I've found that the problem with selling long-dated puts is that you don't get much benefit relative to short-dated puts. I usually run through the expirations calculating static rates of return. There's typically a sweet spot after which the static rate of return drops off. It varies exactly how far out it is, interestingly; I'm not sure why. Maybe Jonathan Hewiit knows.

The sweet spot is typically the same expiration date for all of the OTM put strikes though.

Here's a long post in reply to your question plus a lot more than you asked for because I thought my answer was incomplete without it and I thought other people could benefit from a more complete answer

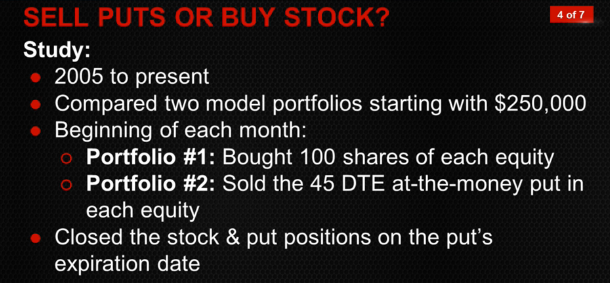

The research I've seen shows that for equities in general, the following parameters over time will give you the best return for writings puts:

1. 45 Days to Expiration

2. 0.3-.35 Delta

3. Higher than normal IV

for that stock

4. Close out at 50% max profit

This data is based solely on statistics and assumes no market timing is involved. It also is an average of all stocks researched and is not customized for TSLA so please use at your own discretion. If one can time the market then it also doesn't apply.

1. 45 DTE is the sweet spot of theta decay, premium received, and minimizing gamma risk. If you look at the graph JBRR posted you can see theta decay is the worst for sellers way way out in time so even if you get a ton of premium it really isn't going away very fast. If you look at the week before expiration it is the best for sellers but you aren't receiving much premium. Your gamma (rate of change of delta) risk is also the highest. This means that while you have really good theta decay a small stock move can easily wipe out all that premium and then some, making what looked like an easy win of a little bit of premium a huge loser.

2. 0.3-.035 delta is the sweet spot for delta because you are far enough from the current stock price that it will expire out of the money but not too far that it doesn't give you any premium. An option with a .3 delta is priced by the market as having a 70% chance of expiring out of the money (1-.3=.7=70%) Also notice that 1 standard deviation is 68%.

3. Higher IV than normal for that stock is important for a few reasons. One is obvious in that higher IV means more premium for the same strike put, or the same premium for a farther out of the money put. The other part is easiest explained by looking at a chart of TSLA's IV over the last year:

If you look at all of the IV spikes you will notice that after the spike IV returns to a more normal value; it is somewhat "mean reverting." You will also notice that generally the IV spikes aren't really long. This means that if you wait for an IV spike to sell a put you have a lot higher chance of winning because by the time your put expires IV may come back down. You should also notice from the chart that Historic Volatility (HV) is lower than Implied Volatility (IV) most of the time. This makes sense as the stock SHOULD actually move less than people think it will, otherwise no one would sell options (aka sell insurance) as they would constantly lose money. It also makes sense that the stock SHOULD move more than people think occasionally, otherwise smart people would never buy options (aka buy insurance).

4. Closing out at 50% max profit is important for a few reasons. One is that statistics show that your probability of having a profitable trade is much higher than the market priced it originally. Remember, the delta is determined by what the market thinks the probability of the option expiring in the money

at expiration. It says nothing about what it's going to do between now and expiration. In other words, once you have 50% of max profit you should take it because it could all be gone and then some between now and expiration. You could say this about any % profit level between 0% and 100% but statistics generally show that 50% is the sweet spot as far as obtaining enough profit that it makes the trade worth taking in the first plate but not too much profit whereas you put yourself close to expiration and end up losing it (gamma risk!!). Another important thing about closing out at 50% max profit is it lets you get your capital back and put on another, possibly higher probability trade. The first 50% profit is generally easier to get than the second 50%. The first 50% was probably easy as IV may have reverted to the mean since you sold the put, or you sold the put when the stock dipped and it bounced, thus removing a lot of the premium from the put. The second 50% you have to hold all the way to expiration and be exposed to Gamma risk. The second 50% is usually not worth holding out for and it's better to open another trade with more favorable odds.

Most of the above info I've learned from TastyTrade.com so sorry if I butchered any of it.

With all this said, I've written long dated puts before for a few different reasons that seemed like a good idea to me (not validated by any statistics, data, learned from anyone else, etc). For example, one reason I've done it before was if TSLA was at a low point/technical resistance and I didn't feel like the 45 day out put gave enough premium but IV was high and I was pretty sure TSLA would be higher by the further out expiration. Another reason was TSLA IV was high and I thought the return over the longer time frame was a lot better than any other opportunities I was looking at, aka best use of my capital for the time and I wanted to "lock in" the higher IV while it was available. I'm not sure if these were the best things to do but they worked out ok for me.

Another thing I've done is write ITM puts with a time frame in the 3-6 month area. This is something I've done a few times when I think TSLA is going on an uptrend. My idea here is that I don't want to pay 7-8% interest to buy stock on margin and I don't want to buy calls that might expire worthless and use funds that could cause me to margin my stock, so I write an ITM put that is way in the money at a medium time frame. By writing a put it puts money IN my account (until I buy back the put) instead of taking it out and putting me on margin. Another big advantage here is if TSLA doesn't go up, stays flat, or goes down a little is that you can still have a profitable trade thanks to the extrinsic value you collect whereas margined stock and long calls NEED the stock to go up to win. There are a few negatives, of course. One is that if TSLA shoots up to your strike and past it then your delta goes down pretty quick and then becomes negligible and you would have done much better if you had bought calls or stock on margin. Another negative is that if TSLA goes up too fast you have to decide whether to take your profits or hope TSLA doesn't drop again while trying to collect more premium via theta decay. This is part of the art of selecting a strike that is high but not too high and far enough out to get some extrinsic value but not too far where your theta decay is really low. Another negative is that will see cash in your account instead of a negative margin balance so you can forget that you are VERY LEVERAGED. Depending on your brokerage there are a few different ways to see how leveraged you are so please do not rely on how much cash is sitting in your account to figure out how leveraged you are. If you are concentrated in one stock with all long positions (stock, long calls, short puts) and it takes a huge drop you can blow up your account really really quick so keep this in mind. I also don't recommend this approach as a large part of your account but part of a balanced strategy of stock, long calls, and puts, with plenty of cash in order to exercise puts if you get assigned.

Hopefully this helps some people with some ideas. Keep in mind that it's not easy. "Options are not for everyone," etc. I'm also definitely not an expert so take all this with a grain of salt and be careful out there.