Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

CNBC reporting that:

- The settlement would have barred Musk as Chairman for 2 years

- Fined Musk and Co.

- Required company 2 new independent directors

- Required Musk neither admit nor deny culpability

The 2 independent directors, approved by the SEC, was the deal killer. It puts Musk on a short leash, having to placate a board that could fire him at any time.

$5k a share? If that happens I'm going to buy a roadster.

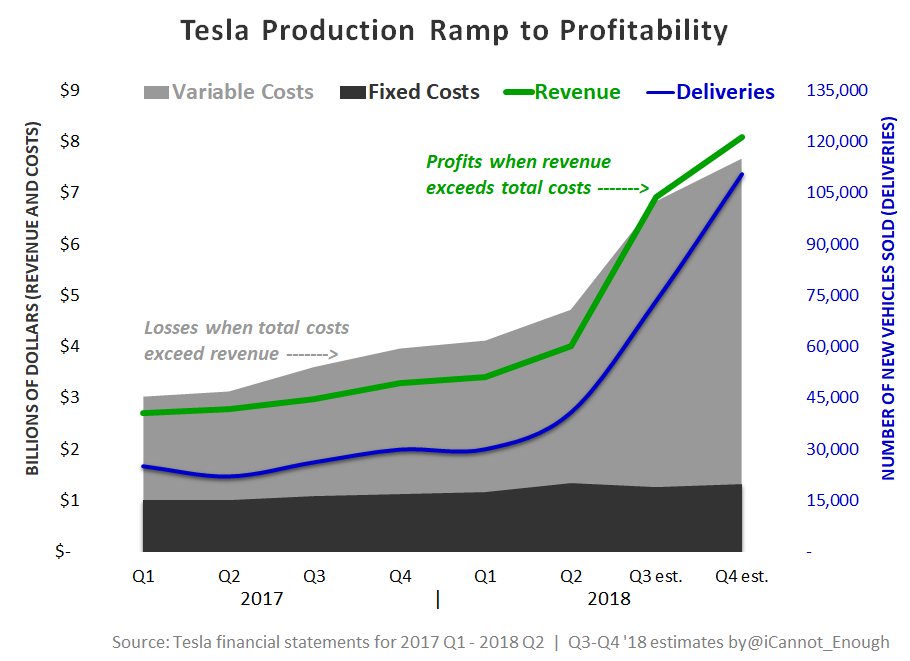

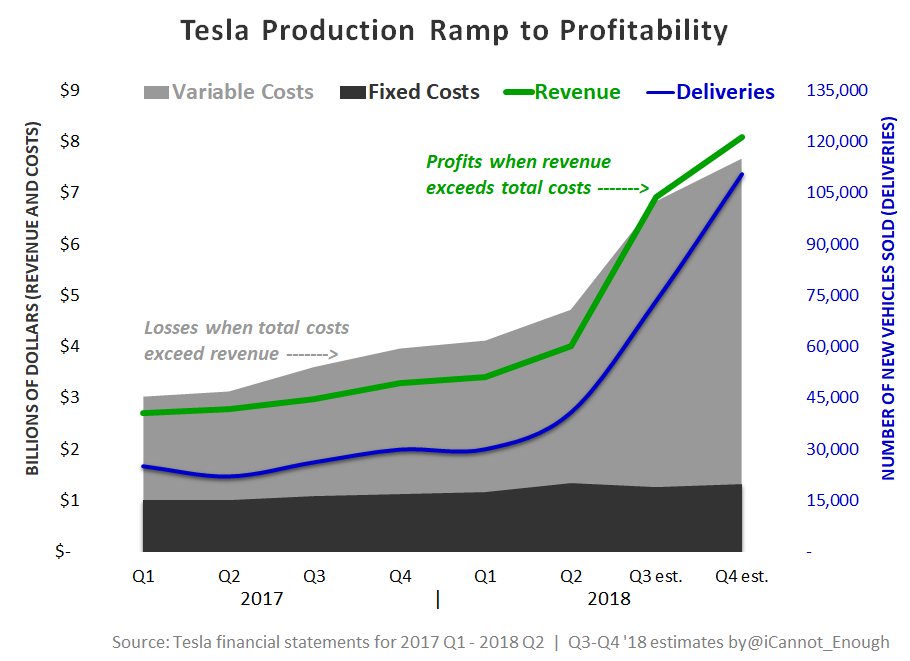

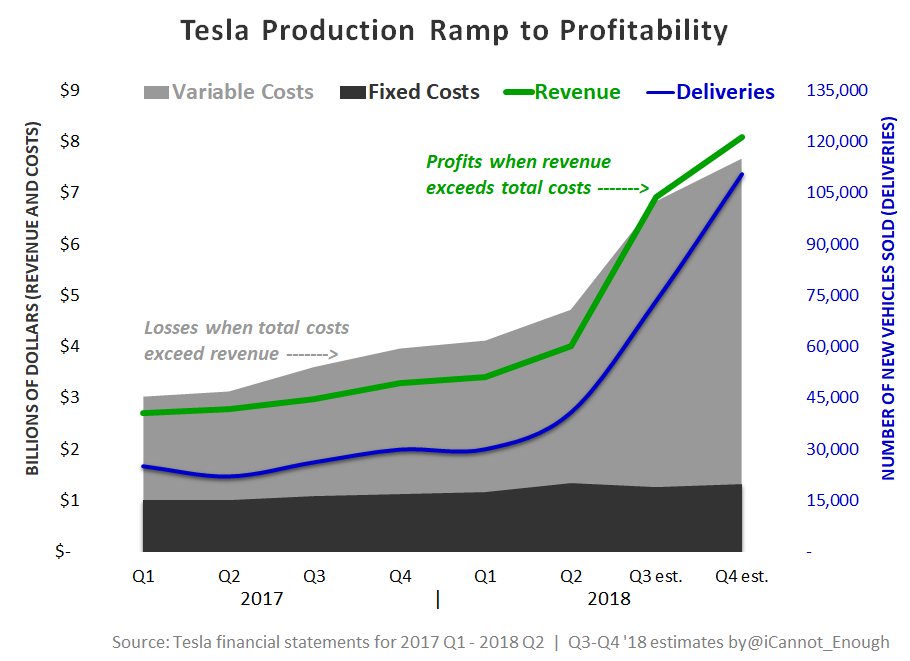

Not sure about the underlying numbers but that graph shows pretty much in perspective how I see Q3 and Q4

James Stephenson on Twitter

James Stephenson on Twitter

TSLA_Hopeful

Member

I guarantee it was going to be something like a big fine, twitter restrictions, and giving up the chairman position. He didn't take the settlement because it would cause damage in the civil lawsuits thrown his way.

I’m sorry... but I deserve a called it.

Attachments

I am on Musk his side, but the legal definition of reckless is different than the regular use of the term. I'll let the relevant paragraph from the SEC charge speak for itself. This is their view:

Musk Knew or Was Reckless in Not Knowing that His Statements Were False and Misleading

68. Musk made his false and misleading public statements about taking Tesla private using his mobile phone in the middle of the active trading day. He did not discuss the content of the statements with anyone else prior to publishing them to his over 22 million Twitter followers Case 1:18-cv-08865 Document 1 Filed 09/27/18 Page 18 of 23 19 and anyone else with access to the Internet. He also did not inform Nasdaq that he intended to make this public announcement, as Nasdaq rules required.

69. Musk’s statements were premised on a long series of baseless assumptions and were contrary to facts that Musk knew. Between the July 31 meeting with representatives of the Fund and his August 7 misstatements, Musk knew that he (1) had not agreed upon any terms for a going-private transaction with the Fund or any other funding source; (2) had no further substantive communications with representatives of the Fund beyond their 30 to 45 minute meeting on July 31; (3) had never discussed a going-private transaction at a share price of $420 with any potential funding source; (4) had not contacted any additional potential strategic investors to assess their interest in participating in a going-private transaction; (5) had not contacted existing Tesla shareholders to assess their interest in remaining invested in Tesla as a private company; (6) had not formally retained any legal or financial advisors to assist with a going-private transaction; (7) had not determined whether retail investors could remain invested in Tesla as a private company; (8) had not determined whether there were restrictions on illiquid holdings by Tesla’s institutional investors; and (9) had not determined what regulatory approvals would be required or whether they could be satisfied.

70. In addition, Musk knew that Tesla’s board had not yet voted on any proposal or authorized a shareholder vote on it, and in fact, Musk had not yet even submitted a formal proposal to Tesla’s board.

71. Musk did not disclose any of these material facts that were known to him when he made his August 7 statements. Unlike market participants reading his tweets, Musk knew that his ostensibly “secured” funding was based on a 30 to 45 minute conversation regarding a potential investment of an unspecified amount in the context of an undefined transaction Case 1:18-cv-08865 Document 1 Filed 09/27/18 Page 19 of 23 20 structure. Musk also knew that there were many uncertainties beyond just a shareholder vote that would have had to be resolved before any going-private transaction could have been possible. As a result, Musk knew or was reckless in not knowing that his August 7 statements were false and misleading.

I'm not saying the SEC is right. I am saying it isn't as crystal clear as some make it out to be.

In Elon's defense, the above is basically a double negative. They say A) Elon did not know enough details about what he suggested and B) He left out that he did not know enough details. You could argue that - by not speaking of details - you are implying you don't know the precise details. (The term "considering" will help this argument, IMHO).

Now let's just sit tight and wait for those damn delivery numbers. They better be fantastic.

68) is for speaking as a company or CEO, not as a stockholder

69) It was shown that there was funding during the lead up to the stay public decision, the firms stated funding was available.

70) non-issue since he was doing it personally, not as Tesla. Also stated it required a vote.

71) "Am considering" is personal, "Tesla considering": is corporate the second blog post specifically calls out that it is personal.

dqd88

Member

I think the main determinant for SEC to sue Elon Musk for lying about his funding secured tweet is that he didn’t follow through with going private. He fooled me and I lost a lot of money.

When Musk claimed his intent to consider going private, I thought it was duly considered and announced, and I put in a lot of money to TSLA to sell or hold at the 420 price point. When Musk turned out to be weak, margin ate most my money. I try to learn from this, but the main issue is the same SEC ‘s suit claims, that Musk wasn’t in earnest.

Now wirh the most promising transformative quarter for TSLA ever, once again, the SEC is causing me to lose a lot of money, and may make me homeless.

Damn, I feel for you. I think Musk was stupid in the way he went about informing people of the go-private idea, but he wasn't malicious. He could have stated the same intent in a more formal way, and people would have bought on the information. And the deal would have fallen through (ie - same result whether through a tweet or 8k).

dmckinstry

Model X 2019

The point is that taking TSLA private would force a sell by many/most retail investors.lose for shareholders? Shares public are the same shares private. Current price only matters if you selling.

The entire premise is false and misleading on behalf of the SEC.I am on Musk his side, but the legal definition of reckless is different than the regular use of the term. I'll let the relevant paragraph from the SEC charge speak for itself. This is their view:

Musk Knew or Was Reckless in Not Knowing that His Statements Were False and Misleading

68. Musk made his false and misleading public statements about taking Tesla private using his mobile phone in the middle of the active trading day. He did not discuss the content of the statements with anyone else prior to publishing them to his over 22 million Twitter followers Case 1:18-cv-08865 Document 1 Filed 09/27/18 Page 18 of 23 19 and anyone else with access to the Internet. He also did not inform Nasdaq that he intended to make this public announcement, as Nasdaq rules required.

69. Musk’s statements were premised on a long series of baseless assumptions and were contrary to facts that Musk knew. Between the July 31 meeting with representatives of the Fund and his August 7 misstatements, Musk knew that he (1) had not agreed upon any terms for a going-private transaction with the Fund or any other funding source; (2) had no further substantive communications with representatives of the Fund beyond their 30 to 45 minute meeting on July 31; (3) had never discussed a going-private transaction at a share price of $420 with any potential funding source; (4) had not contacted any additional potential strategic investors to assess their interest in participating in a going-private transaction; (5) had not contacted existing Tesla shareholders to assess their interest in remaining invested in Tesla as a private company; (6) had not formally retained any legal or financial advisors to assist with a going-private transaction; (7) had not determined whether retail investors could remain invested in Tesla as a private company; (8) had not determined whether there were restrictions on illiquid holdings by Tesla’s institutional investors; and (9) had not determined what regulatory approvals would be required or whether they could be satisfied.

70. In addition, Musk knew that Tesla’s board had not yet voted on any proposal or authorized a shareholder vote on it, and in fact, Musk had not yet even submitted a formal proposal to Tesla’s board.

71. Musk did not disclose any of these material facts that were known to him when he made his August 7 statements. Unlike market participants reading his tweets, Musk knew that his ostensibly “secured” funding was based on a 30 to 45 minute conversation regarding a potential investment of an unspecified amount in the context of an undefined transaction Case 1:18-cv-08865 Document 1 Filed 09/27/18 Page 19 of 23 20 structure. Musk also knew that there were many uncertainties beyond just a shareholder vote that would have had to be resolved before any going-private transaction could have been possible. As a result, Musk knew or was reckless in not knowing that his August 7 statements were false and misleading.

I'm not saying the SEC is right. I am saying it isn't as crystal clear as some make it out to be.

In Elon's defense, the above is basically a double negative. They say A) Elon did not know enough details about what he suggested and B) He left out that he did not know enough details. You could argue that - by not speaking of details - you are implying you don't know the precise details. (The term "considering" will help this argument, IMHO).

Now let's just sit tight and wait for those damn delivery numbers. They better be fantastic.

Elon did state clearly he was considering going private. This was not a prediction of any sorts nor was it a statement of fact that he had any deal what so ever at $420.

The SEC has no grounds that Elon mislead anyone in saying he was considering going private at $420 given the funding secured at that price. He was considering is the key term of the entire thought, idea, expression to shareholders — not short traders betting on the company stock to go down, which is evidence is clearly showing they are the supporting force behind this SEC action.

Elon’s tweet was simultaneously available to *all* Tesla investors big and small, board members, employers and the like. All received the consideration at the same time, which prevented leaks and/or insider trading while putting out there for shareholder discussion as a consideration.

Then, as further development happened as all shareholders went down the road together in exploring the consideration further, more information as it came available was further pushed forward to shareholders.

This was a transparent *process* for shareholders to partake in. Shareholder feedback did happen and as a result the deal did not progress due to conditions not being met — such as small common share holders being able to maintain equity stake if they wanted and not just being bought out.

Retail shareholders love Tesla. They are the beating heart cheerleaders, the 12th person fan if you will of the company. It is more then just a piece of paper. It’s the future of a better country and of the world.

If a trial happens, the government will see that in spades and will quickly understand the direct relationship Elon has through his platforms of communication to them, the fellow investors and the how his extreme efforts he takes to create shareholder value every day.

CNBC reporting that:

- The settlement would have barred Musk as Chairman for 2 years

- Fined Musk and Co.

- Required company 2 new independent directors

- Required Musk neither admit nor deny culpability

Knowing this, I’m glad Elon is fighting it. Not as bad as I thought but still worse than it should be.

Tesla achieving Amazons market cap by 4Q23. It's within the realm of possibility. Sign me up for a roadster too.$5k a share? If that happens I'm going to buy a roadster.

Apart from settling, I think Tesla should add two independent directors. The question is, who? I would kinda like to see Jigar Shah on the board. I think he can bring some really good leadership in the Energy space.

Also I get the impression that Kimbal may be taking a more visible role perhaps as a prelude to being named as Chair.

If the board were to move fast to add a few directors, it could also lower the stakes for the SEC suit. Naming Kimbal as Chair would take this further. There would be little upside for pursuing weak case in court, and the whole thing could be dropped.

But apart from how this would impact the SEC action, I think there are other benefits to enhancing the board as Tesla grows and expands into multiple industries.

Giving up chairmanship (not CEO position) for two years does not seem such a big deal.

Assigning an ex sec lawyer as a chairman figure head and then bring

In two more symbolic figures would not seem such a huge sacrifice.

Any thoughts about that?

According to people familiar with the thinking of people familiar with the matter, the SEC proposed Jim Chanos and Mark Spiegel as independent directors.The 2 independent directors, approved by the SEC, was the deal killer. It puts Musk on a short leash, having to placate a board that could fire him at any time.

If they can become the dominant player in EVs and greatly expand general tech offerings it is possible I suppose. Or I'll lose half my investment and VW will buy them at $150 a share.Tesla achieving Amazons market cap by 4Q23. It's within the realm of possibility. Sign me up for a roadster too.

Not sure about the underlying numbers but that graph shows pretty much in perspective how I see Q3 and Q4

James Stephenson on Twitter

Curious why the revenue curve flattens after Q3. ASPs are not coming down as SR deliveries are still at least a couple of qtrs out, so why wouldn't revenue track with deliveries?

O

I can't remember whether you've explicitly stated untruths, but I know for sure you twist and slither some facts, and ignore others that "put the lie to" whatever your current narrative is. Honest debate and exchange of how one sees facts is one thing; twisting them starts down the slippery slope.If you think that I have said something untrue, pls point it out - I will be happy to either support or modify/withdraw it.

I do think that you are incorrect about shorts. Shorts are good for longs and longs are good for shorts. The debate between the the two clarifies the arguments for and against any particular stock, reduces the effects of confirmation bias and makes price discovery more efficient, while the market interplay between the two increases liquidity and reduces over-shooting.

On the other hand, your posts are generally written in a calm, non-emotional manner and you don't use gratuitous insults, even when you're attacked in a not-nice manner. You're a far better person than I in that specific regard. Thus, I can still see your posts. But make no mistake, I'm not fooled in the least.

And I'll just correct that second sentence in your second paragraph: I think shorts CAN BE good for the overall process, for seeing things differently and having a discussion so both can learn. Where shorts turn to crap is the spreading of FUD; that's dishonest and morally bankrupt (note the proper spelling).

Their entire 23-page complaint contains ZERO instances of the words intent, intended, intentionally, etc. Zero. SEC's position is that Musk knowingly misled with known false statements. They are silent regarding intent. Clearly, they do not believe intent is relevant to the violation alleged. A court could disagree, but SEC's position on the matter is clear.

The precise element required for 10b5 fraud is scienter, which is a fancy word for intent. But it does NOT require true normal intent. A constructive intent concept is implemented in the concept of "reckless". A good discussion of this is at: https://www.wsgr.com/PDFSearch/pleading_of_scienter.pdf

An element of any securities fraud claim is the defendant’s state of mind. In a claim brought under Rule 10b-5, the applicable question is whether the defendant acted with fraudulent intent (i.e., scienter) when he made the alleged false or misleading statement.

the Second Circuit ... concluded that ... conduct that is ‘“highly unreasonable’ and ‘an extreme departure from the standards of ordinary care . . . [such] that the danger was either known to the defendant or so obvious that the defendant must have been aware of it.’” was enough to prove recklessness and meet the scienter requirement.

For EM to defend himself he needs to show that the statements were true/not materially misleading OR that he wasn't reckless, i.e., he didn't depart from the standards of ordinary care such that he knew or should have known that his statements were misleading.

It's a close case that depends on the facts as to how much the funding was actually secured/committed/certain, and what other emails and texts did he write leaving a trail of how much care he took (or didn't take) to make sure his statements were accurate. Or whether there is any smoking gun evidence -- a text to a friend saying "this will show the shorts".Lots of unknowns and uncertainty. A settlement where he could have stayed as a CEO -- basically an appropriate slap on the wrist for a relatively minor and victimless disclosure sloppiness -- was almost certainly better than taking the risks of this litigation.

Yeah. Or we're going to sic the SEC on you. Since the SEC obviously has nothing better to do.Interesting.

CuriousSunbird, some advice: Be honest. If that was your intent, admit to it, apologize, and promise that you're not going to do that again.

dqd88

Member

Can we give this one more flypast ? Is this a common practice ???

Reading to pages and pages of apologetics here... While the approach of the SEC is seemingly aggressive and in stark contrast with other cases where it also could have reacted but didn't (to this extent), this is entirely self-conflicted.

Now the lawsuit is just their side of the story and Musk will answer through their laywers. But the SEC has subpoena powers and used them on Tesla related parties. Therefore, I consider it near certain that the citations from internal Tesla/Musk communications are genuine. They do paint a picture of a 'Saudi deal' that was barely discussed. (30-45 minute meeting, his own IR department having to verify the authenticity of his intents with his tweets, his own board barely being on board). Even something as basic as the share price had not been discussed. The lawsuit makes the case that Elon made a lot of promises over twitter that he should have known to be difficult to keep (and therefore being reckless). For example that retail investors could continue to invest.

The SEC sounds like shorts in their fear mongering illogical statements. There's no law that requires one to have a share price locked down before consummating a deal. There's not time requirement of meeting length to consummate a deal. This is one of the stupidest things I've ever heard. They repeatedly bring up the 30-45 minute thing. yeah, so what? What the f does it matter whether it was 5 minutes or 5 hours? Has nothing to do with anything. Seems Yasir gave Elon carte blanche as long as it was within reason. That's good enough. If that's how Yasir wanted to start the deal then that's how it starts. There's no legal requirement to have certain deal terms locked down in writing before sending a tweet.

of course? I do! This is Art of War stuff though; dwelling on Elon's obvious innocence is a waste of resources and paints the wrong picture. We are on offense, not defense here.No disrespect, but isn't this a contradiction?

If the SEC suit is frivolous, wouldn't that mean you agree Elon is on the right side of the argument here?

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K