Hi all

Where do I find the details of optional final payment if I want to keep my Tesla at the end of the PCP?

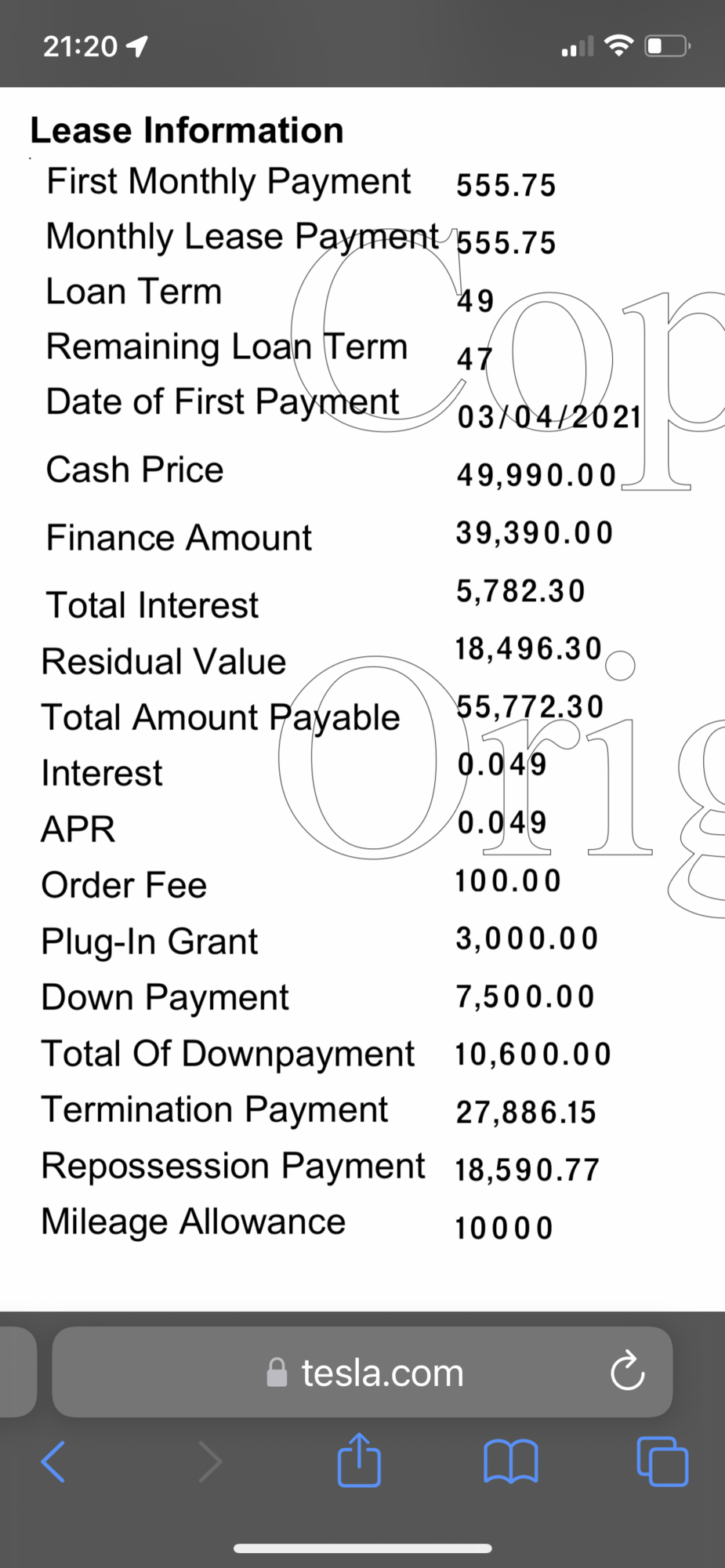

If I look in the Tesla App under the Financing section. There is a Loan Agreement, (see below) but I’m not sure which figure is this final payment?

Also how does it work if I trade in for a new Tesla at the end of the PCP? Will I have any equity on my trade in to apply to the deposit?

Sorry, I can’t find the answer in search.

Many thanks.

Where do I find the details of optional final payment if I want to keep my Tesla at the end of the PCP?

If I look in the Tesla App under the Financing section. There is a Loan Agreement, (see below) but I’m not sure which figure is this final payment?

Also how does it work if I trade in for a new Tesla at the end of the PCP? Will I have any equity on my trade in to apply to the deposit?

Sorry, I can’t find the answer in search.

Many thanks.