Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

insaneoctane

Well-Known Member

OT...but, ummm, aren't those boring tunnels supposed to be a little further below the surface? That video depicts a tunnel that is shockingly close to the surface IMO.

-=buzz=-

Member

I'd blame William Wallace...Guilty.. Not sure why I do that. I could blame it on autocorrect but...yah no.

Cheers.

Have a nice weekend!

Shanghai is back in production after the Chinese New Year shutdown. It seems from the video that they are starting construction to extend some of the buildings. Just about the only space they haven't built on now is the outgoing car loading lot.

J

jbcarioca

Guest

This is not correct. There are no complete knock-down kit (ckd) involved in Grüneheide. We have already had >2000 cars produced there under production testing authorization. We know this is manufacturing, not just assembly, because we have seen the presses in operation and vehicles being produced.…

As for Berlin, I'll be fine if they begin even by Q2. Again, it's got to fit inside Tesla's 30% Auto gross margin goals. Whether that complete knock-down kit is assembled in Germany, or shipped to Germany from Shanghai makes ZERO difference to the total number of cars that Tesla will build in 2022 (and that number shall be 'comfortably over +50% from 2021').

…

CKD does near zero manufacturing, it is only assembly. Factually both new GF’s operations will initially have less vertical integration than they will have at maturity. Thus production at both Austin and Grüneheide is indeed incremental from Shanghai and Fremont.

New factories are not a zero sum game.

Last edited by a moderator:

They do that on porpoise...OT...but, ummm, aren't those boring tunnels supposed to be a little further below the surface? That video depicts a tunnel that is shockingly close to the surface IMO.

To launch/ retrieve the TBM and make ramps to the surface for the cars.

Much faster than the old style of digging a big hole, craning the TBM into it, and reversing the process at the other end.

Prufrock — The Boring Company

In the short term, it is zero sum due to part shortages. Though, the sum is increasing.New factories are nit a zero sum game.

UkNorthampton

TSLA - 12+ startups in 1

UK/Tesla/Leasing

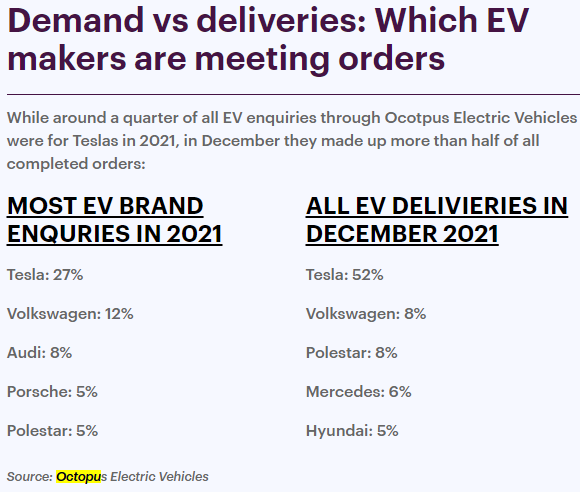

Source: (sorry, it'sDaily Hate "This is Money" - same publisher, similar audience) - Failure to meet EV demand could be 'Kodak moment' for car makers

This is an article based on Octopus Car leasing info.

Spin was that people are enquiring about certain EVs but ended up leasing different ones due to availability, principally Tesla Model 3. Other arguments that Legacy must increase production otherwise people would switch to Tesla purely on wait time.

I think there are many counter arguments/observations

Source: (sorry, it's

This is an article based on Octopus Car leasing info.

Spin was that people are enquiring about certain EVs but ended up leasing different ones due to availability, principally Tesla Model 3. Other arguments that Legacy must increase production otherwise people would switch to Tesla purely on wait time.

I think there are many counter arguments/observations

- People see VW advertising, enquire, get a shortlist, then do further research and DECIDE that Tesla is better option.

- Legacy advertising drives Tesla sales

- Whole of 2021 enquiries compared to December 2021 deliveries (last month in quarter), so Tesla deliveries should be double average enquiry rate due to delivery wave

- Nice way to nudge legacy to deliver more to Octopus/UK. If Octopus are known as the ones getting in the media, they might have extra clout in getting cars.

- Legacy are struggling to deliver EVs

- Leaseplan Uk say 12 month wait for VW ID 3, 4, 5 and same for other brands

- Open goal for Tesla if they can produce and ship cars to UK (other markets the same, so competition for supply)

- Daily Hate/Fail comments mostly anti-EV but with some pro-EV replies. Over time this ratio is improving. I read another Daily Fail article recently that was overwhelmingly pro-EV in the comments. I was shocked, shocked I tell you!

Yet, despite its staggering sales lead, Octopus Electric Vehicles says customers have been showing an increasing interest in Tesla alternatives during the last year.

According to the leasing company, more than two in five of all EV enquiries it received in January 2021 were for Teslas. However, that dropped to just 17 per cent in the final month of the year.

On the flipside, VW saw interest increase from 1 per cent to 12 per cent in the 12-month period, while Audi requests grew from 5 per cent to 12 per cent.

Enquiries for Polestar cars, the EV-only off-shoot of Volvo, also gained from 7 per cent in January 2021 to 10 per cent by December.

But even with this shift in favour of mainstream brands, long lead times caused by the semiconductor shortage means customers are reverting back to Tesla, which continues to buck the industry in terms of meeting deliveries.

Last edited:

Featsbeyond50

Active Member

Guys, we're having a recession.Corey thinks we are in a bear trap currently and that SPY and QQQ will be testing higher resistances over the next two weeks or so...YMMV

If you don't believe Elon, believe your finances. Compare you're cost of living for 2021 vs 2020. I spent the last 6 months hearing 6-7% inflation, didn't like it but brushed it off as not that bad.

I just added up my families spending for 2021 and was shocked to see it went up by $14,500 with no vacations and no big purchases. Same husband, same wife, same 3 kids doing the same activities. In 2020 we bought a new fence. Back that out and our spending went up $20,000 which for us is a 20 percent cost of living increase. Other people are crunching the numbers the same way I just did and they are shocked the same way I am. In my opinion, this will lead to a lot of people cutting back on spending which will lead to recession.

TheTalkingMule

Distributed Energy Enthusiast

You've spent a lot more and that leads you to believe you'll soon be spending less? What you're observing is inflation. IMO its mostly transitory, but opinions differ.Guys, we're having a recession.

If you don't believe Elon, believe your finances. Compare you're cost of living for 2021 vs 2020. I spent the last 6 months hearing 6-7% inflation, didn't like it but brushed it off as not that bad.

I just added up my families spending for 2021 and was shocked to see it went up by $14,500 with no vacations and no big purchases. Same husband, same wife, same 3 kids doing the same activities. In 2020 we bought a new fence. Back that out and our spending went up $20,000 which for us is a 20 percent cost of living increase. Other people are crunching the numbers the same way I just did and they are shocked the same way I am. In my opinion, this will lead to a lot of people cutting back on spending which will lead to recession.

Look at gas prices. Right now oil is at $92, IMO it'll be at $20 by the 4th of July. If you don't believe me, look around at home Wall Street is trading in every other market.

J

jbcarioca

Guest

That would be true if parts shortages were identical in all locations of Tesla manufacturing. That manifestly is not so. There are definitely some shortages everywhere but not equally.In the short term, it is zero sum due to part shortages. Though, the sum is increasing.

Featsbeyond50

Active Member

LOL, no, unfortunately we won't be spending less. I'm already cheap as hell and when I ask my wife to cut back she dutifully agrees, then goes right back to doing exactly what she wants to do. A lot of other people will cut back though. Some of them out of necessity. Keep in mind the covid relief package expired too (probably good for the long term but not the short term).You've spent a lot more and that leads you to believe you'll soon be spending less? What you're observing is inflation. IMO its mostly transitory, but opinions differ.

Look at gas prices. Right now oil is at $92, IMO it'll be at $20 by the 4th of July. If you don't believe me, look around at home Wall Street is trading in every other market.

-=buzz=-

Member

And if you're expecting shortages to ease shortly, it's better to have 4 plants running half loaded/single shift, than two going full tilt and two shutdown cold.That would be true if parts shortages were identical in all locations of Tesla manufacturing. That manifestly is not so. There are definitely some shortages everywhere but not equally.

Recession does not mean bear market. 2020 economy shutdown had dramatic negative gdp numbers and yet biggest bull market in human history.Guys, we're having a recession.

If you don't believe Elon, believe your finances. Compare you're cost of living for 2021 vs 2020. I spent the last 6 months hearing 6-7% inflation, didn't like it but brushed it off as not that bad.

I just added up my families spending for 2021 and was shocked to see it went up by $14,500 with no vacations and no big purchases. Same husband, same wife, same 3 kids doing the same activities. In 2020 we bought a new fence. Back that out and our spending went up $20,000 which for us is a 20 percent cost of living increase. Other people are crunching the numbers the same way I just did and they are shocked the same way I am. In my opinion, this will lead to a lot of people cutting back on spending which will lead to recession.

A minor recession right now imo will do wonders to inflation which may keep feds from doing crazy things. This is most likely will be well received by the market.

Featsbeyond50

Active Member

I agree with this and I hope it's followed up with the other deflationary pressures that get talked about so much. In this case, I think the stock market will also have a recession though.A minor recession right now imo will do wonders to inflation which may keep feds from doing crazy things.

Both operating plants are running under capacity due to shortages. If Berlin and Austin use the same supply base and components, then parts sent to them are no longer going the Shanghai or Fremont.That would be true if parts shortages were identical in all locations of Tesla manufacturing. That manifestly is not so. There are definitely some shortages everywhere but not equally.

Only if the union of the set of surplus parts from both regions is sufficient for a complete vehicle and Tesla crossships parts would it not decrease existing manufacturing, or Berlin/Austin have unique suppliers/ part versions that can't be used to fill shortages in existing production.

Agree that running the Berlin and Austin lines is a good thing, even though it will reduce production at Shanghai & Fremont. However, no plant is going full tilt now (due to lack of parts), that's why added production capacity cannot increase production (zero sum).And if you're expecting shortages to ease shortly, it's better to have 4 plants running half loaded/single shift, than two going full tilt and two shutdown cold.

The stop must be long enough so that if there is a policeman there you don't get a ticket.Makes me wonder. To what standard do you need to "stop". 0 mph for 1 ms? 100ms (0.1 second)? 500ms (0.5 second)? 1 second? Is it enough to get the ABS sensor to say the tire stopped moving or are you going to have to hold for some externally observable amount of time?

Can we have a quick/short/low duration stop setting if we can't have a rolling stop setting?

How to Boost the Price of Your Tesla? Drive It Off the Lot

Used models can sell for more than new ones. But parting with a used Tesla comes with side-effects: marital tension, a sense of loss.

For your reading pleasure. Don’t you all go out and sell all at once.

BTW, bullish AF.

A minor recession that is fixing inflation while having full employment does not sound like some kind traumatic event to the economy that causes a bear market. In fact this is literally fixing the economy, not causing harm.I agree with this and I hope it's followed up with the other deflationary pressures that get talked about so much. In this case, I think the stock market will also have a recession though.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K