Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Shell and Tesla

- Thread starter Jack6591

- Start date

-

- Tags

- Tesla Inc.

Oil is finite, so something will change. That those drilling for oil know that is not surprising. Interesting is the time horizon chosen. I would think that other scenarios are being considered as well. Those scenarios serve to test investment proposals. Unless a proposal is robust it will not go ahead. They do not necessarily foreshadow a larger scale move onto new pastures.

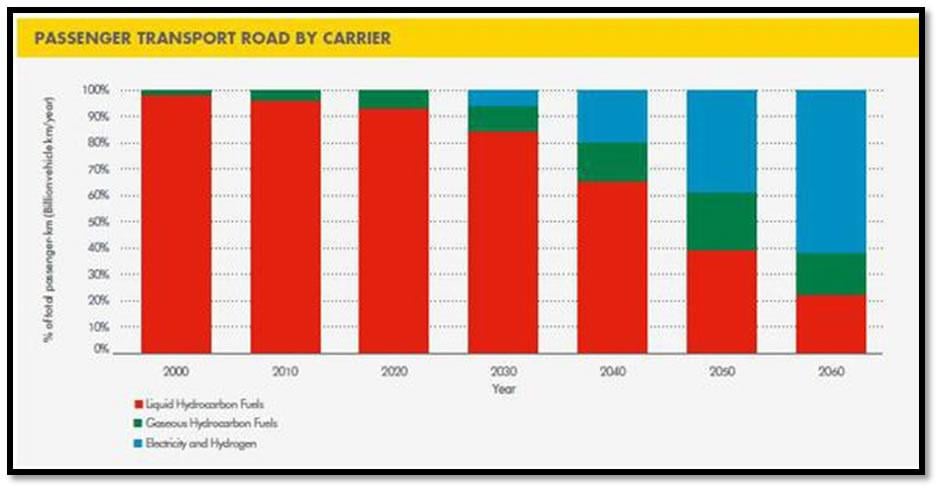

Great article, not the kind of prediction you'd guess would come from an oil company: by 2070 - streets will be free of gasoline vehicles. Wow. Not in their best interest to publicize this, but, I guess it's a reality they have to make public... my only issue is that they're lumping EVs and Hydrogen into one "category" -- would like to see how they'd split the two out...

Great article, not the kind of prediction you'd guess would come from an oil company: by 2070 - streets will be free of gasoline vehicles. Wow. Not in their best interest to publicize this, but, I guess it's a reality they have to make public... my only issue is that they're lumping EVs and Hydrogen into one "category" -- would like to see how they'd split the two out...

Shell and other oil companies nowdays presents themselves as energy companies, they eventually will go where profit in energy is. But if anybody is making so huge money as they do, why should they invest in something else?

They believe that if they will maximise profits today they will be able to get in something else in the future. Actaully Shell and other oil companies are already among biggest corporate investors in green energy.

The problem is that for them it is only drop in the pocket and if they would commit more of their plentifull resources in green energy they would speed it up significantly. However that would decrease their profits shortterm and wall street thinks in only 3 months horizont, so if you are CEO you can be out of the office by the time investment bring back money.

RobStark

Well-Known Member

This lumps together electric (BEV) and hydrogen (fool cell vehicles) together. Shell is hoping to dominate the production, distribution and retail of hydrogen.

OPEC and Big Oil always talk about a 50-60 year horizon for the end of oil. It justifies high oil prices but no urgency to transition to BEV.

OPEC and Big Oil always talk about a 50-60 year horizon for the end of oil. It justifies high oil prices but no urgency to transition to BEV.

jaanton

Roadster NA #1026

Not really surprising. Natural Gas is going to be available longer than Oil and the best way to produce hydrogen is steam reforming of Nat Gas. The oil companies become Nat Gas companies (if they aren't already really) and refineries become steam reformers to produce Hydrogen. BEV and FCEV are pretty close in design. Just seems to me that going the way of FCEV's we would be better off with CNG vehicles instead of FCEVs. But I think the push point there is that big steam reforming plants can sequester the resulting CO2 which isn't feasible if you have millions of CNG vehicles. No one really wants to do that CO2 sequestering though.

Shell and other oil companies nowdays presents themselves as energy companies, they eventually will go where profit in energy is. But if anybody is making so huge money as they do, why should they invest in something else?

They believe that if they will maximise profits today they will be able to get in something else in the future. Actaully Shell and other oil companies are already among biggest corporate investors in green energy.

The problem is that for them it is only drop in the pocket and if they would commit more of their plentifull resources in green energy they would speed it up significantly. However that would decrease their profits shortterm and wall street thinks in only 3 months horizont, so if you are CEO you can be out of the office by the time investment bring back money.

As much of the money they claim to invest in green technology is matched with an amount to purchase and shelve patents and new technology. It makes good business.

jeffhre

Member

I don't see it as admitting defeat. With oil more expensive to find, planes trains trucks and ships to fuel. A myriad of industrial and chemical processes to feed. Heating and a small slice of passenger car transport needs to fulfill, oil companies will have their hands full with as much business as they can handle for decades to come.

And oil companies are just now treating their gas (NG) divisions as thought they are part of the business and not unwanted step kids. With the loss of a portion, even a large portion, of the passenger car fuel business, it won't mean the collapse of oil companies.

A small slice of the global passenger vehicle miles in 2060 (22%) could well be the same as nearly 100% of the smaller automotive fuel market of 2013. How much of a concession is this by Shell in the aggregate? Lubricants, non road going transport, petrochemicals will continue to grow substantially - all things considered, is this a concession at all?

Add in a planned transition from gasoline to hydrogen covering the 2060 to 2070 period, with reliance on some technological wizardry, and it's more business as usual than shocking revelation.

And oil companies are just now treating their gas (NG) divisions as thought they are part of the business and not unwanted step kids. With the loss of a portion, even a large portion, of the passenger car fuel business, it won't mean the collapse of oil companies.

A small slice of the global passenger vehicle miles in 2060 (22%) could well be the same as nearly 100% of the smaller automotive fuel market of 2013. How much of a concession is this by Shell in the aggregate? Lubricants, non road going transport, petrochemicals will continue to grow substantially - all things considered, is this a concession at all?

Add in a planned transition from gasoline to hydrogen covering the 2060 to 2070 period, with reliance on some technological wizardry, and it's more business as usual than shocking revelation.

Peak Oil is not even the important factor for the success of EVs.

Countries like China and the whole EU and all the other countries that dont have their own Oil supply are really struggling with the big trade deficit (the Money that leaves the Country every year to buy Oil)

Will tax the S**t out of Gasolin as soon as a lineup of really affordable EVs comes on the market.

I dont see a reason why a Gallon Gasolin shouldnt be 20$ or 30$.

And the mentioned economies are well aware of that, E.g. Turkey hast 12$/Gallon to push the people to use local Natural Gas to power their cars.

That in my opinion will be they key driver for mainstream success in EVs.

Countries like China and the whole EU and all the other countries that dont have their own Oil supply are really struggling with the big trade deficit (the Money that leaves the Country every year to buy Oil)

Will tax the S**t out of Gasolin as soon as a lineup of really affordable EVs comes on the market.

I dont see a reason why a Gallon Gasolin shouldnt be 20$ or 30$.

And the mentioned economies are well aware of that, E.g. Turkey hast 12$/Gallon to push the people to use local Natural Gas to power their cars.

That in my opinion will be they key driver for mainstream success in EVs.

There are indeed a number of possible drivers. If you look at the mechanical simplicity of the Model S platform, with its very limited number of parts, you could easily imagine also that in a not too distant future electrical cars could become cheaper to produce than any equivalent combustion engined vehicle. This would merely be a repeat in the history of technical changes, where so often electricity displaced mechanics since about 1880. Not all that unlikely - with more dramatic consequences than most seem to be able to visualize.Peak Oil is not even the important factor for the success of EVs.

Countries like China and the whole EU and all the other countries that dont have their own Oil supply are really struggling with the big trade deficit (the Money that leaves the Country every year to buy Oil)

Will tax the S**t out of Gasolin as soon as a lineup of really affordable EVs comes on the market.

I dont see a reason why a Gallon Gasolin shouldnt be 20$ or 30$.

And the mentioned economies are well aware of that, E.g. Turkey hast 12$/Gallon to push the people to use local Natural Gas to power their cars.

That in my opinion will be they key driver for mainstream success in EVs.

The end of the oil age is near! Long live Tesla!

Source: Royal Dutch Shell

"By 2070, the passenger road market could be nearly oil-free

and towards the end of the century an extensive hydrogen infrastructure rollout displaces oil

demand for long haul and heavy loads.

By this time, electricity and hydrogen may dominate, and

affordable, plug-in, hybrid hydrogen vehicles offer the ultimate in flexibility and efficiency."

Article:

http://seekingalpha.com/article/177...t-projection?source=email_rt_article_readmore

ff

Source: Royal Dutch Shell

"By 2070, the passenger road market could be nearly oil-free

and towards the end of the century an extensive hydrogen infrastructure rollout displaces oil

demand for long haul and heavy loads.

By this time, electricity and hydrogen may dominate, and

affordable, plug-in, hybrid hydrogen vehicles offer the ultimate in flexibility and efficiency."

Article:

http://seekingalpha.com/article/177...t-projection?source=email_rt_article_readmore

ff

Similar threads

- Marketplace listing

Available

Tesla Supercharger Shell

- Replies

- 2

- Views

- 202

- Locked

- Marketplace listing

- Replies

- 6

- Views

- 636

- Locked

- Marketplace listing

- Replies

- 4

- Views

- 675

- Replies

- 9

- Views

- 599