Hello,

I recently totaled my M3 LR which was being lease.

So a little confusing

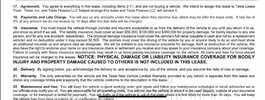

(See pictures)

19. Says they are entitled to proceeds regarding damage/destruction

29. Says “We will credit you for any excess of the insurance settlement over the adjusted lease balance.”

My cars value at time of lease was 48600 plus tax

50900

Used cars are selling between 55-60k

50900-13 lease payments (550)

43750- balance of car?

Will I receive the excess if the lease payoff? This is real important because the price has gone up $9000 plus $2000 NY tax credit that is no longer given.

Before running these numbers I honestly didn’t think I would be able to afford another Tesla. The only way i can get another is if the official answer is that I am entitled to the excess payout, even if I lease from Tesla.

I recently totaled my M3 LR which was being lease.

So a little confusing

(See pictures)

19. Says they are entitled to proceeds regarding damage/destruction

29. Says “We will credit you for any excess of the insurance settlement over the adjusted lease balance.”

My cars value at time of lease was 48600 plus tax

50900

Used cars are selling between 55-60k

50900-13 lease payments (550)

43750- balance of car?

Will I receive the excess if the lease payoff? This is real important because the price has gone up $9000 plus $2000 NY tax credit that is no longer given.

Before running these numbers I honestly didn’t think I would be able to afford another Tesla. The only way i can get another is if the official answer is that I am entitled to the excess payout, even if I lease from Tesla.