Thesis for Tuesday. 9/18/2018 quick and dirty

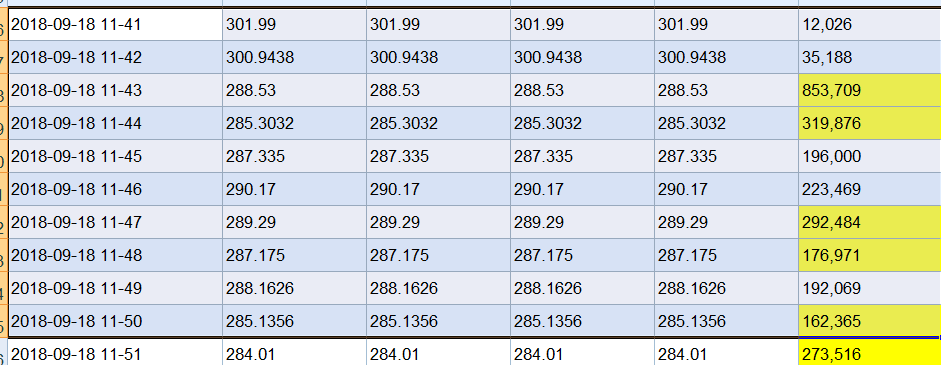

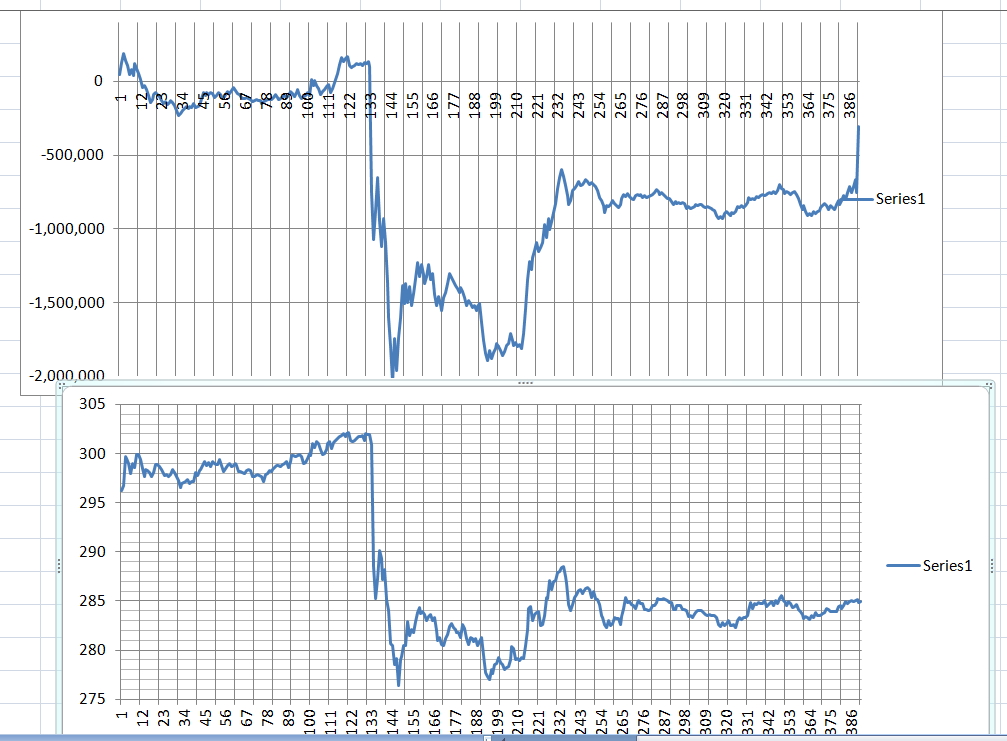

minute by minute of Vol and price.

1) if next minute price lower, subtract vol, if next minute higher add vol

2) 11:43 am anomaly of 853,709 sold

as of 4pm, (385 data points) shorts still have ~300,000 left to cover

https://www.nasdaq.com/symbol/tsla/interactive-chart?timeframe=5d

of

of

minute by minute of Vol and price.

1) if next minute price lower, subtract vol, if next minute higher add vol

2) 11:43 am anomaly of 853,709 sold

as of 4pm, (385 data points) shorts still have ~300,000 left to cover

https://www.nasdaq.com/symbol/tsla/interactive-chart?timeframe=5d