Yesterday. Today I’m wearing the “I’m kind of a big deal” t-shirt.

so was it Trump or Musk who responded to your tweet?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Yesterday. Today I’m wearing the “I’m kind of a big deal” t-shirt.

ValueAnalyst on Twitter

In just three months, @Tesla Model 3 will become the top selling sedan in the United States, ahead of @Toyota Camry:

Current Market Cap:

$TSLA: $53B

Toyota: $200B

Current Enterprise Value:

$TSLA: $60B

Toyota: $325B

Investing is not that difficult.

#NotSellingAShareBefore1000

“That production rate would fall below guidance of exiting the quarter at a 2,500/week run-rate."

Exiting the quarter at a 2,500/week run-rate would presumably produce 32,500 vehicles during the 13 weeks of the ensuing quarter--production was 28,578.

Just don't use acronyms. Too specialized. Doesn't help communicate, only hinders communications.

Anyone else find it interesting that Tamberrino released a note on June 26 predicting that Tesla would "miss" on model 3 deliveries, coming in below "consensus," rather than focusing on Tesla's production guidance? Here's the CNBC quote:

"Goldman Sachs is reiterating its sell rating on Tesla and expects the electric car maker's widely watched Model 3 delivery number to fall short of Wall Street expectations."

Goldman reiterates sell on Tesla and expects Model 3 deliveries to miss estimates

I find his note interesting for a couple of reasons. Until this point, the widely watched metric has been Model 3 production. Why the switch this time to focusing on analysts consensus of deliveries rather than production? Tesla had guidance for production, not for deliveries. In a previous note from March 19, he kept his rating at sell, focusing on a production miss:

“Assuming that the last few weeks in March have a similar 1k/week production rate, we see total 1Q18 Model 3 production registering at approximately 9,500 vehicles,” they said. “That production rate would fall below guidance of exiting the quarter at a 2,500/week run-rate."

Tesla stock is still a sell at Goldman Sachs

That previous note focused on an average production for the quarter, which was also not something that Tesla had guided for, but note that it was focused on production as the metric. This time, it appears that Tamberrino had gotten the message that Tesla was going to meet production guidance. So, what to do, what to do? Remember, he has a $190ish price target to support. Oh, wait, deliveries appear to be down (for whatever reason), so let's focus on that and ignore the production. What was his stance about the production? "Tamberrino wonders how sustainable that rate is." Talk about moving the goalposts to make sure Tesla appears to have failed. Tamberrino is not unique in this. Several analysts switched their focus to deliveries rather than production, since Tesla did in fact meet guidance. There simply was no delivery guidance from Tesla. The analysts spun the data toward their bearish stance on Tesla. The analysts can come up with whatever consensus they want, based upon whatever metric they want to focus on, and there isn't a thing Tesla can do about it. Expect the analysts to be even worse with the Q2 financials next month. However, my guess is that since everyone knows Q2 financials will be bad and will expect the stock to tank, it probably won't. Bad Q2 financials certainly won't be a surprise to anyone following Tesla.

I assume that's a closing price, given that it's about 3am in Frankfurt. Encouraging, anyway.T$LA is trading at $315.xx in Europe right now, I’d like to see us $320 again tomo and then $350s by earnings.

T$LA is trading at $315.xx in Europe right now, I’d like to see us $320 again tomo and then $350s by earnings.

It's the Q4 financial results which should be undeniable and should shut down the bankwuptcy narrative. Interestingly, they will come out in mid-February BEFORE the March convertible bond maturity. Everyone who can read a balance sheet agrees that Tesla has enough cash to get through to that point, even in the most pessimistic scenario.

Whether Tesla will also have enough cash to pay off the March bonds outright is a harder matter to predict, though I am personally sure that any financing gap can be covered by available access to credit lines, and there is a possibility (if Q4 profits are good enough) that they won't need to increase financing. Of course if the stock is over $360.32 at the end of Febuary, those bonds will be converted rather than paid off.

---

Actually, I'm trying to game the behavior of the convertible holders out. Conversion can happen starting December 1. If TSLA is over $360.32 any time after December 1, we'll probably see conversions.

It would be quite logical for a convertible bondholder to short-sell stocks car.” against the convertible whenever the stock was higher than $360.32 + their carrying cost for carrying a short position until December 1; it's essentially a way to cash out early. Looking at margin rates for big sellers, this would probably provide strong selling pressure between $360 and $370 until December 1.

I also just realized this is a possibly-legal way to shift income between years by short-selling against the box, which may imply that some conversions will happen on January 1 rather than December 1 to postpone tax payments.

Convertible holders probably mostly hedged the call option aspect of their purchases immediately (though one talking head on TV recommended not doing so and treating them as deliberate call option positions so some may have done this), but I think they would have sold calls rather than going straight into short-selling stock as that's an incorrect hedge early on. When the stock is high enough, close enough to maturity, however, it becomes a correct move.

We should expect to see similar stuff going on with the 2021 convertibles, but the carrying cost of holding a short position for 3 years (including possible increases in interest rates and stock price increases) makes it much more dangerous so we probably won't see much of it until 2020. The 2022 convertibles are almost certain to be in the the money at maturity and may well be converted early.

College aged I think. I remember a wave of people started joining after Robinhood started allowing basically anyone to sign up with margins and options. Almost everyone on wsb uses robinhood. It's a disaster in the making. Thankfully, they don't have too deep of a pocket. Most have 5k to 30k. I've seen one who traded from 300k to 1mil...

Fleet sales will begin at 10k per week rate. Don't underestimate demand from police departments. Can't let us out run them.7000-8000 may be a safe spot to park production, unless it's a line that can interchangeably build Model Y.

I don't doubt demand now, but after Model Y is introduced, and if Tesla wants to gravitate towards $50K average sale price, rather than 40K average, I don't think they should exceed 400K a year.

Of course, what do I know? If production becomes cheap enough, they may go for more basic models in the sale mix, and try to become more ubiquitous than BMW Series 3, rather starving German car industry of the oxygen...

Remember there were 2 weeks of shutdown time to install line improvements, which at 2,500/week equals 27,500...

Anyone else find it interesting that Tamberrino released a note on June 26 predicting that Tesla would "miss" on model 3 deliveries, coming in below "consensus," rather than focusing on Tesla's production guidance? Here's the CNBC quote:

"Goldman Sachs is reiterating its sell rating on Tesla and expects the electric car maker's widely watched Model 3 delivery number to fall short of Wall Street expectations."

Goldman reiterates sell on Tesla and expects Model 3 deliveries to miss estimates

I find his note interesting for a couple of reasons. Until this point, the widely watched metric has been Model 3 production. Why the switch this time to focusing on analysts consensus of deliveries rather than production? Tesla had guidance for production, not for deliveries. In a previous note from March 19, he kept his rating at sell, focusing on a production miss:

“Assuming that the last few weeks in March have a similar 1k/week production rate, we see total 1Q18 Model 3 production registering at approximately 9,500 vehicles,” they said. “That production rate would fall below guidance of exiting the quarter at a 2,500/week run-rate."

Tesla stock is still a sell at Goldman Sachs

That previous note focused on an average production for the quarter, which was also not something that Tesla had guided for, but note that it was focused on production as the metric. This time, it appears that Tamberrino had gotten the message that Tesla was going to meet production guidance. So, what to do, what to do? Remember, he has a $190ish price target to support. Oh, wait, deliveries appear to be down (for whatever reason), so let's focus on that and ignore the production. What was his stance about the production? "Tamberrino wonders how sustainable that rate is." Talk about moving the goalposts to make sure Tesla appears to have failed. Tamberrino is not unique in this. Several analysts switched their focus to deliveries rather than production, since Tesla did in fact meet guidance. There simply was no delivery guidance from Tesla. The analysts spun the data toward their bearish stance on Tesla. The analysts can come up with whatever consensus they want, based upon whatever metric they want to focus on, and there isn't a thing Tesla can do about it. Expect the analysts to be even worse with the Q2 financials next month.

Probably right about stock not tanking after Q2 earnings. But if it's worse, then there could be another "rude awakening".However, my guess is that since everyone knows Q2 financials will be bad and will expect the stock to tank, it probably won't. Bad Q2 financials certainly won't be a surprise to anyone following Tesla.

Note I'm simply trying to guess what the market consensus is made of, personally I'm just holding a leveraged long position and I am not so confident at the moment it'll work out well.

As to buying now vs then: no, this isn't a clear choice. Back then Tesla didn't discredit itself as much by missing its own guidance, folks were actually hopeful they learned from Model X disaster. Turned out, they didn't quite do that. They overspent on automation (wasted money and effort, some auto production expert commented that $2B spend on production line is unheard of), they had to stretch their finances and they are in a less advantageous position now vs. what was anticipated a year ago. Sure, the uncertainty of when M3 ramp happens is resolved, but for valuation to go up on that we would have to assume that valuation was based on an even more grim forecast (say, 5K/month 3 month from now) than what reality delivered.

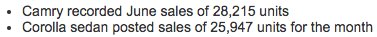

Model 3 will not be exported until 2019, so my point stands: Model 3 will be the top selling sedan by October, ahead of Camry.

Um, it's being exported (to Canada) today.

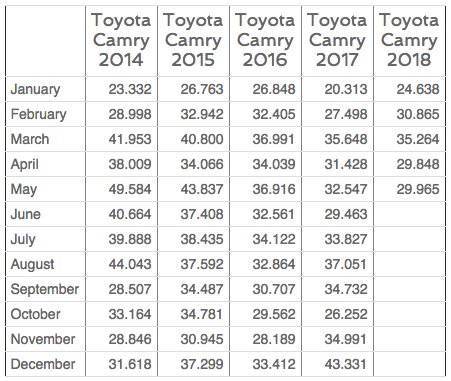

That's great and all, but I give the odds of Model 3 outselling Camry in US by [end of] October at approximately 5%. They'd need about 26,000-28,000 3s in the US. So, maybe 30,000-32,000 delivered including Canada. In other words, a stable 7,500 rate by mid-Sept in order to have stable deliveries at that rate from 10/1-10/31.

That's 10 weeks to go from maybe kinda-sorta 5,000 to 7,500 stable. Could happen, but I certainly won't call it likely, much less something that 'will' happen.

Of course I'd love to be wrong.

When did Musk say 10K M3s per week by the end of the year? I don't think it has been recently. As far as I recall, he has been much less clear on this point in the last half year.