Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Tiger

Active Member

LIDAR has been used for decades by police for speed monitoring. How has this not come up before? In that use case they are shooting it right at your windshield (and presumably face).

Sorry for my contribution to Off Topic: Police are trained to shoot at the grill/license plate if the vehicle is coming at them and license plate/taillight if you are moving away from them.

He doesn't half waffle on. 5:20, more than half way through the video, before he gets to the point. And if he/she thinks this doesn't happen with other brands, they're just lucky not to have experienced that. I have and I'm far from an experienced driver. Definitely agree Tesla should be better than that, though. And I'm sure they will be, they're just in explosive growth phase and unchartered territory as I see it.

TradingInvest

Active Member

Question.

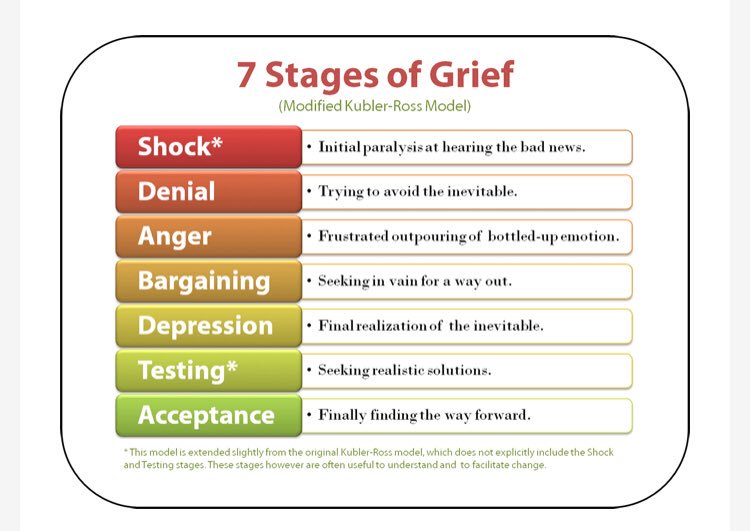

What stage are the shorts in today?

What stage they will be in after ER?

Right now shorts are not in the stages yet. After FSD news, they will start at stage one - Shock. Then they will have a few painful years to get familiar with all the stages.

Fact Checking

Well-Known Member

Raises the question of whether I should roll options (on a SP high) to March rather than 15 Feb. And if so, whether I should wait for the announcement or roll over sooner for less theta decay.

Theta decay is unstoppable and cannot be avoided via rollover. Theta is the price call buyers pay to call writers to assume the time risk of the options.

As @Cherry Wine said it too, this is difficult, generally you can only neutralize theta decay by:

- Financing Theta decay by assuming new risk, such as selling half of your options when Vega and Gamma seem high enough and wait some time with half a position and cash. If the SP drops after this, or Gamma gets lower due to sideways price action, you might be able to buy back a longer expiry and essentially use your Vega and Gamma gains to finance the Theta decay. Another way to assume more risk is to increase the strike price. Note that even if you get it wrong, you'll still have half of your options and are able to capture further rises in a leveraged fashion.

- Financing Theta decay externally. Just pay the higher price with dry powder.

- Financing Theta decay internally via reducing the number of contracts or by shifting up the strike price. This will gradually erode the options with every rollover if it's a losing position or if profits are smaller than Theta decay, but if you got the direction right it would allow extension of expiry.

Maybe options traders can chime in?

Zhelko Dimic

Careful bull

Year end fin. statements are usually audited (and signed by auditor) and take more time to produce. Quarter audits may be more lenient with promise to fix all open questions by year-end, and auditor are usually hard-nosed at the year-end financials, and want everything closed to their satisfactions, including more testing of controls etc...The big question is whether one should expect any arbitrary Q4 to be late (e.g. time required for year-end filings), or just interpret that as an artifact of how few datapoints we have. Raises the question of whether I should roll options (on a SP high) to March rather than 15 Feb. And if so, whether I should wait for the announcement or roll over sooner for less theta decay.

My thoughts are I should probably set a cutoff... say, if there's no announcement by the Friday the 25th or Monday the 29th, then I should roll over. Maybe not even to March, maybe just 22 Feb .. heck, maybe I should just go ahead and do that. It'll probably cost me a contract or two to buy the extra theta if I do that, though (plus fees)...

TheTalkingMule

Distributed Energy Enthusiast

Pretty damn hilarious that here we are doing the pre-earnings straddle right around $360 as predicted months ago based on bond maturities. Was that @neroden I believe, among others? I don't pretend to know options markets or bond issuance, but my gut tells me the entire world is desperately holding back this stock at $359.99 and it'll bust out like mad after a decent earnings/guidance report and the loaded spring is released.

There really needs to be a TMC hedge fund, no reason we shouldn't all get rich.

There really needs to be a TMC hedge fund, no reason we shouldn't all get rich.

Theta decay is unstoppable and cannot be avoided via rollover. Theta is the price call buyers pay to call writers to assume the time risk of the options.

As @Cherry Wine said it too, this is difficult, generally you can only neutralize theta decay by:

Each of these aporoaches have pros and cons, and I might have missed other approaches.

- Financing Theta decay by assuming new risk, such as selling half of your options when Vega and Gamma seem high enough and wait some time with half a position and cash. If the SP drops after this, or Gamma gets lower due to sideways price action, you might be able to buy back a longer expiry and essentially use your Vega and Gamma gains to finance the Theta decay. Another way to assume more risk is to increase the strike price. Note that even if you get it wrong, you'll still have half of your options and are able to capture further rises in a leveraged fashion.

- Financing Theta decay externally. Just pay the higher price with dry powder.

- Financing Theta decay internally via reducing the number of contracts or by shifting up the strike price. This will gradually erode the options with every rollover if it's a losing position or if profits are smaller than Theta decay, but if you got the direction right it would allow extension of expiry.

Maybe options traders can chime in?

Decay is faster as it gets nearer to expiration - so rolling can slow rate of decay

Sell Puts/Calls and negate total portfolio decay ..

I finally got some info that it is indeed true that the European Model 3 will only be able to supercharge over the CCS port and not over the Type 2 port (unfortunately). On the Belgian Model 3 resevation FB group, somebody showed an answer from a Tesla employee on how to know which supercharger has been converted to dual cable. In the future the Tesla site will be updated to show this, and Model 3 will only show converted superchargers, and the navigation will only route through converted superchargers.They only upgrade some of the stalls. Thats asking for trouble between S/X drivers and 3 drivers. At the rate they are currently upgrading the stalls, it will take a year before the suc network is useful for model 3 drivers, unless model 3 can supercharge over the type 2 connector. I expect next gen s/x to also have ccs2 natively, so soon type2 only s/x will be a minority.

Decay is faster as it gets nearer to expiration - so rolling can slow rate of decay

Sell Puts/Calls and negate total portfolio decay ..

This was my first thought. If you're rolling one week out week after week, you're keeping yourself in the highest theta decay "region". You are also holding maximum leverage, however. So yet again, pros/cons.

I think it'll probably be best to roll to 22 Feb '19s just to be sure. Probably as soon as possible, just ideally at as high of a SP as possible, since ITM or near-ITM calls should suffer less from the rollover than OTM calls. I'll fund it by selling a little stock, since I wanted to do that anyway.

Looks like it'd only be a 2% increase in premium to roll over my $300s. By contrast, my $330s would cost me a 3,5% premium hike, and $360s would cost 7,7% to roll. Yeah, it'll cost me, but it would really suck to get caught pre-earnings (or only briefly post-earnings) on expiry.

Looks like it'd only be a 2% increase in premium to roll over my $300s. By contrast, my $330s would cost me a 3,5% premium hike, and $360s would cost 7,7% to roll. Yeah, it'll cost me, but it would really suck to get caught pre-earnings (or only briefly post-earnings) on expiry.

Last edited:

N5329K

Active Member

This is a serious shot across Tesla's bow and will probably have a negative effect on company valuation and stock price. Essentially, it's FUD that rings true, even among Tesla loyalists.He doesn't half waffle on. 5:20, more than half way through the video, before he gets to the point. And if he/she thinks this doesn't happen with other brands, they're just lucky not to have experienced that. I have and I'm far from an experienced driver. Definitely agree Tesla should be better than that, though. And I'm sure they will be, they're just in explosive growth phase and unchartered territory as I see it.

It seems to me the root of the problem is this: Tesla is, culturally, a Silicon Valley company. Some of that's a plus. Iterative, over-the-air fixes are really great, whether it's a frozen laptop or an unresponsive Model 3. But the attitude of "ship now, fix later" was always going to bite Tesla, and it looks (from these videos from ardent Tesla fans) that it has.

So if you are OK with how your hardware and software problems are dealt with today by "traditional" hardware/software companies, you're likely OK with how Tesla deals with missed appointments, blown deadlines, organizational confusion and mysteriously unresolved "issues". If, on the other hand, you're like virtually everyone else on the planet and hate calling technical support to solve a hardware/software problem, you might well think twice about buying a Tesla vehicle.

As Tesla's founder said a long time ago, Software's easy. Cars are hard.

He was right.

Robin

Year end fin. statements are usually audited (and signed by auditor) and take more time to produce. Quarter audits may be more lenient with promise to fix all open questions by year-end, and auditor are usually hard-nosed at the year-end financials, and want everything closed to their satisfactions, including more testing of controls etc...

One question I'm still unclear on: are Q4 reports ever decoupled from year-end reports? Could Tesla release Q4 earnings, then release year-end earnings thereafter? Or is that just not done?

RobStark

Well-Known Member

This is interesting:

The world’s largest roofing company just launched a new solar startup

Not like a Tesla solar roof, but if they get a product like that it will be a major competitor.

The CGI looks like the Tesla solar panels(as opposed to roof), trying to make them look integrated and less ugly.

Zhelko Dimic

Careful bull

Not doneOne question I'm still unclear on: are Q4 reports ever decoupled from year-end reports? Could Tesla release Q4 earnings, then release year-end earnings thereafter? Or is that just not done?

Fact Checking

Well-Known Member

Decay is faster as it gets nearer to expiration - so rolling can slow rate of decay

Sell Puts/Calls and negate total portfolio decay ..

True - so if you want to capture a permanent increase in the stock price, which I believe @KarenRei wants to, then keeping expiry farther out reduces theta decay costs. (Which are still a constant cost.)

Is there any rule of thumb when theta decay speeds up - around 30 days from expiry?

True - so if you want to capture a permanent increase in the stock price, which I believe @KarenRei wants to, then keeping expiry farther out reduces theta decay.

Is there any rule of thumb when theta decay speeds up - around 30 days from expiry?

IIRC ( from books ) .. 45 days .. cheers!!

120 days outTrue - so if you want to capture a permanent increase in the stock price, which I believe @KarenRei wants to, then keeping expiry farther out reduces theta decay costs. (Which are still a constant cost.)

Is there any rule of thumb when theta decay speeds up - around 30 days from expiry?

True - so if you want to capture a permanent increase in the stock price, which I believe @KarenRei wants to, then keeping expiry farther out reduces theta decay costs. (Which are still a constant cost.)

Is there any rule of thumb when theta decay speeds up - around 30 days from expiry?

Exactly. I want to be in a high-theta environment near earnings, for maximum leverage. Far from earnings I want to be in a low-theta environment, to capture long-term changes in the stock. So I try to time calls for expiry shortly after ER.

Right now I'm focused only on Q1. After this quarter however I'm going to be stretching out further, with "low risk" options for low strike prices and distant expiries, "moderate risk" for moderate strike prices and expiries two quarters out, and "high risk" for high strike prices and one quarter out. All as close to post-ER as possible. I want to max out by gains but at the same time have some resilience against the sort of SP freakouts we saw last year.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K