So Tesla sales can only grow 13x is what you’re saying? (And attitudes will not be frozen in place.)

Tesla’s Brand Is Tanking, Survey Finds

New research from Morning Consult finds the EV brand’s image has plunged in the months following CEO Elon Musk’s acquisition of Twitter—especially with U.S. adults who identify as Democrats.www.forbes.com

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

-

Tomorrow at 1PM PDT we will be discussing the latest Tesla Shareholder Meeting on the TMC Podcast. You can watch live on YouTube or X and participate in the chat.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Pretty interesting change going from 3 to 2 front cameras. Before they had long range narrow camera for detecting vehicles far away, the wide camera to detect vehicles near with a wide angle and the main forward camera for middle range improvements. My guess is that Tesla decided that with their new autolabeled 4D dataset the forward wide camera is good enough at the middle range also.

It might be hard to get good labels for the wide forward camera in the image space, but in 4D space it will be a lot easier to generate the labels. Then the question is if the neural network can see good enough in the images to predict the correct labels. With photon count super human detection will be possible, this likely extends the range of the camera somewhat.

Also by increasing the resolution(which has been rumoured) they will effectively increase the range.

Basically the main forward and the radar is elimated and the wide forward will have some extended range thanks to software. The loss will be the blue area outside of the grey area.

Or in image space, the "in between" image quality gain will be sacrificed and it will look the the image quality around it:

(for more examples and source, see this thread)

I am not sure, but I think the narrow long range camera will also get a wider field of view. This will negatively impact the long range performance, but increasing the resolution will improve it. Thus the image in the center will expand somewhat. I think Tesla has figured out a good tradeoff here, they know how many hundred meters forward they need to be very accurate and would not do this change if it risked introducing significant risks.

Also with memory the neural network will have remembered what it saw in the high zoom middle image as it moves forward, I guess that will help a lot. So basically using memory to zoom out from the narrow forward camera.

What they are left with is one less sensor that can fail, less power consumption, less data to process and one less part. The best part is no part.

In hindsight this change makes a lot of sense.

It might be hard to get good labels for the wide forward camera in the image space, but in 4D space it will be a lot easier to generate the labels. Then the question is if the neural network can see good enough in the images to predict the correct labels. With photon count super human detection will be possible, this likely extends the range of the camera somewhat.

Also by increasing the resolution(which has been rumoured) they will effectively increase the range.

Basically the main forward and the radar is elimated and the wide forward will have some extended range thanks to software. The loss will be the blue area outside of the grey area.

Or in image space, the "in between" image quality gain will be sacrificed and it will look the the image quality around it:

(for more examples and source, see this thread)

I am not sure, but I think the narrow long range camera will also get a wider field of view. This will negatively impact the long range performance, but increasing the resolution will improve it. Thus the image in the center will expand somewhat. I think Tesla has figured out a good tradeoff here, they know how many hundred meters forward they need to be very accurate and would not do this change if it risked introducing significant risks.

Also with memory the neural network will have remembered what it saw in the high zoom middle image as it moves forward, I guess that will help a lot. So basically using memory to zoom out from the narrow forward camera.

What they are left with is one less sensor that can fail, less power consumption, less data to process and one less part. The best part is no part.

In hindsight this change makes a lot of sense.

Last edited:

FSDtester#1

Large Member

Another member brought this up earlier. I don't think we will know for sure what exactly the facts are for now. They could be stating that they have a right to the credits, however I haven't seen them mention Tesla specifically. Could they meanHere is the conflict:

In the Supply agreement, it appears that credits for taxes go to Tesla:

View attachment 895588

. . but Panasonic in their quarterly earnings call, seemed to indicate the benefits were theirs:

View attachment 895590

with other manufacturers they supply to besides Tesla? Does the contract they signed with Tesla override this language? Would perhaps they only get credits from sales with Tesla from storage or Megapacks? I don't think we may know until the Q1 2023 earnings release, and maybe not even then. I guess it does take an @The Accountant to figure this stuff out for us!!

EVNow

Well-Known Member

GM is going down … but total marginal profit is going up. Two different things …

/cloudfront-us-east-2.images.arcpublishing.com/reuters/2TCDF4MXDFJ3HLPFXGXNCWFDGU.jpg)

Tesla turns up heat on rivals with global price cuts

The move marks a reversal from the automaker's strategy over the last two years when new vehicle orders exceeded supply.

This is too bullish for Reuters own writing, they probably were hacked

EVNow

Well-Known Member

As I wrote earlier , in US there is simply no battery storage supplier who has better prices.Don't get your hopes up too much - I am being polite. I think that for everything except utility scale storage the signal in the data is already clear.

And also, this is not just about the energy division. Again the real signal is what it tells us about corporate governance issues, something that goes right back to SolarWorld acquisition.

But I am always open to learning from new data.

I’m talking about something an electrician will install and warrantee. Not buying off internet and doing everything yourself … even in that, there aren’t that many choices. For eg ecoflow from Amazon costs about the same.

Would be happy to try out anyone who you can point me to with better prices, since Tesla won’t sell me powerwalls without solar.

FSDtester#1

Large Member

Tesla will be happy to sell you a powerwall without solar as soon as they get caught up on their backlogs, according to EM on the bird thingy. I believe he said starting in 2023, so with my Elon conversion ratio, be ready for your powerwall in 2025?As I wrote earlier , in US there is simply no battery storage supplier who has better prices.

I’m talking about something an electrician will install and warrantee. Not buying off internet and doing everything yourself … even in that, there aren’t that many choices. For eg ecoflow from Amazon costs about the same.

Would be happy to try out anyone who you can point me to with better prices, since Tesla won’t sell me powerwalls without solar.

Artful Dodger

"Neko no me"

the IRA was written to be climate friendly, job friendly, and consumer friendly.

Uh, no, PHEVs aren't "friendly" when most owners never plug them in, power them with gasoline only, and drag around 200 lbs of batteries which are rarely charged from the grid. PHEVs are a boondoggle which might have made sense in 2010, but certainly does not in 2023 (or 2033, which is the planned life of IRA). Nope.

Artful Dodger

"Neko no me"

W-what's this? hell frozen over? CNBC is going to discuss (quote) "the falling stocks of legacy automakers in the light of yesterday's major announcement by Tesla" - gulp!!! Coming up some time in the next hour.

Riddle me this:

Q: What walks on four legs in the pre-Market, two legs during the day, and three legs After-hrs?

A: Jimmy Chill.

Artful Dodger

"Neko no me"

So, in light of these price cuts, just how ramped up are Austin and Berlin right now and into the near future?

WRT Giga Berlin, we learned last month that the 3rd shift is scheduled to begin production in mid-January, which should take production up to 4,500 very quickly (then 5+ K presumably in H1?).

It was later made clear that the Dec start was for logistics, and the start of 3rd Shift production would be mid-January. The 2nd Assembly line will need to be commissioned to take GF4 to 10K / week. Perhaps by H2, or maybe end of year?

Based on that and other factories, sounds like Tesla will have the capacity to make 2M vehicles this year should it want to? Assuming something else doesn’t happen to derail things.WRT Giga Berlin, we learned last month that the 3rd shift is scheduled to begin production in mid-January, which should take production up to 4,500 very quickly (then 5+ K presumably in H1?).

It was later made clear that the Dec start was for logistics, and the start of 3rd Shift production would be mid-January. The 2nd Assembly line will need to be commissioned to take GF4 to 10K / week. Perhaps by H2, or maybe end of year?

Artful Dodger

"Neko no me"

Based on that and other factories, sounds like Tesla will have the capacity to make 2M vehicles this year should it want to? Assuming something else doesn’t happen to derail things.

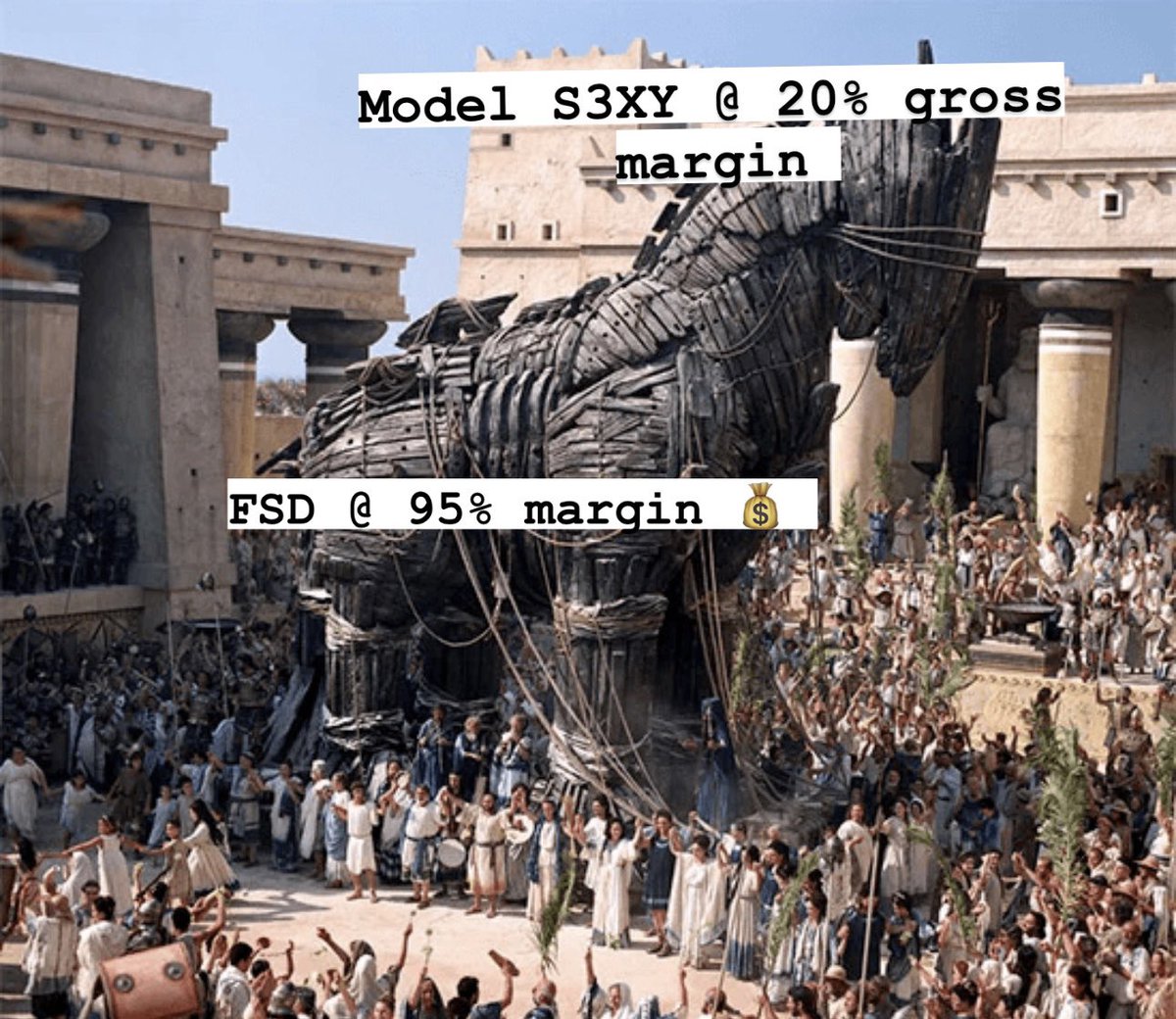

Well, I'd say capacity will be more like 2.2M+ for 2023, but yeah, it's a Trojan Mule kick-to-the-head for Ottoman's.

Artful Dodger

"Neko no me"

Yeah 4D chess.

- If it’s changed to specifically to target Tesla, that’s going to generate legal action and tremendous positive publicity for Tesla.

- If it’s changed to cut subsidies across the board, then the other guys are screwed because they need those dollars to stay even remotely competitive.

- If it’s not changed, then Teslas are crazy cheap.

Actually, I think that's a game of "Rock, Paper, Scissors"...

Cheers!

So I’m late to the game and about 19,700 pages behind in this thread, but the massive price cuts stunned me and gave me interest in TSLA for the first time in 2 years. There is no money for any car manufacturer to make in the US market after this bold move by Tesla. I’m shocked at how much they’ve been able to reduce production costs. I picked up a few shares earlier today but I want to give this stock an appropriate amount of investment. I’ve read a few dozen latest pages to get up to date on this thread’s sentiment, but I didn’t see any figure on PT. What do we think would be a realistic target for TSLA in the next 2 years?

GreenDriver

Member

First time I've felt optimistic in a long time. Real happy. Such a bold, audacious, brazen, assured, brave, confident, courageous, daring, dashing move. There's hope after all.

Dikkie Dik

If gets hard, use hammer

Insightful post by Mathias on prices now versus 2021:

A good way of getting up to speed is to read through @The Accountant and @Gigapress posting history. TMC’s @FrankSG has a blog that I point people to when they express interest in learning more about TSLA.So I’m late to the game and about 19,700 pages behind in this thread, but the massive price cuts stunned me and gave me interest in TSLA for the first time in 2 years. There is no money for any car manufacturer to make in the US market after this bold move by Tesla. I’m shocked at how much they’ve been able to reduce production costs. I picked up a few shares earlier today but I want to give this stock an appropriate amount of investment. I’ve read a few dozen latest pages to get up to date on this thread’s sentiment, but I didn’t see any figure on PT. What do we think would be a realistic target for TSLA in the next 2 years?

In terms of price target, I feel like I have a better idea of where the stock might be in 2030 than where it might be next week.

I’ll take Clueless for $1000, Alex.

Toyota’s CEO Akio Toyoda says we need to convert existing cars to EVs and hydrogen — just selling new EVs isn’t enough.

He showed off a demo of two vintage AE86 hatchbacks converted to hydrogen and BEV drivetrains.

Toyota’s CEO Akio Toyoda says we need to convert existing cars to EVs and hydrogen — just selling new EVs isn’t enough.

He showed off a demo of two vintage AE86 hatchbacks converted to hydrogen and BEV drivetrains.

ZenRockGarden

Active Member

Insightful post by Mathias on prices now versus 2021:

That's an interesting visual, which kinda makes one step back and see that a result of the price changes is it makes the range of Tesla models scale more smoothly as you go up the lineup. That could make some marketing sense.

Last edited:

I made another super inaccurate chart to illustrate just what happened to Teslas margins over the past few months, why margins are restored to where they were in middle of 2022, and how they will climb back up to where they were in late 2021.

Tesla’s margins dropped initially due to Tesla opening their new factories early in 2022, Musk called those factories money furnaces initially and they burned cash for much of 2 quarters with fairly low production. Tesla’s Shanghai COVID debacle added insult to injury there. But during most of 2022, price hikes were slowly kicking in which largely offset that hit. Then once those factories starting producing in volume, margins started climbing fast.

At the same time, commodities and shipping prices came down a lot too. Tesla’s prices were sky high and their materials costs were way down from their highs and near the levels they saw in 2020.

Then finally, at the first of the year, the IRA Manufacturing rebate kicked in and broke my chart. That’s a ~$3600 bonus to Tesla’s bottom line. At retail, thats absolutely massive.

Tesla’s price chop was just reflecting the massive reduction in costs they’ve seen over the past 9 months or so. I suspect Margins for 4th Q will be quite good in spite of the discounting that happened. Teslas new factories aren’t even at half of capacity though. The next year we should see continued improvements in margins until Cybertruck comes online and margins will dip temporarily again.

PS: The chart is generally accurate but specifically wrong so don’t call me out on it unless you disagree with the premise. I know the timeline is crap.

Tesla’s margins dropped initially due to Tesla opening their new factories early in 2022, Musk called those factories money furnaces initially and they burned cash for much of 2 quarters with fairly low production. Tesla’s Shanghai COVID debacle added insult to injury there. But during most of 2022, price hikes were slowly kicking in which largely offset that hit. Then once those factories starting producing in volume, margins started climbing fast.

At the same time, commodities and shipping prices came down a lot too. Tesla’s prices were sky high and their materials costs were way down from their highs and near the levels they saw in 2020.

Then finally, at the first of the year, the IRA Manufacturing rebate kicked in and broke my chart. That’s a ~$3600 bonus to Tesla’s bottom line. At retail, thats absolutely massive.

Tesla’s price chop was just reflecting the massive reduction in costs they’ve seen over the past 9 months or so. I suspect Margins for 4th Q will be quite good in spite of the discounting that happened. Teslas new factories aren’t even at half of capacity though. The next year we should see continued improvements in margins until Cybertruck comes online and margins will dip temporarily again.

PS: The chart is generally accurate but specifically wrong so don’t call me out on it unless you disagree with the premise. I know the timeline is crap.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K