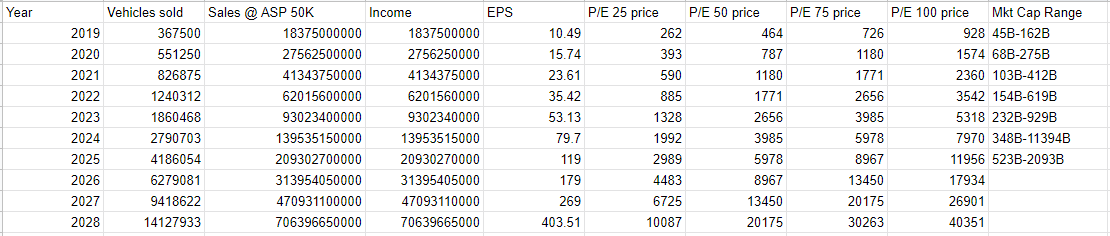

I would like to engage in discussion about what the future value of TSLA as a company. What follows is a screen capture of some of what I've worked on, it is much more bullish than estimates I made many years ago. I've done some math hoping to make sure my use of financial math is correct. I ran calculations using available data for AMZN to make sure I was appropriately using P/E. The following are assumptions:

1. There are 175,060,000 shares of TSLA outstanding per TSLA Tesla, Inc. Stock Quote

2. Tesla sold 362,000 cars in 2019 and going forward could sell 50% more vehicles per year.

3. Average selling price is $50,000. I think this number is currently too low and might end up being too high in the future.

4. Income or profit is assumed to be 10% as I recall this was part of original info Tesla or Elon put out for mass market vehicles.

5. A future value P/E would like be high. AMZN is currently 84.5

So here is the data I come up with.

My discussion: It will be difficult for them to produce 50% more vehicles next year using the data I know. China is at best going to produce 100,000 cars next year though the goal is for 500,000 per year. Model Y is the unknown both domestically and in China. It would bear well for 50% more cars if the Y did not affect model 3 production in Fremont. It might be best to be conservative. My sales and income figures likely underestimate current sales and income, for instance Finviz says current sales are at 24B, not the 18+ I have listed. Solar and energy sales are not included. FSD development might significantly alter things in the future. The one trillion dollar market cap is first attainable in 2024, more likely in 2025. This is significant for the pay package Tesla Announces New Long-Term Performance Award for Elon Musk | Tesla, Inc.

The other thing to consider is the number of vehicles sold. My early estimates were somewhat based upon the world market selling 100M vehicles each year and that TSLA would capture 10% of that market. While I ultimately hope for more of the market, organic 50% growth has them capturing the 10% marketshare within 10 years.

I generally think the above dates and associated figures are a little early, meaning I think it will take longer for the sales figures to occur.

What say you? How can I better think of things?

1. There are 175,060,000 shares of TSLA outstanding per TSLA Tesla, Inc. Stock Quote

2. Tesla sold 362,000 cars in 2019 and going forward could sell 50% more vehicles per year.

3. Average selling price is $50,000. I think this number is currently too low and might end up being too high in the future.

4. Income or profit is assumed to be 10% as I recall this was part of original info Tesla or Elon put out for mass market vehicles.

5. A future value P/E would like be high. AMZN is currently 84.5

So here is the data I come up with.

My discussion: It will be difficult for them to produce 50% more vehicles next year using the data I know. China is at best going to produce 100,000 cars next year though the goal is for 500,000 per year. Model Y is the unknown both domestically and in China. It would bear well for 50% more cars if the Y did not affect model 3 production in Fremont. It might be best to be conservative. My sales and income figures likely underestimate current sales and income, for instance Finviz says current sales are at 24B, not the 18+ I have listed. Solar and energy sales are not included. FSD development might significantly alter things in the future. The one trillion dollar market cap is first attainable in 2024, more likely in 2025. This is significant for the pay package Tesla Announces New Long-Term Performance Award for Elon Musk | Tesla, Inc.

The other thing to consider is the number of vehicles sold. My early estimates were somewhat based upon the world market selling 100M vehicles each year and that TSLA would capture 10% of that market. While I ultimately hope for more of the market, organic 50% growth has them capturing the 10% marketshare within 10 years.

I generally think the above dates and associated figures are a little early, meaning I think it will take longer for the sales figures to occur.

What say you? How can I better think of things?