

Luvb2b thanks for this thread it has been very interesting to follow. I have a option question that is most likely unrelated but I don't know where else to get it answered. I have a variety of basic call options that expire in may and june across different strike prices. All of them did great today except my june 22 43 dollar calls .... they dropped 10 percent. I was curious what could cause such a large drop on such a big gain that brings these options so close to the money. Thanks for sharing your expertise.

PureAmps

Model S P85 (#2817)

Luvb2b thanks for this thread it has been very interesting to follow. I have a option question that is most likely unrelated but I don't know where else to get it answered. I have a variety of basic call options that expire in may and june across different strike prices. All of them did great today except my june 22 43 dollar calls .... they dropped 10 percent. I was curious what could cause such a large drop on such a big gain that brings these options so close to the money. Thanks for sharing your expertise.

The end of day price is based on the last price that particular option traded at during the day. In the case of the the Jun 43 calls, the last price was 1.55, and was in fact down 0.15 from the prior day close. However, the volume for that strike price was only 1 contract, probably sold at the bid near the low of the day. The current bid/ask for that contract is 1.95/2.15 as of the close. So you could have sold it at the bid at the end of the day for 1.95, or up 15% for the day.

TSLA's option market is very thin with low volumes and wider spreads than many other stocks, so you really can't rely on end of day close to determine the current value of the option. Always look at the current bid/ask, preferably while the market is open to determine current value.

blakegallagher

Member

Ok thanks for the info. very helpful. New to trading and am grateful for lessons learned that don't cost me money in the form of bad investments

Luv2b2, I am new to investing and did not take time to learn about option trading yet. Even though I do not understand all the intricacies of the plot involving Larry, Moe, Shemp and Curly, the thread makes for a fascinating read, like a good mystery novel.

Given the above, and asking for your indulgence in case the following question is too naive, what would happen if a group of investors bullish on TSLA get involved in a sort of a flash mob to counteract actions of Larry and Moe, and in the process help Curly and TSLA a bit?

Given the above, and asking for your indulgence in case the following question is too naive, what would happen if a group of investors bullish on TSLA get involved in a sort of a flash mob to counteract actions of Larry and Moe, and in the process help Curly and TSLA a bit?

Given the above, and asking for your indulgence in case the following question is too naive, what would happen if a group of investors bullish on TSLA get involved in a sort of a flash mob to counteract actions of Larry and Moe, and in the process help Curly and TSLA a bit?

it's very tough to do what you said, because larry & moe are trading with each other. they don't even go through an exchange since the print gets posted off the floor. since they use options exercises to swap the shares and "steal" the market maker's short call position, even those trades don't happen on an exchange. the short deep-in-the-money call position is very valuable because a market maker can carry a long position in shares, lend out those shares to shorts earning huge carry, and use the short call as a hedge against capital losses. the 3 stooges theory i posted basically involves larry & moe colluding through the options market to steal this valuable position from the market maker.

the easiest way to thwart them is to make sure there's no open interest in the deep in the money strikes. so if you own deep in the money calls, you just keep rolling them higher to the closest strike that has some time premium in it. the key for larry & moe is they can only do this trades in the contracts that have some open interest. or if you really want to jam it to them, what you do is exercise your deep in the money calls the same day they play this game in your strikes. personally i find vengeful trading a distraction, trade for your own economics, not to punish someone.

also note the 3 stooges story doesn't explain all of the anomalies. for example, why is the trade being repeated over and over in the same options strikes? once they have harvested the open interest out of those strikes the incremental gains from repeating the transaction there get a lot smaller each time. and why is the price usually depressed short term around their executions? i also wonder if this is legal? there's no law that says you can't sell a call spread to someone. but selling a call spread when both are colluding to exercise... that i don't know.

a lot of mystery remains & i haven't figured out those pieces yet to satisfaction.

no word from the regulators.

The end of day price is based on the last price that particular option traded at during the day. In the case of the the Jun 43 calls, the last price was 1.55, and was in fact down 0.15 from the prior day close. However, the volume for that strike price was only 1 contract, probably sold at the bid near the low of the day. The current bid/ask for that contract is 1.95/2.15 as of the close. So you could have sold it at the bid at the end of the day for 1.95, or up 15% for the day.

TSLA's option market is very thin with low volumes and wider spreads than many other stocks, so you really can't rely on end of day close to determine the current value of the option. Always look at the current bid/ask, preferably while the market is open to determine current value.

I've had that exact situation and had to cope with it's answer (from being new to low volume options - I've had AAPL options for a long time- but zero liquidity bids/ask spread issues there);

PureAmps - great explanation and I'll add market-open current bid/ask spreads in thinly traded like TSLA are wide, and as such you can usually do better than a sell at bid- Normally I can get 25% into the spread from bid fairly quickly from the MM

back on current topic- I was wondering the same thing reading luvb2b alternate theory- is this legal to essentially use the MM to collude on exercise. It doesn't seem like it should be, as it produces an internally traded market against known trading positions and intent. It also seems to point to some desperation of these large shorters (they can clearly afford the risk), but it's clearly getting difficult to short- which might foretell of extreme squeeze - once again price action today must be driving them looney. Bothering me- I'm all long, but can't find an entry to add

Last edited:

smorgasbord

Active Member

I just wanted to say that this thread is my new vice. Between what I am learning, plus the sheer enjoyment of watching the money, not to mention my own trades heading more and more positive, it's more than fun!

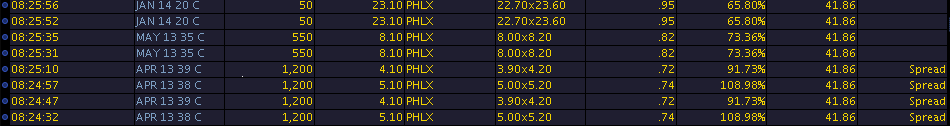

these guys are getting greedy. with the big move today, they see all the open interest in the april 38/39 strikes and maybe they are out harvesting that. check the trades on the psx:

apr 38 calls [email protected] / [email protected] 11:24et oi 1142

apr 39 calls [email protected] / [email protected] 11:24et oi 1270

so is this it then?

larry sells to moe. moe buys from larry. shemp is gonna get his short calls "stolen" away by larry and moe. i guess they think it's still worth it because they can save interest for another 5-6 days on a whole bunch of shares. expect more of these prints today imo if this is the strategy.

so if my second theory is correct, here's what shemp might be looking at today:

shemp is short say, 1000 apr 38 calls and 1000 apr 39 calls.

as a hedge, he is long 185000 shares of tesla (an average delta of 92.5% on the 2 strikes)

now tomorrow morning he'll wake up to find out that larry and moe just stole a bunch of his shares and short calls. let's just say they steal about 800 of each, picking up 160,000 shares in the process. shemp comes in tomorrow:

now he's short 200 apr 38 calls and 200 apr 39 calls.

160,000 of his shares got called away, so he has only 25,000 shares left.

assuming no change in deltas, shemp's going to find that he needs 37,000 shares to hedge the remaining 400 short calls.

so tomorrow morning, shemp's a buyer at the open. in this case 12,000 shares.

looks like larry and moe are busy in the may 35s too. this is a break from their usual pattern of mostly working on tuesday. maybe they're trying to take advantage of the pop?

or maybe i still have the wrong explanation.

apr 38 calls [email protected] / [email protected] 11:24et oi 1142

apr 39 calls [email protected] / [email protected] 11:24et oi 1270

so is this it then?

larry sells to moe. moe buys from larry. shemp is gonna get his short calls "stolen" away by larry and moe. i guess they think it's still worth it because they can save interest for another 5-6 days on a whole bunch of shares. expect more of these prints today imo if this is the strategy.

so if my second theory is correct, here's what shemp might be looking at today:

shemp is short say, 1000 apr 38 calls and 1000 apr 39 calls.

as a hedge, he is long 185000 shares of tesla (an average delta of 92.5% on the 2 strikes)

now tomorrow morning he'll wake up to find out that larry and moe just stole a bunch of his shares and short calls. let's just say they steal about 800 of each, picking up 160,000 shares in the process. shemp comes in tomorrow:

now he's short 200 apr 38 calls and 200 apr 39 calls.

160,000 of his shares got called away, so he has only 25,000 shares left.

assuming no change in deltas, shemp's going to find that he needs 37,000 shares to hedge the remaining 400 short calls.

so tomorrow morning, shemp's a buyer at the open. in this case 12,000 shares.

looks like larry and moe are busy in the may 35s too. this is a break from their usual pattern of mostly working on tuesday. maybe they're trying to take advantage of the pop?

or maybe i still have the wrong explanation.

PureAmps

Model S P85 (#2817)

luvb2b, I still haven't fully bought into any of your explanations so far. But I agree these are "interesting" trades and don't make a lot of sense by themselves. I had a little time to dig into this today, so here's some food for thought.

First a selection of today's trades that *may* be from the same trader:

So going along with the theory, these are all on PHLX exchange, are all large volume trades, and are "in the money" calls. All trades were transacted within the price spread, so it is difficult to tell if they were buy or sell.

Let's start with the bottom 4 trades, they are marked as being part of a spread transaction. So those are really 2 spread transactions at 1200 contracts each. Since we don't know the buy/sell side it is possible that somebody created a spread, and then immediately closed the position for the same price. Why would someone do this? Who knows, but it would lead to no change in open interest the following day.

But let's say they were both new spread positions being put on. Let's say they are long the 38 strike and short the 39. That would make this a debit spread at the cost of $1, with a maximum net profit of $0. So the best this guy can do is break even. So for 2400 contracts, this trader is paying $240,000 so that he can get his money back as long as TSLA is above 39 on option expiration day. Why?

Now about the same time we have some May 13 and Jan 14 Calls being bought or sold. Hard to say which. Again the simplest answer is that somebody bought 550 May 13 calls and then immediately sold them. Why? Makes no sense to me either....

So how long has this been going on:

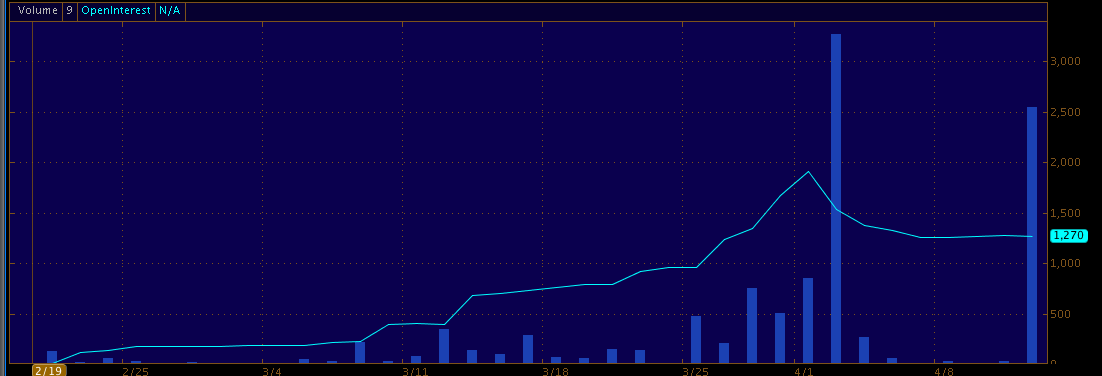

The volume and open interest chart for Apr 39 calls (bars are volume, blue line is open interest):

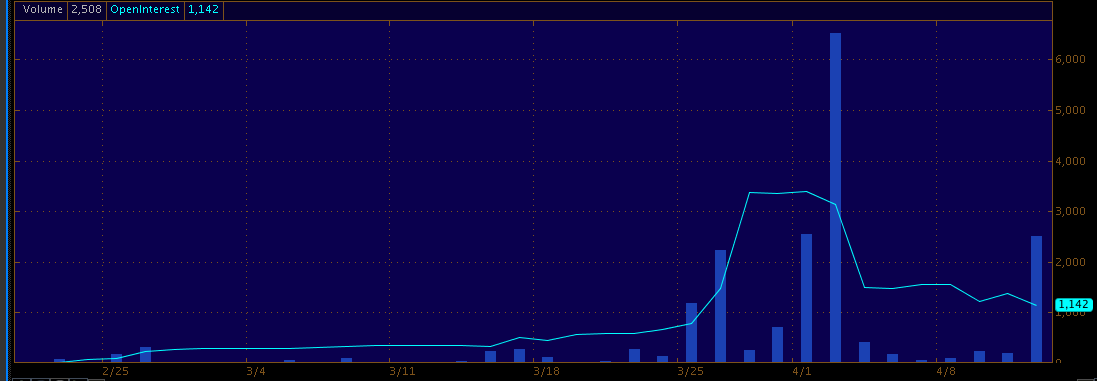

The volume and open interest chart for Apr 38 calls (bars are volume, blue line is open interest):

So in the Apr 38 and 39 call charts, we see heavy volume starting on 3/25 with corresponding increase in open interest, this continues until 4/1. After which we still have high volume, but no corresponding reduction in open interest. Open interest is reducing after 4/1, but does match the option volume.

So what is happening here? Clearly somebody started building some kind of position the week of 3/25. Then, surprise, Tesla says they are profitable on 3/31. Big gap open on 4/1, and traders long those calls start taking profits on 4/1 and 4/2. At the same time our mystery trader starts adding volume, but doesn't affect open interest.

I have my own theories as to what is going on, and it has nothing to do with shorting the stock. For various reasons, including that this trader(s) probably reads these boards, I will not share my theories publicly. It sounds like an investigation is already launched, so I'm sure if there is something illegal going on we will find out eventually....

First a selection of today's trades that *may* be from the same trader:

So going along with the theory, these are all on PHLX exchange, are all large volume trades, and are "in the money" calls. All trades were transacted within the price spread, so it is difficult to tell if they were buy or sell.

Let's start with the bottom 4 trades, they are marked as being part of a spread transaction. So those are really 2 spread transactions at 1200 contracts each. Since we don't know the buy/sell side it is possible that somebody created a spread, and then immediately closed the position for the same price. Why would someone do this? Who knows, but it would lead to no change in open interest the following day.

But let's say they were both new spread positions being put on. Let's say they are long the 38 strike and short the 39. That would make this a debit spread at the cost of $1, with a maximum net profit of $0. So the best this guy can do is break even. So for 2400 contracts, this trader is paying $240,000 so that he can get his money back as long as TSLA is above 39 on option expiration day. Why?

Now about the same time we have some May 13 and Jan 14 Calls being bought or sold. Hard to say which. Again the simplest answer is that somebody bought 550 May 13 calls and then immediately sold them. Why? Makes no sense to me either....

So how long has this been going on:

The volume and open interest chart for Apr 39 calls (bars are volume, blue line is open interest):

The volume and open interest chart for Apr 38 calls (bars are volume, blue line is open interest):

So in the Apr 38 and 39 call charts, we see heavy volume starting on 3/25 with corresponding increase in open interest, this continues until 4/1. After which we still have high volume, but no corresponding reduction in open interest. Open interest is reducing after 4/1, but does match the option volume.

So what is happening here? Clearly somebody started building some kind of position the week of 3/25. Then, surprise, Tesla says they are profitable on 3/31. Big gap open on 4/1, and traders long those calls start taking profits on 4/1 and 4/2. At the same time our mystery trader starts adding volume, but doesn't affect open interest.

I have my own theories as to what is going on, and it has nothing to do with shorting the stock. For various reasons, including that this trader(s) probably reads these boards, I will not share my theories publicly. It sounds like an investigation is already launched, so I'm sure if there is something illegal going on we will find out eventually....

luvb2b, I still haven't fully bought into any of your explanations so far.

neither have i, but as you are seeing, these are big trades representing a lot of shares. just imagine, the trades you posted represent 350,000 shares total in deep in the money calls. that's more than 10% of the day's volume!

[

could i ask what platform you used for the screen shot? my platforms don'ts how the indication of spread or not.

But let's say they were both new spread positions being put on. Let's say they are long the 38 strike and short the 39. That would make this a debit spread at the cost of $1, with a maximum net profit of $0. So the best this guy can do is break even. So for 2400 contracts, this trader is paying $240,000 so that he can get his money back as long as TSLA is above 39 on option expiration day. Why?

so assuming this isn't naked shorting (which i am doubting now because with the size being traded tesla should be on the reg sho list), the larry moe curly story i posted a couple pages back makes the most sense.

did you understand that basic story? the idea is based on the fact that the position of being long tesla shares paired with a short deep in the money call is very valuable. that's because you hedge away the price risk in tesla, or most of it anyway, but you get collect a 40-80% annualized carry on loaning out the long shares.

what's happening is larry & moe are trading the spreads with each other, and then exercising the options to steal the market maker's long stock + short call position. it's a brilliant trade, basically highway robbery stealing a valuable position out from right under the market maker's nose. i'm not sure it's legal, but it's definitely very clever.

if you'd care to pm me your theory, i'd luv to hear it.

hershey101

Active Member

^^^^ What he said. I would like to hear any reasonable story describing what is happening as well. I don't really buy any of the stories put forward on these forms yet...neither have i, but as you are seeing, these are big trades representing a lot of shares. just imagine, the trades you posted represent 350,000 shares total in deep in the money calls. that's more than 10% of the day's volume!

[

could i ask what platform you used for the screen shot? my platforms don'ts how the indication of spread or not.

so assuming this isn't naked shorting (which i am doubting now because with the size being traded tesla should be on the reg sho list), the larry moe curly story i posted a couple pages back makes the most sense.

did you understand that basic story? the idea is based on the fact that the position of being long tesla shares paired with a short deep in the money call is very valuable. that's because you hedge away the price risk in tesla, or most of it anyway, but you get collect a 40-80% annualized carry on loaning out the long shares.

what's happening is larry & moe are trading the spreads with each other, and then exercising the options to steal the market maker's long stock + short call position. it's a brilliant trade, basically highway robbery stealing a valuable position out from right under the market maker's nose. i'm not sure it's legal, but it's definitely very clever.

if you'd care to pm me your theory, i'd luv to hear it.

PureAmps

Model S P85 (#2817)

these are big trades representing a lot of shares. just imagine, the trades you posted represent 350,000 shares total in deep in the money calls. that's more than 10% of the day's volume!

Yes, they represent that many shares if exercised. But that has little relevance to today's volume. There will be some hedging performed by market makers to manage those positions, but it will be based on the net delta of the entire position. In the case of the spreads, the net delta is 0.02, or 2% of the transaction size, so 4,800 shares. No big deal. The long (or short) calls have a bigger impact, but even then you won't find the market makers delta-hedged trades on the tape, because they have marked it against their internal stock inventory, and will manage the position as part of their normal market making operations over the course of the day.

could i ask what platform you used for the screen shot? my platforms don'ts how the indication of spread or not.

That is from TD Ameritrade's thinkorswim desktop app. It is probably the best platform for option trading/analysis. But I have accounts with multiple brokerages. After Lehman Brothers, it's best not to keep all of your eggs in one basket.

so assuming this isn't naked shorting (which i am doubting now because with the size being traded tesla should be on the reg sho list), the larry moe curly story i posted a couple pages back makes the most sense.

did you understand that basic story?

I understand your three stooges theory. But I'm more of an Occam's razor kind of guy. So when I read that tape, I see three trades that were put on and then immediately reversed. Very simple explanation of the high volume with no change in open interest. The only question that remains is why?

So when I read that tape, I see three trades that were put on and then immediately reversed. Very simple explanation of the high volume with no change in open interest. The only question that remains is why?

it's not a trade on and off. there are no economics in doing that and trading like that to create phantom volume is illegal.

they are multiple spreads in the same direction. the more volume they do, the more open interest they can "steal" from the market maker when they exercise. that's because exercises get assigned on a pro-rata basis, not based on who is on the other side of the trade. work out the math and see how many more of shemp's calls they steal by doing 2400 instead of 1200 and you will see what I mean.

last night i called the guy who mentored me as i learned about options. he thought the 3 stooges story made the most sense of the guesses so far. the story is not my original idea, it came from a hedge who thought about my question for a day before coming back to me. so far its the most plausible because it has the clearest economics. and the fact that most of the share volume takes place outside of the exchanges helps explain how the share volume is staying off the tape.

DonPedro

Member

so tomorrow morning, shemp's a buyer at the open. in this case 12,000 shares.

So was this the reason for the spike this morning?

It's true, not disagreeing with you; but I'm afraid it's all one basket regardless of BrokerThat is from TD Ameritrade's thinkorswim desktop app. It is probably the best platform for option trading/analysis. But I have accounts with multiple brokerages. After Lehman Brothers, it's best not to keep all of your eggs in one basket.

- - - Updated - - -

.... and the fact that most of the share volume takes place outside of the exchanges helps explain how the share volume is staying off the tape.

under the stooges theory, (without any specific knowledge) it seems to me these are non-armslength transaction off the tape, and that would disqualify them if anyone with authority was paying attention... just sayin'; It really does skew the market- in fact 'the market' doesn't exist

So was this the reason for the spike this morning?

it seems to me any time larry & more do their trades, the shemps (market makers) are in buying shares the next morning. that's because they're not perfectly delta hedged (meaning maybe they got 9000 shares of stock for 100 short calls). when their short calls are "stolen" that leaves them unhedged and they have to go and readjust the next morning.

need to track it a bit more closely over time to get a better idea.

Similar threads

- Replies

- 5

- Views

- 5K

- Replies

- 23

- Views

- 5K

B

- Replies

- 13

- Views

- 1K

- Replies

- 8

- Views

- 3K