nomad415

Member

@MelaniainLA @cpa - I have read all of your posts. Thanks for those. Highly appreciate, if you can look at my question below and advise. Thanks

I purchased a Tesla Model X LR 2020 on 12/29/2019. I have a W2 full time job. My wife runs a real estate business, in which I help out too. We are filing ‘Married filing jointly’. I am trying to take the full business deduction for the Tesla Model X. Please advise If I am doing it right.

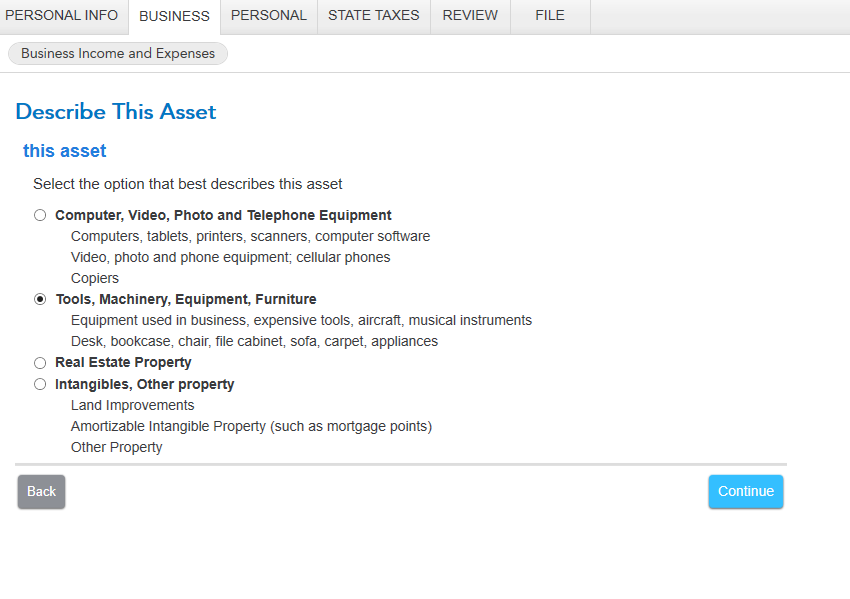

In turbotax Home and Business (desktop version not the online version), I have entered it as an asset under ‘Business Income and Expenses’. In the list of assets that is offered, there is no option to select a vehicle or a SUV. I selected ‘Tools, Machinery. Equipment, Furniture’ (see screenshot 1 below). And then ‘General purpose tools, machinery and equipment’. In there I described it as a ‘Vehicle – SUV’. I put in the full price I paid including taxes of 116K and took the full deduction using section 168K, not the section 179 that allows only 25K for SUV. Is this the right way to do it using Turbo tax ? The issue I have is Turbo tax is flagging this as high risk for audit from IRS because this Tesla Model X is going on schedule C, where that business is not having any income. The income I have is from rental properties that are showing in Schedule E – supplemental income and loss, rents and royalties . Please advise how to correct this? Agree that a CPA should be consulted, but I don’t have time for that now since the filing deadline is tomorrow Oct 15th 2020.

I purchased a Tesla Model X LR 2020 on 12/29/2019. I have a W2 full time job. My wife runs a real estate business, in which I help out too. We are filing ‘Married filing jointly’. I am trying to take the full business deduction for the Tesla Model X. Please advise If I am doing it right.

In turbotax Home and Business (desktop version not the online version), I have entered it as an asset under ‘Business Income and Expenses’. In the list of assets that is offered, there is no option to select a vehicle or a SUV. I selected ‘Tools, Machinery. Equipment, Furniture’ (see screenshot 1 below). And then ‘General purpose tools, machinery and equipment’. In there I described it as a ‘Vehicle – SUV’. I put in the full price I paid including taxes of 116K and took the full deduction using section 168K, not the section 179 that allows only 25K for SUV. Is this the right way to do it using Turbo tax ? The issue I have is Turbo tax is flagging this as high risk for audit from IRS because this Tesla Model X is going on schedule C, where that business is not having any income. The income I have is from rental properties that are showing in Schedule E – supplemental income and loss, rents and royalties . Please advise how to correct this? Agree that a CPA should be consulted, but I don’t have time for that now since the filing deadline is tomorrow Oct 15th 2020.

Last edited: