Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Krugerrand

Meow

Krugerrand

Meow

3Victoria

Active Member

Driver Dave

Member

Sometimes I simply go by:

"Really smart people will do really amazing things for a really smart leader."

This worked for me on APPL

Then worked for me on FB

I'm betting it work again on TSLA.

"Really smart people will do really amazing things for a really smart leader."

This worked for me on APPL

Then worked for me on FB

I'm betting it work again on TSLA.

larmor

Active Member

Also worked for NFLX, and even SCTY in the recent past...Sometimes I simply go by:

"Really smart people will do really amazing things for a really smart leader."

This worked for me on APPL

Then worked for me on FB

I'm betting it work again on TSLA.

TheTalkingMule

Distributed Energy Enthusiast

A lot of time people throw in Amazon as a comparison, especially with regards to valuation.

Here is a good analysis on AMZN's business/financial model. Slightly old but probably mostly relevant.

Why Amazon Has No Profits (And Why It Works)

Here is a good analysis on AMZN's business/financial model. Slightly old but probably mostly relevant.

Why Amazon Has No Profits (And Why It Works)

neroden

Model S Owner and Frustrated Tesla Fan

My valuation model gives a ludicrous range of valuations. But to a first order approximation, it depends on (a) how many cars they can sell per year of model 3 or other high-volume cars, and (b) how many kwh of battery packs per year they can sell. To a second order approximation it depends on the profit margins on these items, but significantly less. The capital costs start being insignificant to the model once the volumes get high enough, even though the company is very capital intensive; this is all about economies of scale, of course.

A lot of time people throw in Amazon as a comparison, especially with regards to valuation.

Here is a good analysis on AMZN's business/financial model. Slightly old but probably mostly relevant.

Why Amazon Has No Profits (And Why It Works)

Don't know how many people appreciated this. But, I couldn't have posted the above link at a better time. Here are a few highlights from the post as they relate to Tesla.

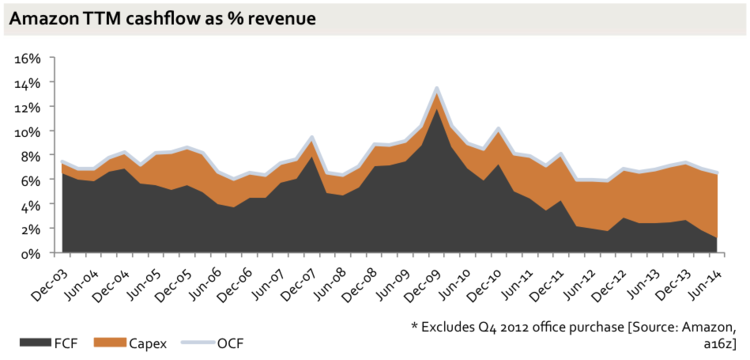

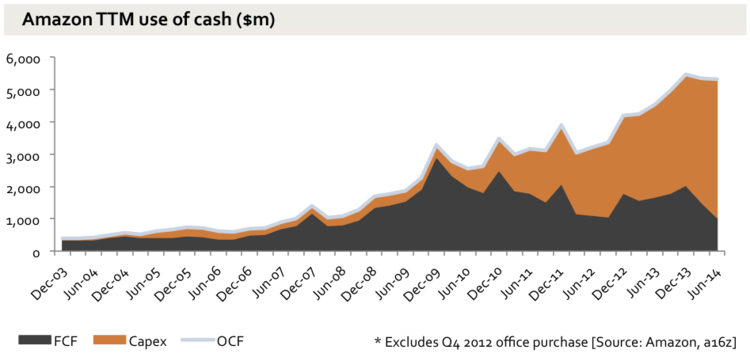

In any case, profits as reported in the net income line are a pretty bad way to try to understand a business like this - actual cash flow is better. As the saying goes, profit is opinion but cash is a fact, and Amazon itself talks about cash flow, not net income (Enron, for obvious and nefarious reasons, was the other way around). Amazon focuses very much on free cash flow (FCF), but it’s very useful to look also at operating cash flow (OCF), which is simply what you get adding back capital expenditure (‘capex'). In effect, OCF is the bulk of running the business before the costs of the infrastructure, M&A and financing costs. As we can see here, Amazon’s OCF margin has been very roughly stable for a decade, but the FCF has fallen, due to radically increased capex.

In absolute terms, you can therefore see a business that is spinning out rapidly growing amounts of operating cash flow - over $5bn in the last 12 months - and ploughing it back into the business as capex.

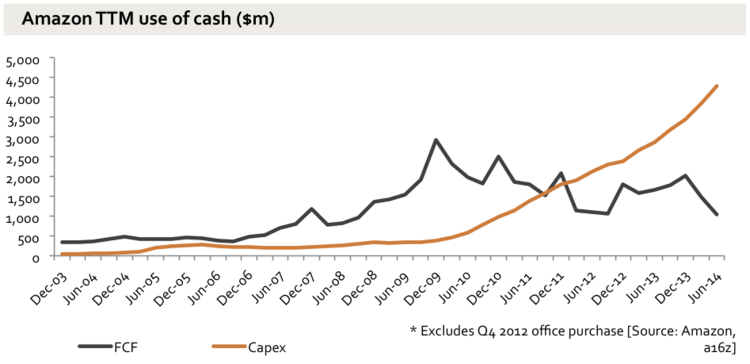

Charting this as lines rather than areas shows just how consistent the growth in capex has been.

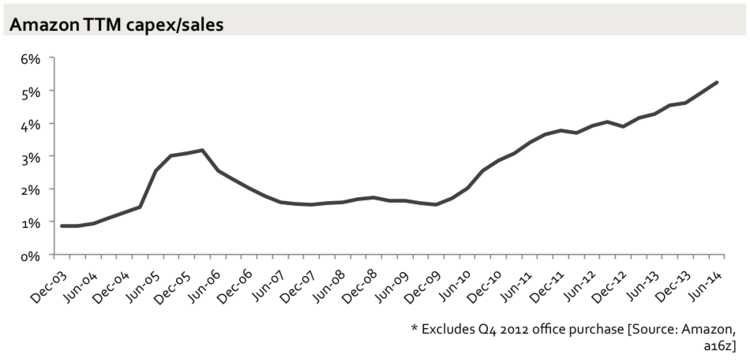

One might suggest that in a logistics business with rapid revenue growth, rapid capex growth is only natural, and one should look at the ratio of capex to sales by itself. But in fact, the increase here is even more dramatic. Starting in 2009, Amazon began spending far more on capex for every dollar that comes in the door, and there’s no sign of the rate of increase slowing down.

Sometimes it is very much lost in media misrepresentation that Amazon grows through loses. It actually grows in an extraordinarily healthy way.

To understand the significance of positive FCF, look at the trajectory of Cash balances on the balance sheets. I posted this earlier in SCTY thread.

Year..........Cash

FY 2015...19,808,000,000

FY 2014...17,415,999,488 <-- Bonds issued $6 Bln

FY 2013...12,446,999,552

FY 2012...11,448,000,512 <-- Bonds issued $2.25 Bln

FY 2011...9,575,999,488

FY 2010...8,762,000,384

FY 2009...6,366,000,128

FY 2008...3,727,000,064

FY 2007...3,112,000,000

FY 2006...2,019,000,064

FY 2005...2,000,000,000

FY 2004...1,779,198,976

FY 2003...1,394,822,912 <-- negligible < $1mln secondary (don't know why)

FY 2002...1,300,969,088

FY 2001...996,584,960

FY 2000...1,100,521,984

FY 1999...706,188,032

FY 1998...373,444,992

FY 1997...125,375,000 <-- Equity raise $54 mln

FY 1996...6,248,000

A growing company needs a growing Cash balance on the balance sheet. Positive FCF helps achieve this growth in Cash balance without forcing the company to go to markets every now and then.

To understand the significance of positive FCF, look at the trajectory of Cash balances on the balance sheets. I posted this earlier in SCTY thread.

Year..........Cash

FY 2015...19,808,000,000

FY 2014...17,415,999,488 <-- Bonds issued $6 Bln

FY 2013...12,446,999,552

FY 2012...11,448,000,512 <-- Bonds issued $2.25 Bln

FY 2011...9,575,999,488

FY 2010...8,762,000,384

FY 2009...6,366,000,128

FY 2008...3,727,000,064

FY 2007...3,112,000,000

FY 2006...2,019,000,064

FY 2005...2,000,000,000

FY 2004...1,779,198,976

FY 2003...1,394,822,912 <-- negligible < $1mln secondary (don't know why)

FY 2002...1,300,969,088

FY 2001...996,584,960

FY 2000...1,100,521,984

FY 1999...706,188,032

FY 1998...373,444,992

FY 1997...125,375,000 <-- Equity raise $54 mln

FY 1996...6,248,000

A growing company needs a growing Cash balance on the balance sheet. Positive FCF helps achieve this growth in Cash balance without forcing the company to go to markets every now and then.

Last edited:

Comparing Amazon and Tesla is an interesting exercise, even if I wonder at the utility of such a comparison.

For sure, Amazon has created a metronome of sales growth. Tesla's growth has been comparatively lumpy. But it's interesting that in the 10th year after sales commenced, both Amazon (2004) and Tesla (2016) will have had ~ $7 billion in sales during that year. Judging by the investments being made, the sales trajectories should diverge from this point, assuming that Musk doesn't break the company in the process.

For sure, Amazon has created a metronome of sales growth. Tesla's growth has been comparatively lumpy. But it's interesting that in the 10th year after sales commenced, both Amazon (2004) and Tesla (2016) will have had ~ $7 billion in sales during that year. Judging by the investments being made, the sales trajectories should diverge from this point, assuming that Musk doesn't break the company in the process.

Last edited:

larmor

Active Member

Interesting comparison with amazon... Amazon, like netflix, FB, google, are basically serving as brokers, amazon for products, netflix for movies, fb/google for data. Tesla is making a product, or with a stretch of imagination, serving as an integrating broker, assembling pieces and reselling, however this assembly process has a higher cost which should translate to higher sales and presumably margins. Vertical integration with solar is unique here in the comparison, maybe amazon would integrate shipping or is working on that with drones. Ebay had the integration with paypal...

so 2016 tsla == 2004 amzn

2016 tsla definitely will beat 2004 amzn in rev

neroden

Model S Owner and Frustrated Tesla Fan

I should warn that high capex is not necessarily good; it all depends on whether it's well-spent. I believe Tesla is making good investments. I don't know about Amazon; they may or may not be. The major oil companies are making *bad* investments with their capex, basically setting money on fire exploring for oil which would cost more to produce than they could sell it for.

The reason I'm uncomfortable with Amazon is precisely because they don't break out much detail on their capex. It could be going into useful expansion, or it could be burned on insane vanity projects of Bezos's, and *investors would not know which*. Amazon's habit of having less and less information in their annual reports each year is suspicious and makes me wary.

Tesla is very clear on where the money is going.

The reason I'm uncomfortable with Amazon is precisely because they don't break out much detail on their capex. It could be going into useful expansion, or it could be burned on insane vanity projects of Bezos's, and *investors would not know which*. Amazon's habit of having less and less information in their annual reports each year is suspicious and makes me wary.

Tesla is very clear on where the money is going.

@Rarity

Revenue growth shows if a company is growing and by how much it is growing.

Cash Flow (FCF or even OCF) shows if growth is healthy or unhealthy.

The above Amazon example shows a very healthy way of growing business.

In comparison, if you ever followed SolarCity, it shows the exact opposite. SolarCity also grew by leaps and bounds but did so in an extremely unhealthy manner. It burnt itself so badly it would have been bankrupt way long ago if not for Musk's heroic rescue in multiple rounds (silverlake deal late last year, personal cash injection in Q3, and finally TSLA merger).

The question we all need to think about is what kind of growth TSLA is executing. Is it healthy or unhealthy.

Growth in itself wont tell you if a company will prosper or if it will crash-and-burn.

Revenue growth shows if a company is growing and by how much it is growing.

Cash Flow (FCF or even OCF) shows if growth is healthy or unhealthy.

The above Amazon example shows a very healthy way of growing business.

In comparison, if you ever followed SolarCity, it shows the exact opposite. SolarCity also grew by leaps and bounds but did so in an extremely unhealthy manner. It burnt itself so badly it would have been bankrupt way long ago if not for Musk's heroic rescue in multiple rounds (silverlake deal late last year, personal cash injection in Q3, and finally TSLA merger).

The question we all need to think about is what kind of growth TSLA is executing. Is it healthy or unhealthy.

Growth in itself wont tell you if a company will prosper or if it will crash-and-burn.

@SBenson

Are you suggesting that the healthiness of growth is determined by keeping the operating cash flow above zero (and how much above zero)? I think this is too constraining, at least as it relates to Musk.

Thought exercise: Should the introduction of Musk's great product ideas be gated by operating cash flow?

I don't think we should fall into the "Tesla loses $x thousand on every car they sell" trap.

Are you suggesting that the healthiness of growth is determined by keeping the operating cash flow above zero (and how much above zero)? I think this is too constraining, at least as it relates to Musk.

Thought exercise: Should the introduction of Musk's great product ideas be gated by operating cash flow?

I don't think we should fall into the "Tesla loses $x thousand on every car they sell" trap.

Last edited:

Similar threads

- Replies

- 1

- Views

- 137

- Replies

- 13

- Views

- 1K

- Replies

- 1

- Views

- 231

- Replies

- 4

- Views

- 2K