Become a bankI wish I could call up the federal reserve and get a loan

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

@electracityYou must be exhausted. Do you have anything meaningful to say about Tesla? Cartoon Tesla is boring, whether from the many naively positive comments here or the absurdly negative comments on Seeking Alpha.

I posted links to documents filed by Tesla that supported my position. What you got? Anything other than High School level posturing?

please remind me of your "handle" on Seeking Alpha. I could swear we have conversed there prior to me going on moderation about 1.3 years ago.

As for your contention that Tesla does not make gigawatt hours of batteries, well, what are the millions of kilowatt hours of batteries being produced somewhere and installed in Tesla 3, S and X.

Myself, I'm Long TSLA. care to disclose?

I'm about to turn up the "Squelch" as the S/N ratio is getting bad

Last edited:

@ZachShahan Not only crushing, but looking at megawatt hours of batteries used in just first 6 months it's 70% of all Li batteries in US for EV/PHEV's,Thanks

These are more and more fun to create.

Seriously — how many days until mass media outlets start noticing and acknowledging that Model 3 sales CRUSH sales of all the other vehicles in its class? (I'd love to hear people's thoughts on that here, since it's a weird wildcard but could really shift the public atmosphere around the company.)

and wait two days till 8/1 for larger numbers.........and %'s

Krugerrand

Meow

This appears to be getting uglier: Stuart D. Meissner on Twitter

Wonder if their strategy is to just get a quick settlement from Tesla to shut them up? Something to be mindful of this week, anyway.

Despicable behavior by the whole lot reforcing my often lack of faith in mankind.

bdy0627

Active Member

I think based upon sheer numbers of model 3s, this media sentiment shift is likely to happen over the next 3 months probably, 6 months definitely.Thanks

These are more and more fun to create.

Also fun to see Tesla pass up automakers like Porsche and Jaguar in terms of overall production.

Tesla Production Now Approximately Twice As High As Jaguar Production | CleanTechnica

Tesla On Track To Pass Porsche In Annual Vehicle Sales In 2018 | CleanTechnica

Curious for Tesla's official numbers on July. Will likely be doing updates of these pieces in a week or so. But I'm hopeful that my July estimates are solid.

From the bottom of the article you linked, these were some big takeaway thoughts for me that I think are particularly relevant to this sub:

Looking at these numbers and charts made me think, “This is why the shorts are freaking out.” For one, once these comparisons start getting out into the mainstream media, the whole narrative around Tesla could shift. The media could transition back to glowing pieces about the wonders of Tesla and the genius of Elon Musk (instead of the tabloid-like nonsense and misleading financial hit pieces we’ve been seeing). In any case, it’s going to get clear very soon that there’s a disruptor in town. What happens if this disruption gets out of control? What happens when the media catches on? What happens when the public catches on? What happens when more players in the financial markets catch on? The shorts will lose a lot of money, and Big Oil and Big Auto will be in for a rocky ride.Seriously — how many days until mass media outlets start noticing and acknowledging that Model 3 sales CRUSH sales of all the other vehicles in its class? (I'd love to hear people's thoughts on that here, since it's a weird wildcard but could really shift the public atmosphere around the company.)

Twitter user Nafnlaus seems to have pretty good responses on this twitter discussion. We could help by giving it some love.

Actually, no he doesn't. He is missing the point and lacking evidence for the things, that he is implying Martin Tripp may have done. Indication is not evidence. Of course it's ok for him to be posting this stuff on twitter. He can ask and insinuate whatever he wants, since he probably has no stake in any of the cases, is not a journalist or is officially involved in any other way. He's just a random guy on Twitter.

Mr. Lambert on the other hand should know better, than to write about sabotage, stealing of data and calling Martin Tripp a saboteur. It's correct to point out, that there is something important missing: A word like 'allegedly' or 'according to Tesla' or something like that. Media persons should aim for higher standards than random twitter guys.

That said, i'm also a bit puzzled by the stuff that Stuart Meissner posts and appearance on twitter. If it's not part of a strategy to gain media attention and push Tesla to agree to a settlement, it's pretty poor. I would also want to apply higher standards to an attorney, if it was mine.

Tesla Model 3 Sales vs Small & Midsize Luxury Car Sales (USA) — Tesla Now Crushing The Competition? | CleanTechnica

Thanks

These are more and more fun to create.

Also fun to see Tesla pass up automakers like Porsche and Jaguar in terms of overall production.

Tesla Production Now Approximately Twice As High As Jaguar Production | CleanTechnica

Tesla On Track To Pass Porsche In Annual Vehicle Sales In 2018 | CleanTechnica

Curious for Tesla's official numbers on July. Will likely be doing updates of these pieces in a week or so. But I'm hopeful that my July estimates are solid.

From the bottom of the article you linked, these were some big takeaway thoughts for me that I think are particularly relevant to this sub:

Looking at these numbers and charts made me think, “This is why the shorts are freaking out.” For one, once these comparisons start getting out into the mainstream media, the whole narrative around Tesla could shift. The media could transition back to glowing pieces about the wonders of Tesla and the genius of Elon Musk (instead of the tabloid-like nonsense and misleading financial hit pieces we’ve been seeing). In any case, it’s going to get clear very soon that there’s a disruptor in town. What happens if this disruption gets out of control? What happens when the media catches on? What happens when the public catches on? What happens when more players in the financial markets catch on? The shorts will lose a lot of money, and Big Oil and Big Auto will be in for a rocky ride.Seriously — how many days until mass media outlets start noticing and acknowledging that Model 3 sales CRUSH sales of all the other vehicles in its class? (I'd love to hear people's thoughts on that here, since it's a weird wildcard but could really shift the public atmosphere around the company.)

Very nice articles and graphs, thank you for fighting against the main-stream media crazyness!

However, you broke the journalist rule!

Your headline is a question, but the answer this time is yes...

bdy0627

Active Member

I agree that this is likely to add to the FUDfest this week. Who knows what he's got, but this attorney is certainly using extremely sensationalist wording: "golden nuggets," "shocking things," "false report," "defaming of Mr. Tripp," "elonmusk will be sued." This tells me he is very clearly trying to create a strong effect merely by his choice of words. When that's the case, it's pretty tough for the facts to live up to such wording. Facts speak for themselves. When they are somewhat ambiguous is when it requires this kind of an approach. This attorney has been very active on twitter over the last couple of weeks trying to sway public opinion against Elon and Tesla. However, he is obviously implying that what he is going to release will be unpleasant for Elon, and possibly the stock by extension.This appears to be getting uglier: Stuart D. Meissner on Twitter

Wonder if their strategy is to just get a quick settlement from Tesla to shut them up? Something to be mindful of this week, anyway.

The fact that he will be releasing just selected portions of police reports suggests to me that he needs to limit the overall picture of the reports to create the impression he wants to achieve. Otherwise, just release the entire report and let the public evaluate it for themselves. Again, facts speak for themselves and need no such sensationalist announcement. Obviously, he wants to be able to control the narrative and the interpretation of the facts. This suggests to me the probable "he said, she said" nature of the situation.

However, this is something to think about for those inclined to do any trading this week, particularly since the media is in a very negative Tesla cycle right now. They will gobble this up and spit it out with their additional spin and sensationalist language. They are salivating over any little "golden nuggets" they can find against Elon and Tesla.

dhrivnak

Active Member

I fully agree as several months of 20,000+ Model 3 sales will go a huge way to strengthen the longs.I think based upon sheer numbers of model 3s, this media sentiment shift is likely to happen over the next 3 months probably, 6 months definitely.

tftf

Member

Tell me about it. Same arguments for the last 10+ years, only slight difference is now instead of "no one wants EV's" we see more of the "look out for the competition". If a bear ever comes up with an original argument I'll be shocked.

How about, just for once, not put words in my mouth or twist what I wrote a long time ago?

I never said there’s no demand for EVs.

I wrote/predicted that there will be a long evolutionary journey over 1-2 decades due to slow replacement cycles and batteries only becoming cost-competitive with ICE in many segments between 2020-2025.

Tesla even in a best-case scenario will have a <1% market share globally for a very, very long time (using a simple TAM of 100M passenger cars/years sold annually in the 2020s).

Which makes Tesla a niche vendor with all the usual caveats in the car sector:

- Very high cap-ex to increase revenue in the sector.

I was laughed when I predicted five years ago that Tesla will need $5-10 billion (depending on output) to get the Gigafactory and the Model3 ramp completed.

That’s what’s happening and with two more factories promised in Europe/Asia. Where is the funding (with GF1 at a completion rate of just ~30% as of mid-2018)?

- Autos are cyclical, any recession/downturn is very dangerous - especially since Tesla has a weak balance sheet and sells into the high-end with S/X (hardest hit in downturns).

- Long-range EV competition is coming globally from 2018-2021 (and then on dedicated EV platforms from 2020-2025, eg. VW Group with MEB - which means large volume of EVs).

Meanwhile, Tesla has just ONE car factory for years to come.

- Model3 space at promised $35k is a shark-tank with constant rebates and lease teasers (which Tesla can’t offer at the moment and there’s still no $35k version in the first place).

- Same shark tank for batteries. Low operating margins and other Asian cell suppliers now overtaking Panasonic in volume (LG Chem, CATL...).

Last edited:

ZachShahan

Active Member

Very nice articles and graphs, thank you for fighting against the main-stream media crazyness!

However, you broke the journalist rule!

Your headline is a question, but the answer this time is yes...

Haha. I never cared much for that rule

Chickenlittle

Banned

Fight in the press if you can’t win in courtI agree that this is likely to add to the FUDfest this week. Who knows what he's got, but this attorney is certainly using extremely sensationalist wording: "golden nuggets," "shocking things," "false report," "defaming of Mr. Tripp," "elonmusk will be sued." This tells me he is very clearly trying to create a strong effect merely by his choice of words. When that's the case, it's pretty tough for the facts to live up to such wording. Facts speak for themselves. When they are somewhat ambiguous is when it requires this kind of an approach. This attorney has been very active on twitter over the last couple of weeks trying to sway public opinion against Elon and Tesla. However, he is obviously implying that what he is going to release will be unpleasant for Elon, and possibly the stock by extension.

The fact that he will be releasing just selected portions of police reports suggests to me that he needs to limit the overall picture of the reports to create the impression he wants to achieve. Otherwise, just release the entire report and let the public evaluate it for themselves. Again, facts speak for themselves and need no such sensationalist announcement. Obviously, he wants to be able to control the narrative and the interpretation of the facts. This suggests to me the probable "he said, she said" nature of the situation.

However, this is something to think about for those inclined to do any trading this week, particularly since the media is in a very negative Tesla cycle right now. They will gobble this up and spit it out with their additional spin and sensationalist language. They are salivating over any little "golden nuggets" they can find against Elon and Tesla.

View attachment 321274

Tesla will look comparatively even better for the Sept numbers when the ICE makers report theirs.I think based upon sheer numbers of model 3s, this media sentiment shift is likely to happen over the next 3 months probably, 6 months definitely.

>>

Daimler repeated a warning that the new Worldwide Harmonised Light Vehicle Test (WLTP) standards taking effect in September would lead to "some temporary restrictions in the availability of vehicles", as well as higher inventories of unsold cars.

As a result, third-quarter Mercedes earnings will be "significantly below" the €1.9bn recorded in the three months to June 30, the group said on Thursday.

The new standards have already caused a slowdown in sales for car makers including Volkswagen, which has rented space to store some of the 250,000 vehicles that may be caught up in testing delays.

French supplier Valeo also cut its 2018 outlook on Wednesday, largely citing WLTP disruption.

Mercedes maker Daimler's profit slips 30 per cent

@tftfHow about, just for once, not put words in my mouth or twist what I wrote a long time ago?

- Model3 space at promised $35k is a shark-tank with constant rebates and lease teasers (which Tesla can’t offer at the moment and there’s still no $35k version in the first place).

- Same shark tank for batteries. Low operating margins and other Asian cell suppliers now overtaking Panasonic in volume (LG Chem, CATL...).

good to hear from you. about Li batteries the last 18 months, not counting (July 2018) looks like Tesla has more than a bit of an edge (_and not counting powerwalls or powerpacks)

(data from Insideevs)

How about, just for once, not put words in my mouth or twist what I wrote a long time ago?

I never said there’s no demand for EVs.

I wrote/predicted that there will be a long evolutionary journey over 1-2 decades due to slow replacement cycles and batteries only becoming cost-competitive with ICE in many segments between 2020-2025.

Tesla even in a best-case scenario will have a <1% market share globally for a very, very long time (using a simple TAM of 100M passenger cars/years sold annually in the 2020s).

Which makes Tesla a niche vendor with all the usual caveats in the car sector:

- Very high cap-ex to increase revenue in the sector.

I was laughed when I predicted five years ago that Tesla will need $5-10 billion (depending on output) to get the Gigafactory and the Model3 ramp completed.

That’s what’s happening and with two more factories promised in Europe/Asia. Where is the funding (with GF1 at a completion rate of just ~30% as of mid-2018)?

- Autos are cyclical, any recession/downturn is very dangerous - especially since Tesla has a weak balance sheet and sells into the high-end with S/X (hardest hit in downturns).

- Long-range EV competition is coming globally from 2018-2021 (and then on dedicated EV platforms from 2020-2025, eg. VW Group with MEB - which means large volume of EVs).

Meanwhile, Tesla has just ONE car factory for years to come.

- Model3 space at promised $35k is a shark-tank with constant rebates and lease teasers (which Tesla can’t offer at the moment and there’s still no $35k version in the first place).

- Same shark tank for batteries. Low operating margins and other Asian cell suppliers now overtaking Panasonic in volume (LG Chem, CATL...).

I guess this makes sense if you think all cars are the same and consumers would only pay a few dollars more for any car than wasn’t a Camry or a Corolla.

And if you ignore what the S and X has done to their respective class.

And conveniently forget that, 5 years after the launch of the S, there isn’t a single competing vehicle from any automaker (and even the i-pace is now delayed)

And that no other battery maker has shown either the scale of manufacturing or volumetric & gravimetric density of the Tesla pack.

And about 50 other things including 1% of a 100M annual auto market is roughly 1M more Teslas, annually, than you have previously predicted on multiple occasions.

Sure, you saw this all coming.

pz1975

Active Member

I guess this is the quality of lawyer one can get for $15,000.I agree that this is likely to add to the FUDfest this week. Who knows what he's got, but this attorney is certainly using extremely sensationalist wording: "golden nuggets," "shocking things," "false report," "defaming of Mr. Tripp," "elonmusk will be sued." This tells me he is very clearly trying to create a strong effect merely by his choice of words. When that's the case, it's pretty tough for the facts to live up to such wording. Facts speak for themselves. When they are somewhat ambiguous is when it requires this kind of an approach. This attorney has been very active on twitter over the last couple of weeks trying to sway public opinion against Elon and Tesla. However, he is obviously implying that what he is going to release will be unpleasant for Elon, and possibly the stock by extension.

The fact that he will be releasing just selected portions of police reports suggests to me that he needs to limit the overall picture of the reports to create the impression he wants to achieve. Otherwise, just release the entire report and let the public evaluate it for themselves. Again, facts speak for themselves and need no such sensationalist announcement. Obviously, he wants to be able to control the narrative and the interpretation of the facts. This suggests to me the probable "he said, she said" nature of the situation.

However, this is something to think about for those inclined to do any trading this week, particularly since the media is in a very negative Tesla cycle right now. They will gobble this up and spit it out with their additional spin and sensationalist language. They are salivating over any little "golden nuggets" they can find against Elon and Tesla.

View attachment 321274

Click here to support Tripp vs Tesla: Help fund the fight organized by Martin Tripp

G

goinfraftw

Guest

I think Elon is being Elon and going on a major PR push in 2018.

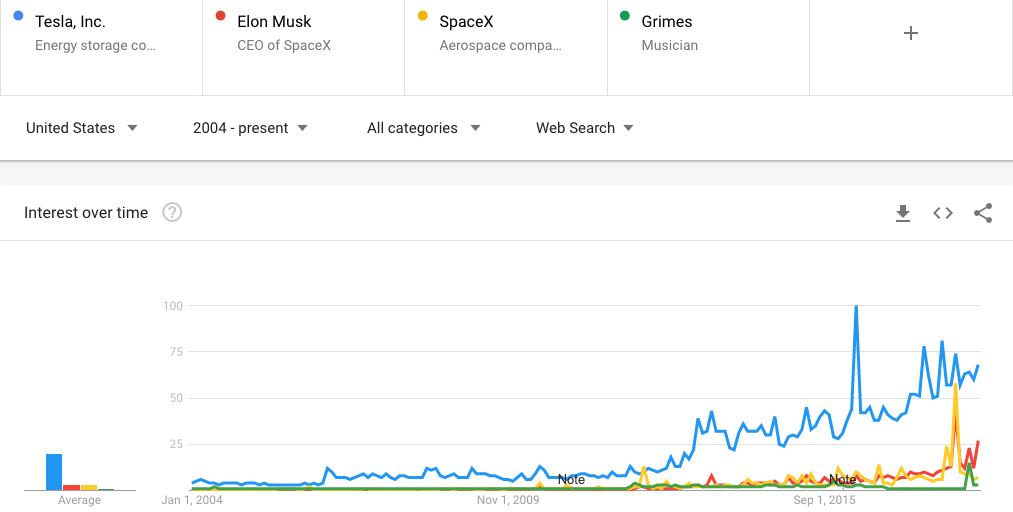

Been tracking since February and it keeps on confirming along the way. With the Starman launch (February), Grimes (May), and "Pedo" (sigh) (July), I think there's something going on in terms of media coverage on various issues in the US/Worldwide, and Elon is either trying to take advantage of it or doing his own thing. Feel free to add the search term "pedo" to this Google Trends chart...I won't.

As @DaveT has mentioned in another thread, maybe this is Elon "taking control of the narrative"?

Note: I haven't done a multivariate analysis with Tesla's share price, but it might be worthwhile now. Once the shorts/media started their campaign last year, it became clear that Tesla's share price was going to be affected in a hedge-fund kind of way. This company should be trading at least at 2-2.5x higher by year end, if the market is accurate and corrects itself.

Been tracking since February and it keeps on confirming along the way. With the Starman launch (February), Grimes (May), and "Pedo" (sigh) (July), I think there's something going on in terms of media coverage on various issues in the US/Worldwide, and Elon is either trying to take advantage of it or doing his own thing. Feel free to add the search term "pedo" to this Google Trends chart...I won't.

As @DaveT has mentioned in another thread, maybe this is Elon "taking control of the narrative"?

Note: I haven't done a multivariate analysis with Tesla's share price, but it might be worthwhile now. Once the shorts/media started their campaign last year, it became clear that Tesla's share price was going to be affected in a hedge-fund kind of way. This company should be trading at least at 2-2.5x higher by year end, if the market is accurate and corrects itself.

Attachments

"$15,519 of $500,000 goal" Bottom feeders gotta dream.I guess this is the quality of lawyer one can get for $15,000.

Click here to support Tripp vs Tesla: Help fund the fight organized by Martin Tripp

I guess this is the quality of lawyer one can get for $15,000.

Click here to support Tripp vs Tesla: Help fund the fight organized by Martin Tripp

Are you aware that there are two cases? That fund you linked is to hire attorneys for the lawsuit that Teslas filed against Martin Tripp. That Stuart Meissner guy is not involved in that case. He is handling the formal filing of Martin Tripp with the SEC and, as far as i know, isn't paid anything by Martin Tripp right now. He will be compensated should they succeed. And since i don't think he got involved into all this for twitter bragging rights alone, he probably thinks there is a realistic chance to win.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K