Artful Dodger

"Neko no me"

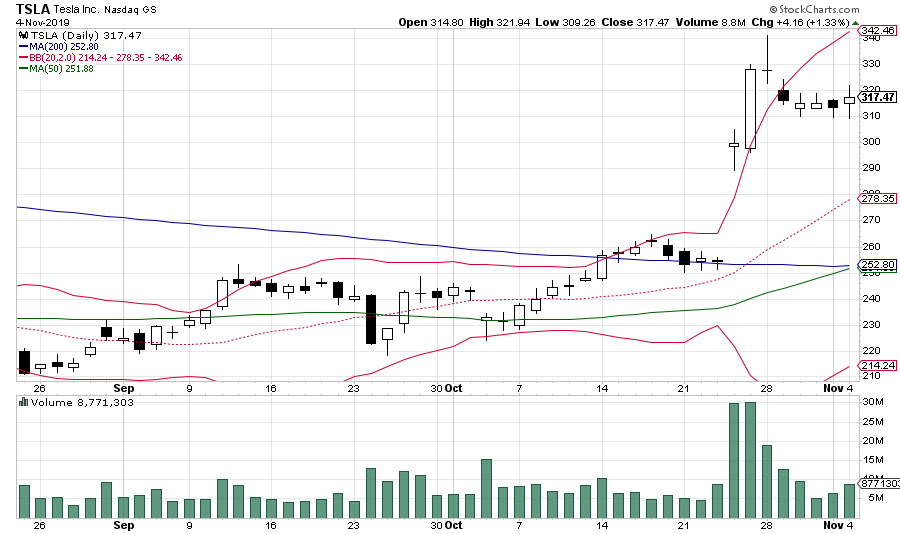

I expect a boost from Technicals tomorrow. The 50-day Moving Average should open at about $254.00 forming a "Golden Cross" with the 200-day Moving Average. Technical or Momentum traders could both be drawn in with this setup: