i need help understanding warranty provisions.

please review the following items from 10q's for q1, q2 2017.

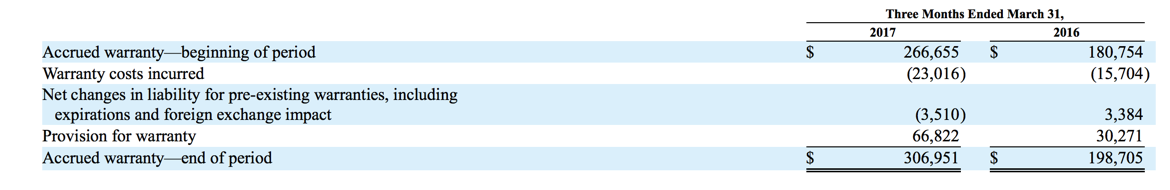

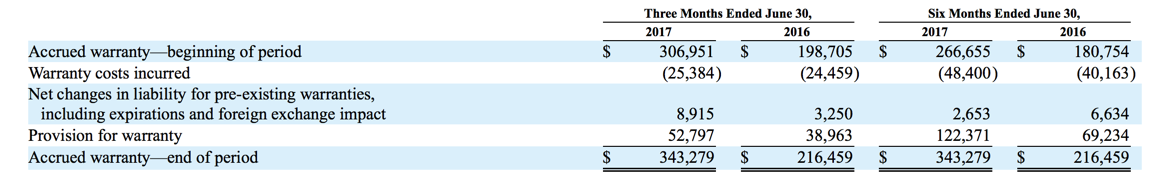

notice q1 2017 provision for warranty = 66,822

notice q2 2017 provision for warranty = 52,797

q1 + q2 = 66,822 + 52,797 = 119,619

notice the total provision for six months ended june 30 2017 = 122,371

why is there a difference?

if you check 2016 figures you will find there is no issue, q1+q2 2016 provisions = provisions for 6 months ended june 2016.

thanks in advance for any insights.

please review the following items from 10q's for q1, q2 2017.

notice q1 2017 provision for warranty = 66,822

notice q2 2017 provision for warranty = 52,797

q1 + q2 = 66,822 + 52,797 = 119,619

notice the total provision for six months ended june 30 2017 = 122,371

why is there a difference?

if you check 2016 figures you will find there is no issue, q1+q2 2016 provisions = provisions for 6 months ended june 2016.

thanks in advance for any insights.