I just did some similar math. My app says I charge 20% at SC, and se 4000 kWh per year, so $800 * .45 (California's exorbitant cost and I’m usually mid day o. Road trips), so $360 total x whatever the margin is. But, every non-Tesla is pure added margin, assuming to date the network was built out for Teslas only. Going forward, that will likely change.Lots of cheering, but what does this deal imply? I'm missing some analysis of the financial implications.

- How often will the average Ford/GM EV driver supercharge per year? Most charging is done at home, because it's more convenient and cheaper. I'd estimate 10 times.

- How much does the average charge cost? I'd say 70 kWh. At $0.30 that makes about $20.

- What is the profit margin on this? 60% perhaps? $12 in profit then. So we get to $120 of profit per EV per year.

- How many EVs will be driving around in the US in, say, 10 years? One hundred million, including Teslas?

Assuming all other brands also sign up that's $12 billion in profit (of which 2/3 was not yet accounted for, the Teslas were). Capital costs and maintenance will take that down to maybe $10 billion. Assuming there's a P/E of 20 for that part of the business that makes for $200 billion in market cap. That's 60 points. A lot, but I suppose not enough to get us to an ATH.

Other implications: Tesla loses a very big moot. But Tesla also becomes a household name for EV drivers who visit the Superchargers and that may lure people to the brand.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Normally most of these (Apple News stories about Tesla) are negative. Nice to see positive (or at least non-negative) news.

TrendTrader007

Active Member

Here’s a little real story:

So I’m on vacation in Europe with zero intentions of trading TSLA. No computer just my iPhone. Plus I’m super bullish

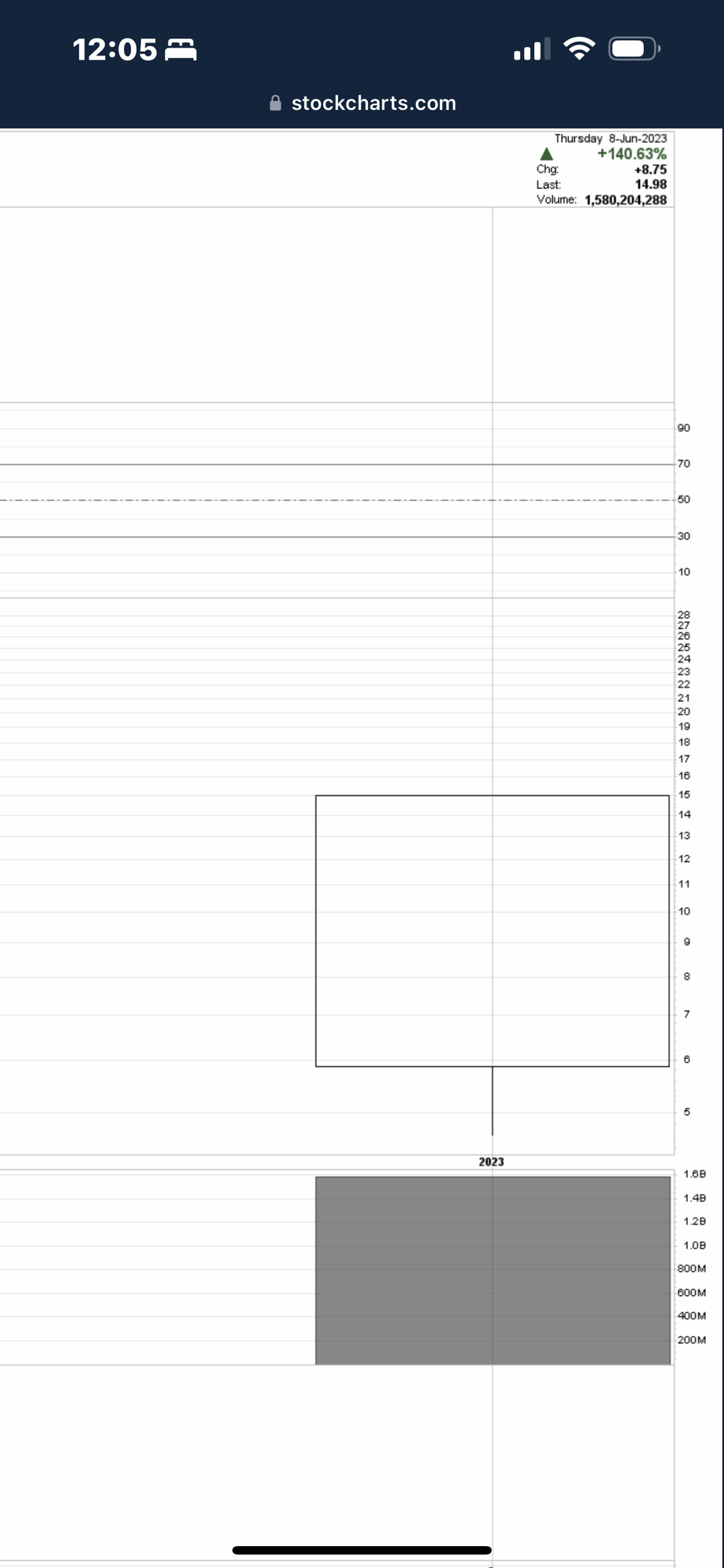

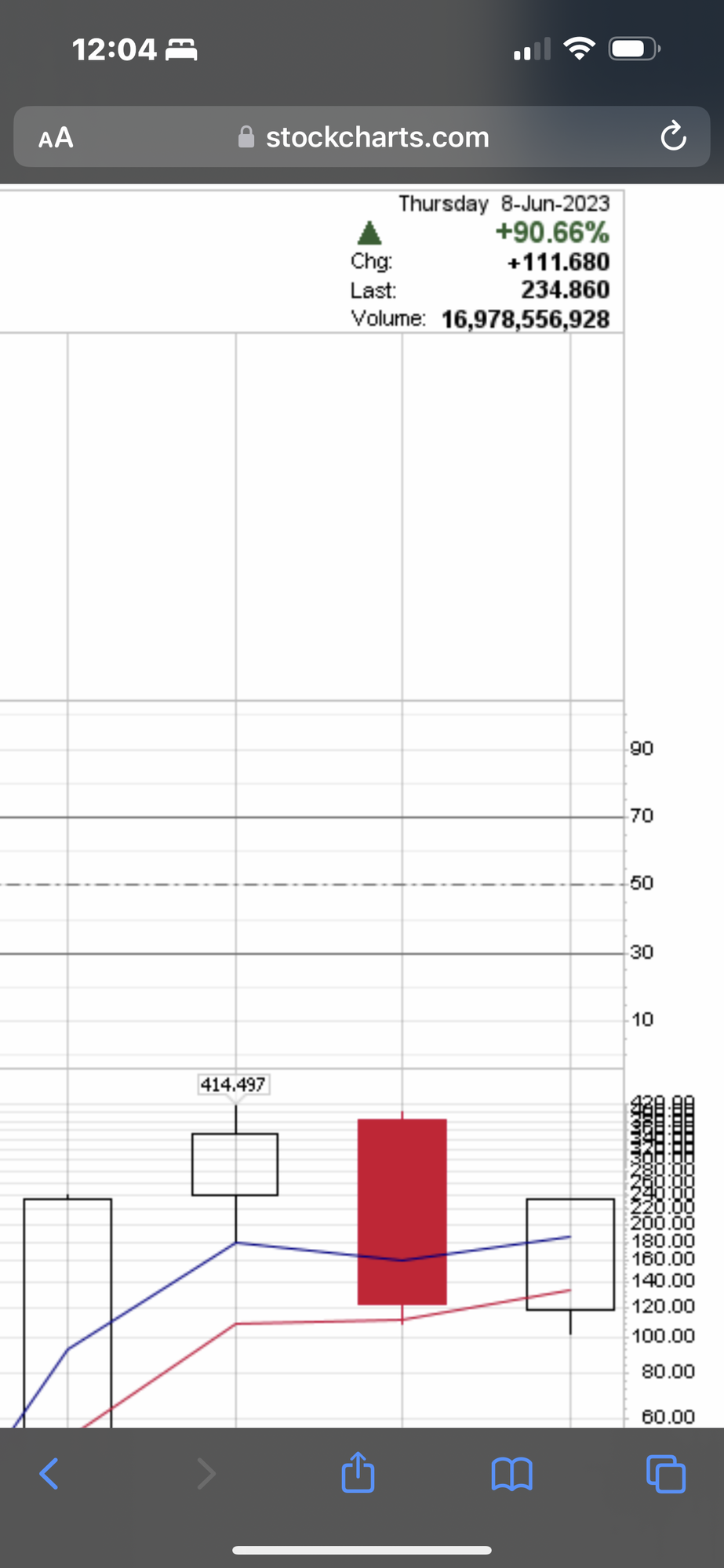

Then the unthinkable happens: TSLA goes up 9 days straight in a row as of last night (10 today)

Plus it had a black candle yesterday. So i sold all my TSLA last night and bought NVDA afterhours : was up till 2 AM local time buying NVDA which all my buying pushed up afterhours price: all this on my cell phone

Woke up this morning and US market does not open till 3.30 PM local time. I was in a restaurant on my cellphone when I sold all my NVDA at market open and went 100% cash expecting TSLA to drop so I could buy it back cheaper. Within 30 minutes I realized that I was wrong. I had sold all my TSLA yesterday at $223.25 and this morning it was flirting with $230. As soon as TSLA hit $231 I knew it was now or never. My 3 options were:

#1 buy back all my TSLA about 4% higher

#2 go Way DITM December 2025 like $25 strikes

#3 go all in TSLL

I chose option #3 but was not sure if daily trading volume could handle all my buying without pushing up the price way too high on myself. Well there was only one way to find out

So for next 2 hours straight there I was walking behind my wife on the streets of Budapest with no idea where I was going frantically placing buy orders for TSLL for a very large position overall. All this on my iPhone!

I completed all my buying just in time before stock shot up

Moral of story: If I’m wrong I immediately change my mind and do what it takes to make money rather than despairing over 4 to 5% here or there

There are folks who cannot handle buying back a stock much higher than what they sold it at

Not me

Not trading or investing or financial advice

So I’m on vacation in Europe with zero intentions of trading TSLA. No computer just my iPhone. Plus I’m super bullish

Then the unthinkable happens: TSLA goes up 9 days straight in a row as of last night (10 today)

Plus it had a black candle yesterday. So i sold all my TSLA last night and bought NVDA afterhours : was up till 2 AM local time buying NVDA which all my buying pushed up afterhours price: all this on my cell phone

Woke up this morning and US market does not open till 3.30 PM local time. I was in a restaurant on my cellphone when I sold all my NVDA at market open and went 100% cash expecting TSLA to drop so I could buy it back cheaper. Within 30 minutes I realized that I was wrong. I had sold all my TSLA yesterday at $223.25 and this morning it was flirting with $230. As soon as TSLA hit $231 I knew it was now or never. My 3 options were:

#1 buy back all my TSLA about 4% higher

#2 go Way DITM December 2025 like $25 strikes

#3 go all in TSLL

I chose option #3 but was not sure if daily trading volume could handle all my buying without pushing up the price way too high on myself. Well there was only one way to find out

So for next 2 hours straight there I was walking behind my wife on the streets of Budapest with no idea where I was going frantically placing buy orders for TSLL for a very large position overall. All this on my iPhone!

I completed all my buying just in time before stock shot up

Moral of story: If I’m wrong I immediately change my mind and do what it takes to make money rather than despairing over 4 to 5% here or there

There are folks who cannot handle buying back a stock much higher than what they sold it at

Not me

Not trading or investing or financial advice

Hock1

Member

How about "helping" Ford, and now GM, to develop software that legacy engineers are incapable of developing. It's got to be done. Who else is going to do it. This is huge.Tesla will in future be energy provider for almost all EVs. I expect the supercharger network to grow much much faster. The utilization will also increase and this is going to create a flywheel effect. The day is not far when majority of superchargers have storage with them connected to Tesla solar/ and other renewable grid sources. With autobidder, Tesla will get almost free electricity to store at supercharger megapack sites considering how quickly solar and wind are expanding. Next would be selling tesla home charger equipment to almost EVs. I just can not fathom how big this announcement is!!!!

Words of HABIT

Active Member

That is a moot point. It's a bridge to transition transport to sustainable EVs, for soon to be all auto manufacturers. We all win. Nuff said.Other implications: Tesla loses a very big moot.

it is the market recognition /validation of the "network effect " of the Tesla supercharger network ... most of us have know but has not been reflected in the TSLA SP ... maybe some are waking up to the fact that Tesla is not just a car companyLots of cheering, but what does this deal imply? I'm missing some analysis of the financial implications.

- How often will the average Ford/GM EV driver supercharge per year? Most charging is done at home, because it's more convenient and cheaper. I'd estimate 10 times.

- How much does the average charge cost? I'd say 70 kWh. At $0.30 that makes about $20.

- What is the profit margin on this? 60% perhaps? $12 in profit then. So we get to $120 of profit per EV per year.

- How many EVs will be driving around in the US in, say, 10 years? One hundred million, including Teslas?

Assuming all other brands also sign up that's $12 billion in profit (of which 2/3 was not yet accounted for, the Teslas were). Capital costs and maintenance will take that down to maybe $10 billion. Assuming there's a P/E of 20 for that part of the business that makes for $200 billion in market cap. That's 60 points. A lot, but I suppose not enough to get us to an ATH.

Other implications: Tesla loses a very big moot. But Tesla also becomes a household name for EV drivers who visit the Superchargers and that may lure people to the brand.

WolfHero

Member

There is also a potential license/royalty fee that GM/Ford needs to pay Tesla for each car they build that uses NACS.Lots of cheering, but what does this deal imply? I'm missing some analysis of the financial implications.

- How often will the average Ford/GM EV driver supercharge per year? Most charging is done at home, because it's more convenient and cheaper. I'd estimate 10 times.

- How much does the average charge cost? I'd say 70 kWh. At $0.30 that makes about $20.

- What is the profit margin on this? 60% perhaps? $12 in profit then. So we get to $120 of profit per EV per year.

- How many EVs will be driving around in the US in, say, 10 years? One hundred million, including Teslas?

Assuming all other brands also sign up that's $12 billion in profit (of which 2/3 was not yet accounted for, the Teslas were). Capital costs and maintenance will take that down to maybe $10 billion. Assuming there's a P/E of 20 for that part of the business that makes for $200 billion in market cap. That's 60 points. A lot, but I suppose not enough to get us to an ATH.

Other implications: Tesla loses a very big moot. But Tesla also becomes a household name for EV drivers who visit the Superchargers and that may lure people to the brand.

Captkerosene

Member

Billions more in free Govt money to build Superchargers ... and we keep the profits.I'm definitely not one of those. I'm quite happy to share the Superchargers as long as Tesla can build them out fast enough so they aren't too crowded. And I think Tesla will deliver on that.

From a business standpoint, it makes sense to charge everyone the same. You want to build goodwill with non-Tesla owners so they come to love the brand and eventually buy a Tesla.

TrendTrader007

Active Member

The reason I chose TSLL over December 2025 DITM:

#1 no worries about time decay

#2 gives me anywhere from 25 to 40% leverage in practical terms with zero margin

#3 NVDL is to NVDA what TSLL is to TSLA

#4 I was pleasantly surprised ease by which I was able to build up my TSLL position within 2 hours when I was under the wrong impression that it would take me at least a full day if not more

#5 TSLL pays dividends 1.13% approximately

Negative: I worry about financial health of Direxion and counterparty risk with swaps

If TSLA plunged extensively then TSLL is toast

Requires very high degree of vigilance with zero complacency

Not financial advice

I share all this because I have no one to talk to about my trading/investing and it’s good to share my experiences

#1 no worries about time decay

#2 gives me anywhere from 25 to 40% leverage in practical terms with zero margin

#3 NVDL is to NVDA what TSLL is to TSLA

#4 I was pleasantly surprised ease by which I was able to build up my TSLL position within 2 hours when I was under the wrong impression that it would take me at least a full day if not more

#5 TSLL pays dividends 1.13% approximately

Negative: I worry about financial health of Direxion and counterparty risk with swaps

If TSLA plunged extensively then TSLL is toast

Requires very high degree of vigilance with zero complacency

Not financial advice

I share all this because I have no one to talk to about my trading/investing and it’s good to share my experiences

Who knew that VW and EA were playing 4-d chess? By deploying a POS charging infrastructure, they pushed US OEMs into the Tesla sphere of influence thereby speeding the EV transition!

Well played.

Well played.

lafrisbee

Active Member

I'm just gonna pretend you were talking to me?Yep. I lost a third of my shares primarily to stupidity, medical costs, and dependence on credit at the end of last year... coming back now, but until Tesla's price drop at the beginning of this year I thought I might lose it all.

So with that in mind, if you're satisfied that you're in good shape going forward without putting your money back in TSLA, more power to you. Don't sweat FOMO because you didn't miss out! You have achieved your financial goals mate, now it's time to enjoy the spoils!

But please keep on posting, we'd miss your valuable input my friend.

JRP3

Hyperactive Member

How not to invest in TSLAHere’s a little real story:

So I’m on vacation in Europe with zero intentions of trading TSLA. No computer just my iPhone. Plus I’m super bullish

Then the unthinkable happens: TSLA goes up 9 days straight in a row as of last night (10 today)

Plus it had a black candle yesterday. So i sold all my TSLA last night and bought NVDA afterhours : was up till 2 AM local time buying NVDA which all my buying pushed up afterhours price: all this on my cell phone

Woke up this morning and US market does not open till 3.30 PM local time. I was in a restaurant on my cellphone when I sold all my NVDA at market open and went 100% cash expecting TSLA to drop so I could buy it back cheaper. Within 30 minutes I realized that I was wrong. I had sold all my TSLA yesterday at $223.25 and this morning it was flirting with $230. As soon as TSLA hit $231 I knew it was now or never. My 3 options were:

#1 buy back all my TSLA about 4% higher

#2 go Way DITM December 2025 like $25 strikes

#3 go all in TSLL

I chose option #3 but was not sure if daily trading volume could handle all my buying without pushing up the price way too high on myself. Well there was only one way to find out

So for next 2 hours straight there I was walking behind my wife on the streets of Budapest with no idea where I was going frantically placing buy orders for TSLL for a very large position overall. All this on my iPhone!

I completed all my buying just in time before stock shot up

Moral of story: If I’m wrong I immediately change my mind and do what it takes to make money rather than despairing over 4 to 5% here or there

There are folks who cannot handle buying back a stock much higher than what they sold it at

Not me

Not trading or investing or financial advice

FairscottL

Member

Nah.I see no micro or macro news that could've inspired that.

Two possibilites come to mind:

1) Somebody knows something positive about Tesla, and algobots are joining the party.

2) After TSLA being up 8 successive sessions, margin calls may be going out to short sellers.

Musk back at Tesla full time.

24% increase in China sales

375,000 CYBRTRK production goal for Giga Texas first year means nothing.

Tesla sharing chargers with FORD

Tesla sharing chargers with GM

New Tesla factory in Spain

New Tesla factory in Mongolia

Musk negotiating with India

New Model 3 release

0

And just a couple other things

Nothing really significant thoughts

It likely doesn't change it at all. The standards require a Type 1 CCS connector on every charger funded by NEVI. But they allow a NACS to be paired with it. So maybe everyone will put dual connectors on now.I wonder how this changes the Infrastructure Law investment into charging networks? Will it end up causing Tesla to be contracted for more of the work and therefore building out the Tesla SuperCharger Network to an even greater extent with public dollars.

We don't even know if Tesla is going to apply for any of the NEVI funds. (It comes with a lot of requirements that I don't think Elon/Tesla want to comply with.)

Tesla hasn't applied for any of the NEVI funding in Oregon yet. There are already 16 companies that have signed up to submit a bid, but there are only three contracts that will be available for the first year of NEVI funding. (Tesla has another ~3 weeks to sign up if they are interested.) I expect the same thing will play out in the other states/territories. Way more companies submitting bids than contracts than will be awarded. And even if Tesla applies, they probably won't win a lot of contracts. (Maybe they will bid double the number of stalls and under-cut everyone on price, it will be interesting to see how it plays out.)

lafrisbee

Active Member

I kept it all the way down. I sold on a significant rise. And I listened to elon.How not to invest in TSLA

lafrisbee

Active Member

And I asked those that comment be niceHow not to invest in TSLA

lafrisbee

Active Member

The list you post is similar of the one that has been posted all the way down from $400 to $100.Nah.

Musk back at Tesla full time.

24% increase in China sales

375,000 CYBRTRK production goal for Giga Texas first year means nothing.

Tesla sharing chargers with FORD

Tesla sharing chargers with GM

New Tesla factory in Spain

New Tesla factory in Mongolia

Musk negotiating with India

New Model 3 release

0

And just a couple other things

Nothing really significant thoughts

Your post is "moat."

I want to understand the outlines of the deals with Ford and GM. But I understand that's not practical.Agree. Non-Tesla EVs will likely pay a flat monthly fee to access the Supercharger network (perhaps even included with their purchase as a payment from the OEM to Tesla), or pay a slightly higher rate per kwh delivered if they aren't a member.

We have already seen how Tesla Europe does this for other EV owners. The difference in N. America will be access to the App API by the OEM, so they can at least get started on their long slog to software self-reliance.

Cheers!

What would be awesome is if Elon communicated to all of the other OEMs that each new partner will pay a higher fee than the previous. Something like that could certainly explain the quick announcement by GM following Ford last week.

Given the mission and Elon's sense of fair play, I don't think this is what happened. It could be that GM has been talking with Tesla for a long time just like Ford. And the timing could be due to GM realizing their asks were not going to happen once Ford announced.

On the other hand, Tesla clearly holds all the cards in these negotiations. Rather than prolonged, dragged-out negotiations, Tesla could offer the same deal to all OEMs as a take-it-or-leave-it, but with the addition that costs will increase with each new OEM that signs up.

ByeByeJohnny

Active Member

So assuming all the others will follow Ford and GM and NACS becomes the lone system in the US.

Will Tesla be the only one having charging stations? Wouldn't that be seen as a monopoly? I think Tesla will have to let other actors start building charging stations using NACS. So we can't assume as someone did above that Tesla will charge every single EV in the future.

I would not be surprised if Tesla gave up both the technology and the patents for free. Obviously Tesla have a huge advantage with already 2.000 or so locations as well as production lines that are constantly churning out new ones. But eventually one or a couple of competitors will appear and I think Tesla would want that to not get in trouble with the government. EA and other will switch and if they can make room in their budgets I wouldn't rule out that GM and Ford could try building their own networks.

Will Tesla be the only one having charging stations? Wouldn't that be seen as a monopoly? I think Tesla will have to let other actors start building charging stations using NACS. So we can't assume as someone did above that Tesla will charge every single EV in the future.

I would not be surprised if Tesla gave up both the technology and the patents for free. Obviously Tesla have a huge advantage with already 2.000 or so locations as well as production lines that are constantly churning out new ones. But eventually one or a couple of competitors will appear and I think Tesla would want that to not get in trouble with the government. EA and other will switch and if they can make room in their budgets I wouldn't rule out that GM and Ford could try building their own networks.

Artful Dodger

"Neko no me"

Just look at GM stock. They are up more AH than TSLA.

TSLA After-hrs Volume was 10,015,844 shares by 6:13 pm ET.

Anybody care to guess when the LAST time TSLA volume was this high after-hours?

Tomorrow gonna be a large day...

Cheers!

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K