My rule of thumb is that TSLA is 2X the move of Nasdaq. Nasdaq is up 1% so the 2% up of TSLA is normal.What is stimulating this rise in price?

Now they are just teasing us! 299.99 daily high? lol

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

rocketlow49

Member

My rule of thumb is that TSLA is 2X the move of Nasdaq. Nasdaq is up 1% so the 2% up of TSLA is normal.

And your assumption would work if it were in moving in the opposite direction as well?

jelloslug

Active Member

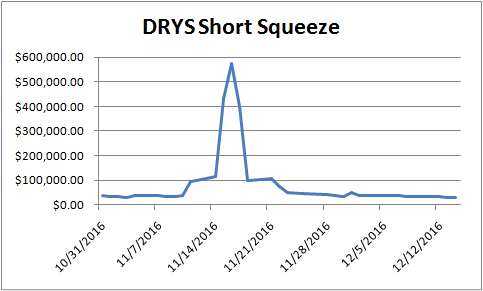

A bunch of shorts buying stock all at once to cover their short position when the stock price starts to shoot up. The resulting excess buying to cover causes the price to go up even more.What is a short squeeze? Please excuse my ignorance. I am assuming "Covering" means taking profit on short?

Yes. I only consider it a good day for TSLA if it is more than 2x up than Nasdaq, or a bad day if it is down more than 2x of Nasdaq. Otherwise it is a case of ‘a rising tide lifts all boats’.And your assumption would work if it were in moving in the opposite direction as well?

Esme Es Mejor

Member

What is a short squeeze?

It’s what Mark Spiegel’s investors are going to do to him when they find out how much cash he’s burned shorting TSLA.

Barron's - 12 minutes ago: Tesla: Short Interest Spikes Ahead of Earnings, but Musk May Laugh Last

An email he sent to company employees said that Tesla is now aiming to make 6,000 cars per month by the end of June, according to news site Electrek. The company did not respond to an inquiry about the email. If Musk seems confident about that 6,000 number on the earnings call, expect the shorts to start sweating -- and the stock to spike.

Confident about the 6k target that is only there to ensure the 5k goal is hit?

I added a snipe. But from his comments, I think the author has more ways to avoid thinking than you/we have time to help him.engaging a lot with the author. he just wrote about how the LA Times $5 billion government money gibberish piece was just a colleague informing the public about "huge" subsidies Tesla was receiving (he brought it up himself). he's been doing a lot of spin on several subthreads, need to go for a walk. some company in the comment section would be appreciated : )

registering to comment is free,

No fooling: Time for Elon Musk to explain why bankruptcy's not in the cards for Tesla

Richgoogol

Member

Tesla's Autopilot Chief Has Left the Company

WTF is this bullshit..by looking at the title alone I immediately assumed that Karpathy has left as well..FUD to the highest level sponsored by Yahoo & Car and Driver

WTF is this bullshit..by looking at the title alone I immediately assumed that Karpathy has left as well..FUD to the highest level sponsored by Yahoo & Car and Driver

Tslynk67

Well-Known Member

What is a short squeeze? Please excuse my ignorance. I am assuming "Covering" means taking profit on short?

Tesla's Autopilot Chief Has Left the Company

WTF is this bullshit..by looking at the title alone I immediately assumed that Karpathy has left as well..FUD to the highest level sponsored by Yahoo & Car and Driver

Good googaly moogaly!!! That article is attributed as report from Car and Driver which is an attributed repost from Popular Mechanics which is an attributed rehash of Electrek. No wonder it's so stale.

Elon's leaked email makes clear that there were 3 weeks in a row with Model 3 production over 2000/week, increasing from 2020 to 2250.

The first two weeks were also verified by other sources:First, congratulations are in order! We have now completed our third full week of producing over 2000 Model 3 vehicles. The first week was 2020, the second was 2070 and we just completed 2250 last week, along with 2000 Model S/X vehicles. Tesla Model 3 production aims for 6,000 units per week in June after upgrade in May – ~5,000 with margin of error, says Elon Musk

We also had a record number of VINs reported for yesterday (48 and probably still climbing versus previous high of 43). An early but positive sign that production is on its way to continuing to improve toward the 3-4K/week goal for this month.Q1 delivery letter (2020) was Tuesday 4/3 (6 am PT) with data through Monday 4/2

CBS interview (2071) was reportedly Tuesday 4/10 with data presumably through Monday 4/9

Leaked email (2250) was Tuesday 4/17 with data through Monday 4/16

Leaving questions about accuracy aside, insideEVs delivery numbers are irrelevant to production and are almost always on the low side the first month of the quarter as Tesla prioritizes deliveries far away from the factory.

In transit was over 2k at the end of Q1. InsideEV’s estimate would mean only part of April’s first week of production was delivered and no subsequent production was. Does not seem possible.

I am pretty sure they are delivering M3s to Canada (it would be malpractice not to, given the federal income tax issue).

I’m pretty sure either you or I do not understand the meaning of the word malpractice.

CuriousSunbird

Member

Crazy works just as well. Tesla should maximize their optionality as regards the income tax credit. Shipping M3s to Canada does that.In transit was over 2k at the end of Q1. InsideEV’s estimate would mean only part of April’s first week of production was delivered and no subsequent production was. Does not seem possible.

I’m pretty sure either you or I do not understand the meaning of the word malpractice.

Jayjs20

Member

Man if only we knew ahead of time. Makes bitcoin look like chump change

Reciprocity

Active Member

What if.. I know this is a bit conspiratorial. But what if Elon was finally fed up with shorts defiling his companies name. What if Elon has been sand bagging it a bit over the last quarter. Remember, this stock was getting close to old highs in Jan. They are certainly behind on the original production goals, but what if Elon has been slow playing the news to catch the Shorts in a bear trap? What if the "place your bets" tweet was the last warning to shorts before he lays down the hammer. This hammer could come tomorrow night or in June? at the annual meeting, given that they want to burst to 6k and 5k constant rate by the end of June. I wouldnt put it past him to slow play the news leading up to a crescendo of destruction for shorts. As they scream for BK and and lie at will with a constant flow of trash, Elon is just biding his time to lay the smack down. Even calling for cash flow positive for Q3 and Q4 is giving fair warning to shorts. If that is true, they will be crushed. Its something that according to them should be impossible. They only incinerate cash, they dont ever have more cash come into the business then is going out. Bankruptcy doesn't happen because your company loses money, it happens because you run out of cash. So cash flow positive will crush the narrative. Is this enough for a short squeeze? Maybe not, but what if 5k/w + no cap raise needed to get to 10k/w and cash flow positive and a deal struck for china plant where Panasonic is putting in 2B? Maybe some big customer is buying 10,000 model 3s at full retail.

MattEnth

Bear and short

Tesla still had 3 billion in cash at the end of 2017, what Bloomburger's counter header is based off is capital expenditures. Tose are largely one time costs, and have ZERO bearing on future spending. (falsehood 3).

I think the flaw in your logic is that Tesla has told us they expect CapEx in 2018 to be the same (or higher) as 2017. The machinery and equipment that Tesla is buying are ordered months in advance. When they want to build a new store, those contracts are made before construction begins. So while you're right that previous CapEx has no bearing on future CapEx, Tesla has given that guidance already.

From their Q4 2017 letter:

Additionally, some capex payments for Model 3 have been deferred to Q1

Capital expenditures in 2018 are projected to be slightly more than 2017. The majority of the spending will be to support increases in production capacity at Gigafactory 1 and Fremont, and for building stores, service centers, and Superchargers.

That's more than 3.5B in capital expenditures given as a forecast for 2018.

When asked on the conference call, Tesla's CFO was asked how much of that CapEx had to do with the Model 3:

I would say, overall more than 50%. Way more than 50% is Model 3, and the rest is all the many other things we talked about, whether it's energy storage, whether it's -

This is why the Model 3 gross margin is going to come under heavy scrutiny.

Just from that guidance alone, we can conclude that Tesla was planning to spend more than 1.7 billion on ramping the Model 3 in 2018. That's half their entire cash position.

Last edited:

What if.. I know this is a bit conspiratorial. But what if Elon was finally fed up with shorts defiling his companies name. What if Elon has been sand bagging it a bit over the last quarter. Remember, this stock was getting close to old highs in Jan. They are certainly behind on the original production goals, but what if Elon has been slow playing the news to catch the Shorts in a bear trap? What if the "place your bets" tweet was the last warning to shorts before he lays down the hammer. This hammer could come tomorrow night or in June? at the annual meeting, given that they want to burst to 6k and 5k constant rate by the end of June. I wouldnt put it past him to slow play the news leading up to a crescendo of destruction for shorts. As they scream for BK and and lie at will with a constant flow of trash, Elon is just biding his time to lay the smack down. Even calling for cash flow positive for Q3 and Q4 is giving fair warning to shorts. If that is true, they will be crushed. Its something that according to them should be impossible. They only incinerate cash, they dont ever have more cash come into the business then is going out. Bankruptcy doesn't happen because your company loses money, it happens because you run out of cash. So cash flow positive will crush the narrative. Is this enough for a short squeeze? Maybe not, but what if 5k/w + no cap raise needed to get to 10k/w and cash flow positive and a deal struck for china plant where Panasonic is putting in 2B? Maybe some big customer is buying 10,000 model 3s at full retail.

Far be it for me to be the voice of reason

Nah, next quarter...

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K