Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

trading

- Thread starter Boomer19

- Start date

@bdy0627 @Tenable and anyone else

i guess we should give it another shot - and see if we can keep it going and control it a bit better this time

@tivoboy

im not looking to moderate or direct the conversation...i kinda just want to let it fly, but the thing that caught my eye this week, along with everything else is posted below

i guess we should give it another shot - and see if we can keep it going and control it a bit better this time

@tivoboy

im not looking to moderate or direct the conversation...i kinda just want to let it fly, but the thing that caught my eye this week, along with everything else is posted below

Last edited:

the recent thing that's been interesting this week is that monday night into tuesday there were many calls to locate tesla stock to borrow. i wrote about this uptick in demand and that tsla cost to borrow went up slightly in turn.

meanwhile tuesday us when NYT had article about Tels undercutting the industry ~ 38% for solar in future, solar installers got ripped and tsla went nowhere.

ihor ( the short interest guy in twitter) confirmed today that theres still plenty of tsla stock to borrow, but rates are starting to creep up slightly as the 'free excess' position on the street is being chipped away at, and short interest is rising

theyre seemingly piling up on tsla shares to borrow so they can suppress any rally after the latest earnings. tivoboy, who, in my experience, has some pretty good insights on technical patterns, may be better positioned to explain more about this. he sees weakness, even after cap raise today, and a support level all the way down to 215ish and the next at 185

i guess my question is, why such a large gap this time? and at this point, has tesla lost all power to the street - their announcements are now akin to throwing pebbles at a rhino...any uptick in TSLA price is quickly beaten down no matter what they say

ive been adding more shares sub 260 in traunches, and have picked up a few long nov 315c on the way.

ive been cautious with approach and have left plenty of ammo for further downturn

i wrote some jan20 and jan21 puts that are covered and are in green

meanwhile tuesday us when NYT had article about Tels undercutting the industry ~ 38% for solar in future, solar installers got ripped and tsla went nowhere.

ihor ( the short interest guy in twitter) confirmed today that theres still plenty of tsla stock to borrow, but rates are starting to creep up slightly as the 'free excess' position on the street is being chipped away at, and short interest is rising

theyre seemingly piling up on tsla shares to borrow so they can suppress any rally after the latest earnings. tivoboy, who, in my experience, has some pretty good insights on technical patterns, may be better positioned to explain more about this. he sees weakness, even after cap raise today, and a support level all the way down to 215ish and the next at 185

i guess my question is, why such a large gap this time? and at this point, has tesla lost all power to the street - their announcements are now akin to throwing pebbles at a rhino...any uptick in TSLA price is quickly beaten down no matter what they say

ive been adding more shares sub 260 in traunches, and have picked up a few long nov 315c on the way.

ive been cautious with approach and have left plenty of ammo for further downturn

i wrote some jan20 and jan21 puts that are covered and are in green

Last edited:

Well, we've been testing here for a little while. We've breached the recent low ~$245, so that one is gone. Now it's a question of if we try and test other levels lower.. and the ~$185 is really the only nearby target. We're IN A pocket at the moment, being help up by uncertainty, someone trying to sustain these levels, uncertainty - BOTH WAYS. Certainly, if there is buying buying buying and people chase the pricing we'd get higher but I think it would have to be significantly above recent levels, no $275, $285, $293 is going to provide enough upward momentum to hold us above these levels.

Granted, short of some really unforeseen significant news. Something like BIG money coming in and announced, like 5B from softbank or 3B from UAE (or similar) or some significant change to USA EV credits, something in that realm.

Without more BAD news, I don't see $185 as realistic or reasonable. But I DO still think that NO news and short positions can move us closer to low 200's and as I've said before, I'd be accumulating as we go lower.

the vacuum really never gets "negated", only that the farther we get away and stay away from it, it's gravity is lessened.

thank you for not skewering me.. I'm sure others will, and yet somehow I still come back. ;-)

As for todays announcement, I/some of us saw this coming. Frankly, I think the reason it didn't have MORE of a positive impact on share price is that it really should have BEEN MORE.. I would have been happier as a shareholder (not currently) if they just said lets just take in 3.5-4B and really try and be done with that for the next 18-24 months of production growth, new models, new GF, etc.

I think that if they had done THAT, we'd probably be even higher.

thanks - transporting to trading thread in case we gain some traction here and get some discussion going.

very good

Advertising the new shares available at $243 opens up a world of possibilities for manipulation. The shorts, of course, would love to pull the stock price back into the 230s and make this stock offering unattractive. What is to prevent them from doing so?

I suspect expectations of a successful cap raise and an apparent bottoming out on this latest descent will both bring some upward pressure on the stock price, but how do you really judge the money and the effort that the shorts might put forward during the next week? Hopefully some friends of Tesla are standing by and ready to do some buying if the manipulations get too great.

The best solution would be to see a few days of nice climbing, because when volumes are high and the stock price is rising, the shorts tend to lack the horsepower to reverse.

I like the volume: an active trading day seems to be in the cards considering <20 minutes to pass 33% of average daily volume and clearing 43% in <30 minutes. With all of the activity I can't help but wonder if there is some short covering going on mixed with profit taking on the >$10 differential for those who bought near the bottom. Might be interesting to ask @ihors3 at end of day what short activity he saw.

papa fox implied that we need a high volume day to combat overselling. which could exhaust their ammo and cause a bit of a bounce up. especially after the ride in SI over the past week, and the black candle days comparison of last week and oct and subsequent bounce up.

it’s trying to play that way at the moment.

let’s see. paws crossed

@humbaba

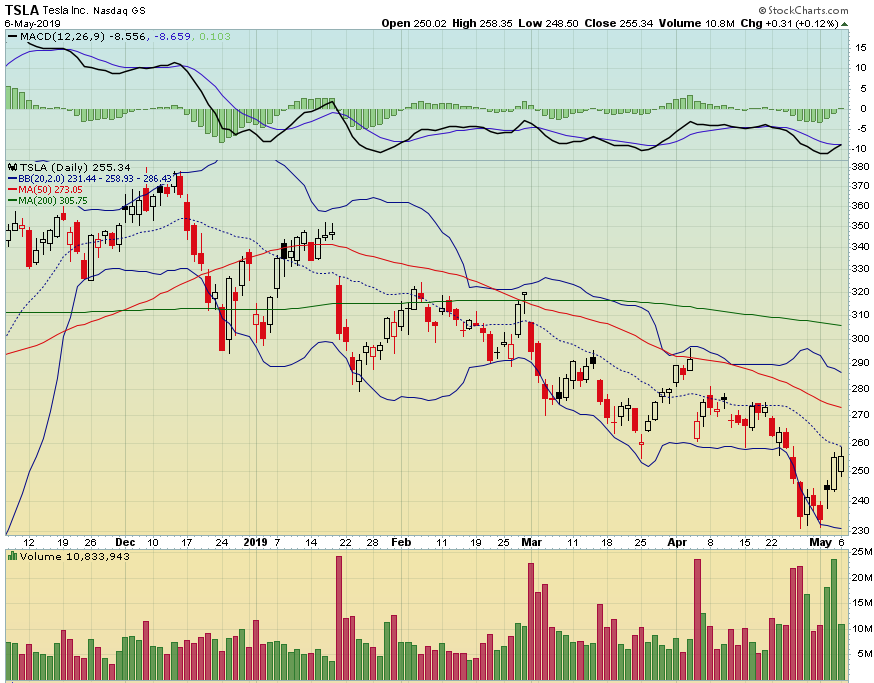

I have posted a tech chart that shows both the October bottom and the April/May bottom. The three days after the initial bottom are very similar in both cases and yielded a second bottom. Notice in the October bottom that the breakout was accompanied by high volume. Notice the black candle day (an up day with a close lower than open) that occured immediately after the second dip. In both cases I attribute the black candle to short efforts to artificially push the SP down after it opened quite a bit higher. Today we saw both a price increase and high volume, which hints that a breakout might be possible here. For this reason I picked up a few more DITM leaps today.

@humbaba

bdy0627

Active Member

Here's an update from my spreadsheet tracking dips and climbs. This last dip from $296 to $231 was a 22% drop. That's a pretty sizable drop by itself, but even more impressive is the drop from the prior ATH of $389 back in Sep 2017. This dip brought us down just over 40% from that ATH. The only drop from an ATH since 2014 that has been bigger was in Feb 2016 when we dropped 51% from the prior ATH. The stocked climbed 69% after that dip, but the dip itself was much bigger at 42% from the prior local high. I don't think we can expect that kind of climb, at least not in one shot. Since January 2018, we've had the following dips of over 20%:

4/2/18

-32.2% (-37.3% down from prior ATH)

stock climbed 26.6% from there

8/20/18

-25.6% (-26% down from prior ATH)

stock climbed 13.5% from there

9/7/18

-22.9% (-35.2% down from prior ATH)

stock climbed 25% from there

10/10/18

-21.8% (-36.5% down from prior ATH)

stock climbed 14.2%

12/26/18

-22% (-24.4% down from prior ATH)

stock climbed 15.3%

1/24/19

-20.7% (-28.3% down from prior ATH)

stock climbed 16.1%

4/26/19

-22% (-40.6% down from prior ATH)

How high will we climb from here? All the way back up to the top of the range?

Macros are becoming more uncertain with China, which will certainly be a factor. The 50 moving average on the daily chart ($273) has been resistance. I would expect resistance again there. That's an 18% climb, which is roughly what I think is likely here. If it gets through the 50 MA then the upper BB will likely be the next point of resistance at $286. That would be a climb of 24%. I wouldn't expect more than that before a pullback. We might hit some turbulence here with the China trade conflict, but I will personally be surprised if our current high of $258 is all we see out of this climb before a significant pullback. Notice below on the chart that several climbs were resisted at the mid BB, but buying volume was pretty weak on those climbs. Green candle volumes are much better this time.

4/2/18

-32.2% (-37.3% down from prior ATH)

stock climbed 26.6% from there

8/20/18

-25.6% (-26% down from prior ATH)

stock climbed 13.5% from there

9/7/18

-22.9% (-35.2% down from prior ATH)

stock climbed 25% from there

10/10/18

-21.8% (-36.5% down from prior ATH)

stock climbed 14.2%

12/26/18

-22% (-24.4% down from prior ATH)

stock climbed 15.3%

1/24/19

-20.7% (-28.3% down from prior ATH)

stock climbed 16.1%

4/26/19

-22% (-40.6% down from prior ATH)

How high will we climb from here? All the way back up to the top of the range?

Macros are becoming more uncertain with China, which will certainly be a factor. The 50 moving average on the daily chart ($273) has been resistance. I would expect resistance again there. That's an 18% climb, which is roughly what I think is likely here. If it gets through the 50 MA then the upper BB will likely be the next point of resistance at $286. That would be a climb of 24%. I wouldn't expect more than that before a pullback. We might hit some turbulence here with the China trade conflict, but I will personally be surprised if our current high of $258 is all we see out of this climb before a significant pullback. Notice below on the chart that several climbs were resisted at the mid BB, but buying volume was pretty weak on those climbs. Green candle volumes are much better this time.

Here's an update from my spreadsheet tracking dips and climbs. This last dip from $296 to $231 was a 22% drop. That's a pretty sizable drop by itself, but even more impressive is the drop from the prior ATH of $389 back in Sep 2017. This dip brought us down just over 40% from that ATH. The only drop from an ATH since 2014 that has been bigger was in Feb 2016 when we dropped 51% from the prior ATH. The stocked climbed 69% after that dip, but the dip itself was much bigger at 42% from the prior local high. I don't think we can expect that kind of climb, at least not in one shot. Since January 2018, we've had the following dips of over 20%:

4/2/18

-32.2% (-37.3% down from prior ATH)

stock climbed 26.6% from there

8/20/18

-25.6% (-26% down from prior ATH)

stock climbed 13.5% from there

9/7/18

-22.9% (-35.2% down from prior ATH)

stock climbed 25% from there

10/10/18

-21.8% (-36.5% down from prior ATH)

stock climbed 14.2%

12/26/18

-22% (-24.4% down from prior ATH)

stock climbed 15.3%

1/24/19

-20.7% (-28.3% down from prior ATH)

stock climbed 16.1%

4/26/19

-22% (-40.6% down from prior ATH)

How high will we climb from here? All the way back up to the top of the range?

Macros are becoming more uncertain with China, which will certainly be a factor. The 50 moving average on the daily chart ($273) has been resistance. I would expect resistance again there. That's an 18% climb, which is roughly what I think is likely here. If it gets through the 50 MA then the upper BB will likely be the next point of resistance at $286. That would be a climb of 24%. I wouldn't expect more than that before a pullback. We might hit some turbulence here with the China trade conflict, but I will personally be surprised if our current high of $258 is all we see out of this climb before a significant pullback. Notice below on the chart that several climbs were resisted at the mid BB, but buying volume was pretty weak on those climbs. Green candle volumes are much better this time.

View attachment 404907

thanks!

yeah i don’t see us raging higher from here, yet. forgetting china and tariff talk, i’d cap it around 285-300, which id take, just to capture gains on the nov 315c (as long as it’s in the next 60 days or so)

now with the tariff talk, we may not see 265-270. it’d be interesting to compare open interest on the next 6 months prior to eq raise, and post eq raise (the final numbers are out - https://ir.tesla.com/node/19861/html,

and then after the tariff outcome this friday, to see if any real deviation. i’m doubtful it’s much different than any other 6 month window sample, considering the bonds are 2024. but just thinking/typing out loud.

i did sell a handful of puts, like i said earlier, but i haven’t written any covered calls yet, just in case. this is the one thing that could provide recurring income that i should probably do. i just don’t want to part with the stock if it takes off past the strike i write.

thoughts on that, or other strategies?

and papafox has been commenting to his hesitation to deploy funds this week due to china talks as well,

i kinda started this thread because i didnt want to clog up his thread, but the genesis of this is pretty much me trying to scan who is talking about the daily movements, like bdy, papa, tivoboy, and all others i see here and there, and carry that to here. if they, or anyone want to chime in that would be great

i kinda started this thread because i didnt want to clog up his thread, but the genesis of this is pretty much me trying to scan who is talking about the daily movements, like bdy, papa, tivoboy, and all others i see here and there, and carry that to here. if they, or anyone want to chime in that would be great

bdy0627

Active Member

Totally agree that this thread is much needed. It's crazy to try to weed through many pages of general Tesla posts just to find 1 or 2 related to daily trading thoughts. We will need more than just the 2 of us to post here if we are to keep this thread active. Let's see how it goes. I may try to cross post to the general thread for responses if we don't get any here.and papafox has been commenting to his hesitation to deploy funds this week due to china talks as well,

i kinda started this thread because i didnt want to clog up his thread, but the genesis of this is pretty much me trying to scan who is talking about the daily movements, like bdy, papa, tivoboy, and all others i see here and there, and carry that to here. if they, or anyone want to chime in that would be great

bdy0627

Active Member

I think with how TSLA has been trading, it is smart to take profits after modest climbs and not hold out so much for larger climbs. At least, that's what I'm planning to do. I generally have bought LEAPs or monthlies out several months and just held those until we got a solid climb, but we haven't been getting the climbs that we used to, so I've still got many of those from when we were around $280 and $300. Those were OTM and are way way down. I'm planning to sell on more modest climbs but keep a small number of nearer dated calls in case of further climb. That way I have less risked but won't be out of the game if there is a larger climb. My calls are down way too far with Tesla at the bottom of range to switch over to selling puts right now. That's a nice lower risk strategy but it wouldn't even come close to capturing what the calls have lost on this long slow drop since December.thanks!

yeah i don’t see us raging higher from here, yet. forgetting china and tariff talk, i’d cap it around 285-300, which id take, just to capture gains on the nov 315c (as long as it’s in the next 60 days or so)

now with the tariff talk, we may not see 265-270. it’d be interesting to compare open interest on the next 6 months prior to eq raise, and post eq raise (the final numbers are out - https://ir.tesla.com/node/19861/html,

and then after the tariff outcome this friday, to see if any real deviation. i’m doubtful it’s much different than any other 6 month window sample, considering the bonds are 2024. but just thinking/typing out loud.

i did sell a handful of puts, like i said earlier, but i haven’t written any covered calls yet, just in case. this is the one thing that could provide recurring income that i should probably do. i just don’t want to part with the stock if it takes off past the strike i write.

thoughts on that, or other strategies?

Another decent approach would be to buy a few weekly puts after a rapid climb of 8-12% since we usually seem to pullback quite dramatically. I have generally not done well with puts, but that would have been a great strategy over the last 6 months.

well i guess it’s a gamble at this point to bet either way on what happens tomorrow regarding any trade talks. i don’t have a decent handle on what the market thinks the impact is to tesla if talks go south, or how much it’s already priced in...

but i guess it’s not a stretch to consider testing that 228 we kinda held up at last time...but below that people have mentioned allthe way down to 180s. i still find that a little much, and i’d most likely be a huge buyer at that point, depending on the data accompanying a fall like that.

the upside to me remains the same as i previously suggested, and bdy was in same ballpark.

but i guess it’s not a stretch to consider testing that 228 we kinda held up at last time...but below that people have mentioned allthe way down to 180s. i still find that a little much, and i’d most likely be a huge buyer at that point, depending on the data accompanying a fall like that.

the upside to me remains the same as i previously suggested, and bdy was in same ballpark.

bdy0627

Active Member

I do think if price is accepted below $230 there is likely rapid capitulation down to $200ish area. I personally think there would be plenty of support around $200 to not be too concerned about much further drop. The upside from there is so massive and the downside so minimal that I think big buyers would step in. It looks like QQQ wants to fill the gap from March 29. That's not too far below anymore. It's at the 50 MA already, so let's see what kind of support that provides.

well this is bad. what probability is this tariff stuff going to stick, versus get some sort of resolution that the market kind of takes a step back and catches its breath. it feels like the market is over-amplifying the issue, or trading based upon the worst-worst case scenario. but i dunno

bdy0627

Active Member

No idea on the tariffs, but this is quite a reaction. Fear is starting to increase, though I don't sense people are really scared of the market yet. QQQs filled the 3/29 gap, dropping below the 50 MA. It's around $180 now. There is a confluence at the 100 and 200 MA around $172. I would expect that to provide a LOT of support if we continue down. For Tesla, I think the 2x range level around $208 will provide support if we continue down. I will be buying with everything I've got left if we get down below $210.

No idea on the tariffs, but this is quite a reaction. Fear is starting to increase, though I don't sense people are really scared of the market yet. QQQs filled the 3/29 gap, dropping below the 50 MA. It's around $180 now. There is a confluence at the 100 and 200 MA around $172. I would expect that to provide a LOT of support if we continue down. For Tesla, I think the 2x range level around $208 will provide support if we continue down. I will be buying with everything I've got left if we get down below $210.

Tesla, TSLA & the Investment World: the 2019 Investors' Roundtable

tivo talking price points in the same area

Similar threads

- Locked

- Marketplace listing

- Replies

- 2

- Views

- 246

- Locked

- Marketplace listing

- Replies

- 5

- Views

- 382

- Marketplace listing

- Replies

- 0

- Views

- 293

- Locked

- Marketplace listing

- Replies

- 5

- Views

- 456

- Locked

- Marketplace listing

- Replies

- 1

- Views

- 221