bdy0627

Active Member

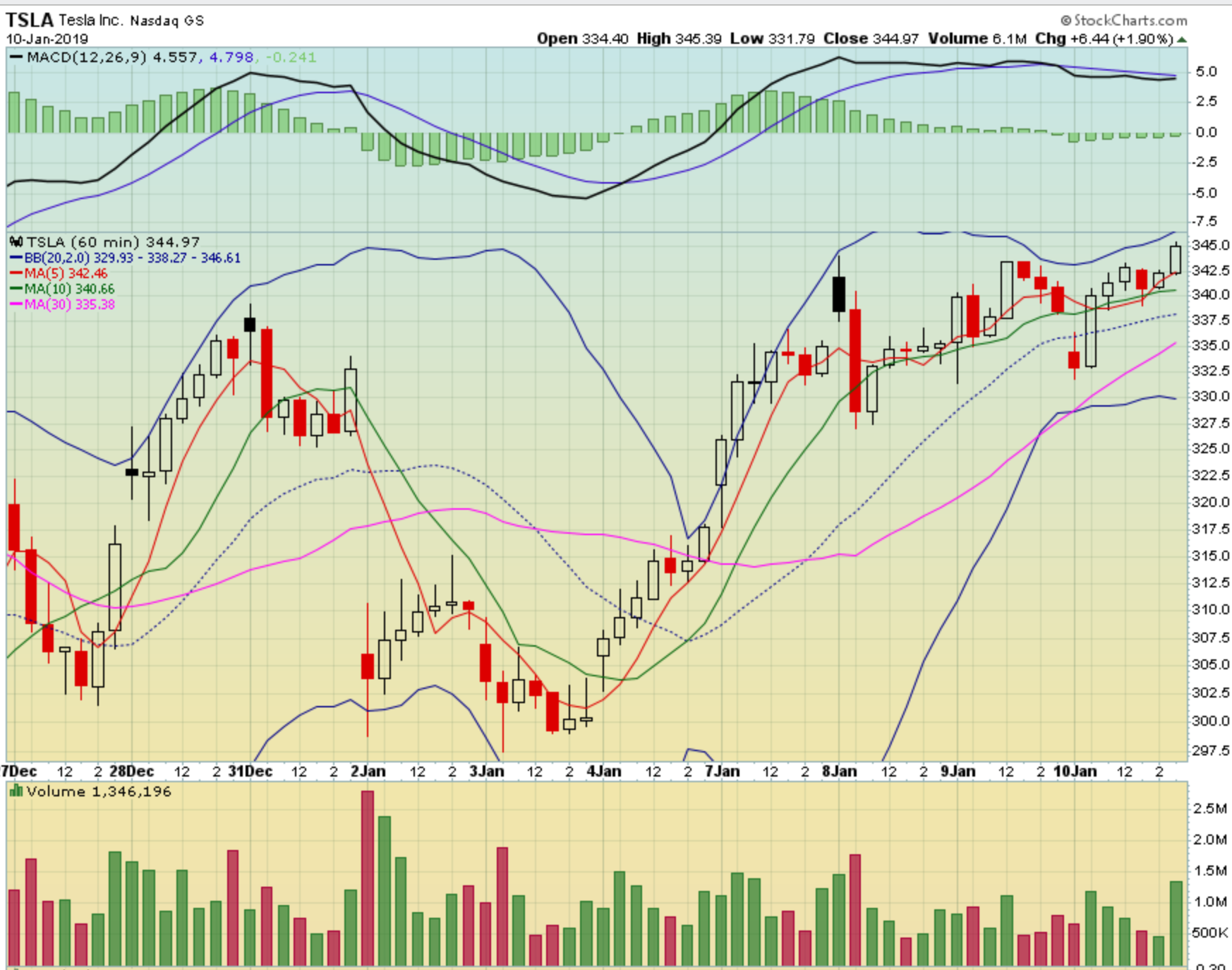

Remember the 10% rule will limit the shorts ability to drive the price down further. For comparison, take a look at the hourly trading chart of the big drop after the Q4 2018 deliveries report Jan2. The initial 12% drop triggered the rule limiting shorts. The stock traded up from there, closing well above the early low. The next day, with the rule still in effect, the low for the day was just slightly lower than on Jan 2 and it traded up from there. This time it may be different but the 10% rule will definitely mitigate the damage. That delivery report was certainly much better than this one. The market reacted negatively to Tesla announcing price cuts. At that time, it was not the right move to sell on the big dump the first day assuming the price was going down a lot further. You didn't need to buy that first day but you wouldn't have wanted to sell, except maybe very short term on the bounce that first day.