The last year has been crazy. Found out Virginia property taxes on my 2020 MY may increase from ~$1430 paid in 2021 to as much as $2,324 based on NADA Official Car Guide: clean trade in value using vin number for 2022 - though they are thinking of doing tax drop because so many older cars' values have increased. The 10% they are kicking around as a "discount" is not going to make up for this increase.

Assessed value for this base white MY AWD was $41,545 in 2021 (took of 10% purchase price in 2020 and I think an additional 10% for 2021). At the time a NADA Official Car Guide valuation for this car was not available.

Soooo, the NADA Official Car Guide: clean trade in value for this two year old car with none of the great improvements that have been made to the 2021 and 2022 cars is $62,250. Because of their taxation system, cars over a certain value are taxed more. So there is a potential for a $900 increase.

This is discouraging. Virginia has no incentives and adds a flat electric vehicle tax yearly already. I keep my cars until they die - one is on life support. The initial year's taxes for a new car are painful but it's supposed to ease up as time goes on.

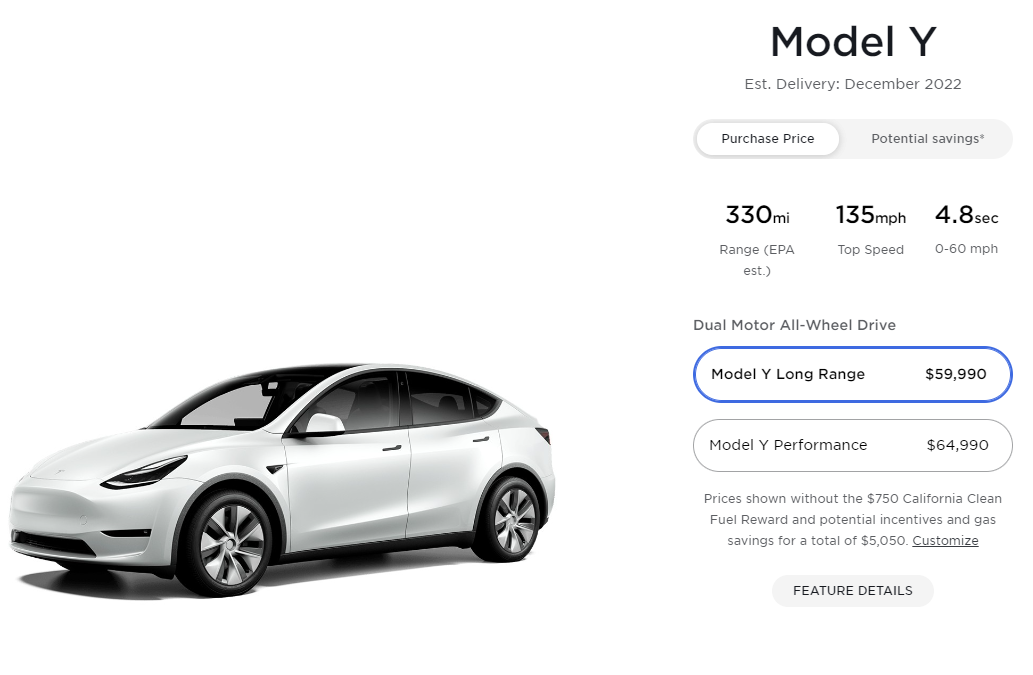

Looks to me like a base 2022 is cheaper than my 2020 RIGHT NOW! Here's a March 9 post by cloudiness. $59,990

teslamotorsclub.com

teslamotorsclub.com

Assessed value for this base white MY AWD was $41,545 in 2021 (took of 10% purchase price in 2020 and I think an additional 10% for 2021). At the time a NADA Official Car Guide valuation for this car was not available.

Soooo, the NADA Official Car Guide: clean trade in value for this two year old car with none of the great improvements that have been made to the 2021 and 2022 cars is $62,250. Because of their taxation system, cars over a certain value are taxed more. So there is a potential for a $900 increase.

This is discouraging. Virginia has no incentives and adds a flat electric vehicle tax yearly already. I keep my cars until they die - one is on life support. The initial year's taxes for a new car are painful but it's supposed to ease up as time goes on.

- Can anyone tell me how NADA uses the VIN? Teslas are unique in that after purchase, one can add FSD and get a speed boost.

- Is the valuation on the vehicle as purchased or do they have access to additional information that might increase the value of the car? Trying to figure out why the valuation is so high.

Looks to me like a base 2022 is cheaper than my 2020 RIGHT NOW! Here's a March 9 post by cloudiness. $59,990

March 2022 - Tesla Model Y Increases price by $1,000

Looks like Tesla secretly increased the price of the Model Y by $1,000 today. Can't say I'm surprised!