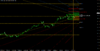

So I was bothered by the length of what I had identified as Wave 2 from April 2016 to Nov 2016. There were just too many waves to be a typical ABC pattern Wave 2. I circled the area on the chart below:

As I read more about Wave Pattern, there is a phenomena called a Combination Wave Pattern (corrective). Basically Corrective waves can go longer due to a combination of different types of Corrective wave patterns. A simple way of thinking about it is an "extension" of Corrective waves created by linking (typically) different Corrective waves together.

The three main types of Corrective waves are: ZIGZAG, FLAT and TRIANGLES. They are also defined by their internal wave pattern/sequences. ZIGZAGs tend to have 3 waves, with an internal pattern of 5-3-5 sub-waves. FLATs also have 3 waves, but with a 3-3-5 sub-wave pattern. Finally TRIANGLEs often have 5 waves, but they are all 3-3-3-3-3.

When I looked at the sub-wave patterns, there were too many internal waves for it to be a consistent TRIANGLE pattern. So it must be a Combination type pattern. As I applied the rules I realized it is likely a combination of a FLAT pattern, followed by a ZIGZAG, as below:

This fits things better.

What changes from a predictive perspective is that it means that our current Motive/Impulse wave pattern is Wave #1. Which is great for additional gains, but makes current predictions on price action more difficult.

As I read more about Wave Pattern, there is a phenomena called a Combination Wave Pattern (corrective). Basically Corrective waves can go longer due to a combination of different types of Corrective wave patterns. A simple way of thinking about it is an "extension" of Corrective waves created by linking (typically) different Corrective waves together.

The three main types of Corrective waves are: ZIGZAG, FLAT and TRIANGLES. They are also defined by their internal wave pattern/sequences. ZIGZAGs tend to have 3 waves, with an internal pattern of 5-3-5 sub-waves. FLATs also have 3 waves, but with a 3-3-5 sub-wave pattern. Finally TRIANGLEs often have 5 waves, but they are all 3-3-3-3-3.

When I looked at the sub-wave patterns, there were too many internal waves for it to be a consistent TRIANGLE pattern. So it must be a Combination type pattern. As I applied the rules I realized it is likely a combination of a FLAT pattern, followed by a ZIGZAG, as below:

This fits things better.

What changes from a predictive perspective is that it means that our current Motive/Impulse wave pattern is Wave #1. Which is great for additional gains, but makes current predictions on price action more difficult.