Yup, Americans feel there's some kind of oversight by US executives or federal agencies when it's an US brand manufactured in China. People think this oversight doesn't exist if it's an actual product made and branded by the Chinese.There’s a difference between manufactured in China and have the brand be Chinese. Those two are fundamentally two different things and the facts are - one of those sells a lot in the US and the other doesn’t

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Nobody complains that Volvo is Chinese owned. Few people even know it.There’s limits. Polestar is relatively unknown. US consumers could easily fall for the notion that its Swedish made and not really bother to look into it because there’s no association there.

Something like Dodge/RAM is too much name recognition for the Chinese to buy. It would kill whatever value the brand has the moment the public becomes aware that Dodge is owned by the Chinese. It todays age where things like this can be put in the spotlight in the matter of minutes, no way a Chinese company could get away with that

Most people don't even know Dodge/ Ram are no longer US owned brands.

It's possible people will get up in arms because the Chinese bought them out, but they've changed hands so many times I doubt it.

I bet most folks buying new Volvos know about the Chinese ownership. It just doesn't particularly bother them.Yes I said this is the only way. The Chinese needs to disguise themselves as anything but Chinese in order to make a dent in the U.S. Volvo is now owned by the Chinese..but how many people knows that? Collaboration or joint venture means reduced margins. Piggybacking onto well known brand power is not free for either party.

StarFoxisDown!

Well-Known Member

Very different consumer base between Volvo and Dodge.Nobody complains that Volvo is Chinese owned. Few people even know it.

Most people don't even know Dodge/ Ram are no longer US owned brands.

It's possible people will get up in arms because the Chinese bought them out, but they've changed hands so many times I doubt it.

But the argument here, at least from what I’ve seen in the last page or so is about a Chinese branded car…..one that’s a made in China and branded as Chinese like Nio succeeding in the US market. People can list off that Korean and Japanese were successful and some would say those countries were viewed more favorably in terms of quality. But in reality, it was the market dynamics that helped the Japanese/Korean auto makers get a foothold in the US market……in that they were able to introduce compact sedans at a cheaper price than US auto makers could at the time

Chinese auto makers won’t enjoy that luxury. Thanks to first mover status by Tesla, the proper investments, and the scale of Tesla, they’re not going to be able to undercut Tesla and they definitely can’t flood the US market with volume over Tesla. Given a choice, I don’t see the US consumer choosing a Nio over a Tesla, especially when there’s no pricing advantage for the Nio

Last edited:

ZeApelido

Active Member

Amusing China related story: I worked for Huawei up until Trump basically banished them in 2019. I was then able to roll over that 401k account into a self directed IRA and all into TSLA.

Combining that with the performance bonuses I got that also went into TSLA, Huawei and Trump alone probably made me a Teslanaire.

I’m very amused!

Combining that with the performance bonuses I got that also went into TSLA, Huawei and Trump alone probably made me a Teslanaire.

I’m very amused!

WADan

Member

Don’t forget the geopolitical environment. The western world seems to be united against the China intent on world domination and their bullying Asian countries. It’s hard to imagine the US would be completely open to Chinese car companies without severe tariff.Umm... the most popular phone in the US is Chinese made.

It's called the iPhone.

I don't think the Chinese brands are going to have as much trouble making it in the US as you seem to think they will. The Polestar is owned wholly by Geely and the auto media seems to love them.

Even if Chinese *brands* don't make it in the US, there will almost certainly be a massive Chinese presence in the battery industry as many companies will turn to BYD or other Chinese companies for batteries.

It doesn't matter if it says "Toyota" on the outside if it's BYD on the inside and the profits are flowing to China.

Again, *how would people even know*.Very different consumer base between Volvo and Dodge.

But the argument here, at least from what I’ve seen in the last page or so is about a Chinese branded car…..one that’s a made in China and branded as Chinese like Nio succeeding in the US market. People can list off that Korean and Japanese were successful and some would say those countries were viewed more favorably in terms of quality. But in reality, it was the market dynamics that helped the Japanese/Korean auto makers get a foothold in the US market……in that they were able to introduce compact sedans at a cheaper price than US auto makers could at the time

Chinese auto makers won’t enjoy that luxury. Thanks to first mover status by Tesla, the proper investments, and the scale of Tesla, they’re not going to be able to undercut Tesla and they definitely can’t flood the US market with volume over Tesla. Given a choice, I don’t see the US consumer choosing a Nio over a Tesla, especially when there’s no pricing advantage for the Nio

Polestar didn't exist as a brand in the US 10 years ago. Or at least I never heard of it. Yet here is is getting piles of press and not a peep from the auto media about it being Chinese owned. Likewise, Volvo. The auto media still treats them as a Swedish brand.

I'm not overly worried about the Chinese taking over the American market, but not because of branding. I don't think the Chinese will be able to compete with Tesla on price/ features, the Supercharger network, etc.

I strongly suspect we'll have a fairly strong Chinese presence in the US auto market in the form of brands like Volvo and Polestar, but they will be taking share from VW and GM more than Tesla.

StarFoxisDown!

Well-Known Member

Last time I checked Polestar hasn’t sold diddly squat in the US. They can pay off as much media coverage as they want, they still have to prove demand for their cars on a mass scale.Again, *how would people even know*.

Polestar didn't exist as a brand in the US 10 years ago. Or at least I never heard of it. Yet here is is getting piles of press and not a peep from the auto media about it being Chinese owned. Likewise, Volvo. The auto media still treats them as a Swedish brand.

I'm not overly worried about the Chinese taking over the American market, but not because of branding. I don't think the Chinese will be able to compete with Tesla on price/ features, the Supercharger network, etc.

I strongly suspect we'll have a fairly strong Chinese presence in the US auto market in the form of brands like Volvo and Polestar, but they will be taking share from VW and GM more than Tesla.

And I touched on the 2nd part of your post in the post you quoted me on. No one can match Tesla on scale and volume and due to Tesla’s current scale, they would need to be posting growth rates of 5-10X Tesla’s just to keep pace and not fall further behind.

And back to our regular channel….Don’t waiver. HODL.

www.entrepreneur.com

www.entrepreneur.com

3 Stocks That Are Ready to Rip in 2022 | Entrepreneur

Whether you are interested in stocks that have pulled back significantly from their highs or market leaders that could continue running higher next year, there are plenty of intriguing opportunities...

Last edited by a moderator:

If folks haven't found @Papafox amazing posts, or even if you have, you'll really want to check out the latest: Papafox's Daily TSLA Trading Charts

As always, great insights for the coming week!

As always, great insights for the coming week!

StealthP3D

Well-Known Member

We have been here before.

Japan took over the World Auto industry in the 1980s with their efficient, well made and reliable vehicles in response to laggard American auto manafacturers resting on their laurels.

The 2020s will have China EVs and Tesla take over the World Auto industry with their electric propulsion, computing prowness for autonomous driving and safety, in response to the laggard American, German and Japanese ICE auto manufacturers resting on their laurels.

Based on all we have seen to date, this is as certain as the sun coming up tomorrow.

The adoption of EV's is going to be a lot faster than many expect but China dominance will take a long time (if it happens at all).

I see some incomplete thinking going on here. Japanese brands made rapid inroads because domestic makers lagged in many areas. Specifically, the big three lagged in ICE technology, manufacturing skill (quality) and cost of manufacture (a big factor) and didn't have the high MPG solutions consumers wanted when the oil embargo happened. The later competition from Koreans (and others) had some success due to cost of manufacturing advantages but they did not gut sales like the Japanese cars did. The big three were vulnerable to disruption in a way that Tesla is not.

The dynamics now are very different. In order to make big inroads into the N. American market, Chinese EV makers will need to establish supply and service networks and that takes years. More importantly, they will need to ramp production beyond levels that can absorbed in China and all other markets more convenient to China. That's going to take a lot of time considering the likely fast rate of EV adoption globally. It's more profitable to sell the cars they can make closer to home as long as those markets have not become saturated yet. They will also need to establish brand recognition and trust, something Tesla started doing over a decade ago.

Another factor with consumer trust is that the state of modern EV technology is still in its infancy relative to ICE technology in the 1970's, 80's and 90's. Catching up to Tesla is a fast-moving target that Japanese and Korean manufacturers didn't have to contend with because domestic makers were stagnant. Innovation for them was a bigger engine or new styling every year. The Koreans could copy Japanese ICE technology that was a few years old and still have a modern product. EV technology that is even three years behind the leader must sell at a discount. The consumer doesn't know how long the batteries will last or what the resale value will be. This means the imports will need a lower cost of manufacture to make inroads. It might not be as easy to compete on price with Tesla in N. America as one might assume, simply because they are manufactured in China (which is actually a disadvantage in many ways). Even Polestar doesn't have but 4 locations in N. America and they were one of the first Chinese companies with eyes on N. America.

I think the Chinese will likely be very successful auto makers, even globally, but I would caution against thinking big inroads into Europe and USA could happen quickly - they need to ramp fast enough to meet the quickly growing demand of local markets and, even in those home markets, they will need to produce at a lower cost than Tesla to gain market share which is far from a given if you want to compare products that are comparable. Expanding globally will take a decade or more to become a force to be reconned with. In the interim the market is wide open for Tesla to continue to expand. Tesla is constantly lowering the cost to produce. Comparing this situation to that of foreign ICE compacts in the '70's, 80's and '90's will not turn up many parallels.

Having worked with computer vision I can tell you: stereo is overrated.I often wonder about human ability to see depth from context vs 3d. One eye is all I need to drive - mono vision. This could be a challenge for Tesla vision as we notice creeping for turning seems challenging. It needs to move to get depth until it’s out on the road in some cases.

Most information are encoded in things like shadows, lighting, edges and most importantly: world knowledge.

You KNOW A fly can't be 3m big but must be sitting on the camera. You know the height of a stop sign and can guess the height of objects behind an next to it.

You know if a car appears x height it should be y away - because the all have nearly the same sizes.

Stereo makes things way more complicated for little to no gain. That's why Tesla's don't have 2 identical cameras, but 3 different looking ahead (fisheye, narrow & far)

Depth from image (not stereo or video. Single static image) is a well-established research area

And it usually works better than humans.

404s for meAnd back to our regular channel….Don’t waiver. HODL.

MC3OZ

Active Member

I've posted here many times that I expect tariffs and some consumer skepticism about Chinese EV brands.Don’t forget the geopolitical environment. The western world seems to be united against the China intent on world domination and their bullying Asian countries. It’s hard to imagine the US would be completely open to Chinese car companies without severe tariff.

But the counter argument is that the Chinese EVs are the closest thing to genuine competition that Tesla has, and if we want to understand the competition, Chinese EVs are a good place to start.

There are also a lot of countries that will not put tariffs on Chinese EVs becuase they have no local car industry and they want to trade with China.

China is certainly a good chance of selling a EV to someone who can't afford a Tesla or who can't get a Tesla.

The Chinese can and probably will purchase many car brands. They are in for the long haul, I think Tesla can match or better them in many areas, but not many legacy brands can.

If legacy brands are reduced to selling only in their home markets, behind tariff walls, with government bailouts and subsidies. That is a recipe for failure unless legacy brands can transition out of that mode.

MC3OZ

Active Member

I agree service is a big issue for new car brands and it isn't easy to overcome.The adoption of EV's is going to be a lot faster than many expect but China dominance will take a long time (if it happens at all).

I see some incomplete thinking going on here. Japanese brands made rapid inroads because domestic makers lagged in many areas. Specifically, the big three lagged in ICE technology, manufacturing skill (quality) and cost of manufacture (a big factor) and didn't have the high MPG solutions consumers wanted when the oil embargo happened. The later competition from Koreans (and others) had some success due to cost of manufacturing advantages but they did not gut sales like the Japanese cars did. The big three were vulnerable to disruption in a way that Tesla is not.

The dynamics now are very different. In order to make big inroads into the N. American market, Chinese EV makers will need to establish supply and service networks and that takes years. More importantly, they will need to ramp production beyond levels that can absorbed in China and all other markets more convenient to China. That's going to take a lot of time considering the likely fast rate of EV adoption globally. It's more profitable to sell the cars they can make closer to home as long as those markets have not become saturated yet. They will also need to establish brand recognition and trust, something Tesla started doing over a decade ago.

Another factor with consumer trust is that the state of modern EV technology is still in its infancy relative to ICE technology in the 1970's, 80's and 90's. Catching up to Tesla is a fast-moving target that Japanese and Korean manufacturers didn't have to contend with because domestic makers were stagnant. Innovation for them was a bigger engine or new styling every year. The Koreans could copy Japanese ICE technology that was a few years old and still have a modern product. EV technology that is even three years behind the leader must sell at a discount. The consumer doesn't know how long the batteries will last or what the resale value will be. This means the imports will need a lower cost of manufacture to make inroads. It might not be as easy to compete on price with Tesla in N. America as one might assume, simply because they are manufactured in China (which is actually a disadvantage in many ways). Even Polestar doesn't have but 4 locations in N. America and they were one of the first Chinese companies with eyes on N. America.

I think the Chinese will likely be very successful auto makers, even globally, but I would caution against thinking big inroads into Europe and USA could happen quickly - they need to ramp fast enough to meet the quickly growing demand of local markets and, even in those home markets, they will need to produce at a lower cost than Tesla to gain market share which is far from a given if you want to compare products that are comparable. Expanding globally will take a decade or more to become a force to be reconned with. In the interim the market is wide open for Tesla to continue to expand. Tesla is constantly lowering the cost to produce. Comparing this situation to that of foreign ICE compacts in the '70's, 80's and '90's will not turn up many parallels.

At one stage BYD was trying to find a local service partner in Australia. I.e. someone with an already established service network. I don't think that worked out, or maybe it is taking a while to finalize.

The Chinese can reduce consumer concerns about batteries with a good warranty.

There are only two likely ways for a Chinese EV to get significant market share in the US: offer a car of similar quality to the 3/Y with at least a 20% discount, or offer a car of lower quality with at least a 30% discount. Given Tesla’s manufacturing efficiency, and Chinese EV shipping costs and tariffs, neither scenario seems remotely likely.

MC3OZ

Active Member

You are assuming Tesla can satisfy 100% of EV demand.There are only two likely ways for a Chinese EV to get significant market share in the US: offer a car of similar quality to the 3/Y with at least a 20% discount, or offer a car of lower quality with at least a 30% discount. Given Tesla’s manufacturing efficiency, and Chinese EV shipping costs and tariffs, neither scenario seems remotely likely.

When we come to South America, Africa and some parts of Europe the Chinese are probably close to parity on tariffs etc.

IMO by 2030 Tesla 20-30% of the global market, Chinese companies 30-40%.

I'm not saying that the Chinese will impact on Tesla marketshare and margins before 2030. After 2030, we should see some competition in the EV marketplace.

Tesla is well placed to innovate faster than the competition, diversify and offer a superior customer experience.

Last edited:

CLK350

Member

Correct link is 3 Stocks That Are Ready to Rip in 2022 (remove last [ character)

...

Tesla (NASDAQ:TSLA)

Tesla stock has been facing heavy selling pressure to end the year, as the company’s CEO Elon Musk has been unloading billions of dollars in shares for tax purposes. This has caused the stock to fall well off of its 52-week highs, yet it’s important for investors to note that nothing has fundamentally changed about the company’s growth story. Tesla is still the premier electric vehicle manufacturer in the United States and a company with plenty of upside in international markets like China. With Elon close to wrapping up his selling, the stock should be ready to rip back to highs in 2022.... /snipPaypal and ROG - an oil & gas company (!)

Last edited:

Artful Dodger

"Neko no me"

On Dec 16, 2021

Elon has added 1.1M followers on Twitter in the past 10 days. I suspect half of those people will pre-order a Cybertruck (and then buy a Model 2).

#DemandCliff #DemandMountain

Don't know if anybody else noticed this, but Elon is picking up about 100K twitter subscribers per day right now. Currently at 66.7M, Elon's Armee...

Cheers!

Elon has added 1.1M followers on Twitter in the past 10 days. I suspect half of those people will pre-order a Cybertruck (and then buy a Model 2).

Elon Musk @elonmusk

J

jbcarioca

Guest

From a US perspective it’s hard to see what is happening with BEVs. BYD has fleet sales of trucks, busses, delivery vans, cars and battery storage in many countries. MostI just saw a very nice red BYD in Costa Rica. Thought it was a Tesla Model S at first. O… K…

My brother in law commented how they are fairly common here, and there are charging stations for them, but the kW he wasn’t sure. Reason this wasn’t a Tesla is cost he said.

China surprised me, unexpectedly here. Competition isn’t from the ICE converting to EVs I think - Monroe has the right idea. I’m going to look into this more.

China also funded a very large bridge decades ago here. Seeds were planted long ago. But man… same headlights and a sweet looking ride.

of that is invisibly to non-enthusiast. JAC is selling BEV small trucks quite widely, and a range of cars. Almost all of that is largely invisible to the general populace. Then there are tiny urban delivery vehicles, many of them being BEV replacement of tiny polluters. That one is widespread in Europe too.

We at TMC naturally see big cars and pickups and ignore the BEV revolution actually happening elsewhere. FWIW much of this is not even reported, after all they are not sexy.

CLK350

Member

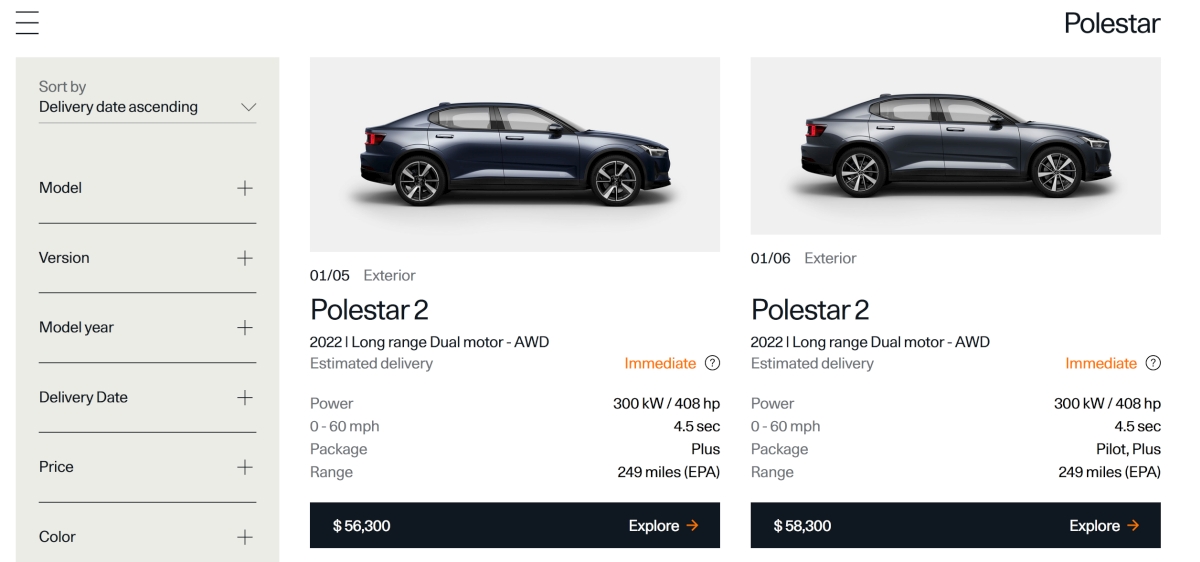

Hmm speaking of the Chinese .. I knew Rawlinson's Lucid had landed a store in NYC (product a year away) but was surprised to find Polestar has its full EV cars for delivery right now in NYC (at least a couple) .. have to go take a look, see how real this inventory situation it (or anyone else in NYC - they're at 150 Amsterdam in the UWS)

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K