Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

nativewolf

Active Member

I agree on the solar roof and man if something doesn't give one pause on FSD it should be the solar roof business.No Solar Roof on the house I am building either. Tesla told me to get stuffed after two years when we finally got to the point in construction where we were ready for the roof, with multiple forms signed and final applications filed with utility and township. We need a roof immediately and I am clueless.

First world problems.

I get the feeling that the Tesla Solar Roof is pretty much DOA as a mass market commodity.

Think Tesla energy is all about storage going forward, not generation.

@petit_bateau posts on the margin impacts of energy, cell growth, implications for production going forward etc is a wonderful posts and gives one hope that the energy side can continue to deliver revenue growth at acceptable margins for several years. Well branded product where purchase managers won't get fired for buying Tesla megapacks.

Exactly my thoughts, i was thinking 'gee..this is the least action that $TSLA has ever seen AH after numbers were released' Knew it was too good to be true!It is funny that the stock was pretty flat after the numbers came out after the bell. And then came the call...geez.

I knew it!I found another couch out back. Is this the dip?

Sometimes ya gotta wonder. I could pull a (meek) salary at that rate. Combine with SS...CIT Bank (Not Citibank) 4.95% yield with balances of $5k or more.

Na, that's so boring! We'll make 10x (OK maybe 5X) on TSLA, one day.

You can stop wondering cause once our good buddy JPOW pulls the rug, bank interest rates will go back to 0.01%. You're aiming too low, we will make 50x on TSLA if we just hold for another decade or 2...NFA, JMHO of course.Sometimes ya gotta wonder. I could pull a (meek) salary at that rate. Combine with SS...

Na, that's so boring! We'll make 10x (OK maybe 5X) on TSLA, one day.

The "market" is supposed to be forward-looking.....so does that mean just the next three months?

If the news that Q3 might be a bit less robust, does that mean the SP should drop 9%?

By that logic if Tesla said we are shutting down and everything is for sale the SP should rocket as the next quarter would look awesome.

If the news that Q3 might be a bit less robust, does that mean the SP should drop 9%?

By that logic if Tesla said we are shutting down and everything is for sale the SP should rocket as the next quarter would look awesome.

2daMoon

Mostly Harmless

The "market" is supposed to be forward-looking.....so does that mean just the next three months?

If the news that Q3 might be a bit less robust, does that mean the SP should drop 9%?

By that logic if Tesla said we are shutting down and everything is for sale the SP should rocket as the next quarter would look awesome.

In order to achieve a steady accumulation of higher highs and higher lows to establish the trend, there must be lows, correct?

We really should thank the MMs for helping provide these reference points so we can make accurate measurements against them going forward.

/s

GhostSkater

Member

Taking this logic further, because Tesla FSD is the "driver" in both private and commercial applications there must be included coverage for Tesla while FSD is being used.

In the long run the natural progression would be toward a subscription model being the only one offered and the FSD aspect of the insurance would be included in the subscription cost.

Well, the safety part of FSD is always running in the background, for every Tesla other than some really old ones

We've seen multiple examples of it preventing accidents when the human driver screwed up

I sold about 2K shares yesterday for an investment, but finally got to keep half of them after a change of plan.

With the drop in SP, I'm tempted to buy the remaining half back with a price limit to make up for the tax bill on the capital gains (~20-30% of the total, since the shares were bought a decade ago). Have you guy ever tried to do that?

With the drop in SP, I'm tempted to buy the remaining half back with a price limit to make up for the tax bill on the capital gains (~20-30% of the total, since the shares were bought a decade ago). Have you guy ever tried to do that?

Hope so. I was only quoting Elon yesterday saying "10X... uh um... OK 5X."You can stop wondering cause once our good buddy JPOW pulls the rug, bank interest rates will go back to 0.01%. You're aiming too low, we will make 50x on TSLA if we just hold for another decade or 2...NFA, JMHO of course.

Yeah, i knowHope so. I was only quoting Elon yesterday saying "10X... uh um... OK 5X."

Optimeer

Member

Beginning of April, there was a guy sitting a few days in in his car in front of the Lathrop factory and he said that they produce 10-11 Megapacks per day, on 7 days per Weeks (TMC Post 7552116).

13 weeks/quarter x 7 days/week x 10.5 Megapacks/day x 3.9 MWh/Megapack = 3.7 GWh/quarter.

In Q1 Tesla deployed almost 3.9 GWh and I would say at least 3 GWh are Megapacks from the Lathrop factory and the rest are probably Powerwalls.

For me it looks like that Lathrop phase 1 is already running very steadily since months and I expect only little improvement for Q2 and even for Q3 regarding production output (margins and revenues could improve a bit more).

On the bright side it looks like Tesla now has a factory design they can copy paste all over the world

- Lathrop phase 2 will ramp in Q4 and Q1 2024

- Shanghai phase 1 will ramp in Q2-Q4 2024

- Shanghai phase 2 will ramp in Q4 2024 - Q1 2025

- Next site phase 1 will ramp in Q4 2024 - Q2 2025

- ..

something like that. Then we need to keep in mind that also the supplier need to ramp their factories.

Regarding the margin aspiration of 25 %: Probably there is a lag until the money is transferred from the customer to Tesla at the end of the project, so we potentially didn’t see the steep ramp last quarter fully reflected in the earnings report. Maybe Tesla is scared that the selling prices will come down significantly over time with significantly increased supply. Also it is not given that purchase costs will go down considering the crazy demand which these products will have over the next years from Tesla and competitors.

I revisited my predictions for the Megapack business I made after Q1 2023 earnings and saw that there were no surprises yesterday. I think eventually this will be a great business.

2daMoon

Mostly Harmless

Well, the safety part of FSD is always running in the background, for every Tesla other than some really old ones

We've seen multiple examples of it preventing accidents when the human driver screwed up

Which should mean that Tesla's actuary table for FSD will look very nice and the cost of insurance for FSD will be a negligible portion of the subscription.

When a person is driving their own car those same features running in the background ought to lead to significant reductions in that insurance cost as well. Even though an ape-descended-life-form will have taken personal responsibility for operation of the vehicle, the vehicle will be looking out for them.

Perhaps this is an example of a When-Win scenario? (When FSD is unleashed, everybody wins)

Last edited:

Most of us here have crystal balls in fact. Some diamond perhaps by now.Yeah, i knowWish we all had a 'crystal ball' but since we do not, we will just have to resort to hanging out here for good company (mostly)

When we get a hunch on something and don't quite know why, there is hidden knowledge behind it. There's an interview technique that I used in order to pull out deep knowledge from the Expert Technicians (early KM systems). Trust me, people here know way more than they think they know. It's a deep subject!

2daMoon

Mostly Harmless

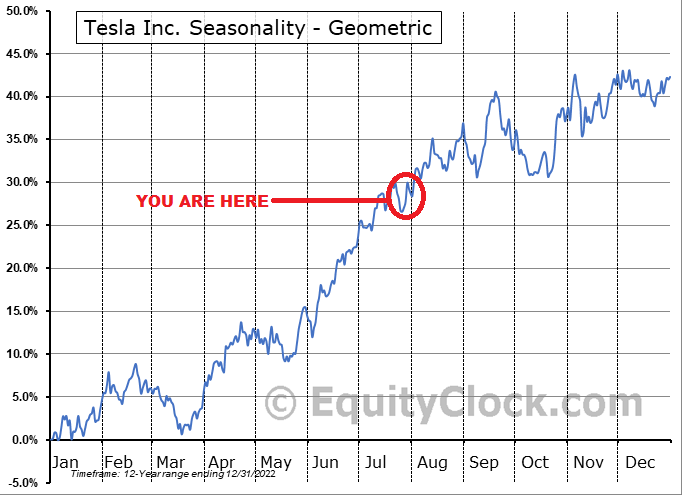

Speaking of hidden messages, here's a 12-year Senility, er, Seasonality Chart for TSLA that I found to reflect upon.

This mid to late July dip may be an annual expectation.

This mid to late July dip may be an annual expectation.

Thekiwi

Active Member

One important factor to consider regarding Megapack factories internationally is how much of the current 18% margin is due to the IRA battery credits (which obviously won’t be present internationally).My early thoughts:

1. Lucky accident that in my forecast I got the GAAP EPS correct at $0.78, mainly because of the bump of $328m in the other income line, as auto GM% was below my forecast. But a win is a win, nailed it.

(see the Quarterly Projections thread if you want to stay abreast of that stuff Near-future quarterly financial projections )

2. GM% on energy is now broadly equal to GM% on automotive, i.e. 18% or so in round numbers for illustrative purposes. A 500k/yr vehicle line consumes about 40 GWh/yr of cells. The Lathrop megapack storage line is currently consuming approximately 12 GWh/yr of cells (after allowing for some cells to go into Powerpacks, Powerwalls). This means that the Lathrop line is now the equivalent of about 150,000 vehicles/yr in both revenue and profit terms. You can see that Lathrop now is almost contributing as much revenue and profit as Berlin is now, as Berlin is at about 200k/yr now. When Lathrop reaches 40 GWh/yr it will be equal to about 500k/yr vehicles, i.e. that is the same as the fully built and fully ramped phase 1 of Berlin. It is not obvious whether Berlin phase 1 will get fully ramped to 500k/yr=40GWh/yr before Lathrop reaches the equivalent fully ramped situation. This means that there no longer needs to be any hesitation in selling/ramping/etc storage vs vehicles and that makes overall business strategy decisions so much easier. Well done Lathrop. That makes LFP cell capacity allocation and negotiations so much easier. Plus of course there is the long tail of service/etc income from storage.

This table sets out the approximate situation and the broad equivalency between a 40GWh vehicle line and a 40GWh stationary storage line.

View attachment 957962

3. This means that decisions on Megapack factories are as important for recipent nations as automotive factories, but that they involve less technology exposure than automotive. That is good as they don't need as much labour/etc as an auto factory. This has huge implications for ability to scale overall business in a way that manages sovereign / political / strategic risk.

4. Berlin capacity is now significantly ahead of Austin capacity. The cell supply situation out of China has perked up now that Shanghai has gone fully LFP, clearing the way for the LG 2170 stream to go to Berlin. As yet the 4680 ramp in Austin has not caught up with the Chinese stream into Berlin (and into Lathrop). Well done to the Chinese LFP suppliers. It is still all about the cells.

5. The improved 4680 for CT sounds to me like same external 4680 can, maybe with decreased wall thickness and perhaps (?) tweaked chemistry. The 4680 ramp is likely the pacing factor for CT launch, and since there is still plenty to do on vehicle shakedown and cell side they don't seem in any hurry. Pencil in Q4 deliveries in low volumes.

6. Volume expansion and operating at full capacity is still the overriding target. Forget all about the waffle in the Q1 call about targetting operating margin. Or in previous calls about any other margin. Or about maintaining positive cash flow. though happily things are - and will continue to be - cash generative and so fully internally funded. Or share price stability. Or anything, except ramping as fast as possible and keeping the lines full. It is quite clear from the actual observable facts, that Tesla will reduce prices and throw in whatever promotional stuff it takes to keep the lines full.

7. This means that the real determinant of Tesla price is - wierdly - the extent to which there are competitive BEVs available from other automakers. The market will obviously take as many credible BEVs as the industry can produce, provided they aren't outrageously priced. So if Tesla has limited competition then Tesla can pretty much hold its own price up to a reasonable extent, with the result that Tesla obtains a (now) 18% or so GM%. And since (at the moment) the competitor BEVs are not as compelling a customer proposition (and their CoGS are higher) then the competitor OEMs are forced into low or negative GM%. It is really difficult to get those numbers, but let's just posit they range from +5% GM to -5% GM with an average BEV competitor of 0% GM. This is why demand for BEVs is collapsing at VAG etc, and they are in a cash crisis. The implication is that Tesla is probably near the bottom on pricing for the time being. Only if the competitors start bringing better products to market in a manner that is financially sustainable for them, will Tesla need to reduce prices. Of course that will happen, and so there may be further Tesla price reductions. But hopefully by then Tesla may have been able to make further CoGS reductions, and obtained further scale benefits, and so stay ahead of the game. But note - in an odd way - given that Tesla prizes capacity expansion above all else, then it is competitor products that now determine Tesla GM% and that is a new realisation for me.

8. Actuators are the pacing constraint on Optimus. Software is constrained by hardware. The hardware cycle is many months, that is the pacing constraint at this stage.

9. FSD will go to market in USA first. One day. Maybe.

10. Yeah, Q3 won't be a lot of growth. We are pretty sure the 3 lines (Shanghai, Fremont) will get a full rebuild and a next-gen 3 product. We don't know how fast they will ramp coming out of that. We don't know what will be done to the Y lines to keep them in lockstep (Berlin, Austin, Fremont, Shanghai). It seems to me that there is no reason for cell production to slow during Q3 (except of course for cell factories to do their hols and line maintenance & updates) and so they can build cells to stock, then that gives excess cells to mop up in Q4. Since vehicle line capacities seem to me to exceed cell line capacities that means that Q4 should be good. FSD-switch promotion to keep deliveries up during Q3 and avoid Osborning. I'm sure they will find enough promotions t keep it going - Herz etc.

11. So 1.8m for the year plus storage.

12. Very steady growth in S&S, nice.

Optimeer

Member

I agree. This is true for 4680 Gen I currently produced at Kato Road in a dry/wet process (capacity target 10 GWh/a). The current Model Y AWD uses these Gen I batteries. The Gen II 4680 factories in Austin and later in Nevada will be Gen II in a dry/dry process and the targeted capacity in Austin is 40 GWh (Note from July 20, 2023: I stated this wrong, it will be significantly more, don’t remember). To reach this capacity I expect the catode plant also in Austin is a pre-requisite.

Gen II 4680 is a prerequisite for a meaningful production of the Cybertruck. For Model Y in Austin and in Berlin, 2170 was the fallback option. For the Cybertruck there is no fallback option, the project will just be delayed until everything is ready.

The Battery Day presentation, there stated 5 major goals.

View attachment 939382

Of these goals, Gen I 4680 includes

- “cell design” (the tabless cell enables the increase of the diameter).

- “cell factory”

- “cathode materials” (with nickel so far)

- “cell vehicle integration” (structural pack combined with front and rear casting)

Gen II 4680 includes the “anode materials” according to slides 41 to 45 of the Battery Day presentation.

“Silicon stores 9x more lithium than graphite” but involves the challenge “volume expansion” which Tesla intends to solve by using a design which can cope with this expansion. Benefits of ”anode materials” are a 20 % range increase (page 44) and a 37 % $/kWh reduction.

I honestly have no idea if the silicon - lithium anode will enable a faster charging rate in 4680 Gen II. We will figure out after the frist Cybertrucks are handed out to customers.

Now I would to look further to the consequences to the model Y and the model 3. Troy Teslike explained with this table that the energy density (Wh/kg) of the Model Y AWD (range 279 miles) is 13 % lower than of the Model Y LR with Panasonic 2170 batteries (range 330 miles)

As stated above, (Gen II cells) with silicon/lithium anodes will offer a 20 % range increase: 279 miles + 20 % is 334.8 miles for the Model Y with 4680 Gen II. So with a small software limit, the range is the same as today.

Therefore, Tesla is currently able to use 4680 Gen II batteries as soon as they are ready instead of 4680 Gen I batteries at their Austin plant and rebadge the Model Y AWD as a Model Y LR. Benefit of this strategy is that Tesla will have a lot of real world experience for the Cybertruck battery system, so there is little to worry about in this regard.

When I watched Munro Live’s Teardown of the 4680 Model Y battery pack I saw that there is about 10-15 % unused space left in the pack. By making the modules wider, a model Y extended range configuration with about 370 miles would be quite easy to build with Gen II 4680 batteries. However, I don’t expect this range increase as long as Tesla is 4680 batteries constrained, so until 2025 or 2026.

For the model 3, there will be simply no space left in the battery pack to further increase the range by adding additional cells. I expect the same Gen II battery pack of the model to fit into the model 3. 4680 Gen II offers a 4 % range advantage over Panasonic 2170 batteries. But in the meantime Tesla has switched to 2170 Batteries from LG which offer a slightly lower range (and as a benefit are eligible at least for a partial IRA credit). So when the switch to 4680 Batteries happens in January 2024 at the earliest imho, the range increase will look a bit more substantial than it actually is. So all together, yes I think at some point we will see a model 3 highland with 400 miles range at some time. But Tesla is for now seriously 4680 battery constrained (Model Y Austin, Cybertruck), so I would not be surprised to not see this configuration for another two years. Another issue of this rumored Ludicrous Model Y configuration with more range is that it can only be produced in Fremont which increases shipping costs for Europe and Asia. Also this version will be more expensive than the limit of 55’000 USD of the IRA credit. Another issue is a further cannibalizing of the Model S which is already low in demand. So the Model 3 Ludicrious could be the suscessor of the Model S, but only after the Roadster 2 as a new halo product is out in 2025 as we learned at the annual meeting.

Last, it makes no sense to ship 2170 batteries from Nevada to Austin since this invovles additional logistics cost of about 1 $ per kWh according to my estimation due to the longer trip. Lowering costs is a current top priority at Tesla. So the Model 3 Highland made in Fremont will use 2170 batteries as soon as the IRA credit expires end of December 2023 and therefore not offer a range real increase compared to the old model 3 LR with 2170 Panasonic batteries. I expect the price to go up a bit again due to the higher range. Of course also a configuration with a lower range will be available. I expect the Model 3 highland will be first handed out to customers in February and March 2024. This makes also sense since this is the quarter with the lowest demand, therefore a demand boost due to a model 3 relaunch is welcome from a business point of view.

In summary it appears that Tesla has a sophisticated plan and is constantly adapting the plan as soon as issues and opportunities arise.

Here an update from my analysis from May 20, 2023 after yesterday’s earnings.

4680 Gen II is still not ready but at least Tesla found other ways to increase the energy density by 10 % vs Gen I (Goal for Gen II was approx. 20 %).

I was disapointed by Elon sometimes not answering the questions, but maybe he took one for the team and the chatter is now about Elon behaving bad (and less about the risk of a slower than expected ramp of 4680 production in the next quarters, which would affect the ramps in Texas (Model Y, Cybertruck) and Nevada (Semi with 2170 batteries, new 4680 production facility).

Since 4680 scale-up may be late, I see the possibility that Model 3 with the Highland update will also in the US rely on batteries from CATL, which doesn’t need to be bad from a customers perspective. This would free up 2170 batteries for a production increase of the Model Y and later for Semi.

After all, we can not blame the Tesla team for not trying hard. The performance of Tesla’s 4680 batteries are on par with the ones of their best competitors (probably better but also currently more expensive). There are also other competitors struggeling to ramp up the battery production very fast.

Not really. Magna is a tier one supplier and contract manufacturer, primarily with Magna Steyr.Which Apple ALSO is not, they pretty famously outsource all their M.

I suppose you could look at someone like Magna as a car OEM without its own "brand" of car?

OEM, by definition, requires both building and supporting the vehicles. Obviously there are many permutations of supplier roles, but they are not OEM's.

Magna Steyr does build everything form some Jaguar Models for which they had a major designing role, many Mercedes Benz, BMW and many others, but they never branded them, distributed them or supported them.

Whoever it is, is it certainly a recognizable known brand since it is 'a major OEM'. I would not speculate, although the temptation is almost irresistible.

Myopia is no fun even here. For most, it was not their first call - surprised many moan that we've been red today. What's new? The WS and all is rigged. Nothing changed.

Tesla on the other hand has been incredible and will do great.

Tesla on the other hand has been incredible and will do great.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K