I've been thinking... if that Tennant Creek solar plant goes through, Australia might get its own Gigafactory.

Tennant Creek is supposed to get a 20-30GWh storage facility. That's the entire current annual output of GF1. Would Tesla send that remotely? I highly, highly doubt it. GF1's output is going to be spoken for for years, as is GF3's, and GF4's in Europe. And Musk hates sending large amounts of product overseas, vs. making it locally. Meanwhile, Australia is among the world's top suppliers of every raw material that goes into making an EV battery pack except graphite (if natural graphite is used) - and the largest current source of that is nearby China.

But Australia also has promising local graphite resources, too - including one of the world's largest graphite deposits (discovered in 2016), which has thusfar been untapped but is planned to start production in 2020, and is expected to yield high quality graphite at very low costs.

And it's not like battery needs would suddenly stop after Tennant Creek; they're just going to keep growing. In Australia, in the region, and globally. The sustained output of such a plant would absolutely be gobbled up even after Tennant Creek finishes construction. Particularly because an energy-dedicated Gigafactory with Tesla's newest battery tech would be able to make storage a fraction the cost that it is today.

If Tennant Creek goes through as planned... I think you Aussies getting a Gigafactory.

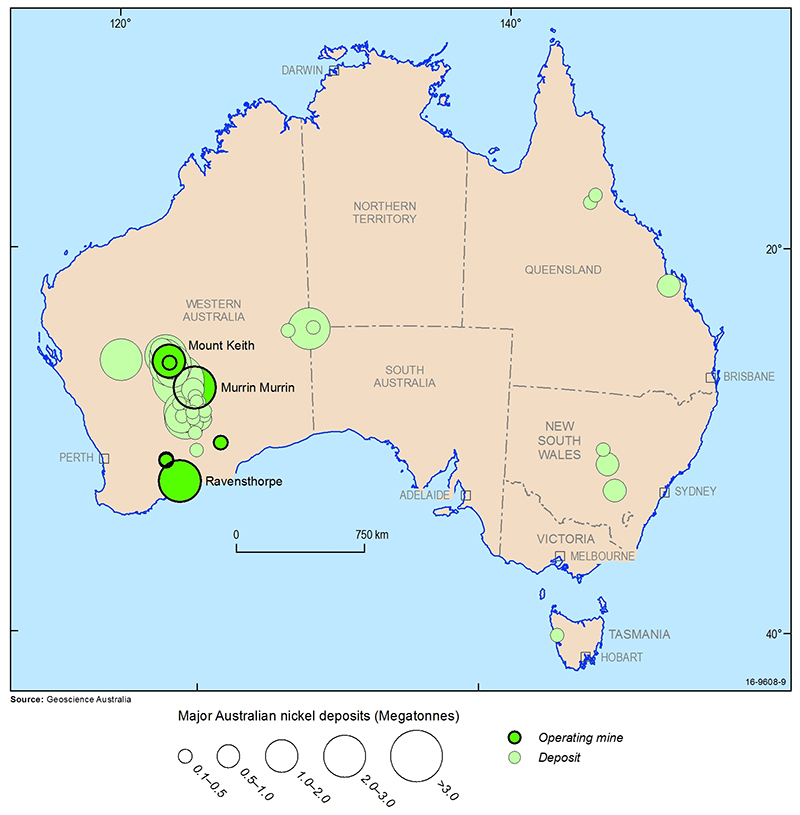

GF5 or GF6. Location would, with high likelihood, be somewhere on the outskirts of Perth, or if not, South Australia; most of Australia's battery-related mineral resources are near there. For example, most of Australia's nickel:

... and the largest lithium mine on Earth:

The Perth area also offers a sufficient local labour pool for construction and operation. The main downside is the tight labour market, which might favour South Australia instead.

The Siviour graphite deposit is in South Australia, here - not that far away:

Siviour graphite

has already been trialed for use in li-ion batteries.