Hi all,

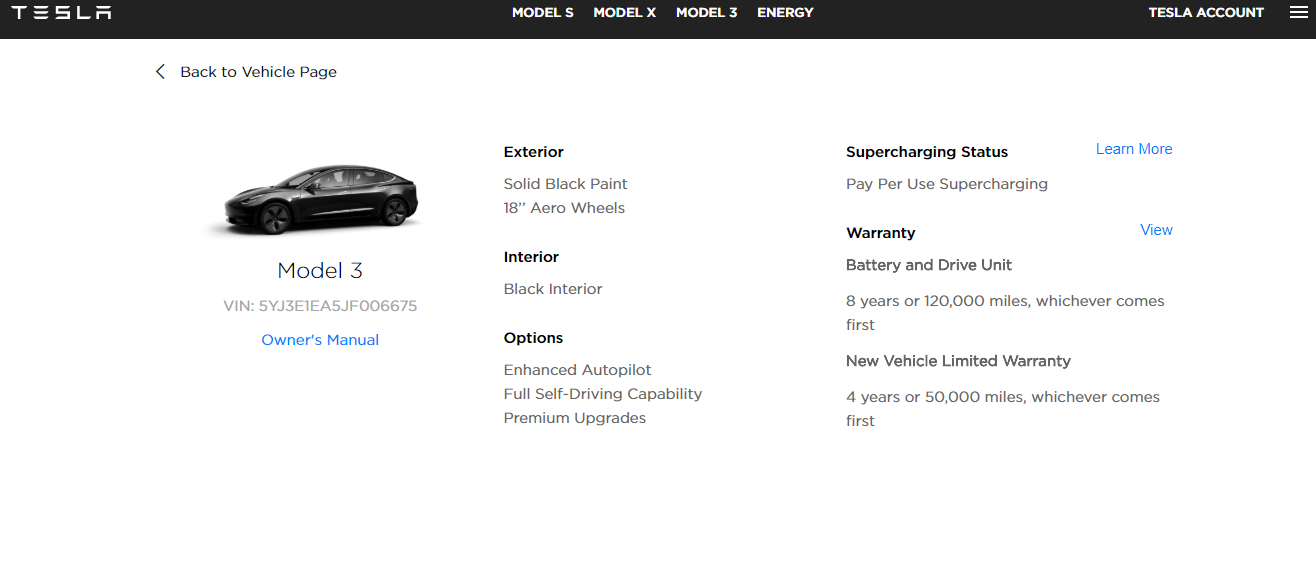

I took delivery on a 2018 Model 3 in April. It's gorgeous - black, long-range battery, plus the enhanced interior, autopilot and self-driving upgrades.It does not have the 19 inch wheels as I really liked the look of the 18 inch black wheels on black car. I've kept it in my garage and it only has 280 miles as of today. I've had a change in circumstances and now sadly have to part with it.

I'm selling it for the exact price I paid - $61,897, no more and no less. It is ready to go now, with pickup in Austin TX. I financed it, so my title is with the credit union and we'd work through them to do the transfer. Whoever can make it happen ASAP gets it. I will not allow test drives - not even the Tesla dealership in Austin is doing that - but you can see it and I can drive you in it before we finalize.

I took delivery on a 2018 Model 3 in April. It's gorgeous - black, long-range battery, plus the enhanced interior, autopilot and self-driving upgrades.It does not have the 19 inch wheels as I really liked the look of the 18 inch black wheels on black car. I've kept it in my garage and it only has 280 miles as of today. I've had a change in circumstances and now sadly have to part with it.

I'm selling it for the exact price I paid - $61,897, no more and no less. It is ready to go now, with pickup in Austin TX. I financed it, so my title is with the credit union and we'd work through them to do the transfer. Whoever can make it happen ASAP gets it. I will not allow test drives - not even the Tesla dealership in Austin is doing that - but you can see it and I can drive you in it before we finalize.