No. Not every feeble lie need be addressed. That article literally claims that a bad picture of a supercharger is a "warning notice".tsla needs to release a statement asap ...

Inane AF

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

No. Not every feeble lie need be addressed. That article literally claims that a bad picture of a supercharger is a "warning notice".tsla needs to release a statement asap ...

The problem is the many buyers who can normally only afford a $25k-$30k car and who are already straining their finances to get a $35k Tesla. For them a $40k car is simply not an option - and they possibly wouldn't get the loan to begin with.

Here's the typical annual household income distribution in the UK (U.S. IRS data is way too coarse unfortunately, but it's similar):

As we can see it on the histogram, "mean" and even "median" income levels don't give a real picture of income distribution: the best figure is "modal" income (not depicted), the peak of the histogram, which is about 65% of "mean" and 80% of "median".

U.S. median disposable income is around $31k, the "modal" max is probably around $25k. For most people the prudent "affordability limit" is around 100% of their annual disposable (post tax) income, and this is roughly how far their banks will allow their car loans to stretch as well.

A lot of people in the $25k-$35k income bracket (~20% of the population) are probably straining to get a Model 3 (giving /r/personalfinance a collective heart attack), and for them the $35k entry price is a godsend.

Put differently: due to the non-even distribution of income, every $1,000 reduction in the entry price moves about +2% more of all car buyers into the "affordability range" of the least expensive Tesla.

In the U.S. alone that's ~2 million more households that can afford a Tesla - and those households alone are buying 300,000 cars per year on average (!).

These entry price reductions are expanding Tesla's addressable market enormously.

My hypothesis is that all available March Model 3 production and most of inventory got ordered already by the time Elon tweeted the Model Y reveal.

He'd not risk Osborning Q1 Model 3 sales without having a firm idea about SR and SR+ induced sales.

That article feels incredibly fake

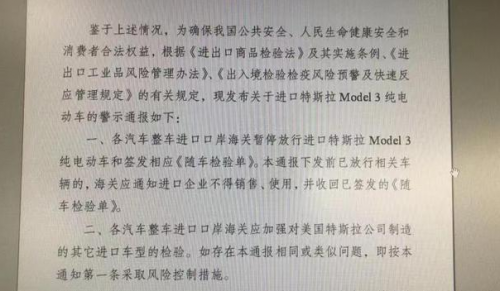

No. Not every feeble lie need be addressed. That article literally claims that a bad picture of a supercharger is a "warning notice".

Inane AF

"jqknews is a news media from China, with hundreds of translations, rolling updates China News, hoping to get the likes of foreign netizens."That article feels incredibly fake

Even in Chinese standards it looks fake, fake of fakes?That article feels incredibly fake

'course it does. Adam Janus/MorganStanley set the price on Feb 28: $283.The information flow is positive, the price action makes no sense.

Some sort of sabotage to nullify bullish news

Volume is monstrous. Some hedge funds/tutes calling it quits it seemsPerhaps it's just MMD?

They're really that short sighted and ready to accept a loss?Volume is monstrous. Some hedge funds/tutes calling it quits it seems

If true, this roughly can impact half the deliveries for Jan, Feb production ... hence better to clarify.

They're really that short sighted and ready to accept a loss?

What loss? TSLA's been at this price level, more or less, for five years now.They're really that short sighted and ready to accept a loss?

Volume is monstrous. Some hedge funds/tutes calling it quits it seems

Yeah. Some people view the risk differently. I can totally see the (sane) bears argument regarding financials, closing stores etc. Plus the stock has basically done nothing since September 2014.They're really that short sighted and ready to accept a loss?