Hot take: Supervised FSD is the correct way to refer to the product, and had Tesla done this from the start, 80% of the crap they've taken for FSD wouldn't have occurred.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Krugerrand

Meow

Rinse and repeat lesson for OEMs right there. I remember the GM headlines about beating Tesla to market with the $35k vehicle. By a WHOLE year!The CT was LATE, giving time for the rivian and Lightning. Now its here, it looks likely to give the existing EV trucks a real challenge.

Be late all you want Tesla.

Nobody beats it. Tesla stands alone and apart from everyone else. The day they don’t, is the day they’ve run out of ideas, stopped innovating, become what every other OEM has become - stale, boring, predictable. That’s the day all of us long term investors need to exit the program.I think there are a lot of short range, low-speed small 'affordable' EVs that are currently doing very well, that will struggle against a model 2. Especially as we are at least a whole years FSD updates away from that. Imagine a $25k model 2 with the option of FSD. How does the Nissan leaf beat that?

Last edited:

Solar Roof is a long long way from being a real option beyond the top 0.1%. I recently was quoted $185,000 to replace my Florida roof. I ended up replacing my roof with the same architectural asphalt shingles for $17,000. Solar Roof also does not come close to matching the hurricane wind rating as asphalt shingles, and would likely result in issues with insurance coverage due to this fact.

(market closed today, so slightly OT)

This surprises me. Asphalt shingles can be blown off in storms far less energetic than a hurricane (I've lost a couple in heavy thunderstorms not approaching hurricane strength). Given the hurricane rating of an asphalt shingle would be a seemingly a low bar, from what we've seen of the solar shingle construction and attachment methods, that seems odd.

Tesla says on their website regarding the solar roof:

- Wind Rating

Class F (highest rating)

And according to this asphalt roofing resource , they agree that class F is the highest rating:

- ASTM D3161, “Standard Test Method for Wind Resistance of Asphalt Shingles (Fan Induced Method).”Class F is the highest rating.

Last edited:

The way I see it, the competition has always been there in Norway, but Tesla is winning.Curious what your definition for “competition” is.

As your data shows, in Q1 2024 so far Model Y is the clear leader in sales of a single model, but it also clearly shows that 79% of Q1 EV sales in Norway are other EVs models.

How high a percentage of the market do competitor EV sales have to become before the competition has officially arrived?

Before Tesla arrived, Norway bought a ton of Leafs, then things changed. Look at the evolution of market share:

Tesla is growing its share since 2022: we don't see the full picture here but Kia, Toyota, Volvo arrived and probably other Chinese. All the others are being compressed but Tesla.

If I'm not mistaken, this Q1 in Norway will be bigger than Q3 and Q4 2023.

All in all, I see Tesla gap widening.

Not bad for the most mature EV market in the world (and with very bad initial conditions, weather-wise).

Buckminster

Well-Known Member

Buckminster

Well-Known Member

As resident super bull I'm getting a bit nervous that y'all are getting a bit bullish on FSD. How can I stand out now? I suppose I could always move to the Neuralink thread. I mean, Elon will never get that working on a human.

EDIT: god damn it...

EDIT: god damn it...

Twenty years ago, I had an ATAS Scan Roof installed. A metal roof that sits ~3 cm from the roof decking to allow air flow so the roof deck is always at ambient temperature, and gives the appearance of tiles. At the time it cost around double the asphalt shingle price. https://www.atas.com/wp-content/uploads/2018/07/ScanRoofLAT732.pdf(market closed today, so slightly OT)

This surprises me. Asphalt shingles can be blown off in storms far less energetic than a hurricane (I've lost a couple in heavy thunderstorms not approaching hurricane strength). Given the hurricane rating of an asphalt shingle would be a seemingly a low bar, from what we've seen of the solar shingle construction and attachment methods, that seems odd.

Tesla says on their website regarding the solar roof:

And according to this asphalt roofing resource , they agreethat class F is the highest rating:

I have HODLing for a decade. The General Advertising is a trigger in spite of all the product, finance and manufacturing prowess TSLA has. Why, you ask. That is an excellent question.I'm not sure what "sentiments" you think I attributed to you, but this statement by you is what I found perplexing:

"If the situation moves to general advertising I will sell"

I don't believe I have an issue with reading comprehension as that statement is fairly straightforward. I'm just confused because you seem intelligent, so you must also realize the progress on FSD and Optimus signal very large revenues and profits in the "near" future. In this context stating you'll sell all of your TSLA if they start general advertising seems odd to me, as any advertising budget will easily be dwarfed by FSD + Bot revenues down the road.

It's possible I misunderstood you, I'm just not sure where or how I did?

When general advertising happens, if it does, it is a signal that the deep dedication to cost effectiveness, efficiency and waste avoidance has ended. Other disasters then happen.

With other things such as FSD, Gigapress, Octovalve, etc have happened they all happened because the opportunity to do something unprecedented and make a major advance justified the risk and uncertain timing of results. I approve of that.

With general advertising there is no probability of payback simply because it has no path to increased efficiency. The counter argument is to demeaning price decreases as wasteful when those directly increase the qualified buyer capacity to buy. Regularly Elon and Tesla explain that, not a demand problem but a capacity to buy problem. General advertising has no such direct link is large infrequently purchased products.

In short, people decide to buy a house or a car. They then begin to gather information and look for what they choose to buy. Some look not at all, because they've pre-decided. Those sometimes will change timing based on price or terms. Nothing in that process benefits from general advertising.

Krugerrand

Meow

I think it’s just a test. Maybe a test to prove all the proponents of conventional advertising that they’re wrong.For >the last decade I have not sold a share of TSLA except for paying taxes and buying a house. On this forum and elsewhere I have been clear that a major trigger for me to sell would be the advent of general advertising. Recent events have caused me to put TSLA on my watch list. Placements to date have been highly targeted but recent use off exceedingly expensive media, including Facebook introduce higher risk.

I have not yet sold a share. If the situation moves to general advertising I will sell.

This si only indicating the careful watch, not a sale. They might just be using excellent analytics, particularly since nothing broad has yet happened.

I know numerous people think it is excellent to advertise for general awareness. I regard such opinion as erroneous simply because of inability to target likely purchasers for a product which is not and likely will not be, so ubiquitous as, say, Ozempic or Snickers or Wheaties, all of which benefit from broad advertising with modest targeting. Not so for cars, trucks and energy products.

I haven’t seen any Tesla typical (or any kind of) advertising in my day to day Internet or TV usage. I only know it’s sort of happening because people report it here.

As I posted over in a Starlink forum, I did see a 15s blurb during a commercial break while watching a Perry Mason episode on a retro TV station.

Wouldn’t the content of the advertising be more telling for you? Like if a CT drove up a mountain in the dead of winter to power some lights on a pond so a kid could skate on said pond for her grandpa 100ft away - well, then. Yeah. I’m with you. But if it was an educational informative 30s?

Let’s face it, a lot of people can’t get out of their own way because the box they live in is so small.

Last edited:

Knightshade

Well-Known Member

Anyway, Elon is optimistic this is solved!

And has been since at least 2016!

As Elon once also said about SpaceX- "we specialize at converting the impossible to late"

I don't get it. Elon said years ago that Tesla would advertise when the time was right. I'm pretty sure most of us who were against advertising defined advertising as Main Stream Media advertising (aka paying protection money). Tesla hasn't done any that I'm aware of.

I’m pretty sure paying some protection money to just one of the MSM would vastly change the tone of the other MSM, purely because of the expectation of also receiving protection money.

It would be worthwhile as an experiment, just to see how the media changes how they represent Tesla.

Krugerrand

Meow

Hot take: Supervised FSD is the correct way to refer to the product, and had Tesla done this from the start, 80% of the crap they've taken for FSD wouldn't have occurred.

Last edited:

Krugerrand

Meow

It won’t happen as long as Elon is at the head. Someone may play around with advertising for a bit, but the very second it shows not to be cost effective etc… it’ll be full stop. I have zero doubts.When general advertising happens, if it does, it is a signal that the deep dedication to cost effectiveness, efficiency and waste avoidance has ended. Other disasters then happen.

cliff harris

Member

Some googling suggest Tesla sold 650k cars in the US in 2023. Some people guess FSD take rate is 19%. I am assuming that even given no more progress, FSD V12 doubles that over time.

so 123,500 extra FSD purchases per year, for revenue (its $12k now right?) of $1.48 billion a year. The marginal cost of sales here is virtually zero.

Thats almost exactly 10% of profit for 2023. That assumes FSD is never improved outside the US.

Given demand for FSD in Europe, China etc, I think 2025 is going to be the year we really see FSD hit the financials in a notable way. Luckily between now and then we have growth in profits from energy, and also the cybertruck and semi ramp.

Of course if FSD 13 comes along and is genuinely end-to-end no intervention for 99.999% of drives, then all bets are off and its robotaxi time, but WAY before that I expect FSD to become a huge driver of sales for people cross-shopping between EV brands.

so 123,500 extra FSD purchases per year, for revenue (its $12k now right?) of $1.48 billion a year. The marginal cost of sales here is virtually zero.

Thats almost exactly 10% of profit for 2023. That assumes FSD is never improved outside the US.

Given demand for FSD in Europe, China etc, I think 2025 is going to be the year we really see FSD hit the financials in a notable way. Luckily between now and then we have growth in profits from energy, and also the cybertruck and semi ramp.

Of course if FSD 13 comes along and is genuinely end-to-end no intervention for 99.999% of drives, then all bets are off and its robotaxi time, but WAY before that I expect FSD to become a huge driver of sales for people cross-shopping between EV brands.

Contributors to this site often talk of the exponential curve when talking of ramping production/sales. Some times we tend to forget that the high end is a mirror image of the start. Some of Tesla’s products are at that end of the curve, The S, X, and possibly the Y. This makes the small car and the truck all the more important. Yes, there are a lot more markets to enter, but the majors have been entered. (The exception Brazil and India, if they are major. Unk? ) The S and X have been stagnant for years. The last refresh did not increase sales. Tesla is in an in between period. The refreshes should help the Y and 3, but true exponential growth depends on the small car.

cliff harris

Member

This is completely wrong. Do you REALLY think every single car company on the planet is wasting their time? That despite spending billion over decades on advertising, nobody thought to look into its effectiveness?In short, people decide to buy a house or a car. They then begin to gather information and look for what they choose to buy. Some look not at all, because they've pre-decided. Those sometimes will change timing based on price or terms. Nothing in that process benefits from general advertising.

Musskiah

DisGruntled

TESLA ENERGY

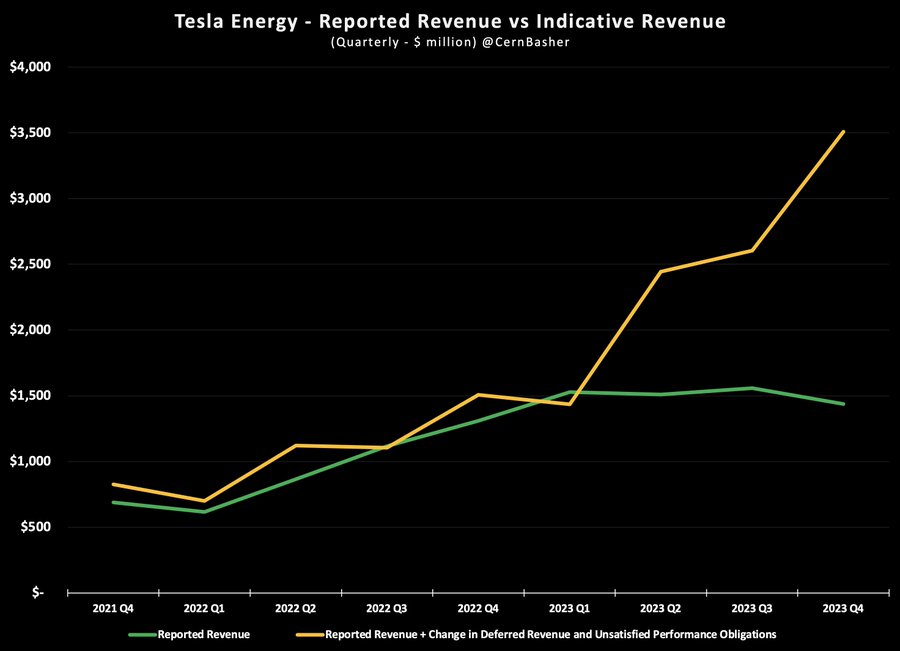

Indicative revenue (IR) = Reported R (RR) + [Deferred R (DR) + Unsatisfied Performance Obligations (UPO)]

What's interesting is while storage deployment is up 125% from 2022 to 2023, Reported Revenues flattened out while the Unrealized Revenues (DR+UPO) grew each quarter until Double the RR by Q4 2023. Yet, Energy Profits Quadrupled between 2022 and 2023! I'm quite certain this apparently flat Energy Realized Revenue is going to catch Wally with his pants down at the same time FSD subscription grows out the Services and Other Segment Profits. The Revenues of these segments will merely double by H2 2025, but the profits will triple, and could quadruple!

Because of the huge amount of Unrealized Revenue build-up that will begin to be realized, Energy Margins will end up in the 30%-35% range for the forseeable future, since demand is quasi-infinite for now as order backlogs remain 1 year out. Remember Energy margins have swelled from under 10% to over 21.8% in just a few quarters, and Lathrop is not fully ramped. Auto margins will likely remain around half the Energy Margins next year and perhaps long after. So every ONE dollar in Energy Revenue that drops to the bottom line is worth roughly TWO dollars in Auto Revenue. As FSD inflates "Services & other" through subscriptions (nearly pure profit), these margins will easily surpass 20% as well in a few short years.

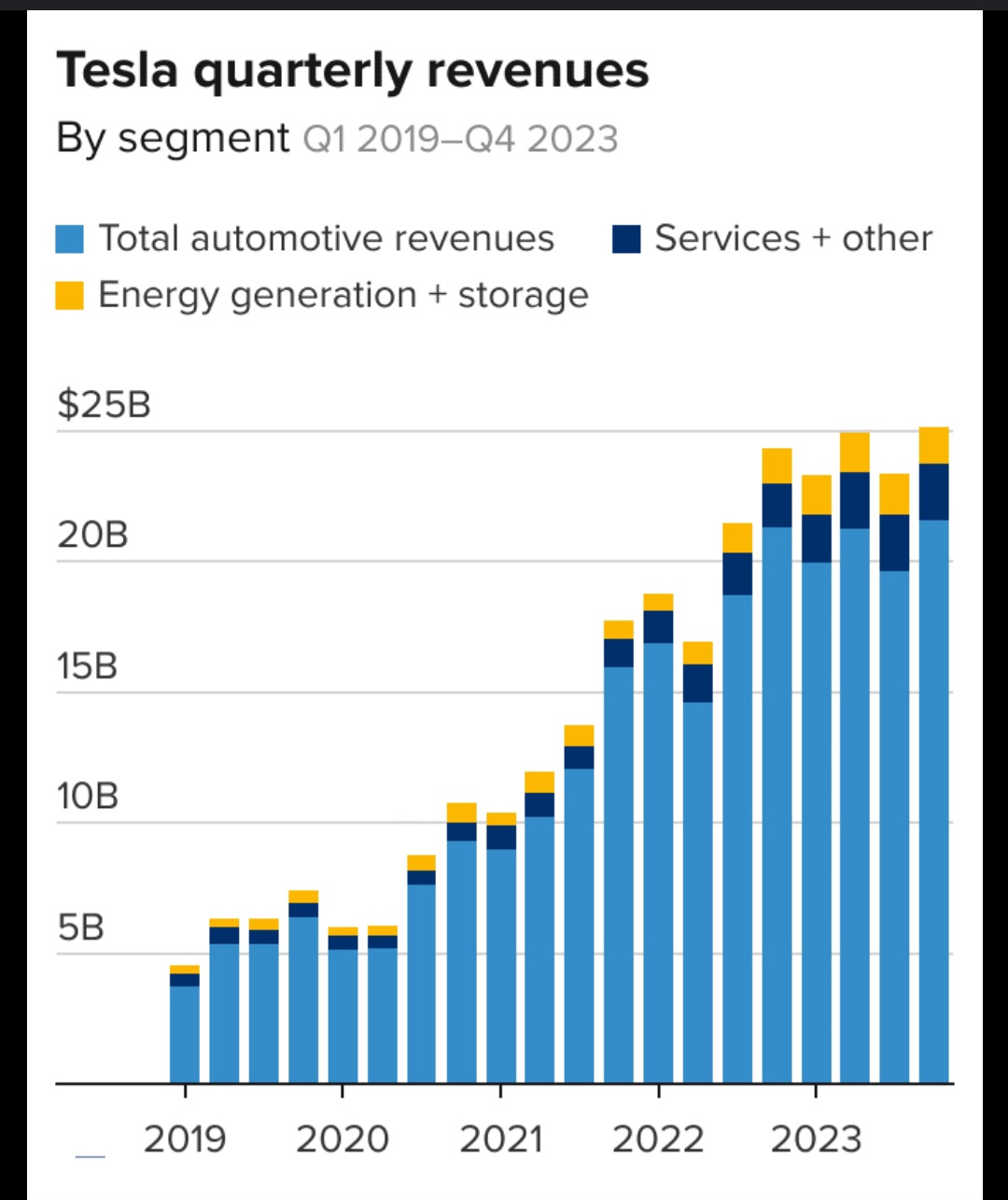

As you can see below"Energy" & "Services + other" revenues combined in 2023 are roughly equivalent to Auto Revenues in 2019.; so basically equivalent to MS&MX Revenues combined. We should expect these Energy/Service Revenue contributors to roughly lag Auto by less years as time goes on because they will grow faster than Auto.

So Lathrop plus Lingang Megafactories both fully ramped in 2026 should roughly quadruple Revenues seen from half operational Lathrop in 2023. Similarly, FSD subscriptions should maybe only triple Services by 2026 (Assuming $2.4k FSD sub/vehicle per year at 20% FSD subscription take rate 10M Tesla cumulative fleet size). This growth puts Tesla in the $15-$20B range if you combine both segments, which is sort of equivalent to Automotive Revenue in 2022 just observing on the graph below.

I would assert that, because Energy and Service (FSD subscription) margins will be double Automotive Margins at or soon after 2026, the profit contribution between Energy/Services and Auto will achieve parity well before the decade is out.

Indicative revenue (IR) = Reported R (RR) + [Deferred R (DR) + Unsatisfied Performance Obligations (UPO)]

What's interesting is while storage deployment is up 125% from 2022 to 2023, Reported Revenues flattened out while the Unrealized Revenues (DR+UPO) grew each quarter until Double the RR by Q4 2023. Yet, Energy Profits Quadrupled between 2022 and 2023! I'm quite certain this apparently flat Energy Realized Revenue is going to catch Wally with his pants down at the same time FSD subscription grows out the Services and Other Segment Profits. The Revenues of these segments will merely double by H2 2025, but the profits will triple, and could quadruple!

Because of the huge amount of Unrealized Revenue build-up that will begin to be realized, Energy Margins will end up in the 30%-35% range for the forseeable future, since demand is quasi-infinite for now as order backlogs remain 1 year out. Remember Energy margins have swelled from under 10% to over 21.8% in just a few quarters, and Lathrop is not fully ramped. Auto margins will likely remain around half the Energy Margins next year and perhaps long after. So every ONE dollar in Energy Revenue that drops to the bottom line is worth roughly TWO dollars in Auto Revenue. As FSD inflates "Services & other" through subscriptions (nearly pure profit), these margins will easily surpass 20% as well in a few short years.

As you can see below"Energy" & "Services + other" revenues combined in 2023 are roughly equivalent to Auto Revenues in 2019.; so basically equivalent to MS&MX Revenues combined. We should expect these Energy/Service Revenue contributors to roughly lag Auto by less years as time goes on because they will grow faster than Auto.

So Lathrop plus Lingang Megafactories both fully ramped in 2026 should roughly quadruple Revenues seen from half operational Lathrop in 2023. Similarly, FSD subscriptions should maybe only triple Services by 2026 (Assuming $2.4k FSD sub/vehicle per year at 20% FSD subscription take rate 10M Tesla cumulative fleet size). This growth puts Tesla in the $15-$20B range if you combine both segments, which is sort of equivalent to Automotive Revenue in 2022 just observing on the graph below.

I would assert that, because Energy and Service (FSD subscription) margins will be double Automotive Margins at or soon after 2026, the profit contribution between Energy/Services and Auto will achieve parity well before the decade is out.

Last edited:

I think we are getting there fast. Maybe even this quarter.Q - how much $$ revenue would it take for Tesla Energy's Megapacks to take on a material effect on the quarterly financial statement? Not solar and solar roof, just megapacks themselves?

For example -

I also think there is a 50/50 chance we see some energy numbers in the P&D report next week. With disappointing deliveries, now would be a good time to show off a bright spot.

Drumheller

Active Member

No, I do not want to see Telsa paying any protection money. You don't give the bully your lunch money. You punch the bully until they learn to leave you alone.I’m pretty sure paying some protection money to just one of the MSM would vastly change the tone of the other MSM, purely because of the expectation of also receiving protection money.

It would be worthwhile as an experiment, just to see how the media changes how they represent Tesla.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K