Or to put it another way, buy low sell highSound financial advice from Sacha:

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StealthP3D

Well-Known Member

As an investor, at what point do you start worrying about China demand? When there is another price cut announcement? The first price cut was substantial. Tesla is not exactly a company that likes to talk about these things and perhaps for the right reasons.

A productive investor doesn't worry, they analyze. How well a particular model car sells in a given market is very price sensitive so it's not a matter of when Tesla "runs out" of demand in China at all, it's what margins they are able to sell the car for as they continue to expand volumes. And Tesla has HUGE margins on made in China cars, better than the rest of the "competition". Even small changes in price or other incentives will increase demand greatly without lowering margins anywhere near the point that I would be concerned. Because demand is so sensitive to changes in price, and Tesla has the best look into demand for Tesla's in China via multiple channels, it ONLY makes sense to analyze demand on solid info and the most solid info is the pricing and incentives. The prices are already so high relative to cost of production, I would need to see multiple consecutive price-cutting, in a short period of time, to conclude demand was much less than I anticipated.

The way people are talking about demand problems in China makes it apparent they don't understand just what a large "sponge" China is when it comes to high-quality EV's and how much pricing power Tesla actually has. Tesla has only just scratched the surface of demand in China and a lot of that demand cannot be filled by domestic brands due to lack of status associated with those brands. More important than demand, is cost to produce. It's a metric shrouded and hard to see perfectly, only as good and as timely as Tesla's quarterly reporting, so it's not as eye-catching and dramatic as screaming about possible demand issues, but it's what ultimately determines how much demand a product actually has. If a company can make a desirable product at a cost to produce that competitors cannot touch, the product is going to sell well and be profitable. It's the biggest advantage a company can have, that's why Elon focusses so intently on lowing the cost to produce, not because this is the company's weak spot compared to the competition, but because it's their strong suit, and the one that determines how large they can grow, how profitable they can be, and how resistant they are to future challenges and roadblocks that may appear. This is ultimately what controls demand.

I'm a long-term investor so I base all my investment decisions on long-term metrics, not little 'hiccups' along the way. Doing that is an invitation to get 'stopped out' of a very lucrative investment. One of the more important; how pricing is trending as production and sales increase. I assume it will decline gradually, so what I'm looking for as a red flag is a sharper decline that could portend the market is getting saturated and there is not a lot of room left to cut margins further to stimulate demand. Eventually, it will be a balancing act of volume/margins but, IMO, we are not even close to that point.

In the future, I will lean towards favoring higher volumes, even at slightly lower total profits, because higher volumes create a bigger customer base for things like insurance, subscriptions, service and accessories. I know Elon has said these are not areas he wants to monetize, and I trust that he does not want to do the distasteful things we have seen with pricing of these things at dealerships and with legacy auto. But it's still a huge and growing business that is very valuable simply because it could be monetized. It will add significant value to the shares beyond the amount of profit realized through low margin sales. The low prices on services and subscriptions are simply a goodwill gesture to help the business grow more quickly and without issues throughout this decade and perhaps beyond. And FSD eventually.

The other advantage of favoring volume over slightly higher total profits (when we get to that point) is that this is what furthers the primary mission of the company. More high-quality and durable EV's at lower prices so they can displace more ICE vehicles.

I don't make my living by playing quarterly profit guessing games, and I'm not about to start now. It's a losing game compared to investing in long-term growth, the building of superior businesses. Cries about China demand are flimsy and misplaced and I'm surprised how deeply it has concerned so many here. It's a false narrative designed to create fear, uncertainty and doubt amongst TSLA investors. I'm sure some well-meaning people have jumped on the bandwagon out of genuine concern, but only because they don't understand just how much untapped demand Tesla has in China.

Speaking of China demand, I'll predict right now that demand in China for the Cybertruck is going to surprise many Westerners because China is not historically a big market for full-sized pickups. As soon as the manufacturing economics are proven in the US, I think Tesla will start producing in them in China for local consumption. If things go well in Texas, I think Cybertruck production lines will start being constructed in China by 2025. Alternatively, Tesla may wait for the smaller 'Wolverine' edition because that may better suit a population with smaller physical bodies.

Last edited:

Thekiwi

Active Member

More than anything, I find this quarter to be fascinating.

As I've mentioned in a few posts over the past weeks/months, I can't find another example out there where a company's Forward P/E is lower than their most recent earnings growth rate........where even by analysts' consensus, the present quarters earnings will be up 2X the Forward P/E.

I'll repeat, never seen anything like this without a company giving some sort of guidance revisions/warning that growth completely stall or go negative for the foreseeable future. Tesla just a month ago gave guidance of just under 50% delivery growth. Wall isn't just saying they expect growth/earnings to slow down, they are essentially saying "We think Tesla's earnings growth has peaked completely and will only grow mid to upper single digits annually for the next 5 years."

The gap between fundamentals/metrics and TSLA's valuation, to me at least, are way beyond what we experience in 2019. Which is why Q4 will be so pivotal. If Tesla can just get one full smooth quarter of production out of Shanghai + Berlin/Austin ramp continuing smoothly, I think Tesla will shock Wall St with gross margins and fully demonstrate it's operational leverage.

I continue to believe that the combination of Q4 + Q1 (which will have the full effects of the IRA on display in earnings) will result in TSLA being back to its' all-time high. If FSD wide release happens in either Q4 or Q1 and recognized in earnings, I think it will break it's ATM in a significant way

Not sure how hard you looked, but you really dont have to go far to find an example, just look at the largest company on the planet:

Apple Annual Net income 2009-2012:

2009: $8.24 Billion

2010: $14.01 Billion (70% growth)

2011: $25.92 Billion (85% growth)

2012: $41.73 Billion (59% growth)

Apple PE Ratio 2009-2012: average below 20x on a trailing basis, and much lower on a forward basis.

Trailing PE ratio chart:

Last edited:

Thekiwi

Active Member

TSMC “A-list” clients (Apple, Nvidia etc) pretty much lock up all volume for the new nodes for the first year or so.Is this really a strategy shift for Tesla? Normally, Tesla puts its chips into production on technology nodes that are one behind the state-of-the art. TSMC web site suggests that its 5nm technology node went into production in mid-2020 and therefore 2023 would seem again to be one node behind the state of the art. Admittedly, if they are on the 4nm technology node, that would probably be at or near the state-of-the art in 2023.

Seems like you told half the story. Right after 2012 I see a lot of negative net income growth for 2013 and a flat 2014.Not sure how hard you looked, but you really dont have to go far to find an example, just look at the largest company on the planet:

Apple Annual Net income 2009-2012:

2009: $8.24 Billion

2010: $14.01 Billion (70% growth)

2011: $25.92 Billion (85% growth)

2012: $41.73 Billion (59% growth)

Apple PE Ratio 2009-2012: average below 20x on a trailing basis, and much lower on a forward basis.

Trailing PE ratio chart:

View attachment 877314

StarFoxisDown!

Well-Known Member

Thanks for saving me a post. Yes Apple had a good stretch from 2009 to 2011. Their earnings growth was pretty tame from 2012-2019. Tesla kept their earnings growth % intact far better and longer than Apple didSeems like you told half the story. Right after 2012 I see a lot of negative net income growth for 2013 and a flat 2014.

View attachment 877330

Thekiwi

Active Member

I showed the 4 year period where smartphone growth absolutely exploded - yet in 2009, when Apple had 3 years of insane net income growth ahead of it - it had a trailing PE of less than 20x, and a forward PE of close to 10x.Seems like you told half the story. Right after 2012 I see a lot of negative net income growth for 2013 and a flat 2014.

View attachment 877330

Last edited:

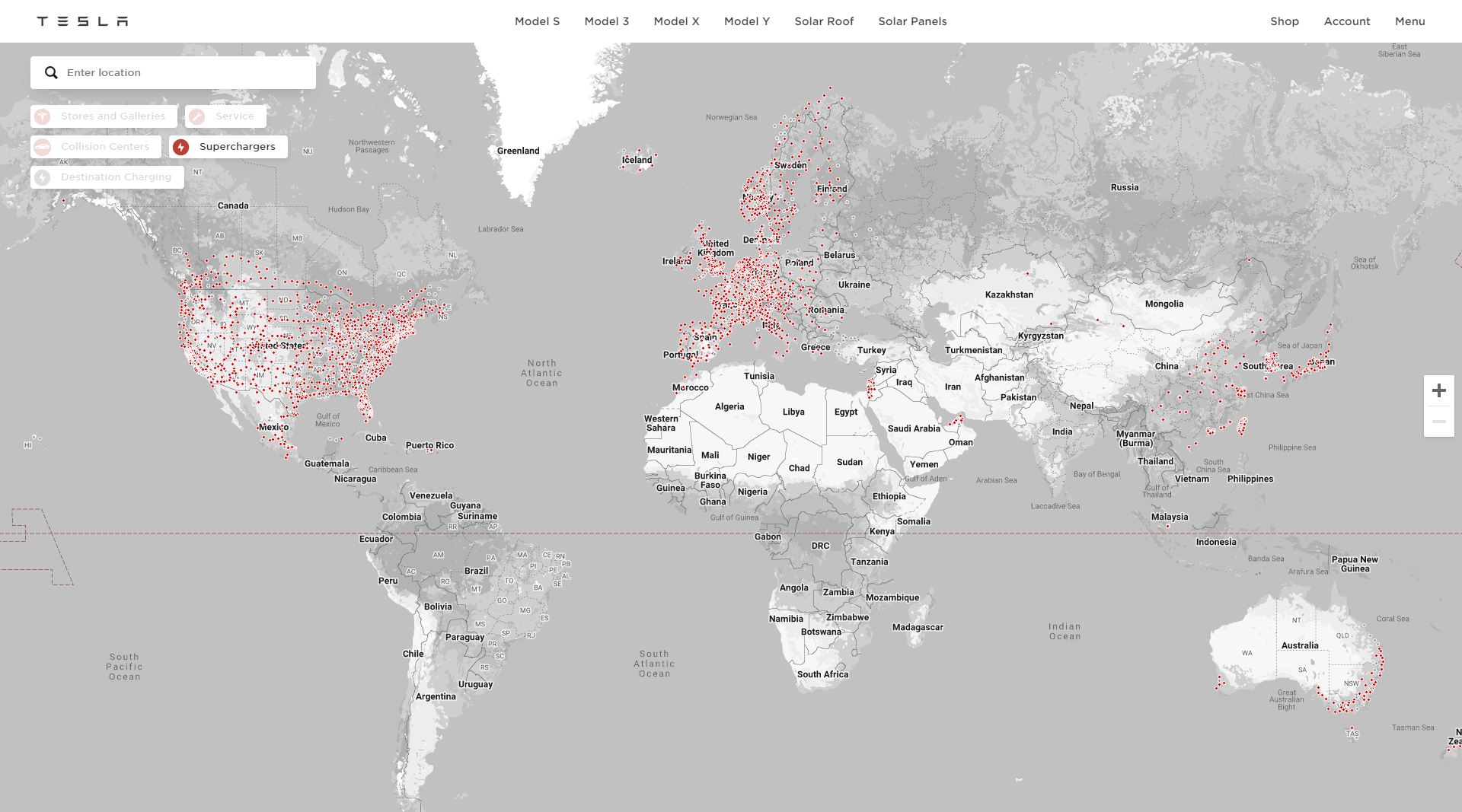

Tesla Supercharger network reaches 40,000 stalls around the world

One of Tesla’s biggest and undervalued assets is its Supercharger network, and today the company announced the network now includes over 40,000 stalls around the world. The milestone was reached just over 10 years after [...]

driveteslacanada.ca

driveteslacanada.ca

Thekiwi

Active Member

lolwot. Apple grew its annual net income from $6 Billion in 2008, to $41 Billion in 2012, to $100 Billion today.Thanks for saving me a post. Yes Apple had a good stretch from 2009 to 2011. Their earnings growth was pretty tame from 2012-2019. Tesla kept their earnings growth % intact far better and longer than Apple did

you are basically writing off a clear example of Apple from 2008-2012 that counters your assertion that no other company was as unfairly treated PE ratio wise like tesla has for a sustained hgih growth multi-year period, when in fact Apple had a drastically lower forward PE over that period than Tesla does today.

(And the PE ratio was even lower when subtracting out the then rapidly accumulating cash pile.)

Last edited:

I showed the 4 year period where smartphone growth absolutely exploded - yet in 2009, when Apple had 3 years of insane net income growth ahead of it - it had a trailing PE of less than 20x, and a forward PE of close to 10x.

I remember that. Apple always was penalized compared to other tech stocks, PE wise, for whatever reason. I guess because it was hardware maybe? It was infuriating back in the day...

Thekiwi

Active Member

The argument was always “Apple is doomed“, “Competition is coming” and “no one can maintain high margins in consumer electronics”.I remember that. Apple always was penalized compared to other tech stocks, PE wise, for whatever reason. I guess because it was hardware maybe? It was infuriating back in the day...

Pretty much the same attitudes that critics have had about Tesla over the past decade.

Look back at FAANG +microsoft stocks, looks like Amazon/Netflix/Facebook had pretty high PEs while Apple, Microsoft and google had pretty low PEs, usually in the teens or 20s.I remember that. Apple always was penalized compared to other tech stocks, PE wise, for whatever reason. I guess because it was hardware maybe? It was infuriating back in the day...

Thekiwi

Active Member

The Tesla / iPhone comparison is admittedly a tired one, but I think the reason it comes up so often is that it is accurate:The argument was always “Apple is doomed“, “Competition is coming” and “no one can maintain high margins in consumer electronics”.

Pretty much the same attitudes that critics have had about Tesla over the past decade.

Apple iPhone: Between 2007-2013, iPhone went from 0% to ~20% of the global cellphone market, then unit growth slowed and was similar to overall market growth. However that global 20% share accounts for the majority of the worlds premium customers (Apple’s 1 Billion users have very high portion of global discretionary spending) which allows Apple to maintain high margins and grow its other hardware & software/services product lines to those same customers.

Tesla Auto: Tesla auto probably goes a similar way, albeit with a longer timeframe as it takes far longer to build auto production capacity than ramping a cellphone factory. But Tesla grows from 0% to 20/25% of global auto sales in 12-15 years post model 3 launch, but that 20/25% will be the majority of the worlds premium customers, and Tesla will concurrently be able to expand its other hardware/service products to those same high discretionary spend customers.

Just like no other smartphone brand maintains margins anywhere near Apple, and struggles to enter or create ancillary markets, no other Car manufacturer will be able to maintain margins anywhere near Tesla, and will also struggle to compete in other markets Tesla is in or creates.

Spokesperson:.Alternatively, Tesla may wait for the smaller 'Wolverine' edition because that may better suit a population with smaller physical bodies.

Uh oh...

Manchester United is now for sale...

What's the sale of another $5 billion or more of Tesla stock between friends?

Manchester United is now for sale...

What's the sale of another $5 billion or more of Tesla stock between friends?

Last edited:

Bleh, Margin called…I was way too greedy back in the good old days…still up a ton but wish I would have been smarter

I would have been margin called if I didn’t inject an insane amount of money lately into my account. Every week that goes buy I am selling more and more covered calls and working more and more to pay my margin. It is not a great feeling.

You have to manage margin instead of buying super happy to buy more and more shares at a super discount.

Yesterday was probably the best day in history to buy TSLA shares. The chance of the decade. Black Friday TSLA deal. However I deployed the last amount of dry powder I had at $185 and have nothing left but energy funds to cover margin if we drop to $150.

My deep respect to all the investors here who have been able to buy with no stress at the les crazy low prices.

We hope.Yesterday was probably the best day in history to buy TSLA shares. The chance of the decade.

Gigapress

Trying to be less wrong

Now that's an interesting idea I don't remember hearing from anyone else. Why do you predict this? Also, do you think Europe or other East Asian nations will have a similar surprising demand for CTs?I'll predict right now that demand in China for the Cybertruck is going to surprise many Westerners because China is not historically a big market for full-sized pickups

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K