Maybe I’m just an idiot, but I don’t see how technical analysis is any different than trying to find patterns in past lottery numbers.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TSLA Technical Analysis

- Thread starter Robert.Boston

- Start date

-

- Tags

- elon is an ass TSLA

ZachF

Active Member

Maybe I’m just an idiot, but I don’t see how technical analysis is any different than trying to find patterns in past lottery numbers.

Like I've said before, TA is objectively dumb ....but a lot of traders use it, giving it sometimes minor predictive power.

Trees are dumb, but the branches emplacement of a tree can be calculated by fractal.

Our biological neural net obeys the same mathematical laws.

And our thoughts/reasoning are made/emanates/generated of/from?

... Yes there can be some deep philosophy in technical trading/analysis

Our biological neural net obeys the same mathematical laws.

And our thoughts/reasoning are made/emanates/generated of/from?

... Yes there can be some deep philosophy in technical trading/analysis

Antares Nebula

Active Member

I think it's more art than science and should be taken with a grain of salt. But I do think there is more logic behind it than reading the stars or entrails. Something to do with the large numbers, complexity, etc. Patterns like cup and handle and head and shoulders calculate so called "measured moves", which actually have some math behind it. But it is also probability based. I don't use it solely, but it is one tool out of many (including fundamental analysis, news, etc.) that is useful together with the rest.

Case in point, it allowed me to buy calls at 223 today. Based on yesterday's chart and the gap up, there was an inverse cup and handle which targeted 223 (see my post in the trading thread). I saw this yesterday. Wasn't completely sure it would hit that or even go beyond. But I waited for that today, and bought at 223.50. But there is luck and chance involved too. Fortunately it worked out.

Also, can't ignore the fact that the stock bounced off 180 support like a dime. That has been long term support for many years. Of course 250 or so was support, but when that broke, the next support was 180. Good chance that it would bounce there (at least for a dead cat bounce).

Case in point, it allowed me to buy calls at 223 today. Based on yesterday's chart and the gap up, there was an inverse cup and handle which targeted 223 (see my post in the trading thread). I saw this yesterday. Wasn't completely sure it would hit that or even go beyond. But I waited for that today, and bought at 223.50. But there is luck and chance involved too. Fortunately it worked out.

Also, can't ignore the fact that the stock bounced off 180 support like a dime. That has been long term support for many years. Of course 250 or so was support, but when that broke, the next support was 180. Good chance that it would bounce there (at least for a dead cat bounce).

Stars aligned

Member

Well, sometimes it helps to try to look beyond its own plateMaybe I’m just an idiot, but I don’t see how technical analysis is any different than trying to find patterns in past lottery numbers.

Last edited:

Stars aligned

Member

Broke nicely through resistance, supported by good P&D number, and the day ended just above 235. Breakout was clearly anticipated by Mr Market.

Is there a new trend channel in the make?

Is there a new trend channel in the make?

Maybe I’m just an idiot, but I don’t see how technical analysis is any different than trying to find patterns in past lottery numbers.

This thread is dedicated to technical analysis. The members posting here believe it is a valuable tool for their investing decisions. Everyone can express scepticism about the usefulness of TA, but this is not the place. Any further posts questioning the value of TA will be removed.

Broke nicely through resistance, supported by good P&D number, and the day ended just above 235. Breakout was clearly anticipated by Mr Market.

Is there a new trend channel in the make?

View attachment 426328

Nice cup and handle dressing up

Antares Nebula

Active Member

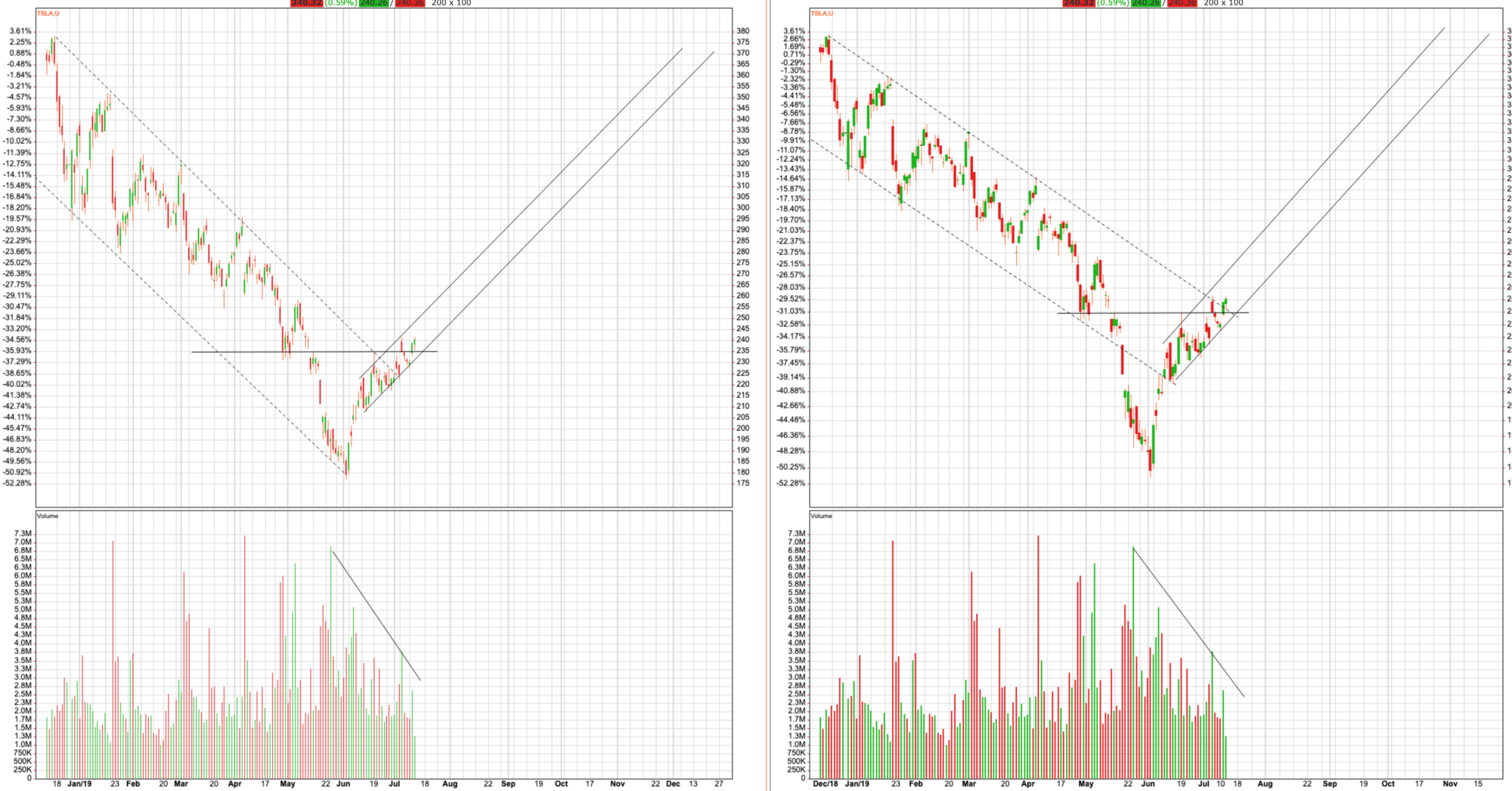

There is some ambiguity about whether TSLA broke above the downtrend line; depends on normal or log scale. See my post:

@Navin and others re longterm Downtrend Line break:

Curious, I saw on many charts that it broke the downtrend, but I did see one chart where it didn't. So I went to tradeview and drew the lines myself. Turns out on the normal scale, it broke; but on the log scale, it hadn't (just touched the top). See pics attached. So, hmm...

I actually expected it to climb higher Wed, but we can write it off to 4th of July mischief. The test will be next week. But seems like the analysts and media are pushing the narrative that earnings will be bad and this is a fade into earnings. Being a news vacuum from now until earnings, the stock may in fact fade. I don't have a strong opinion here. I think it could go either way, but I'm leaning slightly toward it going down into earnings, and then going up afterwards. Not going to trade it either way, but I will add shares if it goes lower.

(Bear in mind that if it does in fact fade, it can still stay above the channel/downtrend line (on the normal scale), if it fades slowly enough -- see chart/pics.)

View attachment 426421 View attachment 426422

This thread is dedicated to technical analysis. The members posting here believe it is a valuable tool for their investing decisions. Everyone can express scepticism about the usefulness of TA, but this is not the place. Any further posts questioning the value of TA will be removed.

A mod moved it to this thread. I didn't post it here.

A mod moved it to this thread. I didn't post it here.

Sorry, I wasn’t aware of that. I’ll leave the remark for future reference though.

Stars aligned

Member

Also intraday today, another cup forming.Nice cup and handle dressing up

What do we get when shorts cover and retails sell (see Robintrack chart)?

Smells like institutional accumulation.

Earnings S&P inclusion would give a massive boost. Even if this is regarded as unlikely in general, some shorts and institutions may want hedge such an event to a certain degree. Especially because there are so many wildcards.

Antares Nebula

Active Member

Stars aligned

Member

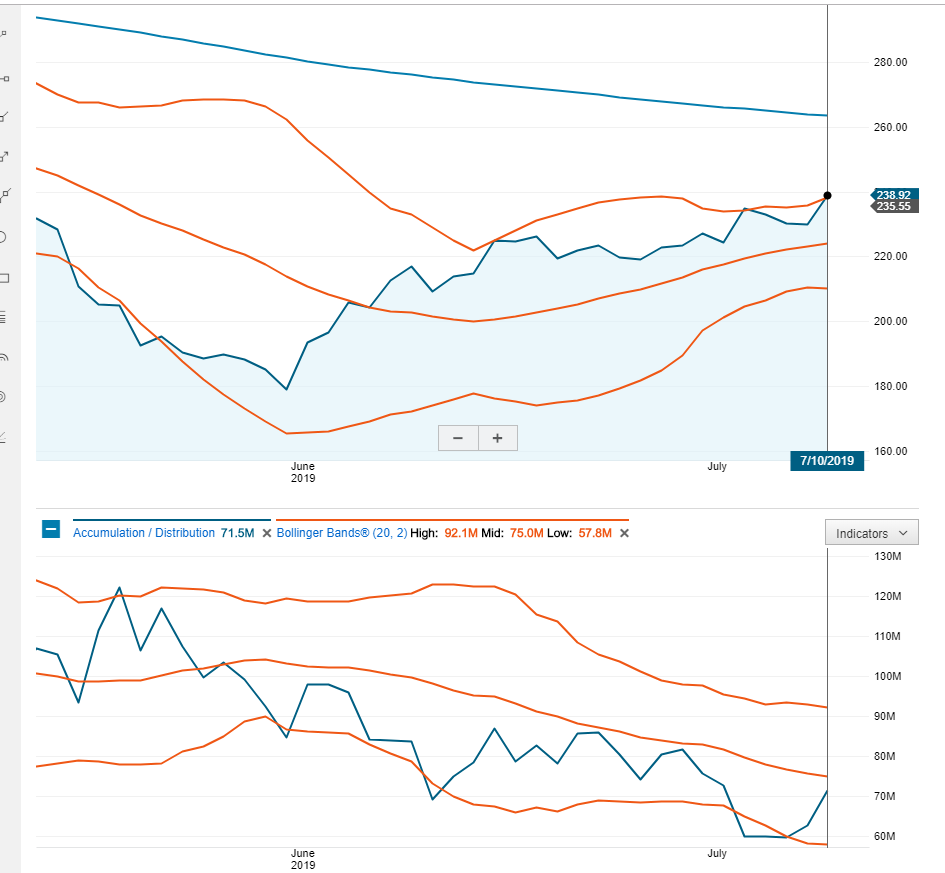

1m graph shows cup after cup. Soon, log scale may show what lin scale knew for some time. Accumulation.

a cautious look at Accumulation/Distribution line and SP, finally turning up

Stars aligned

Member

Upper channel has now been broken on log chart as well, about 9 days later than on the linear chart. On both charts, a new uptrend channel has formed. After SP lost pretty exactly 50% in a little more than half a year, it may go to the old high in November / December, if the new channel holds.

Doesn't look exactly like a V bottom, talk about the newly invented Y bottom. Good sign for upcoming model Y I guess, lol.

The low volume (falling since shortly before bottom was reached) suggests that few shareholders are willing to sell. Those accumulating have to build up positions by buying calls near the money and exercise them. The unusual high aftermarket volume those days (again almost 290k yesterday) and the opricot chart of the last days support this assumption.

235 resistance has broken upwards and became a support again.

Events which have been marked as low probability or impossible such as S&P inclusion in the next round, early Y production or an XLRange model S and X, coupled with the unwillingness of current shareholders to sell, could trigger a massive short squeeze, reaching the old all time high earlier. And the macros seem to give further tailwinds.

As always, this is not an advice, just my personal opinion/interpretation of the chart and the market activities.

Doesn't look exactly like a V bottom, talk about the newly invented Y bottom. Good sign for upcoming model Y I guess, lol.

The low volume (falling since shortly before bottom was reached) suggests that few shareholders are willing to sell. Those accumulating have to build up positions by buying calls near the money and exercise them. The unusual high aftermarket volume those days (again almost 290k yesterday) and the opricot chart of the last days support this assumption.

235 resistance has broken upwards and became a support again.

Events which have been marked as low probability or impossible such as S&P inclusion in the next round, early Y production or an XLRange model S and X, coupled with the unwillingness of current shareholders to sell, could trigger a massive short squeeze, reaching the old all time high earlier. And the macros seem to give further tailwinds.

As always, this is not an advice, just my personal opinion/interpretation of the chart and the market activities.

ev-enthusiast

Active Member

Waiting for confirmation of breaking upper border of falling wedge right here at $238. I still see the downtrend intact.

neroden

Model S Owner and Frustrated Tesla Fan

Waiting for confirmation of breaking upper border of falling wedge right here at $238. I still see the downtrend intact.

Is $243 confirmed enough for you?

Waiting for confirmation of breaking upper border of falling wedge right here at $238. I still see the downtrend intact.

This post has not aged well.

Antares Nebula

Active Member

Well, it definitely broke the linear and log scale downtrend channel. Today was the day. A close under 235 would have kept it in the downtrend. This is a clear break at 245. Could definitely move higher now. But so hard to trade (I hold long term shares). After a 60 point run up, earnings coming soon, etc., I'm afraid to trade it. My gut says its going higher into earnings, but I wouldn't be surprised by a crazy head fake either.

Similar threads

- Replies

- 21

- Views

- 6K

- Replies

- 4

- Views

- 354

- Replies

- 3

- Views

- 900

- Locked

- Replies

- 0

- Views

- 3K