Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Genesis, Tesla, Volvo, etc.

Lots of brands can sell at a significant premium to the lower costs option (Toyota / Chevy / Hyundai) with almost the exact same specifications. It’s really the definition of a “luxury” brand.

What’s confusing is that Tesla sells at a premium but with a whole host of very differentiators features (performance, efficiency, technology).

So is it luxury or is it just superior?

Lots of brands can sell at a significant premium to the lower costs option (Toyota / Chevy / Hyundai) with almost the exact same specifications. It’s really the definition of a “luxury” brand.

What’s confusing is that Tesla sells at a premium but with a whole host of very differentiators features (performance, efficiency, technology).

So is it luxury or is it just superior?

RobStark

Well-Known Member

Genesis, Tesla, Volvo, etc.

Lots of brands can sell at a significant premium to the lower costs option (Toyota / Chevy / Hyundai) with almost the exact same specifications. It’s really the definition of a “luxury” brand.

What’s confusing is that Tesla sells at a premium but with a whole host of very differentiators features (performance, efficiency, technology).

So is it luxury or is it just superior?

Volvo and Genesis are luxury brands.

Selling at a premium while offering more features. Like lower NVH, premium leather/wood finishes, more horsepower/accleration, more tech features. Not just higher price.

The only real difference between Tesla and the BEVs from traditional luxury brands is Tesla doesn't offer leather.

Mercedes now has a certificate from the State of Nevada offering Level 3 semi autonomous software and will be opening their own charging network.

And Elon keeps saying the Supercharger Network will be opening to other BEVs too. So that differentiator will be diminishing if not eliminated. And Tesla has opened up their charging standard to others for free.

Most luxury car companies will also add some other options. The German luxury brands offer custom paint jobs. Tesla offers 5 colors. Plus an extra two in Europe.

Sometimes a mainstream brand like Chevrolet will offer a fully spec'd Corvette for $185k and BMW might dip down $12k below the price of an average car like a base X1 but the bulk of Chevrolet sales are in the mainstream category and the bulk of BMW sales are in the luxury category.

Last edited:

cwerdna

Well-Known Member

Half Of US New Car Buyers Believe EVs Are Too Expensive: Survey

Around 52 percent of respondents to the 2023 Deloitte Automotive Consumer Study are most concerned about the cost/price premium of EVs.

Almost seven in 10 of the Americans surveyed said they expect their next vehicle to cost less than $50,000, which would leave out much of the EVs on sale today. Besides pricing, prospective EV buyers also listed range and charging times as significant concerns – 48 percent and 47 percent, respectively. The lack of a proper public charging infrastructure was named as another big issue by 46 percent of respondents.

Deloitte also asked the type of car people want to buy next. In the US, 62 percent of respondents said they wanted a gas vehicle, 20 percent said hybrid, 8 percent said PHEV, and 8 percent said EV.

RobStark

Well-Known Member

In the first 9 months of 2022 BEV market share was 5.6% according to Cox Automotive.

Entire 2022 numbers are not out yet.

According to Kelly Blue Book 36% of Americans are buying/leasing an EV for the next vehicle or are seriously considering it.

There will be a lot of BEVs with a ~$42k starting price in the heart of the market.

EV6, Ioniq 5, Mach-e,BZ4X, Blazer EV, Prologue

And Equinox with a sub $35k price likely.

Entire 2022 numbers are not out yet.

According to Kelly Blue Book 36% of Americans are buying/leasing an EV for the next vehicle or are seriously considering it.

There will be a lot of BEVs with a ~$42k starting price in the heart of the market.

EV6, Ioniq 5, Mach-e,BZ4X, Blazer EV, Prologue

And Equinox with a sub $35k price likely.

RobStark

Well-Known Member

RobStark

Well-Known Member

Doggydogworld

Active Member

They're labeled backwards, the top chart is net profit and the bottom one gross. And the BYD numbers don't make sense to me -- I seriously doubt they had $15k gross profit per car in Q4 2020. Their average sale price was barely $15k back then (it's risen, but is still much less than Tesla China's ASP). And how could they preserve net profit per car while gross profit per car fell catastrophically from 15k to 5k?

I also don't get why VW and Toyota show such different operating leverage on similar volumes, though I'm probably missing something. Could be a one-time expense in one of their quarters, too.

petit_bateau

Active Member

Try this version, note it has a different citation in lower left. I popped this one on the energy news thread yesterday.They're labeled backwards, the top chart is net profit and the bottom one gross. And the BYD numbers don't make sense to me -- I seriously doubt they had $15k gross profit per car in Q4 2020. Their average sale price was barely $15k back then (it's risen, but is still much less than Tesla China's ASP). And how could they preserve net profit per car while gross profit per car fell catastrophically from 15k to 5k?

I also don't get why VW and Toyota show such different operating leverage on similar volumes, though I'm probably missing something. Could be a one-time expense in one of their quarters, too.

RobStark

Well-Known Member

RobStark

Well-Known Member

California 2022 Registrations

Tesla remains #2 California Automaker ahead of General Motors( Chevrolet, GMC, Cadillac and Buick.) Increases Market Share by .5% to 11.2%

Total..........................1,667,831................................100

"Other" category has increased by over 50% over the last year. Rivian should be on the board next quarter and maybe Lucid by the end of the year.

Tesla remains #2 California Automaker ahead of General Motors( Chevrolet, GMC, Cadillac and Buick.) Increases Market Share by .5% to 11.2%

- Toyota........289,304 ...........,..........................17.3

- Tesla.........186,711......................................11.2

- Ford...........140,881...........................................8.4

- Honda........131,793.........................................7.9

- Chevrolet...112,826..........................................6.8

- KIA.............80,626............................................4.8

- Merc Benz..72,879..........................................4.4

- Nissan........70,075..........................................4.2

- Hyundai......65,149...........................................3.9

- Subaru......63,799............................................3.8

- BMW..........61,718............................................3.7

- Lexus..........48,726..........................................2.9

- Jeep............45,492..........................................2.7

- RAM...........37,794...........................................2.3

- Mazda..........34,388.........................................2.1

- Volkswagen..33,537........................................2.0

- GMC.............32,313..........................................1.9

- Audi..............32,308.........................................1.9

- Dodge..........19,181...........................................1.2

- Porsche........14,490...........................................0.9

- Acura ...........12,008...........................................0.7

- Volvo.............11,394..........................................0.7

- Cadillac.........10,676..........................................0.6

- Land Rover ..10,365.........................................0.6

- Chrysler........9,812..........................................0.6

- Genesis.........7,528...........................................0.5

- Mini...............5,199..........................................0.3

- Infiniti............4,519..........................................0.3

- Mitsubishi.....4,321..........................................0.3

- Lincoln..........4,071...........................................0.2

- Buick...............3,230..........................................0.2

- Alfa Romeo....2,150........................................0.1

- Jaguar...........1,449...............................................0.1

- Other..............5,491..........................................0.3

Total..........................1,667,831................................100

"Other" category has increased by over 50% over the last year. Rivian should be on the board next quarter and maybe Lucid by the end of the year.

Doggydogworld

Active Member

Something isn't adding up. "Other" grew by 2k in 2022 (basically all in Q4). Rivian delivered 20k vehicles last year and Lucid 4k. About 40% of US EV sales are in California, so I'd expect about 10k of Lucid+Rivian in CA last year. Even factoring in a decline in non-EV "Other" sales I still can't get these numbers to line up."Other" category has increased by over 50% over the last year. Rivian should be on the board next quarter and maybe Lucid by the end of the year.

Something isn't adding up. "Other" grew by 2k in 2022 (basically all in Q4). Rivian delivered 20k vehicles last year and Lucid 4k. About 40% of US EV sales are in California, so I'd expect about 10k of Lucid+Rivian in CA last year. Even factoring in a decline in non-EV "Other" sales I still can't get these numbers to line up.

Maybe the discrepancy is that Rivian didn't deliver that many into CA? I found this survey on the rivian forums: What State Has the Most Rivian Deliveries: Add Yours Here!

Out of the 185 who responded, only 25 are in CA, so that's only a 13.5% ratio.

Edit: 14% of 24000 would still be ~3500.

RobStark

Well-Known Member

Survey of owners who bought the car new and have owned it for 3 years.

RobStark

Well-Known Member

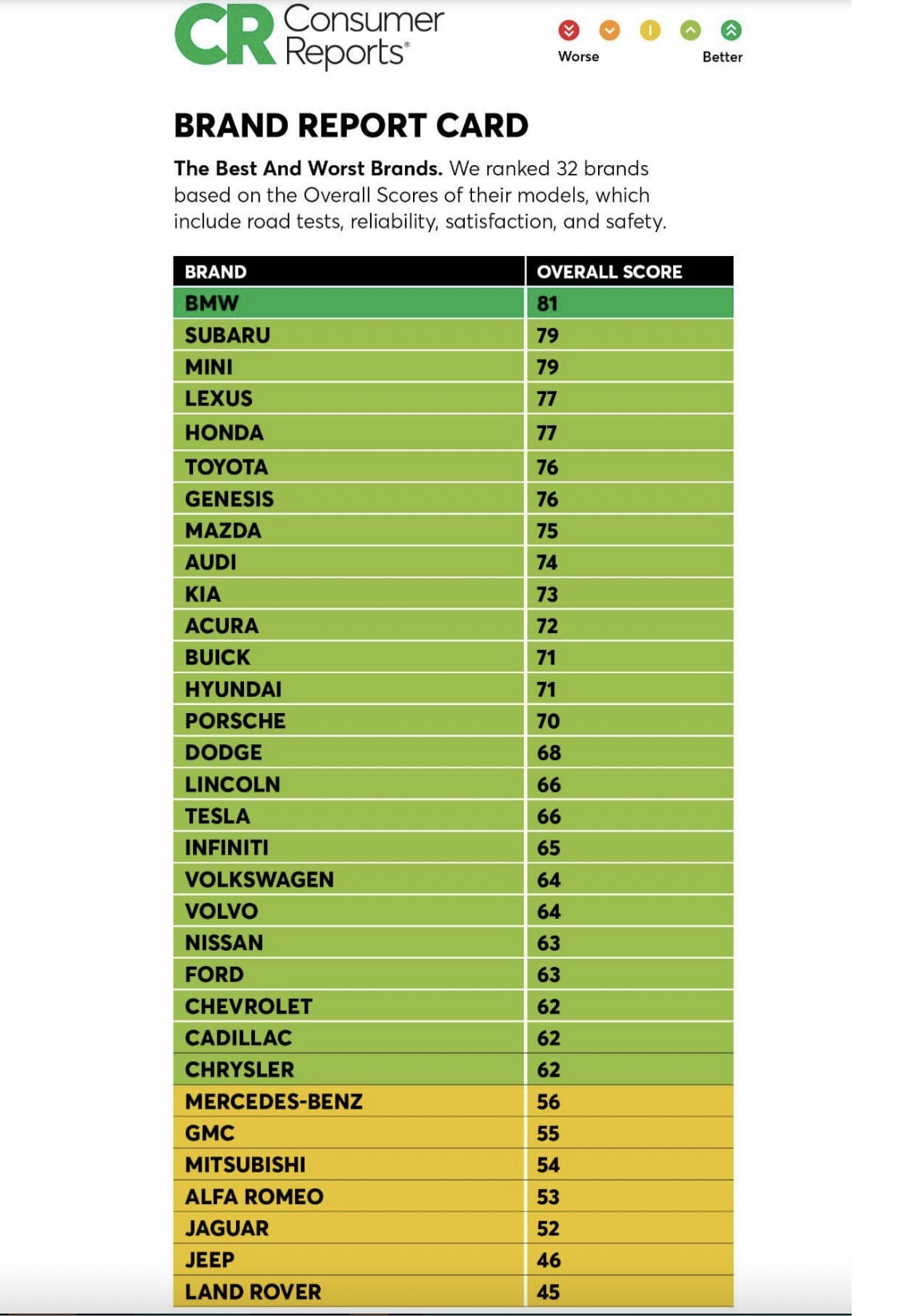

Consumer Reports overall Automotive Brand Rankings

Based on that brief explanation, this is CR's ranking of the brands, NOT based on the owner's preferences?

RobStark

Well-Known Member

Based on that brief explanation, this is CR's ranking of the brands, NOT based on the owner's preferences?

It says right at the top of the graphic.

Based on road test, reliability, satisfaction, safety.

Reliability is owner reported problems per 100 vehicles in CR surveys.

Satisfaction is completely owner subjective rankings in CR surveys.

Safety is NHTSA and IIHS rankings.

Road test are Consumer Reports own road test.

RobStark

Well-Known Member

Which car brands connect with women?

For mainstream automotive brands to show continued growth in challenging economic times, they must find traction across all demographics. The latest analysis from S&P Global Mobility shows that some brands are enjoying much more success with women buyers.

Doggydogworld

Active Member

CyberTruck will fix thatView attachment 910614

Which car brands connect with women?

For mainstream automotive brands to show continued growth in challenging economic times, they must find traction across all demographics. The latest analysis from S&P Global Mobility shows that some brands are enjoying much more success with women buyers.www.spglobal.com

RobStark

Well-Known Member

Similar threads

- Replies

- 9

- Views

- 1K

- Replies

- 6

- Views

- 11K

- Replies

- 8K

- Views

- 998K

- Replies

- 98

- Views

- 26K