IMO now is an excellent time to buy J19 LEAPS,

if you believe that we are either at or close to the bottom. Obviously if you think that the SP is likely to drop to $140-$175 it's better to wait.

I bought J19 240's. I feel good about the $240's, but $200-$220's would be much safer though. But please decide for yourself. One tool I use to do that is:

Options profit calculator

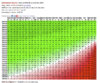

Here is their chart for J19 $240s, purchased for $19.50:

View attachment 203098

The way I use this is to pick a date or dates that I prefer to sell by. A for the J19 LEAPS I used the end of March (Q1) when I'd prefer to roll them, and my personal "worst case" date July-August 2018. I used July-August 2018 because even though I'm highly confident that the M3 will start volume by the end of 2017 I don't want to risk a major amount of money on that, so at the end of March I would make a small profit if the SP is $224 and in July-August 2018 I would make a small profit if the SP is $236. I believe that those are very conservative numbers. I think it's probable that we exceed those numbers based on MS-MX and TE alone.

I believe that $350-$450 is more likely by July-August 2018 than $236 ($450=$19k profit per contract

).

Important Note:

I included my thought process with the hope this will help others reach their own conclusions. Please don't blindly use this as investment advice.